Home / Real estate / Land / Taxes

Back

Published: 04/01/2017

Reading time: 10 min

0

781

In accordance with the law, the use of land in the Russian Federation is paid. In this regard, organizations and ordinary citizens are required to pay tax for the ownership of their land plots.

At the same time, funds received as land tax (LT) go to the local budget. This tax is one of the main sources of the local budget, which can be used for various needs of local municipalities.

- Laws

- Cadastral value of plots

- Calculation of ZN

- Tax benefits

- Tax rate in Moscow region

- Calculation examples Example 1

- Example 2

Basic Concepts

Land tax payers are absolutely all organizations, individual entrepreneurs and ordinary people who own land. In Moscow and St. Petersburg, the nuances of land tax are established by the local authorities themselves.

Local regional authorities, on the basis of the Federal Law, issue local regulations on land tax, which establish the terms, payment procedure, reporting period, benefits, etc.

Land tax was introduced by Federal Law No. 141-FZ of November 29, 2004; the latest changes to this type of deduction were made by Federal Law No. 382-FZ of November 29, 2014. Chapter 31 of the Tax Code of the Russian Federation spells out all the nuances relating to land tax.

Back to contents

The tax base

The tax base (that is, the characteristics of the object on the basis of which the tax is calculated) is the cadastral value of the land plot for which the tax will be paid.

Organizations and individual entrepreneurs (for 2014) determine it themselves, based on information from the State Land Cadastre; for individuals and, starting from 2015, individual entrepreneurs, the tax base is determined by the tax service based on information provided by state bodies from the same register.

If a plot of land is in common joint ownership, the tax base is divided equally between all owners, if the plot is in common shared ownership - in proportion to the shares of the owners.

Back to contents

Cadastral recalculation

The cadastral value of a plot, according to the new legislation, is considered as the basis for paying a tax on the value of a plot of land. The prices set on the market are completely identical to it. For a more complete understanding of the situation, you can consider the following example. In a certain region, a revision of land tax was carried out 3 years ago. It is possible to get acquainted in detail with the cadastral map, where all data is entered at the official level (Public cadastral map). To do this, you can use the website (uniform for the entire state). There you can also find data about the area of interest by searching for it by cadastral number. Thus, the cadastral registration system will be unified, which will avoid corruption on the part of local authorities.

If the owner of a plot is not aware of the cadastral number of his land area, then he should resort to the help of landmarks: first, the closest location of interest on the map is studied, then, for example, a gardening partnership, and so on, until the plot of interest is found taxpayer. This method allows you to consider the exact cost. Individualization of tax will make it possible to differentiate the tax rate and avoid the so-called “equalization” in its payment.

Land tax for individual entrepreneurs

Individual entrepreneurs are required to pay land tax in the same way as everyone else if their land is used in business activities. That is, if an individual entrepreneur, for example, is engaged in agriculture and owns land on which he grows potatoes for sale, he is obliged to pay land tax.

But: only if this plot belongs to the individual entrepreneur by right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession. If the land is leased or for free fixed-term use, then the tax is paid by its owner.

An individual entrepreneur is obliged to pay tax regardless of the taxation system he uses.

Back to contents

The procedure for paying land tax for individual entrepreneurs before and after 2015

Back to contents

We calculate the tax to be paid

If your organization is the sole owner of the land, and you used the land for a full calendar year, then you can make a simplified calculation of the amount of the tax payment. By multiplying the cadastral value by the rate, you will receive an indicator of the amount of tax payable at the end of the year. But in practice, such cases are quite rare, so below we will consider the procedure for calculating tax in special cases.

If the land is in common use

Quite often, companies own land in common use, that is, one plot is divided among several owners. If your company owns land under such conditions, you should calculate the tax in proportion to the share of the plot in the common property.

Example No. 1.

According to title documents, Pharaoh JSC owns land with an area of 314 square meters. m. This plot is 1/3 owned by Pharaoh, the rest is owned by Nefertiti LLC. The cadastral value of all land is 904,720 rubles. For Pharaoh, a general tax rate of 1.5% has been approved.

When calculating, the accountant of “Pharaoh” carried out the following actions:

- The accountant determined the cadastral value of land owned by “Pharaoh”

RUR 904,720 * 1/3 = 301.573 rub.;

- The accountant calculated the amount of tax payable

RUR 301,573 * 1.5% = 4.524 rub.

Calculate the amount of advance payments

Unlike individual entrepreneurs who pay taxes in the total amount for the year, enterprises are required to transfer advance payments to the budget according to the following deadlines:

- for the 1st quarter – until 30.04;

- for the 2nd quarter – until July 31;

- for the 3rd quarter – until 31.10.

You must make the final tax payment for the year before February 1 of the next year (for 2021 - before 02/01/18).

Advance payments constitute ¼ of the tax amount calculated for the year. The final payment is made based on the amount specified in the declaration, the filing deadline for which is also limited - until February 1 of the next year.

Example No. 2.

In January 2021, the accountant of Olympus JSC calculated the tax based on the following indicators:

- cadastral value of land as of 01/01/16 – 334,420 rubles;

- The tax rate taking into account regional benefits is 1.4%.

The total amount of the annual payment was determined by the Olimp accountant in the amount of 4,682 rubles. (RUB 334,420 * 1.4%).

On 04/14/16, 07/12/16 and 10/05/16, the Olimp accountant transferred the same amounts to the budget - 1,170 rubles each. (RUB 4,682 / 4).

When preparing a tax return, an Olimp accountant discovered an error in indicating the cadastral value of the plot during the initial tax calculation. The declaration indicated the correct value of the land - 348,470 rubles. Thus, the tax for the year amounted to 4,879 rubles. (RUB 348,470 * 1.4%).

After submitting the declaration on January 14, 2017, the Olimp accountant made the final tax calculation in the amount of 1,369 rubles. (4,879 rubles – 1,170 rubles * 3).

How to check debt

If you suddenly have doubts about debts or want to check your accounting, the Federal Tax Service of the Russian Federation nalog.ru has introduced a new online service: the ability to find out and calculate debt using a special form. You will only need to enter your first and last name, as well as an identification code. By the way, this service helps not only to find out the debt for land tax, but also for property, transport and personal income taxes.

Back to contents

What to do if the tax was calculated incorrectly

If you find that the amount is too high, you need to submit an application to the inspectorate. Copies of documents with correct information are attached to it. You can write it in any form, or on a standard form. The overpayment can be offset against future payments, or you can return the amount - you need to indicate exactly how you want to proceed.

When visiting in person, it is better to have two copies so that you can keep one for yourself with a note of acceptance. When mailed, you will receive a dated receipt. The received application is considered by the Federal Tax Service within 10 days, and 5 days after the decision is made, the payer must be notified of the results. The money is returned after 30 days.

What benefits are provided?

The law provides benefits and tax deductions for certain taxpayers.

Back to contents

Payment benefits

The fifth paragraph of Article 391 of the Tax Code of the Russian Federation states that a tax benefit in the amount of 10,000 rubles is received by the following citizens:

- Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory;

- disabled people of disability group I and disability group II;

- disabled since childhood;

- veterans and disabled people of the Great Patriotic War and other military operations;

- individuals who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations at weapons and military facilities;

- individuals who were exposed to radiation as a result of the Chernobyl disaster and the liquidation of its consequences, as a result of the accident at the Mayak production facility and the discharge of radioactive waste into the Techa River, as a result of nuclear tests at the Semipalatinsk test site;

individuals who received or suffered radiation sickness or became disabled as a result of interaction with any types of nuclear installations.

Back to contents

Exemption from payment

Article 395 of the Tax Code contains a list of nine active clauses, according to which the following are exempt from land tax (of course, subject to the intended use of land):

- religious organizations;

- organizations and institutions of the penal system of the Ministry of Justice of the Russian Federation;

- organizations that own lands through which state highways pass;

- public organizations of disabled people (provided that disabled people make up at least 80% of the organization);

- organization of folk arts and crafts;

- shipbuilding organizations that have resident status in an industrial and production special economic zone;

- resident organizations of a special economic zone (within five years after the emergence of ownership of the site) and a free economic zone (within three years after the emergence of ownership of the site);

- organizations falling under the Federal Law “On Innovation”;

- individuals - representatives of small peoples of Siberia, the North and the Far East of the Russian Federation. Communities of such peoples.

Back to contents

How to reduce your deductions

This can be done only by reducing the cadastral value of the land. This can be done not only by the owner of the site, but also by the land user, tenant and even subtenant.

To change the cadastral value, you need to contact the arbitration court and provide there a package of documents from an application for revision of the cadastral value to conclusions and reports on the value of the taxable property and real estate (if there is one on the land).

The second way to reduce the cost is to contact the dispute resolution commission about the results of determining the cadastral value (within six months after the cadastral valuation).

Back to contents

Which areas are not subject to taxation?

Land tax is established on specific land plots of legal entities and individuals.

There are a number of lands that are not taxed, for example:

- occupied by cultural and archaeological heritage sites, nature reserves;

- provided for the needs of defense and security of the state, as well as for customs services;

- provided to forest and water funds;

- withdrawn from circulation.

Back to contents

Tax rates

The amount of land tax depends on the intended purpose of the land, as well as on the status of its owner (beneficiary or not). If the above about benefits and exemptions from payment does not apply to you, and you use the land for:

- Agriculture;

- housing or future housing;

- garden, vegetable garden, personal subsidiary plot - you will pay 0.3 percent of the cadastral value of the land once a year.

In other cases, 1.5 percent is paid.

Local governments can establish a differentiated tax rate.

For land acquired for housing construction, during the design and construction period, taxation is carried out taking into account the coefficient.

Back to contents

Recalculation

Cadastral valuation of land is carried out every five years.

If, as a result of the revaluation, the taxpayer’s situation has improved, you can contact the tax service with an application for recalculation of the ZN.

New data is considered valid from the first of January of the new year, therefore, you can ask for a recalculation, for example, for the previous year, because recalculation regulations have retroactive effect if they improve the taxpayer’s situation.

Back to contents

Land tax problems

Due to the fact that the tax base is determined according to the cadastral value of land plots, and many municipalities provide information about taxable objects and land owners to the tax services at the wrong time or not in full, individuals suffer, for whom the tax amount is calculated by the tax services.

Certain problems previously arose when assessing taxes on plots where multi-apartment residential buildings were built: often cadastral registration of such plots was not carried out, and apartment owners do not have documents for the land.

If you think that there are any problems with your land tax, feel free to open the Tax Code, Chapter 31 “Land Tax”, and do not hesitate to contact government authorities with complaints and statements.

Back to contents

Land tax in 2012

From January 1, 2012, on the basis of paragraph 11 of Art. 395 of the Tax Code of the Russian Federation, shipbuilding organizations (see paragraph above on exemption from land tax) do not pay land tax. If, of course, the land is used for ship repair and industrial premises.

Also in 2011, the cadastral value of land was recalculated, which allows those taxpayers whose situation has improved in accordance with new information to apply for recalculation.

Back to contents

Liability for non-payment

Do I need to pay land tax? The responsibility of individual entrepreneurs and legal entities for non-payment of tax, delay in payment or payment of an incomplete amount of tax is essentially identical. When determining liability, which is expressed in the form of a fine, unintentional actions (inaction) of an entrepreneur or legal entity are not taken into account as a valid reason.

That is, excuses due to forgetfulness, and similar reasons, will not be taken into account . A penalty of 20% of the total debt amount calculated from the designated payment period will be imposed. If it is proven that an entrepreneur or company manager did not pay the tax intentionally, then the amount of the authorized deduction will be 40% of the total amount owed. These punitive measures are carried out within the framework of tax liability.

If it is proven that an individual entrepreneur or the head of a company not only intentionally failed to pay the tax, but also tried to hide it from the state, he will be subject to criminal liability. He will be punished in accordance with the provisions of the Criminal Code of the Russian Federation. This intentional act is considered in the context of criminal acts for which serious penalties may be imposed.

To avoid such incidents, paying taxes must be taken more than seriously . The statute of limitations for prosecution for non-payment of taxes is 3 years. But it is far from certain that after this period, the taxpayer will be freed from the burden of debt. The statute of limitations may be canceled upon the statement of tax inspectorate specialists that the culprit in every possible way interfered with the desk audit. On this basis, the issue of paying taxes may become open again.

If the land tax is overpaid, that is, the payment amount exceeds the norm, these funds will be credited to the next tax period. If such a resource is available in your account, then in case of underpayment next time, it will cover the losses.

The amount of payments must be tracked. This can be done on the official website of the local branch of the Federal Tax Service. To do this, you need to go to the website and enter your last name, first name and special identification code in the search engine. You will be given the information you are interested in.

Land tax in 2015-2016

From January 1, 2015, land plots under apartment buildings are not subject to land tax. For tax periods starting from 2015, determining the tax base and calculating the amount of tax in relation to the plots of individual entrepreneurs is the responsibility of the tax authorities.

There are no expected changes to filing deadlines or tax rates for 2016.

The only thing that will significantly affect the amount of transfers to the budget is a change in the base value that was used when calculating the tax. If earlier the inventory value of the site was taken into account (and it was small), now its cadastral value is used in the calculation. This is where all the negativity lies for ordinary individuals, because compared to the inventory value, the cadastral value is much higher. Its size is determined by independent appraisers approved by local authorities.

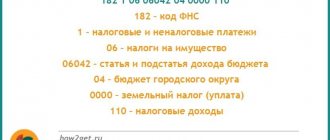

But there have been changes in the form of payment. Since changes to clause 1 of Article 398 of the Tax Code of the Russian Federation have been in effect since January 1, 2015, individual entrepreneurs do not have to submit a land declaration for 2015 - payment will be made upon notification sent to the entrepreneur by the fiscal authorities.

Back to contents