Since January 10, 2002, the federal law “On Environmental Protection” has been in force in Russia, one of the clauses of which provides for a fee for negative environmental impact (NEI). Every year, enterprises and individual entrepreneurs in our country have many questions about the rules for filing a declaration, payment deadlines and possible penalties. This article will help you obtain comprehensive information on this issue and understand the procedure for filling out all the necessary documentation.

general information

The provisions on the tax for environmental pollution replaced the already outdated law on environmental pollution. This fee is defined by the Constitution as a mandatory public payment and is formally considered a fiscal fee. According to the Tax Code, such contributions are mandatory and do not exempt enterprises from taking environmental protection measures.

In accordance with the Federal Law of January 10, 2002 “On Environmental Protection,” the following types of environmental impact assessments are provided. This:

- pollution of surface and underground water bodies, discharge of pollutants into places where water is collected for the needs of the population;

- toxic emissions into the atmosphere, this applies to stationary objects;

- disposal of solid waste generated during the production process.

The terms and rates of payment are stipulated in the Decree of the Government of the Russian Federation dated September 13, 2016 No. 913.

Other types of harmful effects on the environment, such as soil pollution, excess noise, vibration or electromagnetic radiation, are not subject to tax, since there is no way to measure the degree of impact on nature, and therefore there is no standard for determining the required fee. Contributions for atmospheric emissions from mobile objects are also not made, as indicated by letters from the Russian Ministry of Natural Resources dated July 23, 2015 No. 02-12-44/17039 and dated March 10, 2015 No. 12-47/5413. So the organization does not have to pay for existing vehicles.

All issues related to payment and provision of reporting documentation are controlled by the Federal Service for Supervision of Natural Resources of the Russian Federation.

Who is the payer?

NVOS is one of the measures of state control over the level of environmental pollution. According to the Federal Law of January 10, 2002, the established fee must be paid by all organizations, enterprises and institutions whose activities are associated with a negative impact on nature. This list includes domestic and foreign companies, as well as legal entities and individuals. Since 2010, fees for NVOS have also been charged to budgetary organizations that were previously exempt from this responsibility.

Many resource users have questions about the conditions under which an enterprise can be exempt from these contributions. The fee is not transferred only if the production facilities have a hazard category of IV, which means:

- no radioactive emissions are produced;

- the amount of harmful emissions does not exceed ten tons per year;

- The company's activities do not affect the pollution of surface and groundwater.

The degree of danger of an object is determined by Rosprirodnadzor after conducting an appropriate inspection.

Some managers are mistaken that concluding an agreement with an organization engaged in the removal and disposal of waste exempts them from paying tax on the NVOS. The owner (if it is not an office, school, small enterprise, etc.) is in any case obliged to make annual contributions for the negative impact on the environment.

Categories of NVOS sources

When delimiting NVOS objects, a number of criteria are taken into account that determine the level of impact of production on nature. The main provisions are stated in Federal Law No. 7 of January 10, 2002, but in 2014 a special commission made significant changes and additions.

According to these regulations, the following conditions are taken into account to classify an enterprise as a certain category:

- level of harmful impact on the environment;

- to what class the industrial facility or production belongs, to what industry;

- hazard class of discharged substances, toxicity level, presence of mutagenic properties in waste;

- classification as a nuclear energy facility.

According to the specified criteria, NEO facilities are divided into four categories, where I means that the source of pollution has a serious impact on the environment, II – moderate NEO, III – insignificant; and IV is the minimum.

Federal Law No. 219 of July 21, 2014 introduced significant changes to the rules for classifying an enterprise into a particular group. For example, research centers, design bureaus, etc. were removed from the Category I list.

What applies to NVOS objects?

According to the definition prescribed in Federal Law No. 7 of January 10, 2002, environmental pollution facilities are a source (or a combination of them) of harmful effects on the environment located in a separate territory.

Depending on the nature of the location, the following types of objects are distinguished:

- Stationary ones are industrial pipes, boiler rooms, parking lots, diesel installations, places where metal, wood are processed, paint is processed, wastewater treatment plants are located, etc.

- Mobile – any enterprise vehicles, including air, water and underwater, all those whose engines run on gasoline, diesel, gas or kerosene.

- Wastewater discharges are any sources that generate contaminated water as a result of industrial activities and discharge it onto the ground, into a river, lake or sea.

- Household and industrial waste generated during the operation of the enterprise.

The last point includes many public places, such as administrative buildings, schools, workshops, offices, shops, etc.

Waste management report

Enterprises included in categories I or II of the NVOS are required to keep records of emissions arising in the course of their activities. Annual indicators are compiled into a technical report on waste management.

Enterprises in the NVOS category are required to keep records of emissions.

The document is submitted to the supervisory institution after a year has passed from the date of approval of waste standards and limits on their disposal. The period for provision is 10 days.

The document includes:

- information about the enterprise;

- data on the amount of waste;

- information about used, neutralized, disposed or transferred waste.

Registration

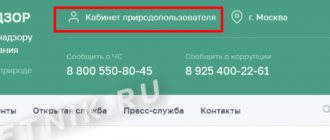

The registration of an organization in the state accounting system is carried out by the territorial Rosprirodnadzor. The tax assessment of the object and the established tax amount will be determined by the regulatory authority itself. The only thing the organization needs to do is fill out an electronic application on the free service of Rosprirodnadzor.

The easiest way to do this is with a certified electronic signature. Together with the application, this data is uploaded to the portal, and all that remains is to wait for confirmation from the territorial authority. If there is no electronic signature, the application is generated using the module where the latest version of the NVOS form is located. The completed document is printed and sent to the controlling organization by mail.

Rosprirodnadzor will register the application, assign it an account number and enter into the register all the data about the source of the NVOS. This is primarily beneficial for enterprises, since if non-payment of special contributions or the fact of concealing the real level of damage to nature is revealed, the organization faces a serious fine.

When do you need to pay?

In paragraph 5 of Art. 16.4 Federal Law No. 7 of January 10, 2002 states that all deductions for negative impacts on the environment must be made once a year (previously once a quarter) no later than the first of March of the year following the reporting year. In 2021, changes were made for large industrial enterprises; it became possible to make an advance payment no later than the 20th; its amount is ¼ of the fee transferred for the previous year. Individual entrepreneurs and small businesses are not affected by this innovation; they pay tax once a year.

Since 2021, the reporting procedure has changed; now the company must draw up a special document in a form approved by the Government of the Russian Federation. The NEI declaration includes several sections; you only need to fill out those that are necessary for the organization. The company must itself calculate the amount of payments, taking into account all possible pollution associated with production. If, for example, the enterprise does not have stationary sources of hazardous waste emissions, then nothing needs to be entered in the first section of the NVOS payment form.

How to find out the required amount?

Every year, new rates and tariffs are calculated, on the basis of which the fee for the NVOS is set. Today, the amount of deductions is prescribed in Decree of the Government of the Russian Federation dated September 13, 2016 No. 913, the data is valid until 2021.

Letter dated June 4, 2007 No. 04-09/673 of the Federal Service for Environmental Supervision contains detailed information on how the NVOS is calculated, as well as on additional coefficients and rates.

You can calculate the final payment amount through the Eco-Expert program, which allows you to optimize the management of the enterprise’s activities and automate the calculations of taxes on the NVOS. There are other programs, including the “NVOS Module,” specially created to simplify the reporting process for organizations, as well as optimize the work of regulatory authorities. You can find it on the official website of Rosprirodnadzor.

When making final calculations, some enterprises are required to take into account an additional coefficient if their economic activities take place in territories specially protected by the state.

2-TP (reclamation)

Organizations working in the field of exploration and extraction of mineral resources, and business representatives engaged in logging, land reclamation and construction must submit a reclamation form to the RPN by February 1.

Reclamation is a set of measures for the ecological restoration of land.

In addition, such reporting is required from enterprises involved in the disposal of solid waste, construction and industrial waste.

Declaration submission format

According to the established rules, a report for a certain period must be submitted electronically; the date of submission will be considered the moment of its registration on the Rosprirodnadzor website. In some cases, filling out the NVOS declaration is allowed on paper:

- if the nature user does not have an electronic signature;

- provided that the annual payment does not exceed 25 thousand rubles;

- or the payer does not have access to the Internet.

In such cases, the deadline for acceptance of payment will be considered the moment of submission to the regulatory authorities.

2-TP (air)

2-TP (air) reporting is submitted by natural resource users who have stationary sources of air pollution on their balance sheets. The document is submitted to the RPN until January 22.

2-TP reporting is submitted by enterprises that pollute the atmosphere.

Difference from the procedure for submitting the previous form

The new reporting rules apply from 2021 with the following changes:

- a separate block has been created for information provided by regional operators on MSW management;

- if the enterprise has suspended its activities completely or partially, the form is still submitted to the control body with a zero indicator or information for an incomplete period;

- data on the facilities where waste is transported is highlighted as a separate item;

- the report is submitted to the RPN department, and not to Rosstat, as was previously customary.

Filling rules

The NVOS declaration form was approved by order of the Russian Ministry of Natural Resources on January 09, 2017. It contains comments and notes describing the procedure. In addition, there are some nuances that must be taken into account by the person responsible for filling it out.

- In the existing table, only those sections that directly relate to the economic activities of the organization are filled in.

- If a company has facilities in different regions of the country, each of them draws up its own IEE declaration.

- All amounts are written with an accuracy of one hundredth; rounding can only be done in accordance with existing rules.

- All numbers, with the exception of TIN and KPP, are entered in the cells from right to left, starting with the smallest.

- All sheets must be signed by the person responsible for filling out the NVOS.

Finished documents, bound, numbered, with the seal of the organization and the signature of the head, are submitted to the territorial Office of Rosprirodnadzor. No additional papers are usually required, but in some cases regulatory authorities ask to provide a lease agreement, regulatory documents, waste transfer acts, etc.

Environmental fee

Disposal of waste generated after the use of manufactured and imported products, including packaging, involves environmental collection. The list of goods and payment procedures are regulated by the Russian government.

The size of the contribution depends both on the category of goods, which determines the rate of collection, and on the volume of products that the business entity can dispose of independently or transfer under an agreement to a specialized enterprise. This is how the recycling rate is calculated. An eco-fee is paid if this value cannot be reached.

If the company's standards are met, this fact should be confirmed by reporting documentation, which will serve as an exemption from the specified fee.

The environmental fee is a relatively new tax.

Who is obligated to pay and report?

Payment of environmental fees is required in the following cases:

- if the goods of the manufacturer or importer are included in the list of products requiring disposal after the expiration date;

- when only the packaging needs to be disposed of.

The environmental fee is payable for each group of goods and packaging by all manufacturers and importers of goods. The exception is for exported products.

Reporting includes the following documentation:

- declaration on the number of goods and packaging put into circulation and included in the relevant list;

- reports on the fulfillment of standards for the disposal of consumer waste (must be submitted, even if the destruction procedure was not carried out);

- calculation of the amount of environmental collection (surrendered if the company did not dispose of the goods or the required volume was less than the established one);

- reporting on recycling facilities and waste collection sites, if the company has any.

Russian manufacturers send reports to the RPN department at the place of registration of the business entity, and import suppliers send reports to the central department (Moscow)

Payment deadline

According to the law, individual entrepreneurs and legal entities pay the environmental fee by April 15.

Sample

Filling out the NVOS declaration is a rather labor-intensive task that requires employees to have certain knowledge and skills. Today there are special companies that provide such a service. In small companies, this responsibility falls on the shoulders of accountants, since not everyone can afford the position of environmentalist. Today there are special companies that provide such a service. However, there are basic principles that will help you figure out what items the form of payment for the NVOS consists of.

1. Title page: all information about the organization and founders is indicated here:

- Name;

- Full name of the head;

- Contact details;

- TIN and checkpoint;

- organizational and legal form;

- signatures of the manager and accountant.

2. Section 1: data on stationary sources is recorded here, the category of the facility, its name, code and location, as well as the date and number of the issued permit for emissions are indicated.

3. Section 1.1: In addition to the above information, indicators such as calculation methods for associated petroleum gas flaring, production and flaring volumes, process losses and utilization levels are added.

4. Section 1.2: this contains data on payment for harmful emissions into the atmosphere when burning or dispersing APG in volumes exceeding the established norm. The name of the object, location, code, calculation methods and data on production and use are also indicated.

5. Section 2: to be completed by the person responsible for the discharge of waste into wastewater and drainage waters.

6. Section 3: any waste that has a negative impact on the environment (garbage, municipal solid waste, etc.) is indicated here.

7. Section 3.1: All activities involving disposal or disposal of waste are specified.

A specific example of filling out the NVOS can be found in the appendix to the Order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 “On approval of the Procedure for submitting a declaration on payment for negative impact on the environment and its forms.”

Small business representatives often have questions about point No. 3. If they prove that the organization is not involved in harmful emissions, it will be necessary to contact the territorial body of Rosprirodnadzor to remove the company from the list of payers.

Declaration of payment for negative environmental impact

Enterprises whose activities are carried out at sites of hazard category II are required to submit a declaration on the impact on the environment.

Together with the declaration, which is submitted once every 7 years, calculations of permissible standards for emissions and discharges into the environment are provided.

Declaration of fee.

If the enterprise has changed production technologies, as a result of which new sources of environmental pollution have arisen, then it is necessary to submit a new declaration without waiting for the expiration of the previous one.

What is the “Nature User Module”?

Since 2011, Russia has been actively implementing a program to transfer government services into electronic form. Every year more and more departments and structures join the initiative. Since 2012, the Federal Service for Environmental Management has been accepting all reports containing information on waste disposal, as well as on payment of fees for negative environmental impact, mainly in electronic form.

“NVOS Module” is a free program created specifically for the needs of natural resource users. Here, the head of the company or other responsible person can maintain an information base about the volume of negative impact on the environment and include details of the posting documents. The module also allows you to calculate fees for the tax assessment.

The program provides the following reports:

- Calculation of the payment amount.

- 2-TP (Waste).

- Application for registration of an object in the Rosprirodnadzor system.

- For small and medium-sized businesses, reporting on the generation, use and storage of waste is provided.

Information about the organization and available documents will need to be entered only once, then, as necessary, add data on the economic activities of the enterprise. All reports are generated by the program.

Types of environmental reporting

The types of reports depend on the form of the business entity, field of activity, category of impact on the environment, etc. Some of them are required for statistical data (2-TP, 4-OS).

Reporting is divided into the following main types:

- SME reports;

- Declaration and calculation of payments for NVOS facilities;

- 2-TP (air);

- 4-OS;

- 2-TP (waste);

- organization and results of PEC;

- declaration of goods sold that are subject to subsequent disposal;

- submission of calculations for environmental fees;

- 2-TP (reclamation);

- 2-TP (vodkhoz);

Types of environmental reporting depend on the field of activity.

Each report must contain information about the cargo transporter and storage areas for transferred waste, etc. Documents are submitted at the place of registration of the enterprise to the control authorities at the end of the reporting period. Each type of reporting has different filing deadlines.

Environmental reports are sent to each division if the organization has several production sites.

Data is indicated for each type of waste by class. Weight is measured in tons.

Consequences of non-payment

Many users of natural resources are interested in the question of where the paid funds go. Since the contribution for the negative impact on the environment is not considered a tax itself, but is a special form of compensation, the amount is distributed in a different way. Part of the amount goes to restore the nature of the region of the country where the economic activity is located. The federal budget receives 20% of the funds, the income of the constituent entities of the Russian Federation - 40% and municipal districts - also 40%.

The legislation provides for administrative liability for failure to make payment within the specified time frame. According to the Code of the Russian Federation of June 22, 2007 “On Administrative Violations,” a fine may be imposed for late payment: for an individual – 3,000–6,000 rubles, for legal entities – from 50,000 to 100,000 rubles.

Fines for lack of environmental reporting

Penalties for violation of deadlines and incorrect submission of environmental reports are specified in the Code of Administrative Offenses of the Russian Federation. Contents of chapter. 8. includes various offenses of legislation in the field of environmental protection. Please note that fines are cumulative if multiple violations are detected.

The leverage of regulatory authorities is reflected in the following figures:

- Individual entrepreneur - up to 50,000 rubles. and suspension of activities for up to 3 months. Responsible persons according to official duties - up to 30,000 rubles.

- Legal entities - up to 250,000 rubles. with a limitation in the form of closure of the enterprise for a period of up to 3 months.

The motivation for timely reporting is not only penalties. To increase the level of responsibility of organizations, an increasing coefficient is applied to the payment of fees for causing damage to the operating system. If there is a delay in submitting environmental reports, the payment may be increased 5-fold.

FAQ

Small companies believe that their activities are not covered by the NVOS law, but this is not the case. All enterprises are required to pay contributions to Rosprirodnadzor. During office work, household waste is also generated: garbage, used lamps, computer equipment, paper, etc. But if a company has an agreement with a company involved in waste removal and disposal, then responsibility for harm to the environment passes to it . The same applies to tenants: they have the right not to pay environmental tax if the contract stipulates that payments are made by the owner of the premises.

If the company did not carry out any activities during the reporting period, then the management will need to submit the so-called zero calculation. However, if regulatory authorities discover fraud, a fine will be imposed on the company in accordance with the Code of Administrative Offenses.

The organization is obliged to keep records in the field of waste management. In case of an audit, there must be a special journal; it can be in paper or electronic form. For this purpose, special programs are provided, including the NVOS module. This application can be found on the official website of Rosprirodnadzor. The data storage period is five years. Also, managers must have passports for all waste generated at the enterprise.

Currently, the legislation does not establish a procedure for returning funds in case of overpayment. In this case, you must contact the territorial body of Rosprirodnadzor with all the papers confirming the transfer of funds and a declaration for the NVOS. The organization will reconcile the data, and if the overpayment is confirmed, the funds will be returned.

2-TP (waste)

The document includes information on the management of production and consumption waste, except radioactive waste. The report indicates the name, statistical codes and assigned hazard level. The form is drawn up on the basis of acceptance certificates issued at the receiving sites.

The 2-TP report includes information on waste management.

The documentation is sent to Rosprirodnadzor before February 1.

Who should take it?

Reporting 2-TP (waste) is intended for users of natural resources working in the field of waste management from production activities and consumption.

Regional operators on MSW management also report using this form.

Do tenants have to submit a form?

Reporting is provided by the tenant if he does not have a direct agreement with the waste collection operator. If there is such an agreement, the obligation to submit reports falls on the specialized organization that accepts MSW from the tenant.