Payment

Authorized capital is the assets of the organization, which the founders of the LLC contribute after state registration. WITH

How are accounts receivable different from accounts payable? Types of accounts receivable How does debt arise? Receivables management

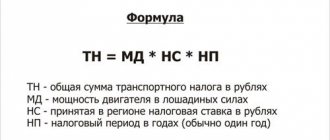

All vehicle owners are required to pay transport tax annually to the treasury, regardless of whether they use

The release of finished products is often accompanied by the formation of residues of raw materials, which have, to one degree or another, lost

Who is exempt from paying income tax The following are exempt from paying income tax: Organizations,

One of the ways to advertise and find new clients is to participate in exhibitions where

Home — Articles Most organizations use the accrual method in tax accounting. Tax Code Provisions

Intangible assets include: scientific developments, trademarks, research costs, software, works

Insurance contributions to state extra-budgetary funds are the basis for the payment of pensions, sick leave and

Line 041 of Appendix 2 to sheet 02 of the income tax return means