Are you planning to open a catering establishment? The form of ownership (individual entrepreneur or LLC) and taxation system for a restaurant, bar, cafe or pizzeria affects what restrictions you will face when starting an activity, what kind of accounting you will have to keep and how much you will pay to the treasury. Read this article so you don’t make a mistake in your choice!

- USN “Income minus expenses”

- Basic tax system

What is meant by catering services?

In accordance with Art. 346.27 of the Tax Code of the Russian Federation, public catering services for the purpose of paying a single tax on imputed income are recognized as services for the production of culinary products and (or) confectionery products, the creation of conditions for consumption and (or) sale of finished culinary products, confectionery products and (or) purchased goods, and also for leisure activities. Services for the production and sale of beer, alcoholic products (drinking alcohol, vodka, alcoholic beverages, cognac, wine and other food products with a volume fraction of ethyl alcohol of more than 1.5%, with the exception of wine materials) are not considered catering services.

At the same time, what should be understood by culinary products and confectionery products in Chapter. 26.3 of the Tax Code of the Russian Federation is not specified. This means, taking into account the provisions of paragraph 1 of Art. 11 of the Tax Code of the Russian Federation, let us turn to GOST R 50647-94 “Public catering. Terms and definitions" and GOST R 53041-2008 "Confectionery products and semi-finished confectionery products. Terms and Definitions".

Note. GOST R 50647-94 and GOST R 53041-2008 are approved respectively by Decree of the State Standard of Russia dated 02/21/1994 N 35 and Order of Rostekhregulirovanie dated 12/15/2008 N 402-st.

They say that culinary products are recognized as a set of dishes, culinary products and culinary semi-finished products, and a confectionery product is a multi-component food product, ready for consumption, having a certain specified shape, obtained as a result of technological processing of main types of raw materials (sugar, flour, fats, cocoa -products), with or without the addition of food ingredients, food additives and flavorings. Confectionery products are divided into the following groups: chocolate, cocoa, sugar confectionery, flour confectionery.

Thus, if culinary products and (or) confectionery products are sold to visitors in a restaurant or cafe, then in relation to this type of activity, an organization or individual entrepreneur can apply a taxation system in the form of UTII.

At the same time, it is worth noting that to classify an activity as a public catering service, the sale of culinary products and (or) confectionery products is still not enough. It is also necessary that one more condition be met, namely: conditions for the consumption of the specified products have been created in the catering facility. Not only regulatory authorities, but also judges agree with this position (Letters of the Ministry of Finance of Russia dated 07/01/2009 N 03-11-09/233, dated 01/26/2009 N 03-11-06/3/10, dated 07/21/2006 N 03 -11-04/3/359 and Resolution of the Federal Antimonopoly Service of the Volga District dated March 11, 2009 in case No. A12-11657/2008).

Now let's look at several situations in which questions may arise in choosing a taxation system.

V. Responsibility

Head production is responsible for:

- The quality of prepared dishes, compliance with food yield standards.

- Compliance of prepared dishes with organoleptic and presentation standards.

- Compliance with sanitary and hygienic standards, safety standards, fireproof™.

- Financial responsibility for the safety of equipment and inventory, products, finished products.

- Correctness and timeliness of documenting technological processes for the receipt and sale of production products.

- Timely and conscientious performance by employees of their duties. If a situation arises that entails a violation of the Criminal Code of the Russian Federation, head. production is liable under the Criminal Code of the Russian Federation.

The HR manager is a specialist in working with the team, a flexible and responsible person, capable of learning and taking part in the work of the restaurant as a whole, able to build a system of priorities in solving difficult situations, focused on success and constant professional growth.

The HR manager is responsible for office work. He processes incoming documents, communicates orders and instructions to the staff, registers, takes into account and stores documents for the staff, brings instructions and instructions to the attention of employees, monitors the execution

instructions, transfers documents to specific performers.

The list of mandatory personnel documents includes:

- personal files of restaurant employees;

- personal cards (form T-2);

- work books;

- medical books;

- orders on personnel issues;

- professional development plan;

- staff turnover data;

- vacation schedule;

- reserve list;

- staffing table taking into account vacancies;

- timesheets;

- employment agreements (contracts);

- schedule for certification of restaurant employees;

- job descriptions of restaurant managers;

- internal regulations;

- logs of labor and medical records, passes, issued certificates.

The hall manager ensures effective and cultural service to visitors, creating comfortable conditions for them. Monitors the safety of material assets. Advises visitors on the availability of available services. Takes measures to prevent and eliminate conflict situations.

Considers claims related to unsatisfactory service to visitors and implements appropriate organizational and technical measures. Monitors the rational design of premises, monitors the update and condition of advertising in the premises and on the building. Ensures cleanliness and order in the premises and areas adjacent to them or the building.

efforts to eliminate them. Monitors employees' compliance with the instructions of the organization's management.

https://www.youtube.com/watch?v=ytcreatorsru

"I affirm"

Director full name

Job Description Department: Hall

Position: hall manager

/. General provisions.

- The hall manager is directly subordinate to the restaurant director.

- In his work he is guided by the instructions and rules defining the work of the restaurant, the Internal Labor Regulations, the orders and instructions of the director and this job description.

- Appointed to the position and dismissed from the position by the director of the restaurant.

- He is the organizer and manager of work in the restaurant halls. Waiters, dishwashers and dishwashers report to him.

- Must have secondary specialized or higher education, work experience in public catering establishments, and speak one of the foreign languages.

P. Responsibilities

26. Order L 2095.

401

1. Timely ensure the preparation of restaurant halls for work, for which:

- check the condition of the equipment and furniture of the trading floors;

- inspect the appearance of the service personnel;

- arrange waiters in the halls taking into account their practical skills and knowledge;

- conduct the necessary briefing of shift waiters on the procedure and forms of serving visitors for the current day;

- meet restaurant visitors, invite them to the table and, if there are no waiters at the moment, take the order or instruct another waiter to take the order;

- Know the sales turnover plan for the sales area and ensure its implementation.

- Monitor compliance by waiters with the rules for serving dishes, drinks, and quality of service. Do not allow visitors to abuse alcoholic beverages.

- Provide practical assistance to waiters in their work, give them the necessary recommendations on serving visitors.

- Monitor the correctness of payments to visitors and timely submission of letters of guarantee for non-cash payments to the accounting department. Sign bills for waiters.

- Prepare menus for banquets, having previously agreed with the production manager or his deputy.

- Check availability of food and drinks included in the menu before the end of the working day

- Immediately resolve any conflicts or situations that arise in the trading floors. Statements and wishes of visitors regarding service issues should be brought to the attention of the restaurant director.

- Take part in organizing work to improve the business skills of waiters; Constantly carry out educational work

We invite you to familiarize yourself with: Double deduction for a child if a single mother - conditions for registration

by staff of trading floors, aimed at strengthening labor and production discipline, ensuring a high culture of service.

- It is good to know the job descriptions of sales floor workers.

- Monitor compliance by hall employees with safety regulations, sanitary standards and fire prevention measures.

- Every day before the start and end of work, sign the cash register tape and check the cash counters, participate in the handover of cashier shifts and sign the act of their handover.

- After the restaurant closes, ensure that waiters hand over advance amounts and proceeds for a given day to the cash register, that dishes and cutlery are returned to service, and that all service personnel leave in a timely manner.

- Prepare a monthly schedule for the employees of the hall to report to work and keep a time sheet for time worked.

III. Rights

https://www.youtube.com/watch?v=ytpolicyandsafetyru

The hall manager has the right:

- Participate in the selection of personnel to work in the restaurant sales areas.

- Suspend from work waiters, barmaids and other employees of trading floors who are not dressed in accordance with the established uniform and have an unkempt appearance.

- Carry out control over the release and registration of ready-made dishes from production, demand replacement of poorly prepared dishes.

- We require restaurant visitors to observe the established rules of behavior in public catering establishments, not to allow drunk persons, contaminated clothes, or dressed in tracksuits, pajamas, bathrobes, etc.

- Make proposals for improving the organization of work, improving the working conditions of employees, encouraging them or imposing disciplinary sanctions.

IV.Responsibility

26*

403

The hall manager is responsible for:

- supervision of sales floor personnel, quality of customer service in restaurant halls;

- for failure to fulfill their duties listed in this job description, as well as the orders of the restaurant director;

- slaughter 1, damage to the property of the restaurant, caused 1 during work, for improper storage and operation of material assets

- Inspection of the sanitary and fire regulations, safety regulations and internal labor regulations of the restaurant was carried out by the workers.

The bar manager must have professional training, know the basics of Labor legislation, the provisions of the Law of the Russian Federation “On the Protection of Consumer Rights,” industry guidelines relating to his professional activities, including certification of services and licensing of certain types of activities (sale of alcoholic products, etc.).

He is responsible for preparing the service, maintaining the operating hours of the enterprise, and maintaining proper order in the bar. The bar manager must know and follow the rules for serving consumers at the bar and in the hall with ready-to-consume alcoholic beverages, confectionery and other products.

He must know the basic commodity, technological, sanitary indicators of the quality of food, drinks and the rules for their serving. Know how to design a shop window and bar counter. Receive products from production, drinks from the warehouse and carry out short-term storage of them, taking into account the temperature regime and the timing of implementation. Comply with the rules of sanitation, hygiene and fire safety. Be able to operate mechanical, thermal, refrigeration equipment, cash registers, and musical equipment.

Select dishes, equipment and tools for preparing and serving mixed drinks and cocktails. Know the technology for preparing mixed drinks, aperitif cocktails, digestif cocktails, the rules for their design and drawing up technological maps. Dispense cold and hot snacks and purchased goods.

Meet visitors and familiarize them with the bar’s wine and cocktail list. Organize the work of bartenders, conduct training with bartenders to study recipes and technology for preparing cocktails, and also introduce them to working methods using classical techniques and fluttering. Supervise the work of bartenders.

The bar manager must know and follow the rules of international etiquette, techniques and specifics of serving foreign tourists. Proficient in a foreign language within the conversational minimum and professional terminology. Keep records of goods received by bartenders, ensure timely preparation and submission of product reports by bartenders. Implementation

If the production and sale of culinary products are carried out in different places

Claims from regulatory authorities in this case, although they exist, are not justified. This is due to the fact that in order to recognize activities as catering services, Ch. 26.3 of the Tax Code of the Russian Federation does not establish such a requirement as the sale of culinary products and confectionery products in the same place where they were produced. The main thing is that the specified products are sold through its own service network (Resolution of the Federal Antimonopoly Service of the West Siberian District dated March 30, 2010 in case No. A27-10571/2009).

Thus, if culinary products and (or) confectionery products are sold through kiosks, tents and culinary shops (departments) operating at a restaurant or cafe, then such activities are recognized as public catering services.

Procedure for certification

- The certification commission conducts individual interviews with each candidate, examines on theoretical and practical issues, and conducts testing.

- The certification commission hears the heads of departments

- Discussion of the results of the answers takes place in an atmosphere of strictness and objectivity.

- The evaluation of employees and the recommendations of the commission must be adopted by open vote in the absence of the person being certified.

- The results of the assessment are communicated to participants immediately after the decision is made.

- Based on the results of the test, the administration makes a decision on the existence of an employee for a certain position and on assigning him to one or another level of remuneration.

If a cafe (restaurant) delivers its products to customers

Today, many restaurants (cafes) have small rooms and cannot serve a large number of guests. Therefore, along with cooking, they often deliver ready-made dishes. In this regard, the question arises: will such activity for the purposes of Ch. 26.3 of the Tax Code of the Russian Federation to be recognized as public catering services? Since in this case conditions are not created for the consumption of manufactured products directly in a catering facility, entrepreneurial activity related to the delivery of ready-made meals to consumers does not correspond to the concept of “catering services” established by Art. 346.27 of the Tax Code of the Russian Federation, and cannot be transferred to pay UTII. Transactions related to delivery must be taxed within the framework of the general taxation system or the simplified tax system (Letters of the Ministry of Finance of Russia dated December 10, 2010 N 03-11-06/3/166, dated July 12, 2010 N 03-11-06/3/101 and dated 13.05.2010 N 03-11-11/133).

By the way, also catering services for the purpose of paying UTII will not include the sale of culinary products to take away, that is, without consuming the said products on site (Letter of the Ministry of Finance of Russia dated December 6, 2006 N 03-11-04/3/528).

Sale of purchased goods

In cafes and restaurants, in addition to their own products, they often sell purchased goods. What “imputed” type of activity should such a sale be classified as: retail trade or public catering services? The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 17123/08 dated June 23, 2009, indicated that the sale of purchased food products at retail through a public catering facility is an activity for the provision of public catering services. And regulatory authorities include the sale of not only food products, but also non-food products as public catering services. For example, in Letters dated March 24, 2008 N 03-11-04/3/148 and dated May 22, 2007 N 03-11-04/3/170, the Ministry of Finance of Russia indicated that the sale of purchased cigarettes and lighters through catering facilities refers to catering services and can be transferred to pay UTII.

Note that if ready-to-drink soft drinks and cocktails (milk, fermented milk, fermented, fruit, etc.) purchased for subsequent sale in the manufacturer’s packaging are sold through retail outlets, then this business activity for the purpose of paying UTII is retail trade (Letter Ministry of Finance of Russia dated December 17, 2009 N 03-11-09/403).

Obtaining licenses

If the cafe plans to sell alcoholic beverages, a license is required. The state authorized the service for regulating the alcohol market to issue a license.

We recommend you study! Follow the link:

The process of obtaining licenses to sell alcohol before opening a catering establishment includes:

- Pass state registration and have the status of a legal entity.

- Set up a room for receiving and storing alcoholic beverages. Recommended area of fifty square meters. If the cafe is located in a village, a smaller area is allowed.

- Install a cash register.

- The amount of capital that allows you to pay the registration fee.

To avoid wasting time, you should first contact the government agency for clarification on the list of required documents.

The license is issued for the following periods:

- 1 year;

- 5 years.

What documents are required to open a cafe with a license:

- An application indicating the details of the legal entity.

- Duplicates of constituent documents. They are certified by a notary.

- OGRN certificate.

- Extract from the register.

- TIN certificate.

- Confirmation of the availability of premises for business activities.

- Bank account information.

- Certificate of compliance with the activities of the enterprise.

- Confirmation of absence of debts and timely payment of taxes.

- Information about the authorized capital.

- A receipt reflecting the fact of payment of the state fee.

Documents are subject to verification by experts and registration. The received application is considered within thirty days from the date of application. Documents are prepared by the applicant in electronic and printed versions.

The amount of the state fee depends on the duration of the license and the type of activity of the legal entity.

Sale of alcoholic beverages

As is known, when selling alcoholic products on the territory of the Russian Federation, companies should be guided by the norms of the Federal Law of November 22, 1995 N 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products” and the Rules for the sale of certain types of goods approved by the Decree of the Government of the Russian Federation dated January 19, 1998 N 55.

Based on them, documents for alcoholic products (bills of lading and certificates for them, certificates of conformity and quality certificates) must be located directly at the point of sale. The seller must be ready to present them at the first request of the buyer or regulatory authority. This is evidenced by judicial practice (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated January 12, 2010 in case No. A29-11272/2008).

As for the “imputed” catering, it includes the sale in restaurants and cafes of only purchased alcoholic beverages and beer, both in the manufacturer’s packaging and packaging, and without it (Letters of the Ministry of Finance of Russia dated July 30, 2009 N 03-11-06/3/ 199, dated June 16, 2008 N 03-11-04/3/275 and dated December 17, 2007 N 03-11-04/3/497). For more information on taxation of sales of alcoholic products, see table. 1.

Table 1. Taxation of sales of alcoholic products

| Kind of activity | Tax system |

| Production of alcoholic beverages and beer and their subsequent sale through public catering facilities | This type of activity is neither public catering services nor retail trade for the purpose of paying UTII, therefore, taxes must be paid on the income received within the framework of the general system or the simplified tax system |

| Sales of alcoholic beverages and beer of own production through a retail network | |

| Sales of purchased alcoholic beverages and beer through public catering facilities | This type of activity refers to “imputed” catering services |

| Sales of purchased alcoholic beverages and beer through a retail network | This type of activity refers to “imputed” retail trade |

You may also be interested in:

Taxation when selling a business

The sale of property rights to an enterprise is a legal process in which 3 parties take part: the current owner, the future owner and government agencies. Moreover, all 3...

Taxation of online stores

There are two taxation options that cover trade in online stores: general (OSNO) and simplified (USNO). For most entrepreneurs, the most convenient and economical option is the simplified tax system...

Responsibility for late submission of accounting and tax reporting

The reporting period is a period of time during which all companies and individual entrepreneurs must submit accounting and tax reports to the tax office and extra-budgetary...

Taxation of foreign representative offices of Russian organizations

In the process of growing the scale of their enterprise, businessmen are sometimes faced with the fact that the opportunities for growth within Russia have been exhausted. A natural solution to this problem is the opening of foreign...

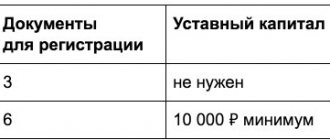

Having decided to start a business in the food industry, we study what documents are needed to open a cafe in 2021. A detailed business plan is also developed, premises are rented, and if there is no own real estate, personnel are selected and a system for preparing and supplying products is being established.

Making cocktails and soft drinks

The production and sale of non-alcoholic drinks and cocktails, except for herbal cocktails obtained by mixing the relevant ingredients immediately before consumption in restaurants and cafes, are considered public catering services and are subject to taxation in the form of UTII.

Thus, freshly squeezed juices are produced through mechanical cooking of fruits and vegetables to impart new properties to them, which makes them suitable for consumption in the form of drinks. If these juices are subsequently sold through public catering facilities, then such activities are recognized as public catering services and are transferred to the payment of UTII (Letter of the Ministry of Finance of Russia dated 04/28/2007 N 03-11-05/85).

But the preparation of teas, herbal cocktails, infusions, decoctions and other non-alcoholic drinks of plant origin, used by visitors as strengthening medical drugs, according to the Ministry of Finance of Russia, does not apply to public catering services (Letter dated December 17, 2009 N 03-11-09/403 ). This is due to the fact that, in accordance with the All-Russian Classifier of Economic Activities, Products and Services (OKDP), the production and consumption of drinks using medicinal plant raw materials are classified as herbal medicine services (code 8512503), which should be provided by clinics and private doctors.

Note. OKDP was approved by Decree of the State Standard of Russia dated 08/06/1993 N 17.

Sales of oxygen cocktails will also be taxed under the general regime or simplified taxation system. Let us explain why. According to Appendix No. 1 to the Nomenclature Classifier of Medical Products and Medical Equipment (medical devices), approved by Order of Roszdravnadzor dated November 9, 2007 N 3731-Pr/07, special medical equipment is used to prepare oxygen cocktails, namely an apparatus for preparing singlet-oxygen mixtures (cocktails) (code 168 4408). In addition, the State Register of Medicines of Roszdravnadzor determines the purpose of use and the recipe for the oxygen cocktail. Thus, the oxygen cocktail is recognized as a medicine.

Organizing leisure time in a cafe

Very often, the services of restaurants and cafes include activities for organizing leisure activities for visitors. What applies to leisure services for the purpose of paying a single tax on imputed income? Let us turn to the All-Russian Classifier of Services to the Population OK 002-93, approved by Decree of the State Standard of Russia dated June 28, 1993 N 163. According to its provisions, leisure services include the organization of musical services, concerts, variety shows and video programs, the provision of newspapers, magazines, board games, gaming slot machines, billiards. The financial department holds a similar opinion (Letter of the Ministry of Finance of Russia dated August 31, 2006 N 03-11-04/3/399).

Note. Organization of leisure is not a mandatory criterion for classifying restaurants and cafes as UTII payers.

Take note. Fee for public performance of musical works

So, restaurants and cafes, along with food services, can provide leisure services for their visitors. Moreover, in relation to luxury restaurants and cafes, the presence of a stage in which is a mandatory requirement, live music cannot be separated from public catering services (GOST R 50762-2007 “Catering services. Classification of public catering establishments” approved by the Order of Rostekhregulirovaniya dated 27.12 .2007 N 475-st). Therefore, charging a separate fee for live music in these catering establishments is unlawful.

It is worth noting that in other restaurants and cafes, charging for live music is a direct violation of clause 2 of Art. 16 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the protection of consumer rights”, since the opportunity to use public catering services (ordering dishes) is made dependent on payment for live music.

Additional fees may be charged only for those services that the consumer can avoid without giving up catering services. Therefore, when charging an additional fee for the public performance of musical works, if the visitor refuses to pay for this service, he must be offered another room for consuming the ordered products.

However, to recognize leisure activities as catering services, it is not enough just to provide the above services. It is also necessary to take into account where the conditions for this are created (Table 2).

Table 2. Application of UTII in relation to leisure activities

| Features of the leisure space | Kind of activity | Tax system |

| The leisure area is structurally separated from the visitor service area | Leisure activities are considered as an independent type of business activity | Income received from carrying out the specified activities must be taxed under the general regime or the simplified tax system |

| Visitors to a catering facility may take snacks and (or) drinks into the leisure areas or there are tables for service in these areas | Leisure activities are considered as accompanying catering services | Activities for organizing leisure time for visitors in this case are recognized as “imputed” public catering services |

Patent system as an alternative

PSN is a less popular, but also suitable for a cafe, tax system under a special regime. Its essence lies in the fact that an entrepreneur receives a patent for a tax rate of 6% of income, which exempts him from paying taxes such as VAT, personal income tax for himself and property tax associated with activities.

In addition, PSN exempts you from using cash register machines, and also provides the opportunity to purchase a patent for a period of 1 to 12 months. This is very convenient, for example, when a café is open seasonally.

It is important to know: the State Duma is considering a bill that would abolish the exemption from cash register for PSN from 2018.

A significant drawback of this system is that not in all regions of the country the local legislative assembly approved the use of PSN. Also, only individual entrepreneurs can acquire patents, which is not always beneficial for working in the catering industry, since, for example, only legal entities can obtain permission to sell alcoholic beverages. The only exception for individual entrepreneurs was beer-based drinks.

It is also worth noting that the rate is calculated on potential annual income, which is determined by a separate regional law, but in the range from 100,000 to 1 million rubles, taking into account the conversion to the deflator coefficient, which is 1.425.

Accordingly, the maximum amount of potential income can be equal to 1,425,000 rubles. Table of main parameters for PSN

| Sign | Feature |

| Who has the right to use | IP |

| Employee restrictions | 15 people |

| Region restriction | Not available in all regions |

| Annual revenue limit | 60 million rubles. |

| Payment for a patent up to 6 months | In full within 25 days |

| Payment for a patent 6-12 months | 1/3 of the amount within 25 days and 2/3 30 days before expiration |

Calculation of the annual tax of the Fisherman's Hut cafe, provided that registration was carried out as an individual entrepreneur:

The potential annual income for a cafe in Moscow is 360,000 rubles. Thus, the calculation is carried out according to the following formula: 360,000 * 6% = 21,600 rubles.

Determining the area of the visitor service hall

As you know, a modern restaurant or cafe often includes not only a hall for consuming cooked products, but also a dressing room, many corridors, a kitchen, a billiard room, a bowling alley, a dance floor or a stage. Therefore, the “imputers” often have a question about what premises are included in the area of the visitor service hall when calculating UTII in relation to the provision of public catering services. Let's try to figure it out.

According to Art. 346.27 of the Tax Code of the Russian Federation, the area of the customer service hall is understood as the area of specially equipped premises (open areas) of a catering facility intended for the consumption of finished culinary products, confectionery and (or) purchased goods, as well as for leisure activities . That is, areas where food consumption by visitors and leisure activities are not provided for (kitchen, food distribution areas, utility rooms, etc.) should not be taken into account in the area of the visitor service hall (Letters of the Ministry of Finance of Russia dated 02/03/2009 N 03-11 -06/3/19 and dated 03/21/2008 N 03-11-04/3/143).

In order to determine the specified area, you should use inventory and title documents (Article 347.27 of the Tax Code of the Russian Federation).

Let us recall that inventory and title documents include any documents available to the taxpayer that contain information about the purpose, design features and layout of the premises of such an object, as well as information that confirms the right to use this object. This can be either a purchase and sale agreement for non-residential premises, a technical passport for non-residential premises, plans, diagrams, explications, or a lease (sublease) agreement for non-residential premises or part(s) thereof, a permit for the right to serve visitors in an open area and many others documentation.

Thus, if the documents highlight the area of the visitor service hall, then it is this that must be taken into account when calculating the single tax on imputed income. If a restaurant or cafe uses a smaller area than indicated in the documents, then UTII can be calculated from the actual area used. However, in this case, in order to avoid disputes with regulatory authorities, we advise you to conduct a technical inventory and make appropriate changes to the documents. That is, clearly state in them exactly what area is intended for food consumption and leisure activities by clients (Letter of the Ministry of Finance of Russia dated January 25, 2010 N 03-11-06/3/8).

Note. Judges share a similar opinion (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated March 29, 2010 in case No. A45-13412/2009, the Volga District Federal Antimonopoly Service dated July 15, 2010 in case No. A12-20984/2009 and the Central District Federal Antimonopoly Service dated December 19, 2007 in case No. A36-1291/2007).

By the way, according to the arbitrators, taxpayers can confirm the actual use of the area of a public catering facility with documents such as lease agreements, acts of redevelopment, repair or reconstruction, estimates of work performed, plans of rented premises (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated 08.10.2010 in the case N A27-673/2010 and FAS North Caucasus District dated January 26, 2010 in case N A63-5939/2009-C4-17).

The procedure for operating catering establishments in the EGAIS system

AP accounting data is reflected in the program in a certain order of operations. EGAIS allows catering enterprises to simultaneously maintain records with several AP suppliers. Persons supplying AP to a catering establishment must be registered and keep records in the EGAIS system. Products purchased from a supplier not registered in the system are considered counterfeit.

Among the functions, users have access to warehouse accounting, generation of journals, reports, acts of confirmation or refusal to accept invoices, and other automated accounting capabilities. Based on accounting data, information on mutual settlements is available for reconciliation of information.

Most catering enterprises use the AIKO program for accounting. In connection with the innovations regarding the maintenance of eradicated accounting of AP, changes were made to the program. The program allows you to automatically write off AP units. When switching to version 3 of EGAIS in the Aiko accounting program, you will need to take into account the balances and switch in the settings from manual to automatic generation of the act. According to users, the retail sales journal in the AIKO program should be constantly adjusted.

| Algorithm of actions | Description | Add-ons |

| Extract of TTN by the AP supplier | Reflection of the invoice in the EGAIS system | The supplier creates a reserve of AP units based on its own balances |

| Checking TTN data by the receiving party | The recipient of the AP compares the data of the invoice and the actual receipt of the goods at the warehouse | The purpose of the inspection is to identify discrepancies in indicators regarding the number and range of product units |

| Acceptance of the TTN by the buyer with the action reflected in the program | The transaction is confirmation of the fact of purchase | Reception is carried out in your personal account using the tab “receiving TTN from EGAIS” |

| Write-off of AP units from the supplier's account upon confirmation of the technical specification by the supplier | In the EGAIS system, balances are reflected in the buyer’s accounting | The confirmation period for the TTN is 3 days for deliveries within the city and 7 days for remote areas (Order of the Ministry of Finance of the Russian Federation dated June 15, 2016 No. 84n) |

The buyer has the right to refuse to accept the goods. The processing time for the operation is the same as the admission period. The grounds for refusal are:

- Inadequate quality of products - lack of excise stamps, damage to containers, violation of the expiration date.

- Lack of delivery due to force majeure or other circumstances.

- A significant discrepancy between the number of delivery units and the invoice data or a large mis-grading.

The program must reflect the refusal to accept the AP on the invoice uploaded by the supplier. The reason for the refusal will be reflected in the report. The invoice will be returned to the supplier.

If minor discrepancies are identified, the buyer also sends a report to the supplier reflecting its own data. The information in the act allows you to adjust the balances or the amount reflected in the Unified State Automated Information System. To make changes, the supplier must accept the disagreement, for which consent is sent to the buyer.

When is the leisure area included in the area of the visitor service area?

So, according to Art. 346.27 of the Tax Code of the Russian Federation, the area for leisure activities must be taken into account when determining the area of the service hall. However, this provision does not always apply. If the premises intended for the provision of leisure services are structurally separated from the premises in which public catering services are directly provided, then the area of such premises is not taken into account in the area of the visitor service hall (Letters of the Ministry of Finance of Russia dated March 26, 2010 N 03-11-06/ 3/46, dated 04/15/2010 N 03-11-06/3/60 and dated 08/31/2006 N 03-11-04/3/399).

Thus, if, for example, a billiards room is separated from the customer service hall, where food consumption occurs, by partitions and visitors cannot eat there, then the area intended for playing billiards is not taken into account in the area of the customer service room.

Example 1. Magnolia LLC provides catering services through a restaurant that it owns. The area of the restaurant, according to inventory and title documents, is 185 square meters. m, of which the kitchen occupies 17 sq. m, utility rooms - 19 sq. m, cashier and display area - 5 sq. m. Are catering services subject to the taxation system in the form of UTII in this case? If so, what area of the visitor service hall should be taken into account when calculating UTII?

Solution

In accordance with paragraph. 20 tbsp. 346.27 of the Tax Code of the Russian Federation, restaurants are classified as catering establishments that have a customer service hall. Therefore, in order to apply UTII, it is necessary to have a visitor service area of no more than 150 square meters. m.

In accordance with the lease agreement, the entire occupied space is one catering facility. But since some of the premises are not used for food consumption and leisure activities (kitchen, utility rooms, cashier’s area and display cases), the area of the customer service hall will be 144 square meters. m (185 sq. m - 17 sq. m - 19 sq. m - 5 sq. m). Thus, in this case, the restaurant has the right to switch to a taxation system in the form of UTII.

UTII payable will be calculated based on the physical indicator “the area of the visitor service hall (in square meters)” in the amount of 144 square meters. m.

conclusions

So, which regime will be more suitable for the store after the UTII is canceled in 2021? Obviously, to resolve this issue, an individual calculation is required based on the data of your retail outlets. Moreover, it is necessary to take into account not only revenue and cost indicators, but also the form of doing business, the list of goods and the area of the sales floor.

In conclusion, we will add about what to do with online cash registers after changing the tax regime. Whichever one the store switches to, you need to change the device settings. The receipt must reflect the current system; mention of UTII will be considered a violation. There is no need to re-register the cash register with the tax service to change the regime.

If the restaurant (cafe) has several halls for serving visitors

In practice, situations where a restaurant or cafe uses several customer service areas to provide catering services occur quite often. How to determine the physical indicator in this case?

Based on the provisions of paragraphs. 8 paragraph 2 art. 346.26 of the Tax Code of the Russian Federation, the area of the hall or halls serving visitors must be determined as a whole for the catering facility.

Thus, if a restaurant or cafe has several halls serving visitors, then when calculating UTII the total area of these halls will be taken into account (Letters of the Ministry of Finance of Russia dated 04/30/2009 N 03-11-06/3/116, dated 06/27/2008 N 03-11 -04/3/300 and dated 03/06/2007 N 03-11-04/3/63).

Judges, when considering disputes, accept the following circumstances as evidence that public catering services are provided through one facility with several halls. Namely: visitor service rooms have common utility rooms, a common kitchen, common service personnel, a common cash register, etc. This conclusion is contained in the Resolutions of the Federal Antimonopoly Service of the North-Western District dated 02/11/2010 in case No. A26-3172/2009 and the Federal Antimonopoly Service of the Moscow District dated 10/17/2007 N KA-A41/9776-07.

If catering services are provided through several catering facilities, each of which has its own hall for serving visitors, then when calculating UTII, the area of the hall for serving visitors must be calculated separately for each facility. The presence of several catering facilities can be established on the basis of inventory and title documents (Letter of the Ministry of Finance of Russia dated March 30, 2007 N 03-11-04/3/98 and Resolution of the Federal Antimonopoly Service of the Volga District dated June 16, 2009 in case N A57-16468/2008).

Example 2. Appetite Center LLC is 211.7 sq. m (148 sq. m + 63.7 sq. m), that is, exceeds the established limit of 150 sq. m. m. Accordingly, the organization in relation to public catering services does not have the right to switch to paying UTII.

Results

In order for a cafe or restaurant to apply UTII, it is necessary to ensure the availability of premises registered in the name of this taxpayer, to create in it the conditions recommended in GOST 30389-2013. The general requirements for UTII must also be met: hall area up to 150 m2; the average number of employees is no more than 100 people; permission from local authorities to use UTII for public catering.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.