Transactions with foreign currency have certain accounting specifics. It can be difficult for an accountant, especially if such transactions are carried out rarely or for the first time. We will try to clearly explain how, by whom, with the help of what transactions such accounting is carried out, what is its complexity, and what should you pay attention to when generating accounting data.

Question: How to record transactions for the sale of foreign currency at a rate lower than the rate established by the Bank of Russia on the date of sale? The organization's foreign currency account received foreign currency earnings in the amount of 20,000 euros from a foreign buyer. The following month, the organization sold the entire amount received to the authorized bank. The currency was purchased by the bank at the rate of 74.4 rubles/euro, the corresponding amount in rubles was credited to the organization’s current account on the day the currency was written off. The organization prepares interim financial statements on the last day of each calendar month. The euro exchange rate established by the Bank of Russia was (conditionally): - on the date of receipt of the currency - 74.3 rubles/euro; — as of the reporting date — 75.0 rub/euro; — on the date of currency sale — 74.6 rubles/euro. The organization uses the accrual method of tax accounting. View answer

The regulatory framework for currency accounting in the Russian Federation is quite extensive. First of all, the accountant should pay attention to three documents: Federal Law-402 dated 06/12/11 “On Accounting”, Federal Law-173 dated 10/12/03 “On Currency Regulation and Control” and PBU 3/2006 on the rules for accounting for objects Accounting instruments valued in foreign currency.

foreign currency transactions on spot terms reflected in accounting ?

Currency transactions in accounting in 2021 - 2021

In accordance with the above PBU, in 2021-2021, as in previous periods, currency transactions in accounting are reflected exclusively in rubles. This accounting provision does not apply to accounting for currency transactions related to:

- with the recalculation of financial reporting indicators, which are submitted in rubles, into foreign currency according to the requirements of foreign creditors;

- when compiling consolidated accounting, when the parent company processes the accounting of dependent institutions located abroad.

You can get more detailed information about currency transactions in our material “Currency transactions: concept, types, classifications” .

For conversion, the exchange rate of the Central Bank of Russia is used on the date that corresponds to the nature of the transaction. We will tell you more about the procedure for converting into rubles when accounting for foreign exchange transactions.

How to convert currency to rubles

To account for transactions in foreign currency, the date on which you should take the Central Bank exchange rate and convert the currency into rubles is very important. As already mentioned, in Russia, accounting for foreign exchange transactions is carried out exclusively in rubles, and since exchange rates are constantly changing, it is important to know the “correct” moment of converting currency indicators into rubles.

Thus, in order to be reflected in accounting and reporting, the cost values of liabilities and assets of a legal entity expressed in foreign currency, as well as the amount of reserves in foreign currency, must be converted into rubles.

In accounting for foreign exchange transactions, only the official exchange rate of the Central Bank of a given currency to the ruble is used to convert cost indicators into Russian rubles. The exception is cases when, in order to convert the value of a monetary obligation or a tangible asset into rubles, a special law or agreement establishes a different rate at which the amount payable must be recalculated.

The date of conversion of currency indicators into rubles is different for each operation. Most often, the date of conversion at the official exchange rate is the moment when the business operation is carried out. In the case where over the course of a month (or a shorter time period) an enterprise carries out a large number of similar transactions in foreign currency, and the official exchange rate has not undergone significant changes, it is possible to keep records of transactions in foreign currency of this type at the rate averaged over a given period of time.

PBU 3/2006 clearly defines all the moments when currency amounts should be converted into rubles:

- On the date of the business operation (when cash flows), as well as on the reporting date (balances at the cash desk/account), it is necessary to convert into rubles all cash/non-cash currency at the cash desk/on the foreign exchange account. Also, in a number of situations, the value of funds may be recalculated as the exchange rate changes.

- Cash/non-cash currency is recalculated at the rate existing at the reporting date in order to reflect the data in the financial statements.

- As of the date of the business transaction, the value of fixed assets, intangible and other non-current assets accepted for accounting, as well as the value of inventories and other assets, with the exception of cash, is recalculated.

- On the date of recognition of foreign currency income or expenses, they are recalculated into rubles. As for the date of recognition of travel expenses, it coincides with the moment of approval of the traveler’s advance report.

- On the date of recognition of costs that form the cost of fixed assets, intangible and other non-current assets, the amount of investments in foreign currency in these non-current assets is recalculated into Russian rubles.

- If an enterprise has received an advance payment in the form of a deposit or an advance payment, then these funds are accounted for in accounting in Russian rubles at the exchange rate at the time of receipt of the specified amounts.

- If the prepayment was paid by the company (in the form of transfer of a deposit or payment of an advance against the delivery of assets or for expected expenses), then this payment will be reflected in the accounting records in rubles at the rate prevailing on the date of payment.

After non-current assets, transferred or received advances have been reflected in accounting, their value is not recalculated when the exchange rate changes.

Read about what points you need to pay special attention to when organizing accounting for foreign economic activity in the article “Features of accounting for foreign economic activity .

Procedure for opening a foreign currency account

The procedure for opening a foreign currency account in a bank is similar to the procedure for opening a current account.

To open a foreign currency account in a bank, an organization must provide the following documents:

- Application for opening a foreign currency account, signed by the head and chief accountant of the organization;

- Bank account agreement (two copies) in the account currency, signed on each sheet;

- Certificate of state registration of a legal entity;

- A copy of an extract from the unified state register of legal entities certified by a notary or the authority that issued the document with an issue date not exceeding 1 month before the submission of documents;

- A copy of the duly approved charter (regulations) with amendments and additions, certified by a notary or the body that registered the document;

- A copy of the constituent agreement, certified by a notary or a higher authority;

- Minutes of the founders' meeting;

- A copy of the employment contract with the head of the organization;

- A copy of the order on assuming the position of the head and the appointment of the chief accountant, certified by the seal and signature of the head of the organization;

- A card with sample signatures and a seal from the head of the enterprise and the chief accountant, certified by a notary;

- A photocopy of the passports of the persons stated in the sample signature card;

- Original certificate of registration with the tax authority and its notarized copy;

- A copy of the information letter from the territorial body of state statistics with assigned codes and confirming registration with the state territorial statistical body, certified by a seal and signatures of officials of the organization (optional);

- Copies of licenses for activities that require licenses.

The list of required documents, as well as when opening a current account, is fixed by Bank of Russia Instruction No. 153-I dated May 30, 2014 (as amended on December 24, 2018) “On opening and closing bank accounts, deposit accounts, and deposit accounts” ( Registered with the Ministry of Justice of Russia on June 19, 2014 N 32813).

Data taken from the article: “Accounting for funds in a current account.”

What is exchange rate difference

The difference in rubles that arises when recalculating the currency value of assets and liabilities on different dates is called exchange rate. The exchange rate difference at the end of the reporting period relates to the financial result of the company, with the exception of the difference that is calculated on constituent deposits. In the latter case, the difference in rubles arises during the time interval between the founders’ decision to make a contribution in foreign currency and the very moment the founder pays the contribution. Such exchange rate differences do not affect the company’s financial results, but change the amount of additional capital.

Also included in the company’s additional capital is the exchange rate difference that arises when converting into rubles the tangible assets and monetary liabilities of a legal entity used to carry out business activities abroad. Exchange differences in this case can be attributed to the financial result in the form of adding part of the additional capital in the event of termination of activities abroad.

In all other cases, the exchange rate difference is credited to the financial result, reducing or increasing its total value.

Exchange differences arise on the following transactions:

- In case of partial or full repayment of debts by debtors or creditors in foreign currency. In this case, recalculation is carried out at the time of payment, if the debt was previously reflected in accounting at a different rate (the cost in rubles was calculated on the day of the transaction or recalculated on the last reporting date).

- When converting assets in the form of non-cash or cash into rubles.

The article “What is the responsibility for illegal currency transactions?” will introduce you to the types of currency violations and penalties for committing them.

Option two: payment was received before shipment took place

If the buyer makes a 100% prepayment, then he generates expenses in the form of the cost of the goods at the time of transfer of money at the rate on the date of prepayment. Subsequently, during shipment, no adjustments are made, and exchange rate differences are not generated. In the accounting rules, this norm is enshrined in paragraph 9 of PBU 3/2006. In tax accounting, the absence of exchange rate differences when making an advance payment is stated in subparagraph 11 of Article 250 of the Tax Code of the Russian Federation and in subparagraph 5 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

The VAT deduction is also generated once - at the time of transfer of the advance payment. The amount indicated by the supplier in the “advance” invoice and calculated at the exchange rate on the date of the advance is accepted for deduction. Further, at the time of shipment, the supplier does not recalculate the VAT amount, as the Federal Tax Service reminded in letter No. ED-4-3/12813 dated July 21, 2015 (see “The Federal Tax Service clarified the procedure for issuing invoices under foreign exchange agreements”). Therefore, the buyer should not recalculate the deduction amount.

Example 2 According to the agreement, Wholesaler LLC must supply products worth 240,000 USD to Magazin LLC. (including VAT 20% - 40,000 USD). In turn, the “Store” undertakes to make a 100% prepayment. In July, “Store” transferred 240,000 USD to the account of “Wholesaler”. at the rate of 55 rubles/cu. In August, “Wholesaler” shipped all the goods to “Store”. The exchange rate on the date of shipment was 60 rubles/cu. The accountant of the “Store” reflected these transactions as follows:

In July, he made the following entries: DEBIT 60 CREDIT 51 - 13,200,000 rubles. (240,000 c.u. x 55 rub./c.u.) - one hundred percent prepayment was transferred to the account of Wholesaler LLC; DEBIT 68 CREDIT 76 – 2,200,000 rub. (40,000 c.u. x 55 rub./c.u.) - accepted for deduction of VAT on prepayment.

In August, the accountant made the following entries: DEBIT 41 CREDIT 60 - 11,000,000 rubles. ((240,000 c.u. – 40,000 c.u.) x 55 rub./c.u.) - reflects the cost of the goods received; DEBIT 19 CREDIT 60 – 2,200,000 rub. (40,000 c.u. x 55 rub./c.u.) - input VAT reflected; DEBIT 68 CREDIT 19 – 2,200,000 rub. — input VAT is presented for deduction; DEBIT 76 CREDIT 68 – 2,200,000 rub. — VAT, previously accepted for deduction from the advance payment, has been restored. Tax accounting includes costs associated with production and sales in the amount of 11,000,000 rubles. The accountant did not make any recalculations or adjustments due to exchange rate changes.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Payments in foreign currency and reporting

The statements indicate exclusively the ruble equivalent of the value of the company's assets, existing liabilities and reserves (including those used/located abroad).

If in the country where a Russian company operates, it is required to prepare reports in the currency of that state, then the reports are also prepared in foreign currency.

The financial statements reflect those cost values that are indicated in the accounting. In most cases, the conversion of the currency value into rubles is carried out at the time of the transaction, but there are situations when it is necessary to make a conversion at the reporting date.

The accounting records reveal the amounts of exchange rate differences:

- formed when converting into rubles the currency value of assets and liabilities for which it is required to pay in foreign currency;

- when recalculating the currency value of assets and liabilities for which payment will be made in rubles;

- credited to accounting accounts, which do not take into account financial results.

The official exchange rate in rubles established by the Central Bank on the reporting date is also reflected in the financial statements. If a rate other than the official rate of the Central Bank of the Russian Federation is established (by agreement or law), then this information is also reflected in the reporting.

Find out about the latest changes in currency legislation from this publication.

Conclusions.

For the correct preparation of financial statements for currency organizations, the date of transactions is important.

It is this date that will make it possible to recalculate the national currencies of foreign countries in relation to the ruble equivalent of the Russian Federation. And based on the result of the revaluation, it will become known whether the completed transaction brought a loss to the company.

Lawyers recommend concluding contracts or additional agreements with specified compensation in case of changes in exchange rates. This will protect the company from unplanned losses.

The revaluation of foreign currencies in relation to the monetary units of the Russian Federation is certainly very important for organizations engaged in relationships with foreign companies.

Its correct recalculation and reporting will help avoid the organization of penalties and litigation.

Currency transactions in case of conducting business abroad

If an enterprise operates abroad, then when preparing financial statements, all assets used and existing liabilities are recalculated into rubles. This also applies to funds held in accounts in foreign banks operating abroad.

Conversion into rubles to reflect foreign exchange transactions in accounting is carried out at the official rate established by the Central Bank for the currency in which assets, liabilities and inventories are recorded. The exception is when recalculation is made at the average rate.

Cash in foreign currency, including in settlements of borrowed obligations, which are used by the organization to conduct business abroad, are converted into rubles at the Central Bank exchange rate in effect on the reporting date. Foreign non-current assets of the company, as well as advances received and sent in connection with activities abroad are recalculated into rubles at the Central Bank exchange rate on the day of the transaction in foreign currency.

If a company has recalculated the value of its foreign assets and liabilities as required by foreign legislation, then this recalculated value is converted into rubles at the rate that was in effect on the date of recalculation.

The difference that arises when converting into rubles the value of assets and liabilities that are used to conduct the company’s foreign activities is reflected in account 83 as additional capital in the accounting of foreign exchange transactions.

The materials in this section will help you understand the intricacies of accounting.

How to set up currency accounting in 1C: Accounting 8

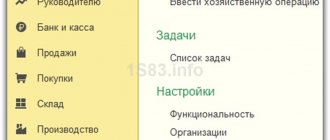

Initially, you should fill out the list of currencies. To do this, you should go to the “Directories” - “Currencies” section, where you can create an arbitrary currency or select from the classifier.

The currency rate is determined in several ways: it is entered manually, downloaded from the Internet, calculated using a formula, or depends on the rate of another currency, i.e. it decreases or increases by some percentage of the reference currency (Fig. 1).

Fig.1

In order for settlements to be made in conventional units for a specific transaction with a counterparty, you should create an agreement in which you must indicate that: “Price” is set in the currency we need, which can be selected from a previously downloaded directory, and “Payment” is made in rubles (Fig. .2).

Rice. 2

After this, the program is ready for foreign exchange transactions.

When choosing a contract for settlements in cu. Accounting accounts will be automatically added to all documents:

- 60.31 “Settlements with suppliers and contractors (in monetary units)”;

- 60.32 “Settlements for advances issued (in cu).”

- 62.31 “Settlements with buyers and customers (in monetary units).”

- 62.32 “Calculations for advances received (in cu).”

It should be noted that when accepting goods for accounting in the document “Receipts (acts, invoices)” in the tabular part, the cost of goods is indicated in monetary units, the same applies to the “Sales” documents.