Deferred tax assets, or DTA for short, are a special indicator that is used by accountants to balance the indicators of two accounting systems: accounting and tax. We will tell you in this article about which transactions to reflect such transactions and in which lines of the balance sheet to reflect this economic indicator.

When reflecting the facts of an entity's economic activity, accounting and tax accounting data are not always identical. In most cases, the difference arises due to the fact that the methods of accepting a specific operation, fact, income, expense are of a different nature. And some indicators are not accepted at all in one of the accounts. As a result, deferred tax liabilities and assets (ONO and OTA) arise. The methods and procedure for their adoption are reflected in PBU 18/02.

What is referred to as SHE

According to PBU 18/02, ONA should include that part of the deferred income tax, which in the future will lead to a decrease in the amount of the fiscal liability payable to the state budget. For example, in the next reporting period or in subsequent periods of time.

In simple terms, IT is part of an enterprise’s expenses that can be taken into account as part of expenses that reduce the taxable base for income tax, but in a given reporting period they cannot be accepted in full. Consequently, such expenses are partially accepted in this reporting period, and the balance is transferred to subsequent ones.

Also, some types of company income that were accepted into NU earlier than in accounting can be included in ONA. Such income is subject to write-off when accepted into the accounting system.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a positive factor

If the indicator decreases

Usually a negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Profitable investments in material assets 1160 Definition Profitable investments in material assets 1160 - investments of an organization in property, buildings, premises, equipment and other material assets provided by the organization for a fee for a temporary...

- Intangible assets 1110 Definition Intangible assets 1110 are: works of science, literature and art; programs for electronic computers; inventions; utility models; breeding achievements; production secrets (know-how); commodity...

- Tangible exploration assets 1140 Definition Tangible exploration assets 1140 - costs of searching, evaluating mineral deposits and exploring mineral resources in a certain subsoil area. As a result of their implementation...

- Intangible exploration assets 1130 Definition Intangible exploration assets 1130 - costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area: the right to perform work...

- Other non-current assets 1190 Definition Other non-current assets 1190 are assets whose circulation period exceeds 12 months and which are not reflected in other lines of Section I of the balance sheet. To them…

- Fixed assets 1150 Definition Fixed assets 1150 are: buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computer technology, vehicles, tools, ...

- Research and development results 1120 Definition Research and development results 1120 are funds spent on research and development work that yielded a positive result. The works for which the results were obtained are taken into account:...

- Financial investments 1170 Definition Financial investments 1170 are financial investments of an organization, the circulation (repayment) period of which exceeds 12 months from the moment on which the reporting was prepared (from the reporting date): state ...

- Balance sheet The balance sheet prepared for the financial analysis of the activity and condition of the enterprise for three years is as follows: Indicator Indicator code 2011 2012 2013 ASSETS OF THE ENTERPRISE I. NON-CURRENT…

- Altman's model for non-manufacturing companies Altman's Z-model for non-manufacturing companies In 1993, Altman, continuing his research, revised the model for non-manufacturing companies. (Altman, E., Corporate financial distress and bankruptcy. (3rd ed.).…

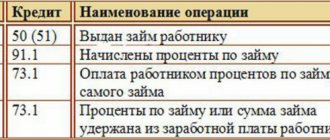

Reflection in accounting: postings

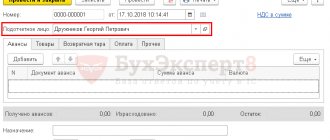

When recognizing a deferred tax asset in accounting, an entry is made in the debit of account 09 “Deferred tax assets.” When amounts accepted are reduced or repaid in full, a credit entry is made to that account. Write off amounts from accounting as they are recognized, in accordance with the requirements for maintaining NU (clause 14 of PBU 18/02).

Typical accounting entries for ONA:

| Contents of operation | Debit | Credit |

| Recognition of ONA in the accounting of an economic entity is reflected | 09 | 68 |

| SHE has been deregistered | 68 | 09 |

If at the end of the calendar year there is a balance on account 09, then there is no need to forcibly write it off. That is, count. 09 does not need to be closed at the end of the financial year before the balance sheet is reformed. Reflect the final balance at the end of the year in the appropriate lines of the financial statements. Deferred tax assets in the balance sheet are line 1180.

What is a deferred tax asset?

To understand what a deferred tax asset is, you need to understand the definition of deferred tax payable on a company's profits. It represents the obligations that the company will have in the future. Deferred tax usually arises as a result of poor business performance. The reason for its appearance is also problems with taxation.

That is, it is a conditional tax. It is calculated based on information from the enterprise’s reporting. It is equal to the amount payable in the current tax period. The methods for calculating amounts for tax and accounting reports differ, which is why a temporary difference appears. It can cause inconsistencies when taking into account the following indicators:

- Valuation of assets and liabilities of an enterprise.

- Determining the amount of income and losses.

How to calculate deferred tax asset ?

Deferred assets arise when the following circumstances exist:

- The presence of a tax difference of a temporary nature.

- Receipt of income in the future, on which tax will be paid.

It is important to calculate them correctly.

How is deferred tax assets inventoried ?

Reflection in reporting

If according to 09 as of December 31 of the reporting year there is a balance, it will have to be reflected in the financial statements. Moreover, the company must independently determine the method of reflecting information in the accounting reports.

Currently, it is permissible to use two methods: expanded and shortened. The decision about which method the company decided to use must be indicated in the explanatory note to the financial statements (balance sheet and income statement). Let's consider how to reflect IT in the balance sheet for each option.

Option No. 1. Expanded

If the company has decided to reflect the information in an expanded manner, then reflect the debit balance on account 09 in line 1180.

What indicators should converge in the Balance Sheet and the Income Statement?

Published 03/17/2020 08:40 Author: Administrator The reporting campaign for 2021 is coming to an end. Accountants throughout the country are now busy preparing a package of annual reports, which must be submitted to the Federal Tax Service by March 31, 2020. But before sending the tax authorities the results of the enterprise’s work for the year, we recommend that you read this article, which will discuss the relationship between two main forms - the Balance Sheet and the Statement of Financial Results.

First, let's talk about important changes in this area. Federal Law No. 444-FZ dated November 28, 2018 amended Federal Law No. 402-FZ dated December 6, 2011 “On Accounting”, and corresponding amendments were made to Art. 23 of the Tax Code of the Russian Federation by Federal Law of November 28, 2018 No. 447-FZ.

The most important news is that from January 1, 2021, organizations are exempt from submitting a copy of their annual financial statements to the state statistics authorities, as was previously the case. Such an obligation will remain only with those enterprises whose reporting contains information classified as state secret, and it will also remain in cases established by the Government of the Russian Federation.

These innovations are explained by the fact that from 2021 the Federal Tax Service of Russia will create a state information resource (base) containing information on the financial statements of organizations. Moreover, for organizations subject to mandatory audit, the database will include data from audit reports. It must be submitted in the form of an electronic document along with the annual reports or within 10 working days from the day following the date of the auditor's report, but no later than December 31 of the year following the reporting year.

Let's return to our reporting forms. So, the balance sheet results must converge, i.e. The balance sheet asset must be equal to the liability (A=P).

Typically, the balance sheet is formed based on the results of the calendar year. But to assess the organization’s activities, interested users can easily generate so-called interim financial statements both at the end of the month and at the end of the quarter.

The indicators in the balance sheet are reflected for the reporting year and the previous two years.

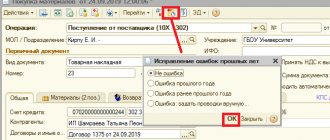

To generate correct financial statements, you must first complete all the routine operations provided for by the program. To do this, go to the “Operations” section, then the “Month Closing” hyperlink.

We carry out the “Closing of the Month” operation monthly. Please note that in the month of December, an additional regulatory operation “Balance Sheet Reformation” appears, which implies a procedure for closing accounting accounts that record the financial results of the organization’s activities.

To fill out the balance sheet, data is taken from the SALT (“Reports” - “Turnover balance sheet”). The balance at the end of the period in the account (debit (asset) or credit (liability)) forms the balance sheet.

Let us consider this point in more detail using the example of our organization Romashka LLC. We will form the closing month for December 2019 and SALT for December 31, 2019.

In the 1C program: Accounting ed. 3.0 financial statements are generated in the “Reports” - “Regulated Reports” section.

Next, click on the “Create” button to select the position “Accounting statements since 2011”, indicate the calendar year period and generate a copy of the statements.

In the generated reporting from SALT, debit account balances are transferred to Asset, and credit balances are transferred to Liability.

The expanded balance is taken, as in the example for account 62 there is a balance for Dt 62.01 = 42,300 rubles, and for Kt 62.02 = 180,680 rubles (the collapsed balance for this account is 138,380 rubles).

Balance sheet indicators are filled in thousands of rubles. If there is no value, a dash is added:

As a result, we get the balance (A=P).

The financial results report is compiled on an accrual basis from the beginning of the year. It can also be formed annually or quarterly. This reporting form shows information on income and expenses, financial results for the current year and the same period of the previous year.

From the balance sheet, the indicators “Turnover for the period” on accounting accounts 90, 91, 99 are taken. The balance at the end of the period for these accounts and sub-accounts must be closed.

Let's take a closer look at the procedure for forming some indicators.

If the organization is on the general taxation system, then the revenue is taken without taking into account VAT amounts (turnover on the account Kt 90.01 minus turnover on Dt 90.03 “VAT”).

Data on turnover from the balance sheet (the name of the accounting accounts and shows which line of the financial results statement the indicator will fall into) is transferred to column 4 (current year) of this report. Lines are filled in in thousands of rubles. Form lines that are being subtracted are shown in parentheses.

Line 2410 “Current income tax” is equal to the amount of tax reflected in the income tax return on line 180 of Sheet 02. If the organization is on the simplified tax system, then the amount of the simplified tax system for this year is reflected.

Line 2400 reflects the result of activity: net profit (loss) of the organization.

A negative indicator is shown in parentheses.

Typically, to assess the financial position of an organization, the balance sheet is analyzed together with the income statement.

So what should converge in these main forms?

1. The most basic balance sheet indicator is line 1370 “Retained earnings (uncovered loss)” and line 2400 “Net profit (loss)” of the income statement:

- If there was no data at the beginning of the year, then these lines in the reporting year of both forms should be equal,

— If there is data at the beginning of the reporting year, then line 1370 of the previous year’s balance sheet + line 2400 of the current year) = line 1370 of the current year,

— If, for example, there was a payment of dividends in the reporting period: (line 1370 of the previous year + line 2400 of the current year) minus dividends paid on Dt account 84 = line 1370 of the current year.

In the example under consideration, the organization paid dividends during the reporting year, therefore: (704 + 2243-2200) = 747 thousand rubles.

As of December 31, 2018, line 1370 = 704 thousand rubles.

as of 12/31/2019 line 2400 = 2243 thousand rubles.

In the reporting period, account 84 = 2200 thousand rubles.

As of December 31, 2019, line 1370 = 747 thousand rubles.

2. If the organization applied PBU 18/02 “Accounting for corporate income tax calculations” (deferred tax assets and deferred tax liabilities must be reflected in detail), then:

Line 1180 “Deferred tax assets” of the balance sheet (the difference between the previous and current periods) is equal to line 2450 “Change in deferred tax assets” of the income statement for the reporting period.

Line 1420 “Deferred tax liabilities” (the difference between the previous and current periods) is equal to line 2430 “Change in deferred tax liabilities” for the reporting period.

In case of identified discrepancies in the balance sheet, we suggest that you watch our video Why the balance sheet does not add up?

Author of the article: Oksana Kalinina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Natalya 01/20/2021 14:11

Quote

0 Svetlana 04/23/2020 14:52 Girls, many thanks to you for your work, everything is so intelligible and thorough that there are no open questions on the topic at all. Thank you good fairies of accounting!!!

Quote

+1 Lyudmila 03.24.2020 19:28 Thank you. The article is very useful

Quote

Update list of comments

JComments

Why are deferred tax assets required?

Tax assets are a method of reducing income taxation. To calculate them, you need to multiply the current tax amount by time intervals.

The temporary difference represents the totality of expenses and losses that make up the profit reported in the report. Instead of profits there may be losses. These indicators are the basis for creating a tax summary. Assets are formed in the following cases:

- using different methods for calculating depreciation;

- making tax payments in excess of the required amount. This is relevant if the overpayment was not returned to the company;

- the presence of a loss transferred to the account of subsequent periods;

- the appearance of accounts payable arising from the purchase of services or goods;

- application by the enterprise of the cash method of calculation.

Deferred assets must be accounted for correctly. This is required for the following purposes:

- Collection of accounting data.

- Collection of data for analysis.

- Possibility of generalized results of the enterprise's activities.

Having all the recorded data will help protect the company during tax audits.