Payment

Who can apply UTII There are many more conditions for using UTII than when using

Insurance If there are insurance transactions for employees and property, subaccount 76 of account is used - 76.1.

Home / Real estate / Land / Taxes Back Published: 04/01/2017 Reading time:

How are utilities charged with VAT when renting premises? Utilities consumed by the tenant may be reimbursed

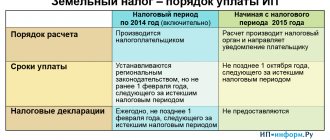

Legal entities carrying out economic activities are obliged to fulfill their obligations in a timely and full manner

The amount of land tax directly depends on the cadastral value of the land plot. At the same time, the planned

General analysis of account 71 First, briefly about what account 71 is

Inventory of goods in a warehouse is a check to clarify data about the goods stored in it.

During the entire period of business activity, each individual entrepreneur may have several reasons for

Federal standard "Fixed assets". What basic concepts does the standard contain? What is the accounting procedure for fixed assets