Payers of income tax are required to periodically report by submitting to the Federal Tax Service the appropriate tax return, which indicates the amount of profit and the amount of tax on it.

Sheet 02 (L02) is the most important section of the report, where the tax is directly calculated. Information for its calculation is formed from the annexes to it: the first (P1), which records all income from the activities carried out, and the second (P2), which combines all the costs that the enterprise incurred in the management, production, production and sale of products. Let us remind you how to generate sheet 02 of the income tax return.

Starting from 2021, you will have to report using the updated declaration form approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-3 / [email protected] dated 09/23/2019, i.e. for 2021 you will need to submit a report using a new form.

Section 1

The amount of tax that needs to be paid to the budget is reflected in section 1.

Subsection 1.1 must be completed. The amount of income tax and advance payments payable for the reporting period is shown here. The data is taken from lines 270–281 of sheet 02 of the declaration. The tax to be paid additionally or reduced is shown taking into account advance payments.

If a company paid 5,000 rubles to the federal budget in the first quarter, and the profit tax to this budget for the half-year is 8,000 rubles, at the end of the half-year it is necessary to pay an additional 3,000 rubles (8,000 - 5,000). That is, on line 040 of subsection 1.1 you need to indicate the amount of 3,000 rubles.

Subsection 1.2 must be completed by organizations that pay advance payments every month based on the profit for the previous quarter or actual profit. This section should not be in the annual declaration.

Lines 120–140 and 220–240 reflect the third part of the amounts indicated in lines 300–310 and 330–340 of sheet 02.

If the company pays income tax on interest and dividends, subsection 1.3 is completed.

What has changed in the declaration in 2021

The current form of the income tax return was approved by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] Compared to the previous form, it has undergone significant changes: the barcode has changed, new taxpayer identification codes have appeared. For the majority of organizations this is still 01, but there are also the following:

- 07 and 08 - for participants in investment projects and investment contracts;

- 09 and 10 - for educational and medical organizations;

- 11 - for those who combine medical and educational activities;

- 12 - for social service organizations;

- 13 - for travel agencies;

- 14 - for regional MSW operators.

If, in accordance with regional legislation, the taxpayer has the right to a reduced tax rate, in line 171 on sheet 02 we indicate the details of the regional regulatory act.

In addition, lines have appeared to indicate the tax base for participation in an investment partnership; new appendix No. 7 to l. 2 must be completed by those applying the investment deduction.

Sheet 02

The tax base is defined as the difference between the income and expenses of the organization, which are reflected in sheet 02 of the tax return.

A detailed breakdown of income and expenses is reflected in the appendices to sheet 02. The sheet itself shows the total amounts of income and expenses, the tax base and calculated tax.

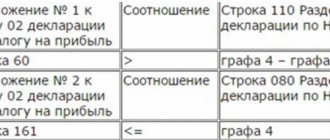

Line 110 reflects losses from previous years transferred to the current period.

The income tax rate (lines 140–170) in 2017-2020 is 20%: 3% for the federal budget, 17% for the budgets of the constituent entities of the Russian Federation (Article 284 of the Tax Code of the Russian Federation).

See detailed filling out sheet 02

Blog

Payers of income tax are organizations subject to the general taxation system. The deadlines for payment and reporting are set forth in Articles 285 and 286 of the Tax Code of the Russian Federation. There are three ways to pay tax and submit reports :

- Monthly based on actual profit

- Quarterly with monthly advance payments (primary)

- Quarterly based on actual profit (preferential: can be used by commercial organizations with revenue for the previous 4 quarters on average not exceeding 15 million rubles).

After you have generated an income tax return in the program, you need to check it with SALT, so to speak, manually calculate the amount of tax, check the program.

We will consider the option of operating a regular organization without applying PBU 18/02.

First, we check Appendix 1 and 2 of sheet 02 of the declaration .

Appendix 1 – Income of the organization.

As a rule, line 010 - this is the organization’s revenue from its main activities without VAT. In SALT we take the turnover on Credit 90.01 and subtract the turnover on debit 90.03

Line 011 is the proceeds from the sale of purchased goods without VAT; here you need to track the amounts passed through the posting Dt 62.01 Kt 90.01 (but only if the invoice was the second posting Dt 90.02 Kt 41). You can generate an analysis of account 41 and look at the correspondence from 90.02.

Line 012 is the proceeds from the sale of finished products without VAT, here it is necessary to track the amounts passed through the posting Dt 62.01 Kt 90.01 (but only if the invoice was the second posting Dt90.02 Kt 43). You can generate an analysis of account 43 and look at the correspondence from 90.02.

Line 040 = sum of lines 020.......030

Non-operating income, line 100 – we check the turnover on the credit of account 91.01 (excluding VAT)

I remind you that when calculating income tax, use in your calculations only the income and expenses accepted in tax accounting (Chapter 25 of the Tax Code of the Russian Federation).

Appendix 2 – Organizational expenses

Related course

Advanced accountant

Find out more

Line 010 – debit turnover 90.02 in correspondence with account 20

Line 020 – turnover on debit 90.02 in correspondence with 41.43 accounts

Line 040 – debit turnover 90.07 + 90.08

Line 130 is the sum of the above lines. (these are expenses for account 90 without VAT and turnover for account 90.09)

Line 200 – non-operating expenses accepted as expenses for tax accounting purposes

See SALT for account 91.02

Sheet 02

We take income according to Kt 90.01 (without VAT) - turnover according to Dt 90.02 - turnover according to Dt 90.07 - turnover according to Dt 90.08 + Turnover according to Dt 91.01 (without VAT) - turnover according to Dt 91.02 (accepted expenses) = line 060 of sheet 02

Then calculate the tax amount in accordance with the established rate in your region. When calculating the amount of tax payable, take into account previously paid advance payments (turnover according to Dt 68.04)

If you have any questions about filling out your income tax return, call us, we will help you with a consultation (we’ll come in remotely). Tel. +7(391) 287-7-287 / “Accounting encyclopedia “Profirosta” 07/25/2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

Appendix No. 1 to sheet 02

This application reflects all income according to tax accounting, including non-operating income.

The total amount of income received is recorded in line 040, which is then duplicated in line 010 of sheet 02.

Non-operating income is reflected separately from income from the sale of goods or services (work). At the same time, some types of non-operating income are allocated in separate lines, for example, income in the form of property received free of charge (line 103).

View detailed completion of Appendix No. 1

Composition of the declaration

The quarterly VAT return contains two sections that must be completed:

- head (title page);

- the amount of VAT to be paid to the budget/refunded from the budget.

A reporting document with a simplified format (Title and Section 1 with dashes added) is submitted in the following cases:

- carrying out business transactions that are not subject to VAT during the reporting period;

- conducting activities outside Russian territory;

- the presence of production/commodity operations of a long period - when the final completion of work requires more than six months;

- a commercial entity applies special taxation regimes (Unified Agricultural Tax, UTII, PSN, simplified taxation system);

- when issuing an invoice with a dedicated tax by a taxpayer exempt from VAT.

If the specified prerequisites are present, sales amounts for preferential types of activities are entered in section 7 of the declaration.

For tax subjects conducting activities using VAT, it is mandatory to fill out all sections of the declaration that have the corresponding digital indicators:

Section 2 – calculated VAT amounts for organizations/individual entrepreneurs having the status of tax agents;

Section 3 – sales amounts subject to taxation;

Sections 4,5,6 - are used when there are business transactions with a zero tax rate or do not have a confirmed “zero” status;

Section 7 – data on transactions exempt from VAT are indicated;

Sections 8 – 12 include a summary of information from the purchase book, sales book and invoice journal and are completed by all VAT payers applying tax deductions.

Appendix No. 2 to sheet 02

This application contains information about the company's expenses, including non-operating expenses.

Conventionally, the expenses that are present in the activities of almost any enterprise can be divided into three blocks:

- direct expenses (lines 010–030);

- indirect expenses (lines 040–055);

- non-operating expenses (lines 200–206).

If the organization operates on the cash basis, lines 010–030 are not filled in.

Separate lines reflect expenses related to the turnover of securities, property rights, etc.

The amounts of losses are shown in lines 090–110 of Appendix No. 2.

The amount of accrued depreciation is highlighted separately (line 131).

Line 205 shows the amount of penalties and interest for failure to fulfill the terms of the contracts.

Please note that fines from regulatory authorities for accounting violations or late payment of taxes are not reflected in line 205.

View detailed completion of Appendix No. 2

We are giving 3 months of electronic reporting through Kontur.Extern for new subscribers!

VAT return line 030: explanation

If a company, not being a VAT payer, has issued an invoice (IF) to the buyer with the allocated amount of tax, then it should be entered in line 030 of Section 1 as payable.

Since line 030 is also found in other sheets of the form, we list them:

- in P2 it indicates the seller’s TIN;

- in P3 in line 030 in the third column indicate the size of the tax base calculated at the rate of 20/120 (if the company carried out transactions for which the estimated tax rate was used), its size is reflected in the fifth column of the line. For example, with a base equal to 1,000,000 rubles. VAT will be 166,667 rubles. (1,000,000 x 20 / 120);

- in Appendix 1 to P3, line 030 reflects the date of commissioning of the OS;

- if the company carries out operations for which the tax rate is 0% (export, international, etc.), then line 030 reflects:

- in P4 – the amount of deductions for justified transactions with a VAT rate of 0%;

- in P5 – transaction code using the VAT rate of 0%;

- in P6 – the amount of calculated tax at rates of 10 and 20%;

- in P8 and P9 – dates of the seller’s SF for each type of transaction code;

- intermediary enterprises fill out sections 10 and 11, where in line 030 (P10) they indicate the numbers of the SF issued in the interests of other persons for transactions (based on the data in the journal of accounting of the issued SF), and in P11 - the numbers of the SF received;

- VAT defaulters draw up Section 12 if they accounted for the SF with an allocated tax amount. Line 030 reflects the number of this SF.

Results

The annual profit declaration is prepared on the same form and according to the same principles as interim reports. However, the declaration generated annually has a number of differences. These differences include:

- the use of special codes to indicate the reporting period;

- no need to accrue advances for subsequent periods;

- your own set of sections that require filling out if there is data to be entered into them.

Another difference is the deadline for submitting the declaration. By year, it is submitted only in the 3rd month coming after the end of this year, in contrast to interim reports submitted in the next month following the reporting period.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Line 150 of the VAT return

In Section 3, in the tax deductions block, line 150 reflects the amount of tax paid at customs when importing goods into the Russian Federation.

Line 150 also indicates:

- In P6 - the amount of VAT adjustments calculated at rates of 10 and 20% for transactions using a zero rate (upon receipt of confirmations);

- When carrying out import/export operations in P8 - registration numbers of the customs declaration, in P9 - the cost of sales in the currency of the Northern Federation;

- In P10 – currency code for an intermediary transaction;

- in P11 – the value of assets according to the SF issued by the agent.

Line 080 of the VAT return: explanation

Line 080 is used in Section 2, filled out by the tax agent - it records the amount of tax calculated upon shipment. Also in line 080 indicate:

- in P3 - the total amount of VAT to be restored;

- in P4 – the amount of VAT previously accepted for deduction and subject to restoration;

- in P5 – the amount of tax to be reimbursed for documented transactions using a zero rate;

- in P6 – the size of the base for transactions that have not yet been confirmed with a zero VAT rate;

- in P8 and P9 – the correction number of the seller’s adjustment invoice.

- in P10 and P11 – the dates of the adjustment SF issued and received by the intermediary;

- in P12 in line 080 reflect the total cost of work/goods subject to taxation.

The concept of indirect expenses and the procedure for their reflection in the income statement

Indirect costs are costs that were incurred in the production and sale of products (works and services), but do not have a direct impact on their cost.

This type of cost has only an actual method of accounting, that is, there is a direct link to the date of its implementation.

Each enterprise determines the procedure for determining the cost of production independently, but always within the limits of current legislation. Consequently, the procedure for forming the cost of production must be documented in the order on the tax accounting policy of the enterprise.

It should be noted that if in the order on tax accounting policy the list of costs does not relate to direct or non-operating costs, then they are recognized as indirect.

Typically, indirect costs include:

- List of general production costs that are associated with maintenance and management of the production process: costs of communication services, lighting and heating of premises, office rent, insurance costs, information and consulting services, and others.

- List of general business expenses that have a direct impact on the production process: maintenance of general business personnel, repairs and depreciation charges for fixed assets for management and general business purposes, and others.

The difference between direct and indirect expenses is that the “latest” expenses of the reporting period are included in full, and direct ones - as goods, works and services are sold.

In addition, the procedure for distinguishing direct from indirect costs directly depends on the stage of completion of the production cycle. Each production cycle may have its own proportions of their delimitation.

Line 090 of the VAT return: explanation

In Section 2, line 090 reflects the amount of VAT calculated by the tax agent upon receipt of payment or advance payment. In other sections of the declaration on line 090:

- In P3 - detail the amount of VAT to be restored in line 080 - indicate the amount of VAT refunds from advances received;

- In P5 - indicate VAT to be deducted on transactions confirmed by documents using VAT;

- In P6 - reflect the amount of tax adjustments for transactions for which a 0% rate is provided. Corrections of VAT amounts are possible upon receipt of supporting documents;

- In P8 and P9 – the date of correction of the seller’s adjustment invoice;

- In P10 and P11 - the correction number of the corrective SF.

When do you submit your annual income tax return?

Another difference between the annual declaration and the intermediate ones is that they are submitted at different times, despite the fact that for each of these documents the 28th becomes a significant date. Interim reports are submitted no later than this date in the month following the end of the reporting period, i.e.:

- for advances accrued monthly from actual profits - monthly (11 times a year);

- for quarterly accrued advances - quarterly (3 times a year).

When do you submit your annual income tax return? No later than March 28 of the year following the end of the tax period specified in this declaration.

Each of these deadlines may be shifted to a later date if a particular day falls on a weekend (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). In 2021, March 28 is a day off. Therefore, you can submit your declaration for 2020 until March 29, 2021 inclusive.

Read more about the deadlines for submitting your declaration for the year here.