The modernization of fixed assets in 1C 8.3 means a change in their original properties. As a rule, it makes sense to modernize for the better. For example, add additional functionality or processing accuracy.

Accordingly, for this it is necessary to purchase the necessary additional equipment and carry out installation work. The work can be done in-house, or done by third parties. In this article, we will consider the option when the work is performed by another organization, as this will cover the topic more fully.

For example, let’s modernize a woodworking machine from the 1C Accounting 8.3 demo database. Namely, we will replace its engine.

What is modernization?

The concept of modernization (for tax accounting purposes) is established by paragraph 2 of Article 257 of the Tax Code of the Russian Federation and implies work to change the functionality of equipment, while reconstruction is understood as a set of measures to increase existing capacities and improve their quality. Needless to say, modernization requires additional costs for the acquisition of new technological elements, spare parts, and payment for modification services. Let us dwell in detail on the basic components of the modernization process.

Purchase of equipment

Let's assume that in January of this year the company purchased equipment for the production of cream with an initial cost of 5.0 million rubles with a useful life of 20 years (240 months).

Fig.1 Purchase of equipment

Document movements:

Fig.2 Document movements

With the same document, the fixed asset was accepted for accounting and put into operation. Every month, starting from February 2021, depreciation was charged on it - 20,833.33 rubles = 5,000,000.00/240 months.

In April 2021, company analysts calculated that it was much more profitable to sell ice cream than cream; a decision was made to modernize cream production equipment in order to start producing ice cream. A contract was concluded with Tensor LLC for the purchase of additional spare parts and equipment modification services in the amount of 2.0 million rubles.

How to revaluate fixed assets in the program 1C: Enterprise Accounting 8 edition 3.0

Working in the 1C: Enterprise Accounting program ed. 3.0, you may encounter the problem of how to correctly re-evaluate the organization’s existing fixed assets. In this article we will figure out how to solve this problem.

But first, let's understand the basic terms. OS refers to objects that are used by an organization for a long time in the production process or for management purposes. These may include, for example, buildings and structures, machinery and equipment, household equipment, etc.

As for revaluation, it means bringing the original value of fixed assets to the market level, as a result of which assets can be revalued or discounted and accounted for at the new restored value.

Now let's look at the options for revaluation and markdown in 1C: Enterprise Accounting ed. 3.0.

To find out the initial cost of fixed assets and the amount of depreciation on the date of revaluation, it is recommended to use the report “SALT by account” for 01.01 and 02.01 (Fig. 1).

The revaluation must be carried out through “Operations” – “Operations entered manually” – “Create” – “Operation”. The header of the document indicates the date and content of the document being processed.

The first action will be to change the initial cost of the OS.

If we are talking about a markdown, we must make a posting: Dt 91.02 (indicating analytics: item of other income and expenses with the form “Revaluation of non-current assets” with the “Accepted for tax accounting” checkbox cleared and the object of revaluation), Kt 01.01, i.e. . account in which the fixed asset and also the object of revaluation are recorded. In the columns “Amount”, “Amount Dt and Kt” (according to the line “BP”) the amount of markdown is indicated (Fig. 1).

When revaluing, the posting Dt 01.01 Kt 83.01.1 (“Increase in the value of fixed assets”) is given with the same analytics of the object. In the “Amount” column the amount of the revaluation is entered. It should be noted that in both operations the results are taken into account only in accounting (accounting), so differences will be formed, in this case constant (Fig. 2).

The next operation is to change the accrued depreciation for the object.

When revaluing depreciation (markdown), you need to make a record Dt 02.01 Kt 91.01 with the same analytics as in the first posting, and in the “Amount” field indicate the amount of adjustment to the accumulated depreciation of the object. Also, tax accounting amounts (TA) must be reflected in the temporary differences line.

When revaluing, you should register the entry Dt 83.01.1 Kt 02.01 indicating the object of revaluation. In the “Amount” column, indicate the adjustment to the accumulated depreciation, and in the NU for the loan, indicate the amount in “PR.”

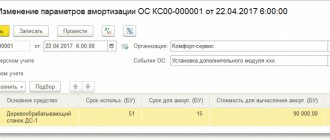

In order for the depreciation of an object to be calculated in the future taking into account the revaluation of fixed assets, we need to create a document “Changing the parameters of fixed assets depreciation” (section “Fixed assets and intangible assets” – “Parameters of fixed assets depreciation” – “Create”). In the columns “Term for depreciation. (BU)", "Using life. (NU)” indicates the useful life (SPI), which does not change during revaluation. And the props “Cost for calculating depreciation. (BU)" is filled in with a new value to calculate depreciation taking into account the revaluation. In the “Depreciation (PR)” field, the amount for a depreciation will be with a minus sign, and for an additional valuation with a plus sign.

After filling out the document and posting it, it will not generate postings. The corresponding entries are reflected in the registers, as can be seen in the following figures.

Accrued depreciation and residual value before and after revaluation can be viewed in the report “Asset Depreciation Statement”. You can also analyze the amount of fixed assets revaluation in the “Account Analysis” report for account 91.02.

The result of all the changes made is the routine operation “Depreciation and depreciation of fixed assets” in the “Closing of the month” in the “Operations” section, where you need to select “Show transactions” and see the result of the revaluation. From the next month after the value changes, the monthly depreciation amount will also change. When revaluing at the end of the month, when performing the “Calculation of income tax” operation, a posting will be generated in the form of a permanent tax liability, since there are permanent differences.

Thus, as a result of revaluation, the cost of depreciation charges increases, which can be used for capital investments and partial restoration of fixed assets.

Having considered the possibilities of revaluation in the program, we can say that its implementation requires the creation of two documents. If done correctly and consistently, the asset will be revalued after the month close.

If you have any questions about this or any other topic, you can contact our 1C Consultation Line. We will be happy to help you. The first consultation is completely free!

Purchase of spare parts for modernization

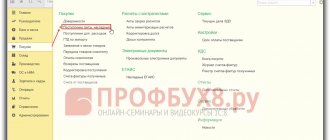

We will reflect the purchase of spare parts for modernization at a cost of 1.5 million rubles. To do this, go to the “Purchases” menu, select “Receipts (acts, invoices)”.

Fig.3 Purchase of spare parts for modernization

Let's create a new document “Receipt” with the type of operation “Construction objects”.

Fig.4 Construction objects

You can add (create) a new construction object directly from the tabular part of the document “Receipts (acts, invoices)” or enter this object in advance into the “Construction objects” directory. This reference book is not always displayed in the interface. You can add a directory to the interface from the “Directories-Navigation Settings” menu.

Fig.5 Navigation settings

Next, in the left window we find “Construction objects” and using the “Add” and “OK” buttons we move it to the right window.

Fig.6 Construction objects

Next, we proceed to register the receipt of spare parts for modernization. In the new document “Receipts (acts, invoices)” with the type of operation “Construction objects”, we consistently fill in the details - the name of the counterparty and the contract. Next, we set up a construction project “Modernization of equipment for the production of cream” and indicate its cost - 1.5 million rubles.

Fig.7 Modernization of cream production equipment

Don’t forget to indicate account 08.03 “Construction of fixed assets”.

Go to the “Services” tab.

Fig.8 Services

We enter the item “Installation Services” in the amount of 500.0 thousand rubles, in the cost account we indicate invoice 08.03 and we fill out all sub-accounts, since we need to take into account the costs of modernization on one account and for one construction project. We check the transactions generated by posting this document.

Fig.9 Checking the wiring

Thus, all modernization costs are reflected in account 08.03 for the construction project “Modernization of cream production equipment.” If you have any questions about the process of purchasing equipment and spare parts for modernization, please contact our 1C support service. We will be happy to answer your questions.

Modernization of OS when applying the general taxation regime

When reflecting transactions related to an increase in the initial cost of fixed assets and a change in their useful life in accounting, one should be guided by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and Methodological guidelines for accounting of fixed assets (approved. by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n), and when reflected in tax accounting - Chapter 25 of the Tax Code of the Russian Federation.

According to the rules established by the listed acts, changes in the initial cost of fixed assets at which they are accepted for accounting are allowed in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. At the same time, the costs of modernization and reconstruction may increase the initial cost of fixed assets of such an object if, as a result of modernization and reconstruction, the initially accepted standard performance indicators (useful life, power, quality of use, etc.) of such fixed assets are improved (increased). Similar rules are established for tax accounting.

The useful life in accounting must be revised if, as a result of reconstruction or modernization, there has been an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset item. If the useful life of a fixed asset in accounting increases, it can also be increased for tax accounting purposes, but only within the limits established for the depreciation group in which such a fixed asset was previously included.

In the 1C: Accounting 8 program, the “OS Modernization” document is used to reflect the increase in the initial cost of fixed assets for accounting and tax accounting, as well as to change their useful life. Let's consider the method of reflecting an increase in the value of a fixed asset using an example.

Example 1

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 60 months. Depreciation is calculated using the straight-line method in both accounting and tax accounting. In May of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization expenses (both for accounting and tax purposes) amounted to 1,500 rubles. (excluding VAT). This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company. The useful life did not change as a result of modernization.

Construction objects

Before increasing the cost of a fixed asset, it is necessary to first collect the costs associated with its modernization at the construction site. To accumulate such costs, account 08.03 “Construction of fixed assets” is intended, which allows you to conduct analytics on construction projects, cost items and construction methods. In our case, we should create a construction object for which the costs of upgrading the computer will be collected. It is convenient to enter the name of the construction project the same as that of the fixed asset for which costs are accumulated. This will make it easier to find and increase the visibility of analytical information.

Collection of modernization costs

Goods purchased from third-party suppliers are registered using the document “Receipt of goods and services” with the transaction type “purchase, commission”. In our example, on the “Products” tab of this document, you should fill in information about the memory module being registered. Since the module is intended for equipment modernization, it can be taken into account on account 10.05 “Spare parts” (see Fig. 1).

Rice. 1

Services for installing a memory module can be reflected in the same document, on the “Computer” tab. This can be done using the “Demand-invoice” document (see Fig. 2).

Rice. 2

As a cost account, you need to specify the construction project accounting accounts with the corresponding analytics for accounting and tax accounting. In our example, this will be invoice 08.03 with the same analytics that were used when registering services for installing a memory module:

- Construction objects: Computer;

- Cost items: cost accounting item for modernization of fixed assets;

- Construction methods: Contract.

When posting the document, a posting will be made relating the cost of the memory module from the credit of account 10.05 to the debit of account 08.03. As a result, all costs for upgrading the computer will be collected in account 03/08.

Increase in initial cost

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document, with the help of which the amount of such costs will be transferred from the construction site to the fixed asset.

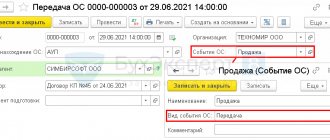

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset. The selected event when posting a document is entered into the information register “Events with fixed assets”. Using this register, you can obtain information about all events that occurred with the fixed asset by setting up the appropriate selection. The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized. To do this, it is convenient to use the “Selection” button located in the command panel of the tabular section. In our example, the main tool “Computer” is being upgraded (see Fig. 3).

Rice. 3

After selecting fixed assets in the “OS Modernization” document, you can automatically fill in the remaining columns of the tabular section based on the program data. To do this, click on the “Fill” button in the command panel of the tabular part of the document, and select “For OS list” in the drop-down menu.

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site. After the accounting accounts for construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button in the “OS Modernization” document and the corresponding fields will be filled in automatically by the program.

After filling out the document, you can print out the acceptance certificate for repaired, reconstructed, modernized fixed assets (form No. OS-3).

When posting, the “OS Modernization” document transfers the amount of costs from the credit of the construction projects accounting account to the debit of the fixed assets accounting account. In our example, the following postings will be made:

Debit 01.01 Credit 08.03 - in the amount of 1,500 rubles.

The corresponding entry will be generated in tax accounting.

Features of calculating depreciation after modernization...

...for accounting purposes

According to the clarifications of the Ministry of Finance of Russia, in accounting, when the initial cost of an item of fixed assets increases as a result of modernization and reconstruction, depreciation should be calculated based on the residual value of the item, increased by the costs of modernization and reconstruction, and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144).

Consequently, after the modernization, the cost must be calculated, which will serve as the basis for further depreciation. It is defined as follows - see diagram.

Scheme

The amount received is reflected in the “Remaining” column. cost (BU)". In our example, this amount will be 20,166.68 rubles. (20,000 - 999.99 - 333.33 + 1,500).

When carrying out the “OS Modernization” document, the residual value and remaining useful life are remembered. In our example, the remaining useful life is 56 months. (60 - 4).

The new value and the new useful life for calculating depreciation are applied starting from the month following the month in which the modernization was carried out.

In our example, starting from June 2005, the amount of depreciation charges for accounting purposes will be 360.12 rubles. (20,166.68:56).

...for tax accounting purposes

The procedure for calculating depreciation after modernization for tax accounting purposes differs from how it is accepted in accounting. The rules for calculating depreciation in tax accounting are established by Article 259 of the Tax Code of the Russian Federation.

Starting from the month following the month in which the modernization was carried out, the changed original cost and useful life are used to calculate depreciation.

In our example, starting from June 2005, the amount of depreciation deductions for tax accounting purposes will be 358.33 rubles. (21,500.00: 60).

It remains to add that after the expiration of its useful life, the cost of the computer in tax accounting will not be fully repaid, since over 60 months the depreciation amount will be 21,399.80 rubles. (333.33 x 4 + 358.33 x 56).

The remaining 100.20 rubles. will be included in the depreciation amount calculated in the 61st month of using the computer.