What regulatory document regulates the mechanism for submitting 6-NDFL during reorganization

A document that describes in detail the algorithm of actions of a tax agent when submitting 6-NDFL in the conditions of reorganization does not currently exist.

However, this does not mean that there is no regulatory regulation on this issue, and companies undergoing reorganization can act at their own discretion. The process of submitting 6-NDFL in such a situation is regulated by the following regulations:

- Tax Code of the Russian Federation (Articles 50, 55, 230).

- The procedure for filling out 6-personal income tax, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] , taking into account changes made by order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/ [email protected]

In addition, the “tax” aspects of the reorganization are based on “civil” ones - clause 4 of Art. 57 of the Civil Code of the Russian Federation, which outlines the key rules of reorganization:

- the company is considered reorganized (except for cases of merger) from the moment of state registration of the companies created during the reorganization;

- the merged company is considered reorganized from the moment information about its liquidation is reflected in the Unified State Register of Legal Entities.

This article of the Civil Code of the Russian Federation defines an important aspect for tax reporting - the date from which responsibility for the preparation and transmission of reporting to tax authorities passes to the newly formed person after the reorganization.

The second important nuance for tax reporting, which includes 6-NDFL, is determining the duration of the last tax period for the reorganized company for which it must report. The algorithm described in paragraph 2 of Art. applies here. 55 of the Tax Code of the Russian Federation: the last tax period for a reorganized company is the period of time from the beginning of the current year to the date of reorganization.

Digital library

Reorganization procedures make it possible to remove an organization from an insolvent state and preserve the debtor enterprise.

An integral attribute of a market economy is the division or consolidation of organizations, that is, reorganization.

Voluntary liquidation of a company is carried out by making a decision to liquidate the participants of the legal entity themselves.

The forced liquidation of an enterprise is carried out on the basis of a court decision in cases specified by the Civil Code of the Russian Federation.

•if gross violations of the law were committed during the creation of the organization and these violations are irreparable;

•if a legal entity operates without permission (license) or carries out activities prohibited by law;

In case of bankruptcy, liquidation occurs on the basis of a decision of the arbitration court, on the basis of applications from bankruptcy creditors.

The decision on reorganization is made by the founders (participants) of the organization or a body authorized to do so by the constituent documents.

•the procedure for forming the authorized capital and its amount to be reflected in the constituent documents of the emerging organizations and the reorganized organization;

After this, an inventory of the property and liabilities of the reorganized organization is carried out. The inventory results are reflected in the inventory act (inventory).

Next, the transfer act (separation balance sheet) is approved by the founders (participants) of the legal entity or the body that made the decision on its reorganization.

•full name of legal entities participating in the reorganization, as well as their organizational and legal form;

•list of attached documents (order on the accounting policy of the enterprise, analytical data on accounts receivable and payable, etc.).

2. Constituent documents of each newly emerged legal entity created through reorganization (originals or notarized copies).

In the process of carrying out reorganization procedures, a number of business transactions related to this procedure were reflected in accounting.

The positive difference between the actual value of the shares being redeemed and their nominal value was written off -

The negative difference between the actual value of the shares being redeemed and their nominal value was written off -

The debt of the transformed company to the participants who become shareholders of the joint-stock company is reflected -

Credit to account 76 “Settlements with various debtors and creditors”, subaccount “Settlements with company participants during reorganization”.

Debit accounts 50 “Cash”, 51 “Cash accounts”, 08 “Investments in non-current assets”, 10 “Materials”, 41 “Goods”, 43 “Finished products”, 58 “Financial investments”;

Reflected the closure of debt to the participants of the legal predecessor by transferring to them shares of the new joint stock company -

Debit of account 76 “Settlements with various debtors and creditors”, subaccount “Settlements with company participants during reorganization”;

Shares were purchased within 10% of net assets from shareholders and organizations leaving the membership (at par) -

The difference between the par value of shares owned by exiting shareholders and the redemption value (par value) is reflected -

Registration of changes in the register of shares owned by shareholders as a result of the sale of the remaining shares of the reorganized enterprise is reflected -

Credit to account 76 “Settlements with various debtors and creditors”, subaccount “Settlements with the reorganized organization”, subaccount “Settlements with other shareholders”.

Included in other expenses is the loss that arose as a result of the decision on reorganization, which should be compensated to creditors -

All transactions related to bankruptcy must be systematically reflected in the accounting records of debtor and creditor enterprises.

Unaccounted liabilities identified during the inventory were restored to the accounting accounts -

Credit of accounts 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”.

How to fill out 6-NDFL during reorganization (liquidation)

6-NDFL during reorganization must be drawn up taking into account the following nuances:

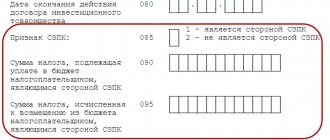

- in the column “Submission period (code)” of the title page, indicate 2 numbers from Appendix 1 to the procedure approved by Order of the Federal Tax Service No. ММВ-7-11/450 - 51, 52, 53 or 90, meaning respectively 1 quarter, half a year, 9 months or year (these codes are used only when registering 6-NDFL in a situation of reorganization or liquidation);

- the data in section 1 is filled in on an accrual basis from the beginning of the year until the date of reorganization;

- section 2 reflects calendar dates and total values for the last reporting period (from the 1st day of the first month of the reporting period to the date of reorganization, but not more than 3 months);

- The data for filling out 6-NDFL must be taken from the tax registers for personal income tax (their maintenance is mandatory).

The material “Sample of filling out a tax register for 6-NDFL” will tell you what the personal income tax register looks like and how it is filled out.

Comparative characteristics

A legal entity is created for the purpose of making a profit and implementing a planned plan. When the task set by the founders is completed, the business is of no interest to the owners and can be closed. This is the simplest reason for a company to cease operations. If the company does not have its own funds or they are not enough to ensure production, problems arise with mandatory and current payments.

The enterprise ceases to justify itself, the debt to counterparties is growing non-stop. In this case, management needs to make decisions as quickly as possible on how to get out of a difficult situation. In practice, very often business owners decide to liquidate the organization in order to avoid potential risks.

It is important that the initiator has the right to interrupt the process at almost any time and restore the work of the company. The only exception is forced liquidation, when all actions are carried out under the control and at the discretion of the judicial authority.

In the general understanding, the reorganization and liquidation of an institution lead the initiator to the same result - completion of the work. Both processes are most often launched with the consent of the participants of the joint stock company. A distinctive feature of the measures is that the first option allows you to maintain the structure of the business, and the second leads to the complete elimination of the company.

Reorganization activities take about six months, while liquidation measures can last from five months to two years. It is obvious that the owners are not interested in delaying time so as not to further accumulate debts and not incite conflicts with counterparties and regulatory authorities. Therefore, many cooperatives prefer to carry out reorganization.

Reorganization does not lead to complete closure of activities

An additional difference between liquidation and changing the type of activity through reorganization of a legal entity is the volume of documentation. If the business completely disappears, there is no need to draw up new projects or plans, but you will have to fully repay all debts and report to the Federal Tax Service. Preparation of documentation will be lengthy and painstaking.

In terms of reorienting the organization, the founders will also have to work hard. But the goal will be somewhat different: to find a new direction of development in order to make a profit in the future and participate in market transactions. Therefore, it is important to interest investors and the new owner in the feasibility of the transaction. Additionally, it is necessary to formalize the procedure for the succession of property and loan obligations.

How and when to transfer 6-NDFL to the tax authorities during reorganization

6-NDFL can be received from the reorganized company to the tax authorities in two ways (they are described in the manner approved by the order of the Federal Tax Service No. MMV-7-11/450):

- a representative of a company or individual entrepreneur can bring a paper 6-NDFL to the tax authorities or send it by mail - these methods are possible for companies that have paid income to no more than 25 individuals from the beginning of the year until the moment of reorganization;

- electronically (via TKS using an electronic digital signature) - this method can be used by all tax agents without exception to submit 6-NDFL.

The reorganized company must complete the latest 6-NDFL report for the last tax period - the period of time from the beginning of the year until the day the reorganization is completed. It must also be submitted before the reorganization (closure) is completed. This follows from the letter of the Federal Tax Service of Russia dated March 30, 2016 No. BS-3-11/ [email protected]

If the reorganized company did not have time to submit a report in Form 6-NDFL, then the obligation to submit reports passes to the legal successor (clause 5 of Article 230 of the Tax Code of the Russian Federation).

Pronounced difference

Comparing liquidation with reorganization, one can undoubtedly identify a number of striking differences. Transformation of activities allows you to choose a profitable alternative; several options for resolving the issue are available. At the same time, it is the complete closure of the business that will avoid negative consequences. The company will pay off debts, pay off payments to employees and the budget. The next stage will be the distribution of assets between the founders.

The reorganization procedure looks more attractive for owners due to the short time frame for registration and implementation. It is worth noting that the possible risks when choosing this path will not disappear. In order to transform a commercial enterprise and move to a new direction of work, you will have to study all the features of the legislation. It is recommended to consult on these issues with practicing lawyers and auditors.

Some reorganization options, such as merger, will require the preparation of an individual form of transfer deed. The form is not approved by law, but is mandatory for the successful implementation of the company owners’ plan. It is advisable to conduct an accounting audit to eliminate problems in the future.

Upon liquidation, fixed deadlines for notifying creditors and the tax service are established. The rules apply equally to commercial and unitary enterprises. If they are violated, the manager will face administrative liability.

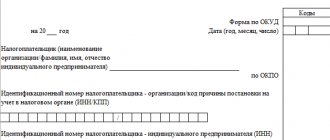

How to fill out 6-NDFL for a legal successor

The successor company submits the 6-NDFL calculation to the tax office at its location or at the place of registration, if it is the largest taxpayer. When filling out the calculation, the corresponding code is recorded in the column “at location (accounting (code))” of the title page:

- 215 - at the location of the legal successor who is not the largest taxpayer;

- 216 - at the place of registration of the legal successor, who is the largest taxpayer.

The Federal Tax Service, by order dated January 17, 2018 No. ММВ-7-11/ [email protected], updated the 6-NDFL calculation form, which officially comes into force on March 26, 2018.

The updated form can be downloaded here.

Fields have been added to the title page of the form that can only be filled in by legal successors:

- Form of reorganization (liquidation) - indicate the code given in Appendix No. 4 to the procedure for filling out the calculation:

- 1 – transformation;

- 2 – merger;

- 3 – separation;

- 5 – connection;

- 6 – separation with simultaneous addition.

- TIN/KPP of the reorganized organization - the codes of the reorganized company are indicated.

The “tax agent” column indicates the name of the reorganized company or its separate division.

The accuracy and completeness of the data in the calculation is confirmed by the assignee by indicating code 1 in the appropriate cell.

Procedure for liquidation of legal entities

Liquidation of an organization is also carried out upon achieving the goal or expiration of the period for which the organization was created.

If we are talking about the liquidation of a municipal or state organization, the decision will be made by the owner of the property.

If liquidation is carried out through reorganization, the previously existing legal entity ceases to operate (Article 51 of Federal Law No. 14).

With this method of liquidation, unfulfilled obligations are not subject to further execution, since they are extinguished.

This is due to the fact that all obligations are transferred to the legal successor, as a result of which they are subject to execution on an equal basis with their own obligations.

If the decision is made, it is important to understand how to properly liquidate a legal entity, what are the step-by-step instructions in 2018.

The decision on liquidation is made at a general meeting of participants. As a result, a liquidation commission is formed.

When the final decision to liquidate the company is made, a notification is sent to the location of the organization within three years (Article 20 of Federal Law No. 129).

The notification is provided in form P15001. It must be accompanied by a liquidation decision.

The notification can be provided to the tax authority not only in person, but also through your legal representative with a power of attorney.

It can also be sent via the Internet or by mail. But it is important to confirm the signature with a notary.

Dismissal of employees is carried out in accordance with legal requirements. This occurs no later than 2 months before possible dismissal.

To do this, each employee receives notice in writing in connection with the termination of the organization's activities.

- measures are being taken to collect receivables;

- creditors are identified;

- A detailed inventory of all property is carried out.

When two months have passed since publication, the liquidator or commission draws up the necessary interim liquidation balance sheet.

This is due to the fact that when a debt is identified, there must be accounts through which it can be closed.

Advantages of the methods

Next, we will find out what is more profitable to carry out: liquidation or reorganization. The choice of path directly depends on the circumstances of the termination of activity and the potential for creating another company. Additionally, losses and economic efficiency of actions are assessed. It is important to take into account public opinion, consumer demand for manufactured products and services provided.

Each method has both its pros and cons

Under a voluntary scheme, owners can go any way, but under a forced scheme - only based on a court decision. It is especially difficult to liquidate educational institutions; the choice of procedure will be made by the municipality of the subject or region. Additionally, legal criteria and legislative norms are taken into account.

Reorganization actions have a significant priority - simplicity and speed. The completion of the company's work will occur in the shortest possible time with minimal financial losses. Registration and subsequent liquidation of an LLC is carried out under the strict control of the Federal Tax Service. It is impossible to stop the operation of an institution if there are still debts to creditors. In this case, you will have to initiate bankruptcy.

In both cases, the business ceases to exist, only upon transformation are obligations subject to succession, and the risk of subsidiary liability of the owners remains, and when the company is eliminated, they are repaid or written off. By completely liquidating an enterprise, participants risk additional taxes, insurance premiums, and penalties. Deficiencies are identified during a desk or field tax audit.

Connection algorithm

The accession procedure includes a number of successive stages. Let's look at them in order.

Reorganization of a company by merger and its step-by-step instructions are discussed in this video:

Preparation stage

At the preparatory stage, a meeting of the founders is held, at which a decision is made on the reorganization and its organizational aspects, fixed by agreement, are discussed. Also at this stage, employees are notified of the upcoming reorganization. According to Article 75 of the Labor Code of the Russian Federation, they are guaranteed employment in the successor company, but employees themselves may express a desire to quit, so they should be given enough time to find a new job before the end of the reorganization.

An essential condition, without which the merger is impossible, is an inventory of the assets and liabilities of the reorganized company. The mandatory nature of inventory is regulated by clause 27 of the “Regulations on Accounting in the Russian Federation”, approved by Order of the Ministry of Finance No. 34n dated July 29, 1998. Based on the results obtained, a transfer deed is formed, according to which all property, rights and obligations of the original company will be transferred to the legal successor.

Notification stage

After preparing the main package of documents, regulatory authorities and creditors should be notified about the decision made. Within three days after the decision on reorganization is made, a notification must be sent to the Federal Tax Service. For this purpose, form No. P12003 is intended, which reflects:

- the basis for the start of the reorganization, namely, decision-making;

- method of reorganization;

- the number of legal entities that will be available upon completion of the procedure;

- information about the reorganized company;

- information about the applicant.

The same form can also be used to notify the tax authorities of the cancellation of the planned reorganization. To do this, on the first page of the notification, “making a decision to cancel a previously made decision” is selected as the basis.

At this stage, publications are made in the media. It is also recommended to inform creditors additionally by sending them notification letters.

Completion stage

At the final stage, the final documentation is submitted to the regulatory authorities. First of all, it is necessary to provide the Pension Fund with personalized accounting information for employees. They are submitted on time - no earlier than 1 month from the beginning of the reorganization, but no later than the day the documents are submitted to the Federal Tax Service on the termination of activities. It is not necessary to take a certificate confirming the provision of information to the Pension Fund, since the tax authorities independently request all the necessary information.

Next, two packages of documents must be submitted to the Federal Tax Service - to terminate the activities of the reorganized company and to register changes to the Charter of the successor company.

The first includes the following set of documents:

- application in form P16003;

- decision of the founders;

- agreement of adhesion;

- deed of transfer.

The second package of documents contains:

- application in form P13001;

- minutes of the general meeting of all participants in the reorganization;

- new edition of the Charter (2 copies);

- agreement of adhesion;

- deed of transfer.

The final liquidation of the reorganized company and registration of changes in the charter of the legal successor can be carried out only after 3 months from the date of the start of the reorganization. This is exactly the period given for appealing the decision on accession (Article 60.1 of the Civil Code of the Russian Federation). Amendments to the Unified State Register of Legal Entities are carried out by the registering authorities within 5 days.