Line 041 of Appendix 2 to sheet 02 of the income tax return implies a breakdown of one of the types of indirect costs of the company indicated in line 040.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Line 041 displays the amounts of all taxes, without exception, that are to be displayed in the list of costs that reduce the organization’s income.

To eliminate the possibility of errors and inaccuracies, it is advisable to consider the procedure for filling out line 041 in more detail.

Briefly about the main thing

All organizations that apply the general taxation system are required to pay 20% of their company’s profits to the relevant budgets of the Russian budget system.

Confirmation of the correctness of calculations and completeness of transfers for this obligation is a declaration in the form of KND 1151006. A separate material “Income Tax Declaration in 2020: Filling out and Submitting” explains what is included in line 041 of Appendix 2 to sheet 02 of the income tax declaration and how fill out a tax form.

ConsultantPlus experts discussed how to correctly fill out and submit a tax return. Use these instructions for free.

Line 041 of the income tax return

Related publications

All organizations operating on the general taxation system are required to submit income tax reports to the Federal Tax Service. How to enter indicators in line 041 of the income tax return? What is said on this topic in the Filling Out Procedure according to Order No. ММВ-7-3 / [email protected] dated 10.19.16? We will answer all questions in more detail.

What to consider in line 041

The filling rules from the Federal Tax Service order No. ММВ-7-3/ [email protected] dated 10/19/2016 indicate what is included in line 041 of the income tax return - information on indirect expenses of an economic entity incurred in the reporting period.

Order No. ММВ-7-3/ [email protected] also provides a transcript of line 041 in the income tax return: the amounts of taxes and fees, insurance premiums accrued in the manner established by the legislation of the Russian Federation on taxes and fees, with the exception of the taxes listed in Art. 270 Tax Code of the Russian Federation. Let us recall that due to changes in fiscal legislation regarding insurance premiums (Chapter 34 of the Tax Code of the Russian Federation), information on insurance coverage is classified as tax payments. Therefore, it is subject to reflection in the appropriate columns of tax reporting.

The Tax Code of the Russian Federation stipulates which taxes are reflected on line 041 of the income tax return: taxpayers should take into account the amounts of tax obligations and payments for insurance premiums that were accrued and paid during the billing period. But legislators provided exceptions: operations named in Art. 270 of the Tax Code of the Russian Federation, are not included in indirect ones.

IMPORTANT!

According to the rules, contributions for injuries are not included in the income tax return in line 041! This insurance liability remained under the control of the Social Insurance Fund.

Amounts excluded from indirect costs

Line 041 of income tax should not display payments for state duties if:

- obligations to pay state duty arose as a result of registering an asset from among non-current assets;

- the amount of the duty was added to the total amount of the valuation of the fixed asset when it was accepted for accounting;

- in tax accounting, the duty was shown as an element of other costs (Article 264 of the Tax Code of the Russian Federation).

The value of costs, which should not be taken into account when calculating the tax base, is excluded from the value of line 041 (income tax 2018). The norm concerns excise taxes and VAT imposed on counterparties. There is no need to reflect in this column the amount of income tax and the amount of payments made in connection with environmental pollution. Penalties, fines and paid arrears on tax obligations are not subject to accounting as part of indirect expenses.

According to the norms of paragraph 9 of Art. 274 of the Tax Code of the Russian Federation in the income tax return on page 041 in 2021 there is no need to include calculated taxes by participants in the gambling business. An exception is made for business entities operating on UTII combined with OSNO. The following costs should also be separated from indirect costs:

- accrued amounts for dividends;

- transferred funds for voluntary forms of insurance;

- in page 041 (income tax 2018) you cannot include the amount of guarantee contributions contributed to the special fund;

- the amount of the accrued and repaid liability for the trade fee;

- expenses of religious structures for ritual and ceremonial events;

- Registration of cost estimates of notary services in terms of their excess of the established tariffs for notary fees.

The group of exceptions includes all funds that the employer transfers to the accounts of non-state pension funds. This type of insurance premium is not regulated by tax authorities. If government agencies apply sanctions to a company in the form of penalties, these amounts should not be shown in indirect costs.

Separately, accounting must reflect taxes that in previous periods were expensed at the time the accounts payable were written off. Amounts spent on the formation of a prize fund for promotions and drawings are excluded. If during the reporting period the company revalued securities due to a change in their market value, the results of such actions should be shown separately from other costs; they are not a structural element of indirect expenses.

Read also

07.11.2016

What amounts to include

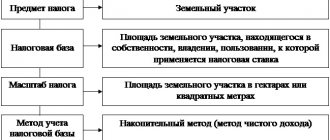

Let us immediately make a reservation that the procedure for reflecting indirect expenses in the tax return directly depends on the method of accounting in the organization. So, if a company has stated in its accounting policy that it maintains accounting on an accrual basis, then the amounts of accruals are included in the reporting.

Here's how to fill out line 041 in the income tax return if the cash accounting method is selected in the accounting policy: indicate as indirect expenses only the amounts of payments made, that is, upon payment of obligations to the relevant budgets.

What is line 041 of the profit declaration intended for?

Page 041 (included in Appendix 2 of sheet 02 of the report) is intended to generate information on indirect expenses of the enterprise for the reporting or tax period. Here, taxpayers indicate the amounts of taxes/fees, as well as insurance premiums, accrued in accordance with legislative norms. The exception is the amounts of taxes listed under Art. 270 NK.

Earlier, before the entry into force of chapters. 34 of the Tax Code, insurance accruals were not required to be entered in this line. Since 2021, the situation has changed, contributions are included in tax payments, and therefore fall under the requirement to reflect amounts on page 041 in terms of mandatory pension insurance, social insurance contributions for temporary disability and compulsory medical insurance.

Note! “Injuries” remained under the control of the FSS and are not subject to entry into line 041 of the income tax return.

The data is filled in upon the fact of accrual of tax amounts using the accrual method or upon payment of fees under the cash method.

Specific list of what to include on page 041

What amounts should be included in indirect expenses when preparing a declaration? Reporting line 041 of income tax includes the following costs:

- Obligations for transport tax if the company owns a car (vehicle).

- Property tax obligations paid to the budget on the value of property assets owned by the entity.

- Mineral extraction tax, if the company’s activities are related to the use of natural resources and subsoil.

- Insurance contributions: compulsory medical insurance, compulsory medical insurance, VNIM (except for NS and PZ contributions).

- Payments for land and land plots owned by the company.

- Water tax.

- Fees paid to the state budget for the use of various species and objects of the animal world.

- Amounts of restored input VAT previously accepted for deduction for preferential activities or through budget financing (Article 170 of the Tax Code of the Russian Federation).

- State fees, except for the amounts that were paid for the registration of fixed assets and were included in the cost of this object.

Line 041 does not include:

- Excise taxes and VAT charged to buyers.

- The amount of the calculated (paid) contribution to profit.

- Payments made for environmental pollution.

- Amounts of penalties, fines and penalties accrued on tax obligations.

- Amounts of calculated UTII when combining tax regimes.

An exhaustive list of obligations that are not taken into account in line 041 is named in Article 270 of the Tax Code of the Russian Federation.

What taxes are not required to be included on line 041?

To understand the essence, let us turn for clarification to the Tax Code, namely to Art. 270. According to this norm, those expenses that are not taken into account when determining the taxable base are not subject to reflection in line 041.

The following types of taxes are not required to be entered in line 041:

- Excise taxes and VAT presented to buyers.

- Insurance premiums for injuries paid to the Social Insurance Fund.

- Income tax.

- Payments for environmental pollution.

- Amounts of penalties, arrears and fines associated with the payment of tax fees.

According to paragraph 9 of Art. 274 of the Tax Code is also not required to include in p. 041 the amount of taxes regarding the gambling business and UTII, accrued when combining the general and imputed regimes.

Additionally, it should be noted that the following amounts are not included in line 041:

- Accrued dividends.

- Voluntary insurance.

- Sanctions imposed on the company by government authorized bodies.

- Amounts paid to NPFs.

- Guarantee contributions transferred to special funds.

- Trade fee amounts.

- Amounts of taxes previously expensed when writing off accounts payable.

- Amounts of notary fees in excess of tariffs.

- Other amounts under Art. 270 NK.

Line 041 of the income tax return in 2021: which taxes to include

What taxes should be shown on line 041 of the income tax return in 2021

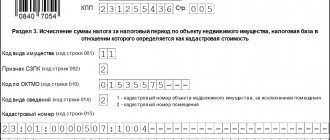

Line 041 of the income tax return in 2021 is part of Appendix 2 to sheet 02. What is reflected in it is stated in the Procedure for filling out the declaration (approved by Order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3 / [email protected] ).

In line 041 of Appendix 2, companies reflect taxes, fees and insurance premiums, which are included in other expenses (letter of the Federal Tax Service dated April 11, 2017 No. SD-4-3 / [email protected] ). These are indirect expenses of the organization, which do not depend on the volume of sales and reduce the income tax base.

TOP 7 errors in profit declarations

Tax authorities will not accept a profit declaration with errors.

Taxes and fees included in Article 270 of the Tax Code do not need to be reflected in line 041. Among them: income tax, UTII, VAT presented to the buyer, trade tax, etc. Which taxes should be included in line 041 of the income tax return in 2021, see the table.

Table. What taxes are included in the indicator on line 041

How to determine the amount of taxes, fees and contributions for line 041

When calculating the line 041 indicator, apply the following rules. Include in the indicator the amount of all taxes, fees and insurance premiums accrued for the 2018 tax period. Also take into account the advance payments of taxes that you would have had to pay during the year. The date of payment of taxes, contributions and fees to the budget for the indicator on line 041 does not matter (letter of the Ministry of Finance dated September 12, 2016 No. 03-03-06/2/53182).

Filling out line 041 of Appendix 2 to sheet 02

Filling out line 041 of Appendix 2 to Sheet 2 in 2021 is not as difficult as it seems if you know exactly what taxes and contributions to include in this column (see table above). The following rules must also be observed:

- line 041 is intended to reflect indirect taxes in the income tax return, in particular those fees and contributions that companies take into account as other expenses (Letter of the Federal Tax Service dated April 11, 2017 No. SD-4-3 / [email protected] );

- enter the amount of accrued fees, contributions, and advances for the reporting period;

What is line 041 checked against?

Tax authorities check the reports submitted by taxpayers for accuracy. To do this, in particular, they use control ratios, which they themselves develop by comparing the lines, their amounts and differences within the declaration or with other reports.

If we talk about line 041 of the declaration, then the main internal document requirement for it is this: the value of line 041 should not exceed the value of line 040, since the amount on line 041 is included in the amount indicated in line 040, which reflects the total figure of indirect expenses.

Also, line 041 must be checked with tax returns and calculations of insurance premiums submitted by the organization for the reporting period.

Often, discrepancies may appear, and tax authorities will have questions about filling out line 041. In this case, they may require clarification. This is a work situation that should not be feared if you have everything filled out correctly. It is necessary to explain to the tax authorities the origin of the amounts in line 041.

Both accrued amounts of taxes, fees, and advance payments on them are subject to inclusion in line 041 when applying the accrual method for accounting for income tax. These taxes should be classified as other indirect costs. Line 041 is reconciled by the tax authorities with other tax calculations and declarations submitted by the organization.