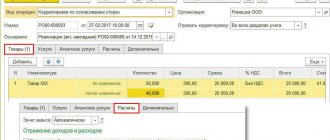

Payment

Starting from 2021, the procedure for withholding income tax when an employee goes on vacation has changed. Considering,

An order to change accounting policies is an administrative document, without the issuance of which no corrections can be made.

The normal activity of any company today is closely related to the good equipping of its existing services with means

Other means those not directly related to the main activities of the enterprise. These expenses and

In accordance with the current legislation of Russia, taxes in the country are divided into three main categories:

Writing off fuel and lubricants as expenses is impossible without their documentary confirmation. The main document performing this function is

Dividend payments are a distribution of net profit in proportion to the participants' contribution to the authorized capital. Happening

Article 80 of the Tax Code of the Russian Federation gives the following description of a tax return - this is a statement about objects

More and more older people want to lead active lives. Energetic lady or gentleman in

The current account may be blocked at the request of the Federal Tax Service. Reasons for suspending settlement transactions