Regulatory regulation

The traffic police fine is taken into account for accounting purposes in other expenses (clause 12 of PBU 10/99) and is reflected in account 91.02 (Chart of Accounts 1C).

Fines for violating traffic rules cannot be taken into account in tax expenses as they are not economically justified (Article 252 of the Tax Code of the Russian Federation). In addition, they are directly listed as expenses not taken into account for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation).

The amount of compensation for damage in the event of withholding it from the guilty person is included in income for income tax purposes (STS) on the date of recognition by the debtor or the date of entry into force of the court decision (clause 3 of Article 250 of the Tax Code of the Russian Federation, clause 1 of Article 346.15 of the Tax Code of the Russian Federation , paragraph 4, paragraph 4, article 271 of the Tax Code of the Russian Federation).

Labor legislation

In settlements with the employee, two options are possible:

- withhold the amount of the fine (Article 238 of the Labor Code of the Russian Federation),

- do not withhold the amount of the fine (Article 240 of the Labor Code of the Russian Federation).

Recovery of damages from the guilty person is carried out by order of the employer, which he must issue no later than a month from the date the amount of damage is established (Article 248 of the Labor Code of the Russian Federation).

Debt can only be collected through legal proceedings if:

- the month period has expired;

- the employee does not agree to voluntarily compensate for the damage caused to the employer;

- the amount of damage caused to be recovered from the employee exceeds his average monthly earnings;

- the employee undertook to compensate the damage voluntarily, but quit before the debt was fully repaid and refused to pay the debt.

The employee must provide written consent to reimburse the amount of the fine to the organization.

Personal income tax and insurance premiums

The organization may decide to forgive the employee for the damage, in which case the question arises about the need to impose personal income tax on the amount of damage.

There are two opposing opinions of regulatory agencies regarding the withholding of personal income tax from an employee in the event that the organization forgives the damage caused to it:

- The employee receives an economic benefit (income in kind) in the form of exemption from the obligation to compensate for direct actual damage in the amount of the undeducted fine (Article 41 of the Tax Code of the Russian Federation). Income is subject to personal income tax (Letters of the Ministry of Finance of the Russian Federation N 03-04-05/1660 dated 01/20/2016, dated 08/22/2014 N 03-04-06/42105, dated 04/12/2013 N 03-04-06/12341, dated 10.04. 2013 N 03-04-06/1183, dated 08.11.2012 N 03-04-06/10-310).

- The employee does not have any income, since the organization is held liable as the owner of the vehicle (Letter of the Federal Tax Service of the Russian Federation dated April 18, 2013 N ED-4-3 / [email protected] ).

If you decide to withhold tax, then for personal income tax accounting purposes:

- date of receipt of income - the day of forgiveness of the damage (date of the order, order for forgiveness) (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation);

- date of personal income tax withholding - the date of the first cash payment in favor of the employee (clause 4 of article 226 of the Tax Code of the Russian Federation);

- the deadline for transferring personal income tax is the day following the day of payment to the employee (clause 6 of article 226 of the Tax Code of the Russian Federation).

The forgiven fine is not subject to insurance contributions, since no payments were made in favor of the employee (Article 420 of the Tax Code of the Russian Federation).

All comments (3)

Good afternoon, Irina! Payment of a fine, like any payment to the budget, must be registered in 1C as a tax payment, since a type of payment order with KBK is required. Therefore, fill out a payment order in the transaction type Tax payment . You can create a special expense item if fines are not uncommon for you, or choose one that makes sense from the ones you have. The main thing is that the type of movement should be - Other payments for current transactions . There is no special document in 1C for calculating the obligation to pay a fine. Use the document Manually Entered Transaction . The postings depend on whether you are going to collect a fine from the guilty employee or pay it at the expense of the organization. If the fine is at the expense of the organization, its amount cannot be accepted as an expense for tax accounting purposes as an economically unjustified expense (clause 1 of Article 252 of the Tax Code of the Russian Federation).

This is interesting: Text of the appeal to the traffic police about the abolition of the fine in 2021

Thank you very much for the quick and accurate answer. Irina

Always happy to help!

You can ask more questions

Access to the “Ask a Question” form is only possible if you have fully subscribed to BukhExpert8. Submit an application on behalf of Legal Entity. or Phys. faces you can here >>

By clicking the “Ask a Question” button, I agree with the BukhExpert8.ru regulations >>

Rules for accounting for fines on taxes and agreements

The company may be fined by the tax authorities, for example, for late submission of reports. Counterparties may impose fines for violating the terms of contracts. The opposite may also happen - the organization itself will receive monetary compensation from a supplier who did not ship the goods on time. Accounting for sanctions in each specific case has its own characteristics. Let's look at them in more detail.

How to remove a traffic police fine from State Services

In the situation under consideration, both the amount of damage caused and the specific culprit have been established; therefore, forgiveness of the amount of an administrative fine leads to the employee receiving economic benefits received in kind, which, in turn, by virtue of Art. Taking into account the position of the financial department, an organization for failure to fulfill the duties of a tax agent may be held liable by the tax authority under Art.

One could perhaps agree with the stated position of the financiers, if not for one thing. With all due respect to the Ministry of Finance, it is completely unclear what relation their conclusion has to the evidence they presented.

Key tags: Fine, traffic police, for, organization, posting

Penalty under a supply agreement

A fine can be imposed on both the buyer and the supplier of goods in the following situations:

1. The supplier violated the terms of delivery of goods specified in the contract.

2. The buyer did not pay for the goods within the terms specified in the delivery agreement.

Most often, the violator pays penalties calculated for each day of late payment. If the terms of the contract are violated, the guilty party must pay a penalty in accordance with the contract. The company whose rights have been violated submits a written demand (claim) to the guilty organization for payment of a penalty (Article 331 of the Civil Code of the Russian Federation). The parties can agree to postpone the payment of the fine by signing an additional agreement.

Often the violator of the contract refuses to pay the fine. In this case, you can file a lawsuit. If the court makes a positive decision, the counterparty will be required to pay a fine. Most likely, the violator will be required to reimburse court costs and the state fee paid by the plaintiff for the consideration of the case in court.

Accounting with the injured party

In tax accounting, the penalty received by the injured party is reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). In accounting, the amount of the penalty is recognized as other income (clause 8 of PBU 9/99 “Income of the organization”).

The postings will be like this:

Debit 76 Credit 91.01 - the amount of the penalty is reflected in the accounting

Debit 91.02 Credit 68 - reflects the state fee for considering a claim in court

Debit 76 Credit 91.01 - the amount of state duty, by court decision, was presented for reimbursement by the violator

Debit 51 Credit 76 - the amount of the penalty was credited to the current account

Violator's account

In tax accounting, the party to the contract who committed the violation includes the penalty as part of non-operating expenses (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation).

In accounting, the amount of the penalty is recognized as other expenses (clause 12 of PBU 10/99).

The postings will be like this:

Debit 91.02 Credit 76 - penalty accrued

Debit 76 Credit 51 - the amount of the penalty was transferred to the injured party.

Globus LLC shipped a power plant to Mech LLC in the amount of 826,000 rubles, including VAT - 126,000 rubles. According to the terms of the contract, Mech LLC must pay for the goods until May 15, 2017 inclusive. The money was transferred to the account of Globus LLC on May 25, 2017. The amount of the penalty is 0.3% of the contract amount for each day of delay. The accrual of penalties will begin on May 16, 2017. Penalty = 826,000 x 0.3% x 10 days = 24,780 rubles. Globus LLC will reflect the penalty as part of non-operating income: Debit 76 Credit 91.01 - 24,780 Mech LLC will reflect the penalty as non-operating expenses: Debit 91.02 Credit 76 - 24,780

How to reflect the deduction of material damage from wages in accounting

The organization purchased a car on lease. According to the leasing agreement, she is the balance holder. The driver of this organization violated traffic rules, and therefore received fines. If an organization forgives a driver’s debt, then in the system of “chap. buh” it is written that we must withhold personal income tax and charge insurance premiums. For this amount. Then, what personal income tax code should you indicate? What kind of postings need to be made to the account? accounting (organization on OSNO)? What if the organization withheld this amount from the employee’s salary? What wiring should be done?

If an organization paid a fine for a violation of traffic rules by an employee and did not withhold this amount from him, make an entry in the accounting records Debit 91-2 Credit 73. In the 2-NDFL certificate, indicate the amount of the fine as income received by the employee in kind, according to income code 2520. Reflect the deduction of the fine from the employee’s salary by posting Debit 70 Credit 73.

From the recommendation of

Oleg Khoroshiy,

Head of the Department of Profit Taxation of Organizations of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

How to reflect in accounting the deduction from wages of material damage caused to the organization

Debit 70 Credit 73

– the cost of damage was deducted from the employee’s salary by order of the manager.

If an employee voluntarily or by court decision compensates for amounts in excess of earnings, reflect this as follows:

Debit 50 Credit 73

– the employee is compensated for the amount of damage.

How to reflect in accounting an employee’s forgiveness of a fine for violating traffic rules

The head of the organization may decide not to fully or partially recover the shortfall from the guilty employee (Article 240 of the Labor Code of the Russian Federation). The reasons may be different: the employee’s previous merits, difficult financial situation, insignificant damage, etc. The amount of damage is included in other expenses:

Debit 91-2 Credit 73

– the residual value of missing valuables is reflected as part of other expenses.

If the organization refuses to recover the amount of damage from the employee, then personal income tax must be withheld from him, and insurance premiums must be charged for the cost of the damage.

Make the same entries if the organization paid an administrative fine for an employee (for example, for violating traffic rules) and subsequently decided not to collect this amount. Don’t forget to also withhold personal income tax and calculate insurance premiums.

How to take into account when taxing the deduction from wages of material damage caused to the organization. The organization applies a special regime

Situation:

Is it necessary to withhold personal income tax if an organization paid an administrative fine for an employee (for example, for violating traffic rules on the organization’s car)

According to representatives of the financial department, the cost of paying an administrative fine is damage caused to the employer. Refusal to collect the fine from the guilty employee results in the latter receiving income in kind. Consequently, in such a situation, the organization must withhold personal income tax (letters of the Ministry of Finance of Russia dated June 17, 2014 No. 03-04-05/28925, dated April 12, 2013 No. 03-04-06/12341, dated April 10, 2013 No. 03-04-06/1183, dated November 8, 2012 No. 03-04-06/10-310).

From letters of the Ministry of Finance of Russia dated April 12, 2013 No. 03-04-06/12341, dated April 10, 2013 No. 03-04-06/1183 it follows that in some cases personal income tax does not need to be withheld. This is possible if: – the employee committed a violation under circumstances excluding financial liability (Article 239 of the Labor Code of the Russian Federation); – the employer did not provide the employee with conditions for the safety of property; – the employee acted in accordance with the employer’s order, regulation, or other mandatory documents. For example, a written instruction stating that the employee is obliged to get to the destination as soon as possible.

ORDER OF THE FTS OF RUSSIA DATED 09/10/2015 No. ММВ-7-11/ [email protected]

On approval of codes for types of income and deductions

Appendix 1. Taxpayer income type codes

www.zarplata-online.ru

Tax fines and penalties

The postings will be like this:

Debit 99 Credit 68 (69) - a penalty has been charged for tax (insurance contributions).

Debit 68 (69) Credit 51 - the tax penalty (insurance contributions) is transferred.

Important! Tax penalties are not taken into account when determining the tax base for income tax (clause 2 of Article 270 of the Tax Code of the Russian Federation).

In addition to penalties, for late payment, regulatory authorities may charge penalties based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation (Article 75 of the Tax Code of the Russian Federation). Penalties = Tax arrears x Number of calendar days of delay x 1/300 of the refinancing rate. Penalties begin to accrue from the next day after the tax payment deadline.

According to the Federal Tax Service, penalties should be accrued until the day of repayment of arrears on taxes, including this day itself (Explanations of the Federal Tax Service of Russia dated December 28, 2009). The courts and the Ministry of Finance do not agree with this approach (letter of the Ministry of Finance of Russia dated July 5, 2016 No. 03-02-07/2/39318). Arbitrators and financiers believe that it is unlawful to charge penalties on the day the debt is repaid.

Important! From October 1, 2017, if there is a delay of more than 30 days, penalties are calculated based on 1/150 of the refinancing rate (Federal Law No. 401-FZ dated November 30, 2016).

Most often, accountants write off penalties on account 99:

Debit 99 Credit 68 - penalties accrued.

Some experts believe that penalties should be attributed to account 91.

The organization will have to independently choose the accounting option and consolidate the corresponding rules in its accounting policies. Please note that penalties are similar in economic essence to fines. And account 99 is intended for accounting for fines. But if the company accounts for penalties in account 91, then it is necessary to reflect a permanent tax liability (according to the requirements of PBU 18/02).

The Federal Tax Service issued a demand to Mech LLC to pay penalties in the amount of 620 rubles. The accounting policy of Mech LLC stipulates that penalties are reflected in account 91. The company will reflect the transaction with the following entries: Debit 91-2 Credit 68,620 - penalties are accrued and reflected in the accounting records; Debit 99 Credit 68,124 - permanent tax liability calculated (620 x 20%).

Common questions and answers

Question No. 1. In a situation where an employee completely refuses compensation for damage, is it possible to deduct wages without his written consent?

If the employee is a financially responsible person in accordance with labor legislation and the fact of the shortage was identified and recorded during all the necessary legal procedures, then there is no obstacle to withholding the damage from wages on a monthly basis until the damage to the organization is fully covered.

Question No. 2. The order to collect the shortfall was drawn up several months after the fact of the discovery of the shortfall was recorded, whether the withholding of wages is legal.

Deduction from wages will be legal if, before the order was issued, an explanatory statement was requested from the financially responsible person about the fact of the damage incurred and, subsequently, the employee was familiarized with the order in which the reason for the deduction is legal and complies with the federal law of the Russian Federation.

Question No. 3. The General Director issued an internal order on fines for errors in documents, is this legal?

In itself, such an order cannot be legal, because it does not comply with labor legislation. In a situation where errors in documents lead to material damage to the company, for example, errors in a tax return can lead to a fine issued to the organization, even in this case a special commission must be organized to identify the perpetrators and obtain explanatory notes from them. And only then is an order issued to recover damages from these specific individuals in a specific case.

Question No. 4. Is it possible to pay off a debt to a company without deduction from wages?

Maybe. By agreement with the general director, an employee can voluntarily pay for damages through the cash register, as well as provide equivalent property, carry out the necessary repairs, etc. In this case, ways to solve the current situation can be discussed personally between interested parties.

One-click call St. Petersburg, Leningrad region call: +7(812) 309-13-76

online-buhuchet.ru

Concept and types of penalties

This is a type of financial responsibility for committed illegitimate actions, expressed in a specific monetary amount.

All fines are divided into two categories:

- Civil law - established for violation by the parties of obligations under the contract (clause 7 of PBU 9/99).

- An administrative fine is a category of sanctions imposed by various government agencies and institutions. Administrative penalties include payments to the Federal Tax Service, State Traffic Safety Inspectorate, Rospotrebnadzor, etc.

Accounting for sanctions is carried out in accordance with the standards of PBU 10/99, according to the following accounts:

- in case of violation of legal norms - in account 99 “Profits and losses”;

- in case of violation of contractual terms and obligations and provisions of the Code of Administrative Offenses - under account 76 “Settlements with various debtors and creditors”.

The documentary basis for reflecting penalty payments is a decision to bring to administrative liability or a payment (collection) order confirming payment of the penalty.

The organization includes the costs of paying the penalty by decision of the judicial authorities and accepted by the debtor in non-operating expenses, thereby reducing the taxable base of the income tax (Article 265 of the Tax Code of the Russian Federation). Based on PBU 18/02, this type of cost is not an integral part of the income tax and is not included in the base that forms the income tax. Therefore, collection costs are written off at the end of the reporting period.

Payment of the penalty

You can enter information about paying a fine into the 1C program using the “Receipt of Goods” document. When creating a document, select the type of transaction “Write-off from current account”. In the open window, fill in the information about the date, number, contract, DDS article. Post the document. Now you can generate a document for payment of penalties. This payment can be made in the “Bank and cash desk” menu, in the “Bank” section, “Bank statements” item. When you click on the “Bank Statements” hyperlink, click on the “Write-off” button and fill out the document “Write-off from the current account” indicating the type of transaction “Payment to the supplier.” You also need to fill out information about the date, recipient, amount of the fine, agreement and settlement account 76.02.

Ask a question to the experts and get an answer within 15 minutes!

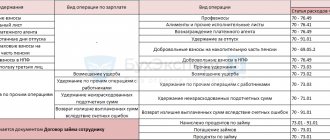

Postings on fines

Let's consider the main entries for reflecting penalties in the accounting of non-profit organizations:

- Dt 99 Kt 68 - imposing penalties for violating the standards of current tax legislation;

- Dt 76.2 Kt 91 - a penalty was assessed for non-compliance with the terms and obligations under the contract.

For a non-profit organization, entries for traffic police fines are generated as follows:

- Dt 91 Kt 76. subaccount “Administrative fines” - the traffic police fine was assessed for an offense under traffic rules;

- Dt 76 Kt 50, 51 - accounting entries for a fine for violating traffic rules (the fine has been paid).

The accrual of sanctions from the Federal Tax Service for non-payment of tax is recorded as follows:

- Dt 99.1 Kt 68.4 - accrual of penalties;

- Dt 99.2 Kt 68.4 - reflection of the penalty accrued for late tax payment;

- Dt 68.4 Kt 51 - payment of late sanctions to the Federal Tax Service.

Expenses for penalties of budgetary institutions are reflected in KOSGU 290 - “Other expenses” (Order of the Ministry of Finance No. 65n dated July 1, 2013).

The wiring, in our opinion, looks like this:

All articles on accounting are here Section of articles: Accounting Section of articles: Personnel records management.

109316, Moscow, Volgogradsky Ave. 35, 6th floor, room 615

Monday – Friday: 10:00 – 20:00, Saturday: closed, Sunday: closed

Penalties and fines are types of monetary payments that a person who has violated legal requirements is required to make. A fine is usually a fixed or predetermined amount, calculated as a percentage of some known value (for example, the amount of debt), and penalties usually depend on the duration of the violated obligation and are calculated as a percentage for each day. We will tell you about accounting for tax penalties in accounting and for tax purposes, as well as accounting for fines in our consultation.

Traffic police fines accounting and tax accounting

Despite the fact that in the described situation the driver violated the traffic rules, in such a case the owner of the vehicle, that is, the organization, will bear administrative responsibility. This rule is established in Part 1 of Art. 2.6.1 Code of Administrative Offenses of the Russian Federation. As the said norm states, the owners (owners) are brought to administrative responsibility for traffic offenses (if they are recorded by special technical means operating automatically, having the functions of photography, filming, video recording, or by means of photography, filming, video recording). Vehicle. Whereas, according to the definition given in clause 1.2 of the Traffic Rules * (1), a driver is a person driving a vehicle. Moreover, we are not talking about the right of ownership of a vehicle as a qualifying feature of the driver.

Based on the above, we can conclude that a driver is any person who gets behind the wheel: not only a driver who has passed the exam for the right to drive any type of vehicle and received the appropriate license, but also a person whose license was confiscated in the manner prescribed by law for a previous violation of traffic rules, a person who did not have or was deprived of the right to drive the corresponding type of vehicle, as well as a person teaching driving on a training vehicle with dual controls.

Note. An administrative fine is a monetary penalty, expressed in rubles and credited in full to the budget (Part 1, 5, Article 3.5 of the Code of Administrative Offenses of the Russian Federation).

So, the organization, being the owner of the vehicle, is the subject of an offense in the field of traffic rules, since in Part 1 of Art. 2.6.1 of the Code of Administrative Offenses of the Russian Federation specifies a special subject of liability - the owner of the vehicle (paragraph 8 of Question 10 of the Review of Legislation and Judicial Practice of the Supreme Court of the Russian Federation for the first quarter of 2010, approved by the Resolution of the Presidium of the Armed Forces of the Russian Federation dated June 16, 2010). Therefore, the organization must pay an administrative fine (Part 1 of Article 32.2 of the Code of Administrative Offenses of the Russian Federation). We note that according to Part 2 of Art. 2.6.1 of the Code of Administrative Offenses of the Russian Federation, an organization can be released from administrative liability if it proves that at the time the administrative offense was recorded, the vehicle was in the possession or use of another person, or at that moment had left the organization’s possession as a result of unlawful actions of other persons.

For your information. Federal Law dated May 7, 2013 N 92-FZ*(2) amended Federal Law dated December 10, 1995 N 196-FZ “On Road Safety” and the Code of Administrative Offenses of the Russian Federation. In particular, the Code of Administrative Offenses of the Russian Federation is supplemented by Art. 12.32.1 as follows: admission to driving a vehicle by a driver who, in cases provided for by the legislation of the Russian Federation on road safety, does not have a Russian national driver’s license or a temporary permit to drive vehicles, entails the imposition of an administrative fine on officials responsible for technical condition and operation of vehicles in the amount of 50,000 rubles. This norm comes into force on November 5, 2013.

Who is guilty?

Meanwhile, the actual culprit in the situation under consideration is the driver, since it was he who committed the administrative offense. This means that he is obliged to compensate the organization for direct actual damage, which, in accordance with Art. 238 of the Labor Code of the Russian Federation is understood as a real decrease in the employer’s cash property.

Based on Part 2 of Art. 130 of the Civil Code of the Russian Federation, money is recognized as movable property. Consequently, the actions of the employee, which led to the payment of a fine by the organization, are considered as causing direct actual damage to it in the form of a reduction in the size of movable property.

If an employee causes damage as a result of an administrative violation established by the relevant government body, the employee bears full financial responsibility (Article 243 of the Labor Code of the Russian Federation).

According to Art. 242 of the Labor Code of the Russian Federation, the employee must compensate for the damage caused to the organization in full. At the same time, the employer may waive its right to recover from the employee the amount of damage caused. This follows from the provisions of Art. 240 Labor Code of the Russian Federation.

Let's summarize what has been said. In any case, the employer is obliged to pay an administrative fine. However, there are then two possible scenarios: the employer will recover the amount of damage from the employee or refuse to collect it. We will consider further how this should be reflected in accounting.

The organization paid the fine, the employee reimbursed it

The situation when an employee agrees to reimburse the amount of the fine paid by the employer in accordance with the Chart of Accounts and Instructions for the Application of the Chart of Accounts * (3) should be reflected in accounting as follows:

Debit 76 Credit 51 - the amount of the fine was paid by the employer to the budget Debit 73, subaccount “Calculations for compensation of material damage” Credit 76 - the employee assumed the obligation to compensate the employer for the damage caused (the entry is made at the time of signing the relevant document (for example, an act) by the employer and employee ) Debit 50 (70) Credit 73, subaccount “Calculations for compensation of material damage” - reflects the amount contributed by the employee to the organization’s cash desk (deducted from his salary)

The organization decides not to collect the fine from the employee

In this case, the procedure for recording transactions in accounting is somewhat different. Let us immediately note that the amount of an administrative fine for violation of traffic rules paid by an employer for its employee is recognized differently in accounting and tax accounting.

In accounting, the amount of the fine is taken into account on the basis of clause 11 of PBU 10/99 “Expenses of the organization” * (4) as part of other expenses.

In this case, the following entries are made in the accounting: Debit 91-2 Credit 76 - an expense in the amount of the administrative fine is reflected Debit 76 Credit 51 - the amount of the fine is paid to the budget In tax accounting, the amount of the fine paid by the employer for violation of traffic rules by an employee is not taken into account for tax purposes arrived. Grounds - clause 2 of Art. 270 Tax Code of the Russian Federation. As a result of recognizing in accounting the amount of an administrative fine that is not taken into account when calculating income tax, a permanent difference is formed and the corresponding amount of permanent tax liability (PNO) (clauses 4, 7 PBU 18/02 “Accounting for calculations of income tax of organizations” *(5)). In accounting for PNO it is reflected as follows: Debit 99 Credit 68-PNO.

It remains to add here that small businesses * (6) may not apply the provisions of PBU 18/02 (clause 2 of this accounting standard). At the same time, such organizations must necessarily register their choice in their accounting policies for accounting purposes.

Important nuance

In addition to directly paying the fine, the amount of which may vary depending on the offense committed by the employee, the employer, when deciding not to recover the amount of damage from the employee, must decide for himself the following question. In this case, does the employee have income subject to personal income tax, and does the employer, accordingly, have the obligations of a tax agent? And this question is by no means an idle one, since the current legislation does not give a clear answer to it, and the opinions of the regulatory authorities seem to be divided.

In particular, the Ministry of Finance believes that if an organization pays a fine for violating traffic rules and subsequently forgives the employee for the material damage caused, the employee receives an economic benefit in kind, which is subject to personal income tax. This is evidenced by the explanations given in letters dated 04/10/2013 N 03-04-06/1183, dated 11/08/2012 N 03-04-06/10-310.

Financiers justify their position as follows. In the situation under consideration, both the amount of damage caused and the specific culprit have been established; therefore, forgiveness of the amount of an administrative fine leads to the employee receiving economic benefits received in kind, which, in turn, by virtue of Art. 41 of the Tax Code of the Russian Federation leads to the emergence of an object of personal income tax.

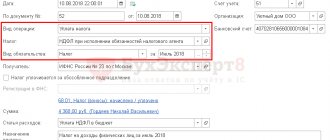

How to issue a traffic police fine in 1C 8.3

Calculation of a fine

The Organization received a resolution on an administrative violation in relation to traffic rules.

On May 7, the Resolution came into force.

On May 8, the traffic police fine was paid.

On May 13, the employee’s consent to compensate for the damage caused to the Organization was received.

On May 20, the employee deposited the compensation amount into the cash register.

The calculation of the traffic police fine in 1C 8.3 is reflected in the document Transaction entered manually, the type of transaction Transaction in the section Transactions – Accounting - Transactions entered manually on the date of entry into force of the Resolution on an administrative offense.

Please indicate:

- Debit - 91.02 “Other expenses”: Subconto 1 - item of other income and expenses, Type of item - Other non-operating income (expenses) , the Accepted for tax accounting is not selected.

- Subconto 1 - the state body that assessed the fine: selected from the Counterparties directory;

Paying a fine to the traffic police

In 1C 8.3, reflect the payment of the fine in the document Write-off from the current account type of transaction Other settlements with counterparties in the Bank and Cash desk section - Bank - Bank statements - Write-off button.

Please indicate:

- Date – date of payment of the fine, according to the bank statement;

- According to document No. from - the number and date of the payment order;

- The recipient is the government agency that assessed the fine;

- Agreement - Resolution imposing a fine;

- Expense item - Other expenses ; Type of movement - Other payments for current transactions .

The employee’s consent to compensation for damage has been obtained

If the employee’s consent to compensate for damage to the organization has been obtained, then reflect the employee’s debt in the document Transaction entered manually, transaction type Transaction in the section Operations – Accounting – Transactions entered manually.

In the document please indicate:

- from - the date of written recognition of the damage by the guilty party.

Attribution of the amount of damage to the guilty employee:

- Debit - 73.02 “Calculations for compensation of material damage”: Subconto - indicates the guilty employee from the directory Individuals from whom the amount of damage is subject to recovery;

- Subconto - item of other expenses and income, Type of item - Compensation for losses receivable (payment) , the Accepted for tax accounting is selected.

The amount of the fine may be:

- deposited by the employee into the cash register;

- withheld by the employer from the salary.

More details using the example of Deduction of damages from wages for shortages

Payment by the employee of the fine amount to the company's cash desk

Complete the document Cash receipt transaction type Other receipt in the Bank and cash desk section – Cash desk – Cash documents – Receipt button.

Please indicate:

- Item of income - Receipt of fines, penalties, penalties for non-fulfillment of contracts : Type of movement - Other income from current operations .

Withholding personal income tax in case of refusal to reimburse a fine

To calculate personal income tax on the forgiven amount of damage, create a new type of accrual Forgiven damage . Setting up a new type of accrual is carried out in the section Salaries and personnel - Directories and settings - Salary settings - section Salary calculation - link Accruals - Create button.

Install:

- In the personal income tax : switch - taxable ;

- income code - 4800 “Other income”;

- The Income in kind checkbox is selected: this is required so that personal income tax is calculated in the Payroll , but the income itself is not accrued.

- Type of income - Income that is completely exempt from insurance premiums, except for benefits from the Social Insurance Fund and allowances for military personnel .

- switch - not included in labor costs .

Calculate personal income tax on forgiven damages using the Payroll in the Salaries and Personnel section - Salaries - All accruals - Create button - Payroll.

Click the Add in the Accruals and specify the created accrual type:

- Payment date - date of payment of the fine by the Organization;

- Amount - the amount of the fine forgiven.

Traffic police fine - postings in 1C 8.3

The document generates transactions:

- Dt Kt - payroll;

- Dt Kt 68.01 - withholding personal income tax from wages and in-kind income;

- Dt Kt 69.01 - calculation of social insurance contributions to the Social Insurance Fund from wages;

- Dt Kt 69.03.1 - calculation of insurance contributions to the FFOMS from wages;

- Dt Kt 69.02.7 - calculation of insurance contributions for pension insurance in the Pension Fund of the Russian Federation from salary.

shtraf.jpg

Related publications

When it comes to fines for a company, the first thing that comes to mind is tax sanctions. Indeed, this is the most common situation in which a company incurs such costs. But in some cases, an organization also has to pay fines that are not related to tax violations. Let's consider in what cases this may happen and how to reflect fines in accounting.

Accounting entries when reflecting fines

This cannot be said to be critical, since the amount of knowledge that the driver has in his head allows him to feel quite confident and safe on the roads. But, as for me, it would not hurt to make mandatory periodic testing certification for all drivers for knowledge of traffic rules, not for the purpose of regular “extortions” or any punitive measures, but in order to refresh a person’s memory of some important aspects about which he I could have forgotten for objective reasons.

On the pages of this site, current traffic regulations will be described in detail and in accessible language. The presentation of the material will be based on an unprepared beginner, for whom some “obvious” things may be incomprehensible. In general, these are the traffic rules for “blondes” (in no way do we want to offend the fair half of humanity), which may well include some of the male population.

In what cases may administrative sanctions be imposed on a company?

The Administrative Code contains dozens of articles, according to which a legal entity may be subject to penalties.

We list a number of the most common cases:

- In case of violation of traffic rules by drivers driving vehicles owned by the organization.

- In case of violations of labor legislation identified by Rostrud specialists.

- In case of violations of legislation on the protection of consumer rights by trade organizations.

- In case of violations of certain requirements of tax legislation that are not directly related to the payment of taxes (for example, deadlines for submitting declarations).

Administrative fine - accounting entries

The general principles for reflecting expenses in accounting are given in PBU 10/99 “Expenses of an organization.”

Because fines cannot be attributed to expenses directly related to the main activities of the company, they can be classified as other expenses in accordance with clause 11 of PBU 10/99. The list given in this paragraph is open, therefore, on its basis, penalties can also be recognized as expenses.

In accordance with the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, account 91 is used to account for other expenses.

Thus, if the company is assessed fines, the accounting entries will be associated with this account. Regardless of the type of fine - traffic violation or labor inspection fine - the accounting entries will be the same:

DT 91.2 – CT 76 – charging a fine;

DT 76 – CT 51 – the fine is transferred to the budget.

If the company challenged the fines in court, but lost the case, the bailiffs can carry out the collection. In this case, the postings on the writ of execution will be similar to those discussed above.

Unlike accounting, tax accounting provisions contain a direct prohibition on including penalties transferred to the budget into expenses (clause 2 of Article 270 of the Tax Code of the Russian Federation).

In this case, there is a constant difference between the two types of accounting in the amount of accrued penalties.

Therefore, if an organization has accrued a fine, the entries must be supplemented with transactions to reflect tax differences in accordance with PBU 18/02. In this case, a permanent tax liability (PNO) arises. To determine its value, you need to multiply the permanent difference by the current income tax rate.

DT 99 – KT 68.4 – reflected PNO

Thus, if an organization has been assessed a fine, the entries relate not only to settlements with the budget, but also to the resulting tax differences.

More materials on the topic:

How to reflect the paid fine in accounting and tax accounting? Is it possible to include such a fine in the tax base for income tax? Income tax Blinds useful life The object of taxation for the wiring tax for Russian organizations that are not members of the consolidated group of taxpayers, traffic police fine, is recognized as profit, which is defined as the difference between the income they receive and the amount of expenses they incurred, determined in accordance with Chapter 25 Tax Code of the Russian Federation p.

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income. As we understand, in the situation under consideration, the organization paid an administrative fine.

traffic police fine for organization

Considering that the amounts of administrative fines are subject to crediting to the traffic police department in full in accordance with the legislation of the Russian Federation. At the same time, expenses that differ from expenses for ordinary types of organization,

are considered other fines. Expenses for ordinary activities are expenses associated with the manufacture of wiring and sales of products, acquisition and sale of goods.

Such expenses also include expenses the implementation of which is associated with the performance of work, provision of services, etc.

The organization's expenses for How many indicators should the document contain administrative fines are not pursued by postings

manufacture or sale of products, purchase and sale of goods, and are also not related to the performance of work or provision of services, we believe that for accounting purposes they should be classified as other expenses, the list of which is open clause.

Let us note that the regulations governing the accounting procedures of the traffic police contain a ban on reflecting expenses in the form of administrative fines in accounting. The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by order of the Ministry of Finance of Russia dated Taking into account the above, we believe that transactions related to the accrual and payment of an administrative fine by an organization are reflected in the accounting accounts as follows: Debit 91, subaccount “ Other expenses" Credit 76, subaccount "Calculations for administrative fines" - an administrative fine has been charged; Debit 76, subaccount “Calculations for administrative fines” Credit 51 - the administrative fine is transferred to the budget.

Considering that this type of expense is not taken into account when taxing profits, in accounting there will be a constant difference between accounting profit or loss and taxable profit or loss of the reporting period. Debit 99 Credit 68, subaccount “Calculations for income tax.”

Compensation for traffic police fines at the expense of the guilty party

In accordance with Art. 238 of the Labor Code of the Russian Federation, the organization has the right to recover the paid fine from the guilty person. In this case, the driver may be found guilty.

If the organization that owns the vehicle was assessed a traffic police fine, the damage compensation transactions will be as follows:

DT 73 – CT 91.1 – the amount of the fine is allocated to settlements with the guilty person;

DT 70 – CT 73 – amount withheld from salary, or

DT 50 – CT 73 – the amount was voluntarily deposited into the cash desk of the enterprise.

Example

Driver Smirnov A.V. in a car owned by Alpha LLC, he exceeded the speed limit and was fined 1 thousand rubles. To reflect this fine for traffic violations in accounting, the accounting entries will be as follows:

DT 91.2 – CT 76 (1000 rub.) – fine charged

DT 76 – CT 51 (1000 rubles) – the amount of the fine is transferred to the budget

DT 99 – CT 68.4 (1000 x 20% = 200 rubles) – permanent tax liability reflected

DT 73 – CT 91.1 (1000 rubles) – the fine is assigned to the guilty person

DT 50 - CT 73 (1000 rubles) - the driver deposited the amount into the cash register.

Postings for imposing a fine and deducting it from the employee’s salary

The deduction itself is made in the document “Calculation of salaries and contributions” when calculating wages. Further, the payment of income occurs without taking into account the amounts under writs of execution. An organization can pay a fine for violating traffic rules (traffic rules) and withhold the amount from the employee’s salary in accordance with Art.

138, 238, 248 Labor Code of the Russian Federation. To do this, in “1C: Salaries and Personnel Management 8”, ed. 3.1, create a new hold.

We enter the amount of the received fine using a special document “Deduction for other transactions”, which is located in “Salary” - “Deductions”. In the new

Driver fines

In this case, compensation must be no less than the value of the property according to accounting data, taking into account its depreciation.

The law may establish a special procedure for determining the amount of damage caused to an employer by theft, intentional damage, shortage or loss of certain types of property, as well as in cases where the actual amount of damage exceeds its nominal amount.

The amount of deduction from an employee for each payment of wages cannot exceed 20%. Exceptions are cases where the employee caused damage to the organization as a result of a crime - then up to 70% can be withheld from wages.

Consequently, in the presented situation, when the amount of damage amounted to 12,000 rubles, and the average earnings of the perpetrator was 10,000 rubles, the employee will need to withhold 10,000 rubles, but not at once, but gradually, taking into account the specified limit of 20% from the amount of payment

Payroll postings

When paying for labor with products of own production, it is taken into account at market prices in accordance with Art. 40 Tax Code of the Russian Federation.

Personal income tax and unified social tax on payments to employees in kind are paid on a general basis based on the market value of products or other material assets issued to employees.

These postings are reflected in the debit of account 70 and the credit of the corresponding accounts. They show a decrease in the organization's wage debt to employees.

Account Dt Account Kt Description of the posting Posting amount Document-basis 70 50 Posting for the issuance of wages from the cash register 254500 Payroll sheet, cash order 70 51 Salaries were transferred to employee accounts in the bank (bank cards) from the company's account 50000 Certificate - settlement, payment order, agreement with the bank 70 68.01 Personal income tax withheld from employees' salaries 45500 Certificate-calculation 70 71 Withheld from the employee's salary the amount that was not previously returned by him, issued for reporting

Don’t forget to also withhold personal income tax and calculate insurance premiums. If an organization recovers damages from an employee, there is no need to withhold personal income tax, since in this case the employee does not generate income.

This follows from Article 41 of the Tax Code of the Russian Federation. Situation: is it necessary to withhold personal income tax if an organization refuses to recover material damage from an employee? Answer: yes, it is necessary. Personal income tax is assessed on employee income received in cash or in kind (Article 209, paragraph 1 Article 211 of the Tax Code of the Russian Federation). Income in kind includes, in particular, payment by an organization for employees of goods, works, services (sub.

1 item 2 art. 211 of the Tax Code of the Russian Federation). The employee’s obligation to compensate the employer for direct material damage caused to him is prescribed in Article 238 of the Labor Code of the Russian Federation.

Thus, if an employee’s guilt in causing material damage is proven and the amount of damage is determined, the employee has an obligation to the organization to compensate for this damage.

Deduction of fine from salary posting

In this case, compensation must be no less than the value of the property according to accounting data, taking into account its depreciation.

The law may establish a special procedure for determining the amount of damage caused to an employer by theft, intentional damage, shortage or loss of certain types of property, as well as in cases where the actual amount of damage exceeds its nominal amount.

The amount of deduction from an employee for each payment of wages cannot exceed 20%. Exceptions are cases where the employee caused damage to the organization as a result of a crime - then up to 70% can be withheld from wages.

Consequently, in the presented situation, when the amount of damage amounted to 12,000 rubles, and the average earnings of the perpetrator was 10,000 rubles, the employee will need to withhold 10,000 rubles, but not at once, but gradually, taking into account the specified limit of 20% from the amount of payment

How to properly make deductions from wages

Persons paying wages or other periodic payments to the debtor are obliged (clause 3 of Article 98 of Law No. 229-FZ):

- within three days from the date of withholding, pay or transfer the withheld funds to the recoverer. Transfer and transfer of funds are made at the expense of the debtor.

- from the date of receipt of the writ of execution from the claimant or bailiff, withhold funds from wages and other income of the debtor in accordance with the requirements contained in the writ of execution;

The employer's order (order) and the employee's consent to mandatory deductions from wages and other income are not required. Deductions at the initiative of the employer Deductions from an employee’s salary can be made in order to pay off debts to the employer only in cases established by the Labor Code and other federal laws.

How to reflect in accounting the deduction from an employee’s salary of the amount of a fine imposed by the traffic police on the organization?

You can get detailed information about settlements with personnel in the Directory “Personnel records and settlements with personnel in 1C programs” section.

Users of ITS versions of PROF can receive free consultations from auditors on accounting and taxation issues, as well as consultations from labor law specialists on personnel issues. You can send your questions to .

The letter must indicate the registration number of the program for which the 1C:ITS contract is issued and describe in detail the situation requiring consultation.

You can get acquainted with other answers from auditors to user questions Topics: , , Category: , Send by email Print Fines for the environment Should we increase payments and fines for negative impacts on the environment? Yes, we should. Nature is being polluted at an alarming rate and we must fight this.

No, don't.

Deductions from employee salaries in 1C

Fixed amount. A share, if the calculation is similar to the calculation by percentage, however, allows you to avoid errors in the calculation due to rounding (for example, 1/3 instead of 33.33%).

A money transfer through a paying agent is completed if the amount withheld from the employee will be transferred to the recipient using a paying agent: bank or post office. The deduction itself is made in the document “Calculation of salaries and contributions” when calculating wages.

Further, the payment of income occurs without taking into account the amounts under writs of execution. An organization can pay a fine for violating traffic rules (traffic rules) and withhold the amount from the employee’s salary in accordance with Art. 138, 238, 248 Labor Code of the Russian Federation. To do this, in “1C: Salaries and Personnel Management 8”, ed.