Payment

INVENTORY AND HOUSEHOLD SUPPLIES Inventory and household supplies are part of the organization’s material and production reserves,

Sheet 03 of the income tax return - purpose The indicated sheet must be filled out when

Many management companies and homeowners associations want to work under a simplified taxation system. But not everyone knows

Companies whose main activity is the production of agricultural products pay a single agricultural tax to the budget

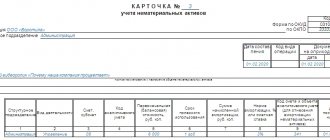

The receipt of an intangible asset (intangible asset) into an organization is naturally accompanied by its inclusion on the economic balance sheet. Others

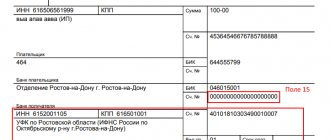

KBK “Property tax for 2021 for legal entities” is the code indicated

Save time and money Accounting services in “My Business” from only 1,667 rubles per

With foreign buyers and suppliers, settlements most often occur in foreign currency. For this

Why is KUDiR needed? Individual entrepreneur on a simplified basis does not keep accounting records and does not hand over and

Basic definition It would seem that revenue is the amount received during the sale of goods. But