Where can I see the list of holidays?

All official holidays are specified in Article 112 of the Labor Code of the Russian Federation. As for the New Year holidays, the non-working holidays in January are as follows:

- 1, 2, 3, 4, 5, 6 and 8 - New Year holidays;

- 7 - Nativity of Christ.

Remember these dates so that you understand which days in January are paid double if you have to work during the New Year holidays.

If a holiday falls on a weekend, it is transferred to the next working day after the holiday. For a more rational distribution of work and rest time, the Government of the Russian Federation moves weekends to other days of the calendar year. In January 2021, by Decree of the Government of the Russian Federation No. 1648 of October 10, 2020 “On the transfer of holidays to 2021” The day off from Saturday, January 2, was moved to Friday, November 5, and from Sunday, January 3, to Friday, December 31. We also recommend remembering these days so as not to lose your salary.

If you have to work when others are resting, then you will be paid at an increased rate. It is possible to compensate with additional days of rest. But in many ways, the answer to the question of how New Year’s holidays are paid at work depends on factors such as:

- established wage system (salary, piecework, etc.);

- availability of summarized accounting of working time and duration of the billing period;

- whether the employee will work out the standard time in January.

Let's consider all situations in more detail.

Production calendar for 2021

Payment for work on holidays and weekends and other types of additional payments at the enterprise

Payroll is an important part of an accountant’s work and a significant amount of expenses for organizations and individual entrepreneurs. If working conditions differ from standard ones (work on weekends and holidays, at night, overtime), then the employee, in accordance with the Labor Code of the Russian Federation (LC RF), is entitled to additional payments. The calculation of such additional payments depends on many factors and is not always clearly defined in regulatory documents. Let's look at these questions in detail.

The content of the article:

1. Payment for work on holidays and weekends

2. Overtime pay

3. Additional payment for night work

4. Payment for overtime work

5. Payment for work under conditions different from normal in tax accounting

1. Payment for work on holidays and weekends

In the general case, payment for work (its calculation), when employees receive wages based on a fixed rate (salary), and they have worked the usual working hours for the month, does not present any difficulties for the accountant.

Payment for work per month = Salary (tariff rate) + RK (regional coefficient for areas where it is established).

Payment for work on holidays, as well as payment for work on a day off, according to the Labor Code of the Russian Federation (LC RF), must be made at least double the amount, or a day of rest must be provided.

Payment for work on weekends and holidays must be provided for by a local regulatory act (LNA) of the organization, a collective or labor agreement. These are the requirements of Article 149 of the Labor Code of the Russian Federation. The amount of the surcharge can be any, but it should not be less than determined by Article 153 of the Labor Code of the Russian Federation:

- for workers with piecework wages, such days are paid based on no less than double piecework rates,

- for employees on a daily or hourly rate - payment is made based on no less than double the daily or hourly rate,

- for salaried employees - in the amount of a single daily or hourly rate in excess of the salary, if the employee worked only the monthly standard of working time, and in the amount of at least double the daily or hourly rate in excess of the salary, if the work was performed in excess of the monthly standard of working time.

Let us recall that weekends are weekly days of continuous rest provided to an employee; the procedure for their provision is prescribed in Article 111 of the Labor Code of the Russian Federation.

Holiday non-working days (their list) are established in Article 112 of the Labor Code of the Russian Federation.

If work on weekends or holidays did not last a full working day (shift), then payment for work on holidays, as well as on weekends, in an increased amount is made only for the time actually worked (from 0 to 24 hours).

The monthly working time norm is determined based on the normal working time according to the production calendar.

In this case, payment for work on a day off or a non-working holiday is made only if the employee went to work by order (instruction) of the manager. If on his own initiative, the employee may not count on additional payment (Article 114 of the Labor Code of the Russian Federation).

Let's consider how payment for work + on holidays + and weekends is determined for various cases of the remuneration system

Time-based wage system (payment based on salary)

The calculation must be based on the daily or hourly rate.

Payment for work on a weekend/holiday (W/PD) = Daily rate × 2

Daily rate = (Tariff rate (salary) of the employee + Incentive and compensatory additional payments and allowances): the number of working days in the month for which the additional payment is calculated.

If you work part-time, we use an hourly rate.

Payment for work in WD/PD = Hourly rate × 2 × Number of hours worked.

Hourly rate = (Tariff rate (salary) of the employee + Incentive and compensatory additional payments and allowances): The number of working hours in the month for which the additional payment is calculated.

This procedure has been in effect since June 2021 - after the publication of the Constitutional Court Resolution No. 26-P dated June 28, 2018 and the letter of the Ministry of Health dated October 25, 2018 No. 16-3/3108910-6506. Previously, the calculations did not take into account incentive and compensatory additional payments and allowances.

Example 1

A salaried employee (20 thousand rubles) worked all days as scheduled in May 2021. Additionally, due to production needs, he worked 4 hours on his day off (Saturday, May 18) by order of his manager. Let’s assume that in addition to salary, an employee receives a monthly bonus in the amount of 3 thousand rubles. Calculate pay for work on a day off.

Solution

The standard working time in May 2021 with a 40-hour work week is 143 hours.

The employee worked 147 hours in May

Payment for work on May 18 will be (20,000 + 3,000) / 18 / 8 / * 4 * 2 = 1,277.78 rubles.

It should be taken into account that, according to the labor inspectorate (see the “Question and Answer” section of the Onlineinspektsiya.rf website), the bonus is included in the calculation of payment for work on a weekend or holiday if two conditions are met:

• the amount of the premium at the time of calculating the additional payment is known,

• the premium is taken into account in the month in which it is accrued; the payment period is not taken into account.

It must be remembered that an employee, at his request, can be given another day of rest for working on a weekend or holiday. Then payment will be made in a single amount.

Summarized working time recording

Summarized recording of working time is typical for a shift work schedule. In this case, you need to consider several points:

- Determine whether the employee worked on a weekend or holiday according to the working hours schedule or over the schedule.

- Find out whether the employee will take time off for overtime work. If not, then when working beyond the schedule, overtime for the first 2 hours of work in the accounting period must be paid at one and a half times, for the third and subsequent hours - at double.

- Make payments for overtime work at the end of the accounting period - month, quarter, other period lasting no more than a year (Articles 99 and 104 of the Labor Code of the Russian Federation).

Example 2

The driver of the organization has a summarized recording of working hours. The accounting period is a month. The driver's salary is 25,000 rubles.

According to the work schedule in May 2021, he was supposed to work 143 hours, including 8 hours on the holiday of May 9. In fact, the driver worked 152 hours. Overtimes were on May 6, 8, 17 for 2 hours, May 20, 22, 27 for 1 hour. In total, 19 shifts were worked in May. Determine the total wages of the driver for May 2021.

Solution

Since the work on the holiday was carried out according to schedule, the driver was accrued:

- monthly salary

- additional payment for work on a holiday (8 hours) in a single amount,

- additional payment for overtime work (152 – 143 = 9 hours).

Employee hourly rate:

25,000 rub. : 143 = 174.83 rub./hour.

Additional payment for overtime work:

(174.83 rubles/hour × 2 hours × 1.5) + (174.83 rubles/hour × 7 hours × 2) = 2,972.11 rubles.

Additional payment for work on May 8:

174.83 rub./hour × 8 hours = 1,398.64 rub.

Total accrued for May - 29,370.75 rubles. (25,000 + 2,972.11 + 1,398.64).

It is necessary to take into account that when recording working hours in total, the number of overtime hours per year cannot exceed 120 (Article 99 of the Labor Code of the Russian Federation).

Piece wages

For piece workers, if it is necessary to work on a holiday, piece rates are doubled

Example 3

The organization sets a piece rate wage for toy assemblers - 200 rubles per toy.

Due to production needs, the assembler was called to work on holidays - May 1 and 9. On each day he worked 8 hours, collecting 5 toys. What will be the pay for working on holidays?

Solution

Payment for work on a holiday for an assembler will be:

5 pieces. × 200 rub./pcs. × 2 = 2,000 rub.

For two holidays, respectively, 4 thousand rubles.

If an employee worked on both holidays and weekends during the month, he is entitled to payment for all time worked beyond the normal schedule.

In this case, piece workers and workers whose payment is calculated based on tariff rates, for work on a weekend or non-working holiday, are entitled to payment based on double prices or double daily (hourly) rates.

Those who work on a salary receive additional payment in a single amount for work during such periods, if the total amount of time worked did not exceed the monthly norm, and double payment for work in excess of the monthly norm.

Taking into account the differences considered, the salary amount will be equal to:

Pay for work = regular pay for work + holidays + weekends.

As we noted above, there are 2 types of accruals for working on weekends and non-working holidays:

- additional pay for working on weekends and holidays,

- payment for weekends and holidays.

The difference is that when an employee works on a day off or a non-working holiday, which for him, in accordance with the work schedule, is a working day (with cumulative accounting of working hours), such accruals are “additional payment for work on weekends and holidays.” In other cases, this is not an additional payment, but payment for weekends and holidays.

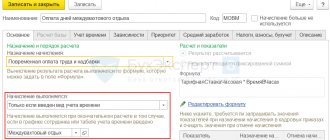

How to reflect payment for weekends and holidays in 1C Accounting 8th ed. 3.0, watch the video.

2. Overtime pay

Payment for overtime work is made in addition to payment for work under normal working conditions.

Depending on the remuneration system adopted by the organization, the time worked above the norm includes:

- daily - hours in excess of those set for the day,

- weekly - hours in excess of those established per week,

- summarized - hours in excess of the standard defined for the period (for this case - calculation only at the end of the period),

- in shifts - the shift schedule is drawn up in such a way that it already includes processing in excess of the standard according to the production calendar.

Example 4

Determine payment for overtime, if the employee has a 2/2 schedule and the shift lasts 12 hours. According to the schedule, for example, April 2021 includes 15 shifts - 180 hours. Salary – 30 thousand. There are 22 working days in a month, the norm according to the production calendar is 175 hours. Determine how much overtime pay will be.

Solution

Processing amount 180 – 175 = 5 hours

Hourly rate – 30,000 / 175 = 171.43

Additional payment = 171.43 * 2* 1.5 + 171.43 * 3 * 2 = 1,542.87

3. Additional payment for night work

Should an organization provide additional pay for night work? Undoubtedly. After all, the employee does not work under normal conditions. The amount of the surcharge should be established in the LNA, taking into account that such surcharge cannot be less than 20% of the hourly tariff rate (salary) for each hour of work at night (Article 154 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation of July 22, 2008 No. 554).

This rule applies to any operating mode - both regular and shift.

Example 5

In April 2021, the employee, at the request of the employer, worked an additional 4 hours at night from 22:00 to 02:00 the next day. LNA established that the additional payment for night time is set at 25% of the tariff rate (salary). Salary – 30 thousand rubles. Determine what the additional payment for night work and the total wages for the month will be equal to.

Solution

Wages for April will be:

30 857,14 = 30 000 + (30 000 / 175) * 4 * 1,25

175 - number of working hours in April according to the production calendar,

1.25 – hourly rate increased by 25%.

4. Payment for overtime work

The total remuneration of employees who had to work overtime is determined by adding the amount of payment for work under usual conditions and additional payment for overtime.

It should be taken into account that for employees who have an irregular working day, time worked in excess of the normal working day is not recognized as overtime (Letter of the Ministry of Labor of Russia dated 03/05/2018 N 14-2/B-149), accordingly, additional payment for overtime work is not provided for such workers.

The only compensation for such workers is the provision of additional leave of at least three calendar days (Article 119 of the Labor Code of the Russian Federation).

How to reflect payment for overtime work in 1C Accounting 8, see the video:

5. Payment for work under conditions different from normal in tax accounting

Insurance premiums and personal income tax on amounts accrued for work in conditions different from normal are accrued in the usual manner.

When accounting for income tax, the main condition that must be met is that all types of remuneration, including additional payments, must be provided for by the organization’s remuneration system and clearly stated in one of the documents:

- collective agreement,

- employment contract,

- local regulatory act (usually this is a provision on remuneration and bonuses).

If all these conditions are met, wages and additional payments can be taken into account in tax accounting for income tax as expenses.

According to the Federal Tax Service, such additional payments can be taken into account in the amounts established by the company in the LNA (letter of the Federal Tax Service of Russia dated April 28, 2005 No. 02-3-08/93).

The Russian Ministry of Finance believes that income tax expenses should include only additional payments in the amounts established by Article 153 of the Labor Code of the Russian Federation (letters of the Russian Ministry of Finance dated May 20, 2005 No. 03-03-01-02/2/90 and dated March 4 2005 No. 03-03-01-04/1/88). We are talking about additional payments of no more than 2 times the amount.

These approaches also apply to accounting for similar expenses under the simplified tax system with the object of taxation being income minus expenses.

The company will have to determine for itself which approach it will follow, reflecting the chosen approach in its tax accounting policies.

In our article, we looked at how payment is made for work on weekends and holidays, payment for overtime work, as well as additional payment for work at night. If you have any questions, ask them in the comments below.

Even more useful materials on Instagram and Yandex-Zen

Payment for work on holidays and weekends and other types of additional payments at the enterprise

Payment for working days according to the usual schedule

In January, with a five-day workday, Russians will have to work only 15 days. Therefore, the question often arises of how New Year holidays are paid with a salary, given that the number of working days has been reduced. Despite the fact that most work less, wages are paid in full. If a salaried employee has worked all the required days, then payment is made in full. This follows from the same article 112 of the Labor Code of the Russian Federation. It makes no sense to separately consider the question of whether New Year's holidays are paid in government agencies or municipal structures, since the law states: the presence of non-working holidays in a calendar month is not grounds for reducing wages for salaried employees.

As for the remaining employees (piece workers, hourly workers, etc.) who were not involved in work during the New Year holidays, for non-working holidays they are paid additional remuneration, the amount of which is determined by the internal LNA.

Read more: How to calculate salary based on salary

IMPORTANT!

If an employee is on sick leave, he will be paid benefits after the certificate of incapacity for work is closed. If an employee is on vacation, he already receives money for the New Year holidays 3 days before it starts, plus the vacation is extended due to official holidays. But there are situations when they won’t pay anything. The first is that the employment contract is valid, but the employee took unpaid leave at his own expense. The second is that the person is registered in the organization, but is not currently fulfilling his duties (applies to women on maternity leave, employees caring for a newborn).

Postponement of holidays in 2021

The production calendar approved by the Ministry of Labor and Social Policy will help employers and employees of organizations competently plan the production process, as well as determine the days allocated for rest. According to this document, in 2021 the following transfers will be made:

- 01/06/2018, which falls on a Saturday, will be moved to 03/9/2018 (Friday), that is, Russians will have the opportunity to rest for four whole days - from 03/9/2018 to 03/11/2018;

- non-working days will be 04/30/2018 (falls on Monday) and 05/2/2018 (falls on Wednesday). This will be done on Saturday 04/28/2018 and 01/7/2018 (Sunday). Moreover, 05/01/2018 is already an official holiday, and 04/29/2018 falls on a Sunday, so Russians will have the opportunity to have additional rest;

- in February, the weekend falls from 02/23/2018 to 02/25/2018;

- The traditional day of the state holiday remains 05/09/2018 - this year it falls on Wednesday;

- Saturday 06/09/2018 will be a working day, but this will be followed by a rest period from 06/10/2018 to 06/12/2018;

- in November, weekends associated with holidays will make the period from November 3, 2018 to November 5, 2018 non-working.

Payment for a shift schedule

At some enterprises, the production cycle cannot be stopped even on holidays. In such companies, payment for New Year holidays during a shift schedule in 2021 is made according to the following rules:

- To register work on holidays, there is no need to issue any additional orders or instructions, because all days of work and rest for such employees are established in the production schedule;

- if a working day on a shift schedule falls on an official day off, it is paid at least twice the tariff rate (Article 153 of the Labor Code of the Russian Federation). The specific amount of remuneration for such employees is established in a collective or labor agreement or other local regulatory act of the company, but it cannot be lower than that established by the Labor Code.

Read more: How to create a shift schedule

ConsultantPlus experts figured out how to pay piece workers for non-working holidays. Use these instructions for free.

What documents will be needed

To apply for work on weekends, you need several documents, but, unfortunately, there are no standardized forms for them.

- Written order (order)

Can have any shape. If necessary, the order can reflect the opinion of the trade union organization, if there is one. .

- Notice of the employee’s right to refuse to work on a day off

This document can be drawn up either as a separate paper or included in the disposition (order) as a separate section. For the second option, the following wording is suitable: “Please report agreement/disagreement, as well as the presence of circumstances that objectively prevent involvement in the specified work, by __ (specify date, time).”

In any case, the document must provide a place for the employee’s signature, which will certify that he is familiar with his rights.

Rostrud recommends preparing the notice in two copies, one of which must be given to the employee.

- Agreement to work on weekends

This document is also drawn up in any order, either as part of a notification, which is issued as a separate document, or in the form of an o on the corresponding order signed by the employee.

Sample consent to work on days off

If consent is drawn up in a separate document, then the following text can be used:

I, (full name), holding a position (specify position) in (specify structural unit), have read the notification and give my consent to work on a day off/non-working holiday (specify date).

I am familiar with the right to refuse work. I have no medical contraindications or other obstacles to work. The terms of payment were explained to me.

For work on a weekend/non-working holiday, please provide another day of rest (specify the date)/pay double (specify as required).

Sample refusal to work on a day off

Since the refusal can also be issued in a separate document, the following wording can be used:

I, (full name of the employee), holding a position (specify position) in (specify structural unit), have read the notification. In accordance with my right to refuse work on a weekend/non-working holiday, I declare that I refuse to be hired to work on a weekend/non-working holiday (indicate its date and, if necessary, the reason for the refusal).

- Minutes of the meeting of the trade union organization (if you have such an organization)

The minutes should indicate the fact of discussion of the issue of employees working on days off and the positive decision taken on it.

Subscribe to our Telegram channel @konturjournal to learn about the most important changes for business on time.

How to pay overtime during winter break

If an employee performs official duties during the New Year holidays overtime, payment for New Year holidays, according to the law of the Russian Federation, is made according to the rules of Article 153 of the Labor Code of the Russian Federation - at least in the amount of double the tariff rate. The payment is not taken into account when determining the duration of overtime work, subject to payment at an increased rate, in accordance with Art. 152 Labor Code of the Russian Federation.

To correctly pay for holidays in January, correctly formalize the recruitment of employees to work. To do this, you first need to obtain the consent of the staff, issue an order from the manager, which is familiarized with the signature of all involved subordinates. The order must provide the reasons for the need to work on New Year's holidays and a list of persons who will have to work on the holiday. If an employee who has agreed to work on holidays does not come to work, disciplinary action will be taken against him.

Read more: We issue an order for overtime work

What does labor law say?

According to Art. 113 of the Labor Code of the Russian Federation, work is prohibited on holidays and weekends (in particular, on the May holidays 2020). Employment is possible for:

- performing urgent work, the transfer of which would endanger the life or health of others;

- eliminating the consequences of emergency incidents;

- performing work imposed by martial law.

Involving creative workers from the media, cinematography, theaters, circuses, etc. is only possible when a collective agreement or agreement has been signed. In other situations - with the written consent of the subordinate and the trade union.

An enterprise can use the proposed sample or develop its own form of the document.

Remember: it is prohibited to employ pregnant women and minors! A similar requirement applies to employees who have entered into a fixed-term contract with the company - this is stated in Art. 290 Labor Code of the Russian Federation.

In the absence of medical contraindications and written consent, you can ask to go to work:

- employees raising children under 3 years of age or disabled children (of any age);

- single mothers who have children under 5 years of age.

Labor Code of the Russian Federation 2021 is this: characteristics?

The Labor Code of the Russian Federation is a collection of legislative norms on labor, approved in Soviet times. Now its role is played by the Labor Code - the main regulatory act of the country, which determines:

- rules of organization and management of labor;

- the procedure and features of employment of all categories of employees on regular days, weekends and holidays;

- increasing the level of qualifications of the employer;

- degree of responsibility of the parties;

- ways to resolve labor disputes, mainly regarding wages and illegal dismissal;

- cases of compulsory insurance;

- implementation of state control.

Compensation

Compensation is provided for working on holidays. Need money? Then the subordinate can choose to pay double for work on a day off. Need to resolve an important issue? It makes more sense to take an extra day off. It is, of course, more profitable for the company to give an additional day off, but the subordinate has the right to choose on his own.

If the employer imposes his own decision, there is a violation of rights. Then the person can complain to the labor inspectorate or other regulatory body.