The institution was given a land plot with the right of permanent (indefinite) use. How to account for this area: behind the balance sheet or on the balance sheet? How to formalize the acceptance of land for registration in the program “1C: Accounting of a government institution 8”. You will find answers to these questions in the article by 1C experts.

Clause 333 of the Instructions for the application of the Unified Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n, as amended on October 12, 2012, establishes that land plots used by institutions on the right of permanent (perpetual) use (including those located under real estate objects) are recorded on off-balance sheet account 01 “Property received for use” on the basis of a document (certificate) confirming the right to use the land plot, at their cadastral value (the value indicated in the document for the right to use the land plot located outside the territory of the Russian Federation) Federation).

Article 5 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” establishes that the objects of accounting of an economic entity are:

- facts of economic life;

- assets;

- obligations;

- sources of financing its activities;

- income;

- expenses;

- other objects if this is established by federal standards.

If an institution has the right to use a land plot, then the land plot is an asset and must be accounted for on the institution’s balance sheet.

By Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n, corresponding changes were made to paragraph 71 of the Instructions for the application of the Unified Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n, hereinafter referred to as Instruction No. 157n, now land plots used by institutions on a permanent basis (perpetual) use (including those located under real estate) must be taken into account in the corresponding analytical accounting account of account 103 00 “Non-produced assets” on the basis of a document (certificate) confirming the right to use the land plot, at their cadastral value (the value specified in document for the right to use a land plot located outside the territory of the Russian Federation).

Clause 2 of Order No. 89n of the Ministry of Finance of Russia dated August 29, 2014 establishes that the changes approved by this order are applied when forming indicators of accounting objects on the last day of the reporting period of 2014, unless otherwise provided by the accounting policy of the institution. The transition to the application of accounting policies, taking into account the provisions of this order in terms of the working chart of accounts of accounting (budget) accounting of state (municipal) institutions, is carried out according to the organizational and technical readiness of the accounting entities.

Thus, before December 31, 2014, institutions should write off off-balance sheet land plots used by institutions on the right of permanent (perpetual) use (including those located under real estate) and put them on the balance sheet - to account 103 11 “Land - immovable property of the institution." According to the explanations of the methodologists of the Ministry of Finance of Russia, these transactions should be documented with an accounting certificate f.0504833.

Article 11 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” establishes that assets and liabilities are subject to inventory. During the inventory, the actual presence of the relevant objects is revealed, which is compared with the data of the accounting registers.

Thus, in order to identify the actual availability of property, compare the actual availability of property with accounting data and check the completeness of reflection in accounting in accordance with paragraph 1 of Art. 11 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, it is necessary to conduct an inventory of land plots, including those located under real estate objects. If the institution has documents (certificates) confirming the right to use the land plot, based on the inventory results, the object should be written off off-balance sheet and placed on the balance sheet at its cadastral value.

In accordance with paragraph 20 of the Instructions for the application of the chart of accounts for accounting of budgetary institutions (approved by Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n), acceptance for accounting in accordance with the Act on the results of the inventory of objects of non-produced assets identified during the inventory is reflected in the debit of the corresponding analytical accounting accounts account 010300000 “Non-produced assets” (010311330, 010312330, 010313330) and the credit of account 040110180 “Other income”.

It should be noted that if an institution has a land plot taken into account off its balance sheet, it may be taken into account as treasury property on the balance sheet of the relevant property management body. The same object should not be simultaneously accounted for on the balance sheets of the institution and the treasury. Write-offs from the treasury balance sheet and acceptance onto the institution’s balance sheet must be carried out in concert.

Changes to Instruction No. 162n: how to maintain budget accounting in 2021

On February 10, an order came into force that amended Instruction No. 162n. Innovations need to be applied when drawing up accounting policies and budget accounting indicators starting in 2019.

There are many edits, in particular, when generating an account number, you need to take into account the new KOSGU codes. The accounting rules have also changed: non-financial assets received or transferred free of charge, as well as unaccounted for items identified during inventory, must be recognized differently.

There are changes in accounting for settlements, obligations, income, and expenses.

Accounts are generated as before, but taking into account the new KOSGU

The updated Instruction N 162n clarifies that accounts for the division of non-financial assets, settlement accounts for income (205 00), for advances issued (206 00), with accountable persons (208 00), for damage and other income (209 00), for accepted obligations (302 00) should be formed as follows:

- in 1–17 digits - the corresponding code (component of the code) of the budget classification;

- in 24–26 categories - subarticles of KOSGU according to the economic essence of the operation.

Example: A government agency purchases bottled water because the sanitary and epidemiological inspection body has declared the water from the centralized drinking water supply unfit for drinking. The accountant accepts the following information for accounting:

Debit KRB 1,105 36,349 Credit KRB 1,302 34,730 (KRB 1,208 34,660 if water was purchased through an accountable entity).

Assets received (transferred) free of charge are accounted for in a new way

Changes in accounting rules are associated with the introduction of additional KOSGU codes. Let's consider how to reflect assets if they are received or transferred free of charge:

The choice of the KOSGU subitem in new transactions will depend on the counterparty and the economic content of the transaction.

Example: A public sector organization donates a computer to a government agency free of charge. The receiving party's accountant makes the following entries:

Debit KRB 1,101 34,310 Credit KDB 1,401 10 195

— the computer has been registered;

Debit KDB 1,401 10,195 Credit KRB 1,104 34,411

— previously accrued depreciation is reflected;

Debit KDB 1,401 10,195 Credit KRB 1,114 34,412

— previously accrued impairment loss is reflected.

Unaccounted for non-monetary assets identified during the inventory are reflected under subarticle 199 of KOSGU

If, after an inventory, an unaccounted item is discovered (fixed assets, supplies, etc.), then, when accepting it for accounting, you need to use the new subarticle 199 of KOSGU.

Example: Based on the results of an inventory, an unaccounted intangible asset was discovered in an institution. According to the act of inventory results (f. 0504835), the accountant receives it at its original (fair) value:

Debit KRB 1 102 30 320 Credit KDB 1 401 10 199

If an object is not reflected in accounting as a result of errors of previous years, then it must be taken into account as a correction of errors of previous years, i.e. separately using accounts 0 304 86 (96) 000, 0 401 28 (29) 000.

Let us note that under subarticle 199 of KOSGU the following is also taken into account:

- fixed assets obtained as a result of R&D;

- material reserves that remained at the disposal of the institution after repair work, including dismantling of non-financial assets;

- change in the value of a land plot (including as part of the treasury) due to changes in cadastral value.

Unexplained receipts are shown under subarticle 189 of KOSGU

According to the new rules, transactions on uncleared receipts are reflected as follows:

Debit 0 210 02 189 Credit 0 205 81 660

— accrual of the amount of income that requires clarification is reflected upon receipt. Basis - an extract from the personal account of the budget revenue administrator;

Debit 0 205 81 560 Credit 0 210 02 189

— adjustments to the amount of income for unknown receipts are reflected when they are clarified. Grounds: notification of clarification of the type and nature of the payment.

Income from donations can be considered as deferred income

To reflect income from donations, grants, charitable (gratuitous) transfers, the new edition of Instruction No. 162n provides for the account 0 401 10 150 (previously), as well as the account 0 401 40 150. We believe that the correspondence below should be used for the intended purpose of income . This conclusion can be drawn from the FSBU “Revenues”. The income of the current period should be accrued by posting:

Debit 0 401 40 150 Credit 0 401 10 150.

The return of subsidy balances by budgetary and autonomous institutions is reflected differently

If a budgetary (autonomous) institution has not fulfilled the state task (goals have not been achieved), then it must return the remaining subsidy to the founder. The latter reflects the income received as follows:

Debit 0 209 34 560 Credit 0 206 41 660.

Compensation for damage in kind by the guilty party is carried out through account 209 00

Compensation for damage by the guilty parties in kind is reflected as follows:

Debit 0 100 00 000 Credit 0 209 00 000.

Capitalization of inventories in some cases reduces off-balance sheet account 02

When capitalizing inventories that were formed as a result of an authorized body making a decision on the sale or gratuitous transfer of movable property that has been taken out of service, it is necessary to reduce off-balance sheet account 02.

Example: by decision of the authorized body, a government agency gives old computers that are no longer used to another organization. To make this transfer of property, the institution needs to capitalize the old computers recorded in off-balance sheet account 02 using the following posting:

Debit KRB 1,105 36,340 Credit KDB 1,401 10,172 (with a simultaneous decrease in off-balance sheet account 02).

Uncollectible receivables are not written off as balance

According to the old rules, if an institution wrote off unrecoverable receivables for advances made, credits, borrowings (loans), accountable amounts, then it had to be reflected in off-balance sheet account 04. Now these amounts are not taken into account off-balance sheet.

Other innovations have appeared in accounting

There are other changes to the order, in particular the following.

Changes relating to non-produced assets

Changes relating to non-financial assets of treasury property

Changes regarding rights to use assets

Changes regarding income calculations

Source: https://igc.ru/news/izmeneniya-v-instrukczii-n-162.html

Principles

The main principle of compiling the land balance of a region is the principle indicator. The entire structure should be as interconnected as possible, and a change in one indicator will entail a change in another. Equality of results must be strict, which shows the connection between all indicators.

A balance sheet can be drawn up in several forms. We are talking about abbreviated and detailed. The second type is to display all movement options for a certain area. This balance may resemble a chess table.

In the abbreviated version, the detail of the change in species of any land is not taken into account. As a rule, this type of balance is drawn up every year. Complete documentation should be completed every 5 years. In this case, all documents should be supplemented with data on pollution and remediation.

Accounting for land in accounting

In budget accounting, non-financial assets include non-produced assets that are accounted for on a synthetic account. 103 “Non-produced assets” and occupies 19-21 categories.

The account is intended to account for non-produced assets used in the process of the institution’s activities, which are not products of production, the ownership of which must be established and legally secured (land, subsoil resources, etc.).

Account 103 “Non-produced assets” consists of analytical accounts:

103 11 "Earth";

103 12 “Subsoil resources”;

103 13 “Other non-produced assets”.

On the account

103 11 “Land” takes into account objects of non-produced assets in the form of land plots, as well as capital expenses inseparable from land plots, which include non-inventory expenses (not related to the construction of structures) for cultural and technical measures for surface improvement of land for agricultural use, carried out due to capital investments (land planning, uprooting areas for arable land, clearing fields of stones and boulders, cutting off hummocks, clearing thickets, cleaning reservoirs, reclamation, drainage, irrigation and other works that are inseparable from the land), with the exception of buildings and structures built on this land (for example, roads, tunnels, administrative buildings, etc.), plantings, underground water or biological resources.

On the account

103 12 “Subsoil resources” takes into account objects of non-produced assets in the form of natural resources, which include confirmed reserves of subsoil resources (oil, natural gas, coal, reserves of mineral ore and non-metallic minerals lying underground or on its surface, including the seabed) , uncultivated biological resources (animals and plants owned by state and municipal property), water resources (aquifers and other groundwater resources).

On the account

103 13 “Other non-produced assets” accounts for objects of non-produced assets that are not accounted for in other accounts for accounting for objects of non-produced assets, for example, radio frequency spectrum.

These assets are reflected at their original cost at the time of their involvement in economic (economic) turnover.

The initial cost of objects of non-produced assets is recognized as the actual investments of the institution in their acquisition, with the exception of objects first involved in economic (business) turnover, the initial value of which is recognized as their current market value on the date of acceptance for accounting.

The current market value is understood as the amount of funds that can be received as a result of the sale of these assets on the date of acceptance for accounting.

Institutions revaluate the value of objects of non-produced assets as of the beginning of the reporting year by recalculating their original cost or current (replacement) cost, if these objects were revalued earlier.

The results of the revaluation of non-produced assets carried out as of the 1st day of the reporting year are subject to reflection in accounting separately.

The results of the revaluation are not included in the financial statements of the previous reporting year and are accepted when generating the balance sheet data at the beginning of the reporting year.

The amounts of revaluation of the value of non-produced assets obtained as a result of revaluation are reflected in the credit account. 1 401 30 000 “Financial result of previous reporting periods.”

Amounts of depreciation of non-produced assets are reflected in the debit of the account.

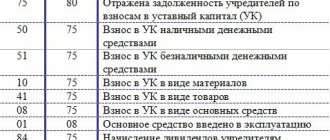

Acquisition of land - posting

1 401 30 000 “Financial result of previous reporting periods.”

Operations for revaluation of the value of non-produced assets are presented in table. 2.10.

Table 2.10

Date: 2015-08-06; view: 306; Copyright infringement

| Did you like the page? Like for friends: |

Some aspects of land accounting

The issue of registering land plots used by budgetary institutions is becoming relevant.

In the Instructions for Budget Accounting, approved by Order of the Ministry of Finance of Russia dated February 10, 2006 N 25n, “Non-produced assets” are designated as the object of accounting on account 10300000, including on account 10301000 “Land”. Is it necessary to register land plots used by budgetary institutions?

In the Land Code of the Russian Federation (hereinafter referred to as the Land Code of the Russian Federation), art.

20 it is determined that land plots are provided to state and municipal institutions, federal government enterprises, as well as state authorities and local governments for permanent (indefinite) use. Possession of land plots under the right of permanent (indefinite) use does not give the right to dispose of these land plots.

Article 3 of the Land Code of the Russian Federation states that property relations regarding the disposal of land plots are regulated by civil legislation, unless otherwise provided by land legislation.

And in the Civil Code of the Russian Federation (Art.

270) persons to whom land plots are provided for permanent use are given the right to transfer this plot for rent or for free, fixed-term use with the consent of the owner of the plot.

Source: https://printscanner.ru/uchet-zemelnogo-uchastka-v-buhgalterskom-uchete/

Regulation of land and property relations of the territory

At the moment, there is an opinion that it is impossible to do without intervention in market power by the state, especially when it comes to land relations. At the moment, the sphere is fully regulated by the President of the Russian Federation, if his words do not contradict current legislation.

The government of the state is capable of making decisions that allow for maximum economic equality. Participants in land relations should be called citizens, legal entities, and so on. Land is an object in relation to which there is a certain legal regime. It is because of this that it can be an object of law and legal relations.

The cadastral value of the land plot has changed. Actions of an accountant of a budgetary institution

Currently, public sector institutions use land plots, including those located under real estate, on the right of permanent (perpetual) use.

Such land plots are recorded in account 10300 “Non-produced assets”. The basis for recording a land plot on the balance sheet is a document - a certificate confirming the right to use the land plot.

Land is recorded at cadastral value. This is stated in paragraph 71 of Instruction 157n.

Advanced training at Kontur.School: Accounting in budgetary organizations. Chief accountant of a budgetary, state-owned, autonomous institution. Diploma of professional retraining 272 academic hours.

, 30 online lessons: theory and practice In addition, an institution may have land plots for free use or rent a land plot under a lease (sublease) agreement.

Such plots of land are accounted for in off-balance sheet accounts in accordance with current instructions.

The Land Code of the Russian Federation does not provide for the right to operational management of land.

State (municipal) institutions are payers of land tax if land plots are assigned to them on the right of permanent (indefinite) use.

Land tax is a local tax, established by Chapter.

31 of the Tax Code of the Russian Federation, regulatory legal acts of representative bodies of municipalities and is obligatory for payment in the territories of these municipalities.

Land tax and advance payments on it are paid by organizations to the budget at the location of land plots recognized as an object of taxation in accordance with Art. 389 Tax Code of the Russian Federation.

Based on Article 388 of the Tax Code of the Russian Federation, organizations that have land plots under the right of gratuitous use, including the right of gratuitous fixed-term use, or transferred to them under a lease agreement, do not pay land tax.

The tax base for calculating land tax, according to Art. 390 of the Tax Code, serves as the cadastral value of the land plot. This is the amount that is taxed. That is why all public sector organizations should know the cadastral value of their own plot of land and monitor its changes, since it is directly related to the amount of land tax to be paid.

Paragraph 14 of Article 396 of the Tax Code of the Russian Federation establishes that based on the results of the state cadastral valuation of land, territorial bodies of the Federal Service for State Registration, Cadastre and Cartography provide land tax taxpayers with free information about the cadastral value of land plots in the form of the cadastral number of the property and its cadastral value in writing taxpayer's application.

You can order an extract from the Unified State Register on the official website of Rosreestr, at the MFC, or at the territorial body of the cadastral chamber.

In accordance with paragraph 1 of Art. 391 of the Tax Code of the Russian Federation, the tax base is determined based on the cadastral value of land plots recognized as an object of taxation as of January 1 of the year that is the tax period.

If a land plot is formed during the tax period, then the tax base is determined as its cadastral value on the day information about it is entered into the Unified State Register of Real Estate (USRN).

The tax period for land tax is a calendar year. The reporting periods for taxpayer organizations are the first quarter, second quarter and third quarter of the calendar year (Article 393 of the Tax Code of the Russian Federation). For land tax, municipalities, as well as federal cities of Moscow, St. Petersburg and Sevastopol, have the right not to set a reporting period.

A public sector institution, having the right of permanent (indefinite) use of a land plot, may be exempt from paying land tax. The list of land tax benefits is given in Article 395 of the Tax Code of the Russian Federation. For example, according to paragraph 1 of Art.

395 of the Tax Code of the Russian Federation are exempt from land tax for organizations and institutions of the penal system of the Ministry of Justice of the Russian Federation in relation to land plots provided for the direct performance of the functions assigned to these organizations and institutions.

In addition, in each specific region of the Russian Federation, benefits may be provided for institutions for paying land tax.

The land tax itself refers to local taxes, and in connection with this, tax rates and tax benefits for taxpayers are established by municipal legislation.

How to calculate land tax

The institution calculates the tax amount independently.

For example, a government institution has a land plot with the right of permanent (perpetual) use, the cadastral value of which is 2,500,000 rubles. The institution does not have tax benefits in accordance with the Tax Code of the Russian Federation and local legislation. The tax rate for land tax is set at 0.3%. Municipal legislation provides for advance payments of taxes.

The amount of land tax will be: RUB 2,500,000. x 0.3% = 7500 rub.

The amount of the advance payment for the 1st, 2nd and 3rd quarters will be: RUB 2,500,000. x 0.3% x ¼=1875 rub.

The amount of tax payable to the budget at the end of the tax period is determined as the difference between the amount of tax calculated using the above formula and the amounts of advance tax payments payable during the tax period (clause 5 of Article 396 of the Tax Code of the Russian Federation):

7500 rub. – (3 x 1875 rub.) = 1875 rub.

In accordance with Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, expenses for paying land tax are included in Article 290 “Other expenses” of KOSGU under expense type code 851 “Payment of corporate property tax and land tax.”

But the cadastral value of a land plot may change. How to determine the tax base for calculating land tax when the cadastral value changes during the tax period?

The concept and purpose of the land balance of the territory

The land balance is a system of documents that describes the entire land fund in one administrative-territorial unit. At the moment, the balance is being calculated by rural, town and city councils. They are also responsible for review and approval. They submit, within a special timeframe, all the data for accounting for the balance of a certain region or region, as well as the country. The main task of the balance sheet is to try to identify the actual state of the land fund in the constituent entities of the Russian Federation and in the country as a whole, as well as the extent to which this territory is used.

When compiling a land balance, the characteristics of the fund by category are indicated. Land users and owners are identified, and the condition of the territory is assessed. All this is indicated for a certain (reporting) period. The main thing is that absolutely all indicators are as reliable as possible. Documents should be formalized and justify all changes if land ownership or composition of land changes. If areas or qualities change, this must be reflected in the balance sheet.

Composition of agricultural lands of the municipality (general information)

Agricultural lands are those lands that are located outside the boundaries of the settlement. They are provided by the state in order to conduct rural activities. These can also include areas that are occupied by forest belts, buildings and roads. Hayfields and pastures are under special protection. It's no secret that agricultural land is necessary to grow crops that determine the level of the economy in the country.

Cropland is land that must be cultivated and used for planting annually. Hayfields and pastures are also an important attribute of municipal land. This area is meadows where herbaceous vegetation grows. Typically, livestock is grazed here and grass is cut to make animal feed.

Economic assessment of land

In order to draw up a land balance, you need to know how the economic valuation of land occurs. It characterizes the value of the territory as a means of the production cycle. Accordingly, it also allows you to find out how efficient and high-quality certain lands are.

The object of economic assessment, as a rule, is not the soil, but the land itself and its area. It includes a description of natural factors that influence the production process. If we talk about the totality of all factors, then in principle they and taking into account specific economic conditions determine the future use of land.

When land assessment work is carried out to compile the land balance of the region, the totality of all the above conditions are accumulated in the agricultural production group of soil. This characteristic holds the land together and determines its use.

The economic purpose of the assessment is aimed at creating all the prerequisites for the rational use of land and resolving these issues. If we are talking about resource protection, then the economic mechanism should be improved.

If we talk about the tasks of economic assessment, then it is necessary to conduct and compile a land balance of a district or region, in order to establish the productivity of each farm and determine the percentage of production labor.

The results of economic assessment also serve to solve certain problems. We are talking about the development of the land market, the introduction and withdrawal of plots, increasing or reducing taxes, rent and cost of the plot, establishing compensation payments, as well as assessing the activities of the Earth.

Transfer to investor

As a rule, when constructing a real estate property at the expense of an attracted investor, the cost of the land plot is fully or partially reimbursed to the developer by the investor. In this case, the developer reflects the cost of the land plot on account 08 and, after completion of construction, transfers the land plot (part of it) to the investor. In accounting, reflect this operation by posting:

Debit 76 subaccount “Settlements with investors” Credit 08 – the land plot was transferred to the investor in connection with the completion of construction of the property.