Bonuses are the second most popular type of accrual after salary in our country and one of the most common methods of motivating staff. In 1C ZUP 3.1, the functionality in this part was significantly expanded compared to 2.5

Next, we will describe step by step how to set up bonuses in the current version of the program and calculate bonuses in 1C ZUP 8.3.

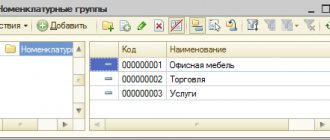

To begin, go to the “Accruals” directory (Settings section).

Fig. 1 Directory “Accruals”

Here you can select only the accruals that interest us through the search window by entering “prem” in it.

Fig.2 Selection through the search window

Here you can also set the taxation of premiums on the “Taxes, contributions, accounting” tab, since premium accruals, according to current legislation, are subject to personal income tax and insurance contributions.

We will help you set up 1C:ZUP for the correct calculation of bonuses to employees

There are 2 income type codes for bonuses:

- 2002 – for payments for achieving certain results specified in the legislation, in the employee’s employment agreement/contract and/or in the collective agreement.

- 2003 is used for bonus payments not related to the performance of work duties. This code indicates that the payment will be made from the organization’s profit, from special purpose funds or targeted revenues.

The date of actual receipt of income, which is reflected in Form 6-NDFL on line 100, varies depending on the bonus: For monthly production bonuses - the last day of the month for which the accrual was made; For production one-time, quarterly or annual incentives, as well as any non-production incentives - the payment day.

Types of bonuses and payment terms

There are two types of awards:

- production, which reduce the income tax base,

- non-productive purposes: they are attributed to net profit and paid for achievements not related to work duties.

Non-production incentives include cash payments, for example, in connection with retirement or state awards. This also includes incentives for employee holidays or anniversaries.

Production can be regular or one-time. As the name suggests, regular incentives are paid at a certain frequency, such as monthly or quarterly. The periods are regulated by the internal local act of the organization, and do not require any special instructions for the payment of these bonuses. If the employee has fulfilled the necessary conditions in full, he receives this systematic bonus.

Irregular, individual incentives can also be named in internal local acts, however, this requires the fulfillment of additional conditions and the achievement of special indicators. The calculation of one-time incentives is most often formalized in a separate order with justification for the payment of the bonus. They can be issued, for example, for the completion of a project, the employee achieving a certain length of service in the company, improving product quality, a significant increase in sales volumes, or participation in any events. And also for the achieved labor results that exceed the standard established at the enterprise.

In order for bonuses to be correctly calculated and accrued, it is necessary to develop Regulations on remuneration and bonuses. It contains all the indicators and conditions for calculating incentives. The mandatory provisions of such a document are the following:

- circle of people who can be awarded,

- types of incentives used in the company,

- conditions and frequency of such accrual,

- calculations, formulas, indicator evaluation system,

- procedure for reviewing and/or challenging assessment results.

Based on this VLA and the order, incentives are paid to the company’s accounting department.

Accounting for buyer bonuses

The receipt of bonus assets leads to an increase in economic benefits, which is recognized as income, and the buyer must take into account the cost of such goods in accounting as part of other income.

Bonus goods are accepted for accounting at actual cost. But PBU 5/01 “Accounting for Inventory” does not contain any special procedure for determining it for inventory items received under paid contracts and not paid for. Therefore, purchasing companies have the right to accept goods for accounting at the current market or regular price for its purchase from the supplier. The buyer can take it into account using an account. 98 “Deferred income” (as applied in case of gratuitous transfer) or without his participation, which in practice happens more often.

Creating an award in the program

In order to calculate, say, a monthly bonus in 1C Accounting 8.3, you should use the “Salaries and Personnel” menu. Please note that the reward itself is not calculated in the system; the amount already calculated is indicated.

For example, if an organization has the same monthly bonus, then you just need to add this type of accrual in the program.

In the “Salary and Personnel” menu, in the “Directories and Settings” section, “Salary Settings” subsection, expand “Salary Calculation” and click on the “Accruals” hyperlink. Here you can check what types and accounting settings are in the system.

Let's assume that it is necessary to establish a monthly incentive for the company's employees. Since this is a periodic payment, the same for all employees, it is enough to create it once. And use it every month when calculating salaries.

To install it, click the “Create” button.

In the window that opens, enter a name, for example, “Monthly bonus,” followed by a letter code. Let's say "EPR". Be sure to note that it is subject to personal income tax and is “other income from employment.” For production incentives, you need to select code 2002 from the list that opens when you click on the arrow.

Since we are talking about cash payments, do not tick the “Income in kind” box.

It should further be noted that income is entirely subject to insurance premiums. And also indicate what is taken into account in labor costs for the purpose of calculating income tax under Art. 255 Tax Code of the Russian Federation. In this case, you need to select point 2 of this article. It is in it that it talks about incentive accruals, incl. bonuses.

Particular attention should be paid to the method of recording. Here it is better not to choose any indicator if the incentive is designed for all employees. The fact is that usually labor costs “fall” into accounts 25 “General production expenses” or 26 “General expenses” for administrative workers in production. In trading enterprises, account 44 is used. Accordingly, depending on the category of employees for whom remuneration is calculated, the initially specified salary expense account will be automatically entered.

If you set a specific indicator, then the established score will always be taken into account when calculating this incentive. Therefore, this field should be left blank.

By clicking the “Record and close” button, the accrual will be created and activated.

Setting a bonus for an employee

As mentioned above, the regular bonus is registered in the organization’s VLA. Therefore, it is installed for new employees at the time of hiring when creating an order.

To do this, in the “Salaries and Personnel” menu, select “Personnel Documents” and use the “Create” button to open the “Hiring” form.

Here you need to indicate the name of the company or department where the employee is being hired. Then select a position and employee. Determine the type of employment, for example, the main place of work.

Then indicate the salary in tabular form. Using the “Add” button, select the EPR and its size.

If previously this remuneration was not accrued to anyone at the enterprise, but was introduced on the current date, then it is necessary to make changes to employment contracts with employees, create an order for personnel transfer (change) with all the ensuing document flow.

In the program, for example, we will create a personnel transfer for an employee and set him the specified bonus. To do this, in the “Salaries and Personnel” menu, select the “Personnel Documents” section and click on the “Create” button and select “Personnel Transfer”.

In the window that opens, select the desired employee and check the box next to “Change accruals.”

Clicking the “Add” button will open a directory of charges. You need to select the EPR and click the “Select” button. In tabular form, indicate the amount of the allowance, suppose 10,000 rubles.

After filling out all the fields, click on the “File and close” button.

Now, when paying wages, the bonus will also be indicated.

Payroll and bonus calculation in 1C

The actual date of receipt of wages and bonuses is the last day of the month, for example, May 31, 2021. The premium is calculated separately, not in the system; the accrual itself is documented in the appropriate document for a period of 1 month. Remuneration can be calculated either together with wages or as a separate document.

In the same menu, click on the “All accruals” section and on the “Create” button select “Salary accrual”.

In the form that opens, indicate the name of the enterprise and the month of calculation. Next, click the “Fill” button to display a list of all employees. Click the “Accrue” button.

As an example, let’s look at payroll accounting for one employee who has undergone a personnel transfer.

To do this, click the “Add” button and select the desired person. The accrual line will reflect the total salary amount. When you click on it, details will open: salary 35,000 rubles. and ERP 10,000 rub.

By clicking on the “Payslip” hyperlink, a document of the same name will open, which will also provide details of wages, allowances and personal income tax.

Thus, if an enterprise has established a regular bonus in constant numerical terms for an employee, then it will be entered automatically when calculating wages. If the amounts differ, they will need to be entered manually in the accrual document.

Also, if you click on the amounts of personal income tax and insurance contributions in the tabular section, you will see details of which types of payments are calculated for which amounts.

By clicking the “Post and close” button, the operation will be reflected in the accounting and tax registers.

In this way, in the 1C Accounting 8.3 program you can calculate the monthly bonus.

Determining the bonus amount for the past month when calculating salaries

Let's look at an example. Employee Ivan Ivanovich Ivanov has been employed since January 1, 2021. He was assigned a daily salary of 30,000 rubles and a monthly bonus of 15%. We create payroll for January 2021. We select an employee. Constant accruals will appear in the document themselves. Salary by day for the interval from January 1 to January 31, 2021 and bonus for the interval from December 1 to December 31, 2021. We see the previous month, however, the result is not calculated, since our employee has not yet been hired in December 2021.

When filling out the “Payroll” document for February 2019, the bonus period will be filled in January 2021 and calculated as 15% of the accruals for the month of January.

Calculation of the annual bonus in the program

Similarly, you should check whether the program has such a type of incentive as an annual bonus. In the “Salary and Personnel” menu, in the “Directories and Settings” section, select “Salary Settings” and click “Accruals”.

Press the “Create” button to enter the name “Annual Bonus”, code “GPR”, and fill out the remaining fields in the same way.

The personal income tax code can be specified as 2000 or depending on the type of bonus. Don’t forget to check the box indicating that the regional coefficient and the northern supplement are calculated.

Let us remind you that choosing a method of accounting for wages makes sense only if the annual bonus is set for a certain circle of people, for example, only for sales employees. Because in this case the bonus amount will “fall” exclusively on the 44th account. Or rather, to the account that was originally indicated in the Employees directory.

After filling out all the fields, the document should be recorded and closed by clicking the button of the same name.

Now let's look at how the annual bonus is calculated and what transactions are generated in the program.

6.Annual bonus in 1C

Also, similar to the monthly one, you should open the “Payroll” form. Enter the required data and click the “Fill” button to display the salaries of all employees. Next, there are two options.

In the first case, select the employee and select “Annual bonus” through the “Accrue” button.

In the second case, click on the salary amount and add GP in the window that opens using the “Add” button.

In both cases, the reward amount will need to be entered manually. After entering all the data, the document should be posted. By clicking on the “Dt Kt” button, postings for these operations will open.

Here you can clearly see the distinction between the amount of wages and the annual or quarterly bonus. On the adjacent tabs you can see the accounting of taxes and insurance premiums.

As you remember, it was recommended above when creating allowances in the directory not to indicate the method of reflection in accounting. We suggest you see what will happen if this method is indicated.

Let’s assume that when creating an annual allowance, the accounting method “Reflection of wages in trade” was selected. In this case, the same organization is considered as in the example above.

Let's enter data for one employee in payroll calculation.

As you can see, the salary and GP have been accrued. After posting the document, click “Dt Kt” to see what transactions reflected the operation in accounting.

As you can see, the salary went to account 26, as before, but the bonus went to the trade account - 44.01, which violates the correctness of accounting and tax accounting.

Therefore, let us remind you again. When creating a new type of bonuses and allowances, do not indicate the method of recording!

Accounting: discounts

In accounting, reflect expenses minus the amount of the discount if it is provided before shipment of the goods (clause 6.5 of PBU 10/99, letter of the Ministry of Finance of Russia dated February 6, 2015 No. 07-04-06/5027).

The supplier can provide a discount later, after the goods have been shipped to the buyer. Then the order in which discounts are reflected in the buyer’s accounting depends on several factors:

- whether the goods for which the discount was received were sold;

- when these goods were sold: in the previous or current calendar year;

- when the work was performed or services were provided: in the previous or current calendar year.

If on the date of discounts the goods were not sold, the cost of the goods received is reduced by posting:

Debit 41 (15) Credit 60

– the cost of goods is reduced by the amount of the discount based on primary documents.

Regardless of whether the goods were sold or not, adjust the amount of input VAT:

Debit 19 Credit 60

– input VAT was reversed on the difference between the cost of goods before and after receiving the discount based on primary documents and an adjustment invoice;

Debit 68 subaccount “VAT calculations” Credit 19

– VAT has been restored on the difference between the cost of goods before and after receiving the discount based on primary documents and an adjustment invoice.

This follows from paragraph 39 of the Regulations on Accounting and Reporting and paragraphs 6.4, 6.5 of PBU 10/99.

If the goods for which discounts were provided were sold in the current calendar year, make the following entries in accounting:

Debit 90-2 Credit 41 (15)

– the cost of goods sold was adjusted based on primary documents to the amount of the discount provided.

Debit 41 (15) Credit 60

– the seller’s debt was adjusted by the amount of the discount provided.

Regardless of whether the goods were sold or not, adjust the amount of input VAT:

Debit 19 Credit 60

– input VAT was reversed on the difference between the cost of goods before and after receiving the discount based on primary documents and an adjustment invoice;

Debit 68 subaccount “VAT calculations” Credit 19

– VAT has been restored on the difference between the cost of goods before and after receiving the discount based on primary documents and an adjustment invoice.

This follows from paragraph 39 of the Regulations on Accounting and Reporting and paragraphs 6.4, 6.5 of PBU 10/99.

If goods were sold in the previous year, their cost is not adjusted. The accounting reflects the profit of the previous reporting period identified in the current year:

Debit 60 Credit 91-1

– income is reflected in the form of a reduction in debt to the supplier for goods received at a discount (including VAT), based on primary documents.

Regardless of whether the goods were sold or not, adjust the amount of input VAT:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT has been restored on the difference between the cost of goods before and after receiving the discount based on primary documents and an adjustment invoice.

The application of this procedure for changing accounting data is based on paragraph 39 of the Regulations on Accounting and Reporting and paragraph 7 of PBU 9/99.

If a discount on work performed (services provided) is provided in the current year, then in accounting, reflect the decrease in their cost by posting:

Debit 20 (25, 26, 44, 91) Credit 60

– the cost of work (services) was reduced by the amount of the discount based on primary documents.

Adjust the amount of input VAT previously accepted for deduction:

Debit 19 Credit 60

– input VAT was reversed on the difference between the cost of work (services) before and after receiving the discount based on primary documents and an adjustment invoice;

Debit 68 subaccount “VAT calculations” Credit 19

– VAT has been restored on the difference between the cost of work (services) before and after receiving the discount based on primary documents and an adjustment invoice.

This follows from paragraph 39 of the Regulations on Accounting and Reporting and paragraphs 6.4, 6.5 of PBU 10/99.

If work (services) were performed in the previous year, their cost is not adjusted. In accounting, reflect the profit of the previous reporting period identified in the current year:

Debit 60 Credit 91-1

– income is reflected in the form of a reduction in debt to the contractor for work (services) performed at a discount (including VAT), based on primary documents.

Adjust the input VAT amount:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT has been restored on the difference between the cost of work (services) before and after receiving the discount based on primary documents and an adjustment invoice.

This procedure is based on paragraph 39 of the Regulations on Accounting and Reporting and paragraph 7 of PBU 9/99.