Payment

Leave a comment on the document Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without

Checking the status of settlements with personnel is an integral part of the inventory carried out before drawing up annual reports.

When imposing taxes, legislators give relief to socially significant enterprises, industries with priority development, public

Stamping on tax reports: to put it on or not Legislative framework for preparing reports Recommended

Often individual entrepreneurs and commercial organizations have to resolve the issue of filing a zero declaration for missing items.

Hello. In this article we will talk about what a markdown of goods is and for

IT and SHE: what is it and how to calculate Deferred tax assets (DTA) and

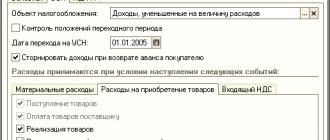

Accounting for software under the simplified tax system: postings Accounting for software of a company is regulated by basic standards of accounting

Many organizations and entrepreneurs operate under the simplified tax system and pay a single tax to the state. His appearance

Author of the article: Anastasia Ivanova Last modified: January 2021 17909 For individuals and civilians