Payment

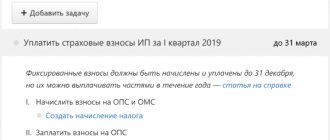

All individual entrepreneurs, regardless of the field of activity and the applicable taxation system, pay for themselves

The accounting policy (AP) is a “particularly important” document that collects aggregate information about

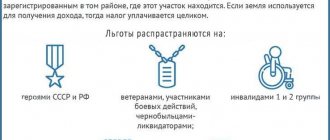

Land tax is monetary payments made in favor of the state, which are collected from organizations and

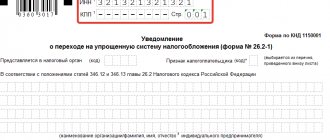

STS is a simplified taxation system. Some companies have the right to use it if they comply with the agreed

Accounting for penalties in accounting In accordance with the Chart of Accounts () amounts

Depreciation in accounting can be calculated using the reducing balance method. This method of calculation allows

Features and differences The main difference between reporting by an entrepreneur and a legal entity is the independent

Fixed assets that cannot be used for their intended purpose immediately after their use are subject to separate accounting.

Legal status In accordance with the current legislation of the Russian Federation, HOA is a non-profit

In order to attract customers, banks often offer various bonus programs. This procedure motivates