During the entire period of business, each individual entrepreneur may have several reasons why he will have to deposit his money into the cash register.

The reason may be:

- financial support for your own business;

- replenishment of the current account;

- debt repayment.

If finances are not enough, then an individual entrepreneur can deposit money into a personal current account from his own savings. In any case, you need to take into account the subtlety of the execution of this monetary transaction, because you need to draw up the correct reporting documents for the tax office.

When depositing his own money into the cash register, an individual entrepreneur must accompany such payment with an indication that confirms the legality of this operation.

For example, a payment can be signed as:

- “Replenishing your account with personal savings.”

- “Depositing your own finances into your account.”

In this case, the execution of a monetary transaction is carried out taking into account the regulations of the Central Bank of the Russian Federation.

How can individual entrepreneurs pay?

According to Russian legislation, individual entrepreneurs are liable for their obligations in full with all their property, but at the same time they have the right to dispose of their income without any restrictions . This means that an individual entrepreneur can at any time withdraw any amount from the turnover and use it for personal purposes, as well as deposit any amount into the account for use in business activities.

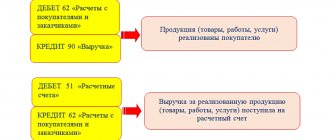

Individual entrepreneurs can pay using cash and non-cash methods. Basically, all payments between legal entities and individual entrepreneurs pass through a current account. If the proceeds from the sale of products, works or services are credited to the bank account of an individual entrepreneur, then the following transactions must be made.

| Business transaction | Wiring |

| An individual entrepreneur sold his products (works, services) | Debit 62 / Credit 90.1 “Revenue” |

| VAT charged | Debit 90.3 / Credit 68 |

| The individual entrepreneur received the proceeds, which were credited to his bank account | Debit 51 / Credit 62 |

If an individual entrepreneur is not exempt from operating an online cash register (currently there is a list of those exempt from operating an online cash register), then when paying in cash, he must have a cash register in accordance with Law No. 54-FZ of May 22, 2003 “On the use of cash registers.” -cash equipment when making payments in the Russian Federation.” However, by July 1, 2021, all individual entrepreneurs are required to switch to online cash registers. The cash register must be registered with the tax office. The list of individual entrepreneurs exempt from the use of online cash registers is listed in Law No. 54-FZ of May 22, 2003. These include, for example, entrepreneurs:

· providing people with small household services, such as nanny services,

· as well as those selling certain goods, such as ice cream, newspapers, magazines, etc.

| Business transaction | Wiring |

| An individual entrepreneur sold his products (works, services) | Debit 62 / Credit 90.1 “Revenue” |

| VAT charged | Debit 90.3 / Credit 68 |

| The individual entrepreneur received the proceeds, which went to his cash desk | Debit 50 / Credit 62 |

| Cash from the cash register was deposited in the bank | Debit 51 / Credit 50 |

Why deposit your money into the cash register?

During the period of operation there may be different situations. At the initial stages, not every month can be profitable, and then the question arises about additional financing for your business.

In some cases, an entrepreneur wants to expand the boundaries of his business, in which case personal savings can help.

The law in no way prohibits an individual entrepreneur from managing his current account. You have every right to deposit funds and withdraw funds at any time. This advantage distinguishes the activities of individual entrepreneurs from LLCs.

The only prohibition on withdrawing money from the account may come as a result of tax debt or a court decision.

If at the moment the enterprise needs an additional cash injection, the individual entrepreneur can deposit his own funds into the cash register.

There may be several reasons for this:

- You want to maintain the financial condition of the company;

- Would you like to replenish your current account?

- Pay off some debts;

- Issue wages to hired workers from personal money (if the amount in the cash register is not enough for these purposes).

If the individual entrepreneur has debt and does not have sufficient funds on the balance sheet, depositing personal funds is a way out of this situation. This is especially true if the payment deadline is approaching, and the receipt of income to the individual entrepreneur’s account is not expected within a short time.

In any case, you need to register the deposit of your own funds correctly so that you do not have questions from the tax authority. Each transaction must be documented and correctly reflected in the company’s accounting.

How can an individual entrepreneur replenish his current account?

An individual entrepreneur can replenish his current account in the following ways:

- depositing funds directly into a bank account;

- depositing funds into a current account through terminals and bank cards;

- with the help of collectors.

Depositing funds into a current account by an individual entrepreneur does not require any formalization from him, unlike a legal entity. There are also no restrictions on the number of open current accounts.

Depositing an individual entrepreneur's own funds into an account: postings

Unlike funds received by a legal entity from its participant (founder) and requiring certain formalization of such relationships (loan, increase in authorized capital, gratuitous transfer), the contribution of individual entrepreneurs’ own funds into their own business does not require any additional registration. By investing money in it, an entrepreneur simply increases his capital generated by conducting commercial activities.

An individual entrepreneur may not reflect the fact of depositing money in accounting, since (subclause 1, clause 2, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- he has no obligation to keep accounts;

- in the registers required for it (they reflect the information necessary to generate data on the object of taxation), these funds are not taken into account, since they are not subject to taxation.

But the entrepreneur has the right to keep records. When implementing it, the individual entrepreneur will reflect the deposit of his own funds into the account by posting, which can be expressed as:

- a regular (not double) entry in the book of accounting for facts of economic activity, if a simple simplified form is chosen for accounting;

- an accounting entry using accounting accounts in it, if accounting is kept in full, full simplified or abbreviated simplified form, in which double entry on accounts is mandatory.

The correspondence of accounts in the accounting entry with double entry will look like Dt 51 Kt 84.

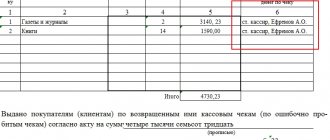

How to record the receipt of funds into a current account through a collector

The cash collector can hand over the money to the bank. In this case, it is also necessary to reflect the issuance of funds through account 57, because the money goes to the current account through an intermediate link - the collector.

| Business transaction | Wiring |

| Cash issued to collectors | Debit 57 / Credit 50 |

| Cash handed over to the bank by collectors | Debit 51 / Credit 57 |

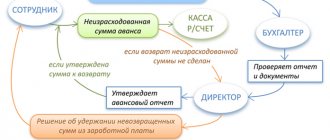

Depositing funds for settlements with employees

An individual entrepreneur has the right to deposit his own funds into the cash register and for settlements with his employees. At the same time, it is very important to correctly reflect the value of the receipt of this money in the book of income and expenses (KUDiR). In this case, you must save all bank receipts.

As soon as the funds arrive in the appropriate account, the payment of salaries to employees will be carried out in accordance with the documents used, which confirm the legality of such financial transactions.

Common questions regarding individual entrepreneur current account

Question. How to reflect the receipt of personal funds of an entrepreneur into the current account?

Answer. Individual entrepreneurs have the right to freely dispose of their funds, then the receipt of funds into the current account and withdrawals from the current account can be reflected in the following entries, using account 76 “Settlements with various debtors and creditors”. You can open a “Personal Funds” subaccount for account 76.

Debit 51 / Credit 76 subaccount “Personal funds”

Withdrawals of money from the account for personal needs must be reflected by posting

Debit 76 “Personal funds” / Credit 51

Accounting

The entrepreneur’s personal funds, which he decided to deposit in the cash register, can be considered as revenue. Therefore, you need to immediately issue a receipt order. And it should be noted that these finances are not related to the activities of the individual entrepreneur, and also reflect the purpose of the payment.

The entrepreneur’s personal funds, which he decided to deposit in the cash register, can be considered as revenue.

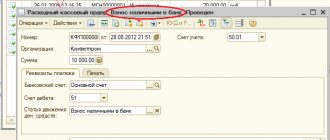

When filling out a debit order, it is also important to indicate the bank account number to which the transferred amount will be credited. It is also worth writing down the address of the bank where the transfer was made.

When depositing money at the cash desk, it is very important to complete the documentation correctly. Namely, it is correct to indicate where this money came from. An individual entrepreneur can deposit cash only into his personal bank account. Otherwise, the bank may refuse.

Upon completion of the operation, the individual entrepreneur will receive a check stamped and signed by the cashier. After completing the operation, you need to make transactions; in our case, you need to use account 84 (“Other operating expenses”).

It is necessary to indicate the purpose of money in a cash receipt order (PKO) only when money received from business activities is deposited into the cash register. In this case, they must be registered as proceeds. Each wiring, regardless of type and purpose, must be documented with the necessary documentation.

When an individual entrepreneur has a debt and deposits money into the account in order to pay it off, it is necessary to issue a PKO. The entire amount that was invested is not taken into account in the KUDiR.

When investing your money in the cash register, you must use the following entries: 72 “Income/expenses of individual entrepreneurs”, 72.1 “Deposit of personal funds”, 72.2 “Replenishment of the account” and 84 “Other operating expenses”.

Taking into account the nuances that relate to the correct execution of various types of documents, it is worth noting that the contribution of personal money to the cash desk should be supported by warrant No. Ko-1. Only in this case, financial accounting of funds deposited in the cash register will be kept in the account that reflects work with creditors and debtors (Debit 76, Credit 50), as well as in the posting account.

Paying taxes on personal money of individual entrepreneurs

In the process of activity, an entrepreneur working on the simplified tax system deposits his personal funds into a bank account to pay for the rent of the premises. A pressing issue for him is the payment of tax on the amount transferred to the account.

An individual entrepreneur who deposited his funds into the account is not a person forming the tax base, and his personal money cannot be recognized as income, since it is not related to the sale of goods or services.

A private individual running a business has the right to spend his own money on any needs, unlike the managers of an LLC, who do not have such a right.

If a request is received from the tax service with a claim regarding payment, it is necessary to send a letter to the Federal Tax Service indicating the purpose of the funds received and the amount of the fee to be paid.

In documents created according to cash register data for individual entrepreneurs, it is necessary to reflect the cash flow mechanism, following the order of the Central Bank of the Russian Federation according to a simplified scheme. Maintaining a cash book is not the responsibility of an entrepreneur, but many managers prefer to document the movement of funds and maintain financial discipline. Maintaining account 50 “Cash” is necessary to reflect debits and credits.

Filling out a cash book helps an individual entrepreneur take into account the movement of money over a 12-month period. An alternative option is the accounting program “1C:Enterprise”. In the absence of a special book, it is impossible to determine the amount of cash remaining in the cash register.

The new provision on the preparation of cash documents applies to entrepreneurs working under the taxation system, and recommends that they issue the receipt receipt counterfoil to the person who paid the money. When working with legal entities or individuals, individual entrepreneurs should always have cash documents.

Results

An individual entrepreneur has the right to withdraw funds from his own business and invest them in it without restrictions. At the same time, it is not mandatory for individual entrepreneurs to open a current account intended for funds involved in business. But having such an account provides certain advantages.

An individual entrepreneur is not required to keep accounting records. However, when exercising such a right, he must take into account the funds contributed to the business as an increase in the capital generated during entrepreneurship. When using the double entry method, the posting will look like Dt 51 Kt 84.

How much can I deposit?

According to current regulatory and legal acts, cash payments from business entities are limited to an amount of up to 100,000 rubles for each concluded agreement.

Such restrictions have nothing to do with the situation described in this article. This is due to the fact that the legislation does not provide for any restrictions on amounts when making payments between an individual and an individual entrepreneur. In addition, the entrepreneur does not draw up an agreement to replenish the current account of his own company.

In this regard, the entrepreneur has the opportunity to deposit exactly the amount that he needs to pay off accounts payable.

Are own funds in the cash register counted as income?

Each transaction on a company account may attract the attention of the tax authority. This is especially true for incoming transactions. When depositing your own funds, it is important to justify them correctly.

If in the purpose of the transfer you indicate that the funds being deposited are your personal savings, then there can be no claims from government agencies against you. The main thing is to save all confirmation forms from banks and keep them for the entire period of the individual entrepreneur’s activity (preferably 4 years).

Do not report your own funds as income in internal reporting. Maintain such income separately from individual entrepreneur operations. This will help avoid confusion and correctly form the tax base.

If, by your own mistake, you do not indicate the correct purpose of the payment in the payment order, then it will be problematic to prove to the tax service that these funds are yours.

If the payment document for depositing funds is completed in compliance with the established requirements, then your money, of course, is not the income of the company. They are not considered a product of the individual entrepreneur’s activities, but only reflect your savings, which should not be taken into account when calculating tax payments.

Basic differences in the ability to use business income between individual entrepreneurs and legal entities

Commercial activities in Russia can be carried out:

- legal entities, including those with a single founder who is an individual (clause 2 of article 50.1 of the Civil Code of the Russian Federation);

- individuals, who in most cases must be registered as individual entrepreneurs for this purpose (clause 1 of article 23 of the Civil Code of the Russian Federation).

All decisions regarding business issues are made by business owners:

- participants (founders) - for a legal entity;

- Individual entrepreneur - for an individual entrepreneur.

However, legislation limits the influence of legal entity participants on its activities, giving them the opportunity to:

- be liable for the obligations of a legal entity only to the extent of the contribution to its authorized capital;

- use the income received by the organization only after the expiration of the reporting period and only in the form of dividends, without providing for the freedom to withdraw funds from circulation for personal purposes.

At the same time, the individual entrepreneur is responsible for his obligations in full, but he also has the right to dispose of income without restrictions, i.e., at any time he can withdraw funds from circulation and deposit them into an account for use in business activities.