Article 80 of the Tax Code of the Russian Federation gives the following description of a tax return - this is a statement about the objects of taxation, income received, expenses incurred and the calculated amount of tax. Tax return forms for various taxes are approved by the Federal Tax Service, so, of course, this is not a document that can be drawn up in free form. In addition to the declaration forms themselves, the Federal Tax Service also approves the procedure for filling them out. Quite often, taxpayers make mistakes when preparing returns.

To avoid this, we recommend contacting specialists in a timely manner if questions arise, and also monitor the submission of reports. You can check yourself with a free audit.

Check your accounting for free

You can download current forms of tax returns and other necessary documents in the Document samples section

What should you do if you discover an error after submitting your return? You may have to prepare and file an amended tax return. In some cases, filing it will be a right of the taxpayer, and in others – an obligation.

When is an updated declaration needed?

Sometimes it happens that after submitting a tax return, an accountant finds an error in the calculations and thus it turns out that the tax was calculated incorrectly.

What to do in this situation? The answer is obvious: it is necessary to correct the accounts and recalculate the tax. If the tax amount turns out to be underestimated, the accountant is obliged to submit an updated declaration (paragraph 1, clause 1, article 81 of the Tax Code of the Russian Federation). If the error did not lead to a tax reduction, then you can do without clarification. Here, the right to choose remains with the organization (paragraph 2, paragraph 1, article 81 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated September 27, 2017 No. 03-02-07/1/62596). The adjusted declaration reflects the amount of tax calculated taking into account changes that have occurred or an error discovered. The results of tax audits carried out during the period of submission of the clarification should not affect the calculation of the tax base and the tax amount itself (subclause 2, clause 3.2 of the procedure for filling out an income tax return, approved by order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/ [email protected] , below is the order).

Important! The income tax return for 2021 is submitted using a new form. Comments and a sample from ConsultantPlus will help you fill it out. Trial access to the system can be obtained for free.

Who writes?

Covering letters are written by persons who are required to declare their income. These include:

- individual entrepreneurs (IP);

- legal entities;

- limited liability company (LLC).

Individuals may also need to submit reports to the tax authorities with an explanatory note. These cases include the sale of property, receipt of income from sources abroad, and the use of inherited intellectual property. Lottery winnings are also taxable.

You can submit documents to the inspectorate and write an appendix with an explanation to them yourself, but it is better to entrust this to a lawyer. The specialist will draw up a note for the documents according to all the rules and take into account all the necessary nuances.

What are the consequences of submitting an updated declaration?

You should always remember that following the submission of an updated declaration with a reduced tax amount, tax authorities can conduct an on-site tax audit for the updated tax period, and they can do this even if this period has already been audited (paragraph 6, paragraph 10, article 89 of the Tax Code RF).

Before submitting an updated declaration (if the accountant initially underestimated the tax amount), the company will need to pay additional tax to the budget and, in addition, pay penalties. An organization can avoid a fine if:

- Will have time to submit an updated declaration before the deadline for filing the primary one (clause 2 of Article 81 of the Tax Code of the Russian Federation).

- The deadline for paying the tax has not expired and the organization submitted an update before it learned about the discovery of errors by the tax authorities or the appointment of an on-site tax audit (clause 3 of Article 81 of the Tax Code of the Russian Federation).

- The updated declaration was submitted after the tax payment deadline had expired, but before the company learned that the tax authority had discovered errors or scheduled an on-site tax audit. In this case, you need to pay the arrears and penalties before submitting the updated declaration (subclause 1, clause 4, article 81 of the Tax Code of the Russian Federation).

Penalty Calculator will help you calculate penalties .

- The deadline for paying the tax has expired, and the updated declaration was submitted after an on-site inspection, the results of which did not reveal any errors or distortions of information (subclause 2, clause 4, article 81 of the Tax Code of the Russian Federation).

The tax agent can also avoid liability under Art. 123 of the Tax Code of the Russian Federation, subject to compliance with the above conditions (paragraph 3, clause 6, article 81 of the Tax Code of the Russian Federation).

The updated declaration is submitted in the form that was in force in the adjusted tax period (clause 5 of Article 81 of the Tax Code of the Russian Federation).

The current income tax return form, as well as the form for submitting an update for previous periods, can be found here.

Adjustment of sales for the reporting year

In "1C: Accounting 8" edition 3.0, there are mechanisms for automatically adjusting tax and accounting data (in a simplified manner) through special documents. Let's consider how the program can reflect the adjustment of the reporting year's implementation when applying the simplified tax system.

Example 1

| Romashka LLC applies the simplified tax system with the object of taxation “income reduced by the amount of expenses.” In December 2021, funds in the amount of RUB 25,000.00 were transferred to the current account of Romashka LLC. as an advance payment from a wholesale buyer. In the same month, 50 units of goods were sold to this buyer for the amount of RUB 25,000.00. The specified goods have been fully paid to the supplier. In February 2021, a wholesale buyer discovered a hidden defect in 10 units of the product. By agreement with Romashka LLC, the buyer, instead of returning the low-quality product, disposed of it, and Romashka LLC transferred the corrected primary document to the buyer. Adjustments in the accounting of Romashka LLC were made before the submission of a tax return under the simplified tax system for 2021 and before the signing of the financial statements for 2021. |

The receipt of funds from a wholesale buyer is registered in the program with the document Receipt to the current account (section Bank and cash desk - Bank statements) with the transaction type Payment from the buyer. An organization using the simplified tax system must explicitly indicate in the Advance field in the tax accounting system the procedure for accounting for advances for tax accounting purposes. According to the conditions of Example 1, in this field you must indicate the value: Income of the simplified tax system, selecting it from the list proposed by the program.

When posting a document, an accounting entry is generated:

Debit 51 Credit 62.02 - for the amount of the prepayment (RUB 25,000.00).

Amount 25,000.00 rub. is recorded in the register Book of Income and Expenses (Section I) as income of the simplified tax system.

Sales of goods in wholesale trade are reflected in the standard document Sales (act, invoice) with the transaction type Goods (invoice).

When posting a document, accounting entries are generated:

Debit 90.02.1 Credit 41.01 - for the cost of goods (RUB 12,500.00); Debit 62.02 Credit 62.01 - for the offset amount of the prepayment (RUB 25,000.00); Debit 62.01 Credit 90.01.1 - for the amount of proceeds from the sale of goods (RUB 25,000.00).

For the purposes of the tax paid in connection with the application of the simplified tax system, entries are made in the accumulation registers, the Book of Income and Expenses (Section I), Explanation of KUDiR and Expenses under the simplified tax system.

Since the goods sold were paid to the supplier, the amount is RUB 12,500.00. recorded in the register Book of Income and Expenses (Section I) as expenses of the simplified tax system.

The amounts of income and expenses from the result of this transaction, reflected in the register Book of Income and Expenses (Section I), automatically fall into Section I of the KUDiR for 2021:

- in the column “Income taken into account when calculating the tax base” - the amount of payment for goods sold (RUB 25,000.00);

- in the column “Expenses taken into account when calculating the tax base” - the cost of goods sold, paid to the supplier (RUB 12,500.00).

Let's say that in February 2021, the accounting service of Romashka LLC received information that the buyer discovered a defect in the goods accepted for registration and disposed of it by agreement with the seller.

In this case, the program must reflect changes in accounting and tax accounting and generate the corresponding primary document*.

Note:

* 1C experts talked about the procedure for correcting and adjusting primary accounting documents using the program, as well as how to reflect the changes made in the accounting of the seller and buyer, in the article Correcting and adjusting primary accounting documents in 1C: Accounting 8 (rev. 3.0).

To adjust accounting and tax accounting data, as well as to generate corrected primary documents transferred to the buyer, in “1C: Accounting 8” the document Sales Adjustment (Sales section) is intended. It is most convenient to generate a document based on the document Sales (deed, invoice) (Enter based on button). On the Main tab, in the Operation type field, the following operations are available:

- Adjustment by agreement of the parties - registers a change in the cost of previously sold goods, works and services agreed between the seller and the buyer, that is, an independent event that relates to the current period. If the supplier is a VAT payer, then in this case he must issue an adjustment invoice to the buyer;

- Correction in primary documents - used to reflect the correction of errors made by the supplier when preparing documents. Correction in primary documents is not an independent event and refers to the same period as the document being corrected. The VAT payer supplier, correcting the primary documents, issues a corrected invoice to the buyer.

The correct qualification of these transactions is extremely important for VAT accounting purposes. The selected type of transaction in the Sales Adjustment document does not affect accounting entries and entries in tax accounting registers for the purposes of the simplified tax system.

According to the conditions of Example 1, at the time of sale of the goods, Romashka LLC had no information about the presence of hidden defects in it.

Therefore, in the document Adjustment of sales, you should select the transaction type Adjustment by agreement of the parties, which reliably reflects the essence of the business transaction (Fig. 1).

Rice. 1. Implementation adjustments

In the Reflect adjustment field, you must leave the default value in all accounting sections, then after posting the document, movements in the accounting and tax accounting registers will be generated.

The tabular part of the Products tab is filled in automatically based on the selected Sales document (act, invoice). Each line of the source document corresponds to two lines in the adjustment document:

- before change;

- after the change.

The quantity and amounts from the source document are transferred to the line before the change, and this line is not edited. In the line after the change, you need to indicate the corrected quantitative indicators, and the new total indicators will be recalculated automatically.

The form of the document Adjustment of sales on the Calculations tab is modified depending on the period of making changes to the basis document.

If the Implementation Adjustments document adjusts the implementation:

- current year - additional parameters for reflecting income and expenses from the adjustment are not required, since all adjustments will be made in the current year.

- last year - on the Calculations tab in the Reflection of income and expenses group, an additional parameter appears: Last year’s accounting is closed for adjustment (the reporting has been signed).

According to the conditions of Example 1, corrections to the accounting data are made in 2017, but before the signing of the financial statements for 2021, therefore the flag Last year’s accounting is closed for adjustments (the statements are signed) does not need to be set.

Despite the fact that the document Adjustment of Sales is dated February 2021, after the document is processed, part of the transactions is formed with the date December 31, 2016, namely:

REVERSE Debit 90.02.1 Credit 41.K - for the cost of defective goods (-2,500.00 rub.); REVERSE Debit 76.K Credit 90.01.1 - for the amount of proceeds from the sale of goods (-5,000.00 rub.); Debit 99.01.1 Credit 90.09 - for the amount of adjustment to the financial result (RUB 2,500.00).

Accounting data adjusted in this way will automatically be included in the financial statements for 2021.

As of the date of the Sales Adjustment document (02/27/2017), the following accounting entries are generated:

REVERSE Debit 41.K Credit 41.01 - for the amount of adjustment of goods (-2,500.00 rub.); REVERSE Debit 62.01 Credit 76.K - for the amount of adjustment of settlements with the buyer (-5,000.00 rub.); Debit 62.01 Credit 62.02 - for the allocation of an advance received from the buyer (RUB 5,000.00).

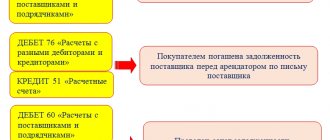

Account 76.K “Adjustment of settlements of the previous period” is used to record the result of adjustments to settlements with counterparties, which were made after the end of the reporting period. Debt for settlements with counterparties is recorded on the account from the date of the transaction that is subject to adjustment to the date of the correcting transaction.

Account 41.K “Adjustment of goods of the previous period” is used to record the result of adjustment of inventory balances, which was performed after the end of the reporting period. Adjustment of inventory balances and (or) their value is taken into account on the account from the date of the transaction that is subject to adjustment to the date of the adjusting transaction. It is easy to see that the amounts in accounts 76.K and 41.K are in transit, then what are they for? Thanks to special accounts 76.K and 41.K, information on settlements with counterparties and product balances falls into the required section of the reporting, but this information cannot be used until the adjustment is reflected. When this moment comes, settlements with counterparties and goods balances are transferred to “regular” settlement or goods accounts.

For example, goods credited to account 41.K as a result of last year’s adjustment are reflected on line 1210 “Inventories” of the balance sheet, but cannot be used in transactions until the adjustment is reflected in the current year.

For the purposes of the tax paid in connection with the application of the simplified tax system, corrective entries are also entered into the accumulation registers, the Book of Income and Expenses (section I), Explanation of KUDiR and Expenses under the simplified tax system.

In the register Book of Income and Expenses (Section I), the simplified tax system expense is reversed in the amount of 2,500.00 rubles, and in Section I of the report Book of Income and Expenses of the simplified tax system for 2021, the entry about the decrease in expense is automatically reflected in the last line (Fig. 2).

Rice. 2. Book of income and expenses for the fourth quarter of 2021

The Sales Adjustment document does not affect the recognition of income in any way, since the simplified tax system uses the cash method, and income is recognized at the time of receipt of funds from the buyer.

To generate a separate primary document recording the new cost of goods sold, you can use one of the printed forms that the program offers as part of commands called by the Print button:

- Value change agreement;

- Universal adjustment document (UCD) with status 2.

The printed form of the agreement (UCD) indicates the number and date of the adjustment, as well as the number and date of the initial certificate of service provision (UPD).

When you select the operation type Correction in primary documents, printed forms of primary documents are available in the Implementation Adjustment document:

- Consignment note (TORG-12) with amendments made;

- Universal adjustment document (UCD) with status 2.

When automatically filling out a tax return under the simplified tax system for 2016, the adjustment made will be reflected in the indicators in Section 2.2.

Ten units of goods capitalized as a result of adjustment and actually disposed of by the buyer must be written off. Depending on the conditions of a particular business transaction, defective goods are written off either as other expenses, or as settlements for claims presented to the supplier, or as settlements with personnel for compensation for material damage.

After the clarification was submitted, the organization ceased to exist

After the reorganization of the enterprise, the updated declaration is submitted by its legal successor at the place of its registration or at the place of registration as the largest taxpayer (clause 2.6 of the procedure).

In this case, on the title page of the updated declaration submitted by the successor, the TIN and KPP of the successor organization and its name must be indicated, and the TIN and KPP of the reorganized organization (its separate division) must be indicated on separate lines.

In section 1 of the updated declaration submitted by the successor for the reorganized organization (its separate division), OKTMO is indicated at the location of the latter (clause 4.5 of the procedure).

If a company moves and changes its address, then the clarification will need to be submitted to the tax authority with which it will be registered, but the OKTMO code is indicated the same as in the initial declaration (letter of the Federal Tax Service of Russia for Moscow dated October 30, 2008 No. 20-12/101962).

It is necessary to note that all explanations from officials were given at the time when the OKATO code was applied. In connection with the replacement of the OKATO code with the OKTMO code, it must be assumed that all the above conclusions have not lost their relevance at the present time.

You also need to keep in mind that if an organization or its OP changes its location and pays taxes or advances during the year to the budgets of different constituent entities of the Russian Federation, the corresponding number of pages of subsections 1.1 and 1.2 of Section 1 can be presented as part of the clarification.

For example, if the address is changed on August 1, in the updated declaration for the half-year, the amount of additional payment (reduction) of the advance for the half-year and the monthly advance payment due “no later than July 28” are indicated in subsections 1.1 and 1.2 of Section 1 with the OKTMO code at the old location. On a separate page of subsection 1.2 of Section 1 with the new OKTMO code, the amounts of advances with payment deadlines “no later than August 28” and “no later than September 28” are given.

This is stated in paragraph 4.6 of the order.

When moving a unit, in the clarification, fill in the details “TIN/KPP of the (closed) separate subdivision that has changed the powers”, indicating here the old checkpoint of the separate unit (clause 2.8 of the procedure).

If you have access to ConsultantPlus, check whether you need to submit an update. If you don't have access, get a free trial of online legal access.

General drafting rules

There is no statutory form for writing a cover letter, but there are rules for its composition that have been developed in practice. The annex to the reporting before the inspection must include:

- name of the tax office (if necessary, indicate the full name of the employee to whom the documents are sent);

- name of the tax organization and address of the sender;

- number and date of the request in response to which an explanation is sent;

- contacting an employee or tax authority;

- a list of documents and other materials indicating the number of sheets and copies;

- Full name and position of the sender, his signature and contact information (phone number, email).

The organization has/had separate divisions

If the OP continues to work, the update is submitted to the same place where the initial declaration was submitted.

If a division is closed, updated declarations for it, as well as declarations for subsequent (after closure) reporting periods and the current tax period, are submitted to the Federal Tax Service at the location of the organization or at the place of its registration as the largest taxpayer (clause 2.6 of the procedure).

In this case, the title page indicates code 223 and the checkpoint at the location of the organization (the largest taxpayer), and in the details “TIN/KPP of the (closed) separate unit that changed the powers” - the checkpoint of the closed separate unit (clause 2.7 of the procedure).

If separate divisions of an organization switch to paying tax through a responsible division (parent organization), then an updated declaration must be submitted at the place of registration of the latter (letter of the Federal Tax Service of Russia dated June 30, 2006 No. GV-6-02/664).

If the OP was responsible, and then ceased to be so, according to the details “TIN/KPP of the (closed) separate unit that changed the powers”, you need to indicate the checkpoint at the location of the former responsible separate unit (clause 2.8 of the procedure).

Rules and terms for approval of financial statements

In accordance with Law No. 402-FZ, accounting reports are signed by the chief accountant and the head of the company. The head of the economic service also puts his signature if the reports contain similar information. Then the reports are approved by the owners (proprietors, founders, shareholders) of the company.

Let us remind you that the usual deadline for submitting financial reports to the Federal Tax Service (without adjustment for coronavirus) is until March 31 of the year following the reporting year. A similar deadline is set for other regulatory government agencies, for example, Rosstat and the Ministry of Justice. At the same time, other dates have been set for the approval of financial statements. For example, the founders of an LLC must carry out approval in March or April of the year following the reporting year. But the owners of joint stock companies have the right to carry out this procedure even later - from March to June inclusive.

Consequently, in most cases, information is provided to the Federal Tax Service that has not yet undergone the approval procedure regulated by Law No. 402-FZ. Thus, the question becomes logical: are adjustments to financial statements submitted after approval? The answer is categorical - no. Once the accounting records are approved by the company's owners, there is no need to make corrections.

The accountant makes corrective entries in the current period without changing the data for the reporting year. The posting is made using account 84 “Retained earnings or uncovered loss” in correspondence with the account for which a significant inaccuracy was discovered.

Results

The obligation to submit an updated declaration arises only if the taxpayer independently discovers non-payment of tax. In the case of separate divisions, when changing the address or reorganization, there are specifics associated with the procedure for reflecting OKTMO, KPP in the updated declarations, as well as the place of their submission. By following certain rules, when submitting an amendment with an increase in the amount of tax, you can avoid liability under Art. 120, 122 Tax Code of the Russian Federation. However, it must be taken into account that its submission may entail an on-site tax audit.

Read about the specifics of generating updated declarations for other taxes in the following articles:

- “How to make an updated VAT return in 2021”;

- “Features of the updated tax return 3-NDFL”;

- “How to submit an updated tax return under the simplified tax system?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Submission rules

A covering letter is sent to the tax office along with the declaration . You can submit the application along with a package of documents to the organization in person. It is also possible to send reports with an explanatory note by mail.

Covering letters are not mandatory elements when sending reports to the tax authorities, but their presence helps to avoid a number of problems and questions. The main thing is to correctly compose the application and clearly indicate your requests and explanations in it.