In accordance with Article 136 of the current Labor Code of the Russian Federation, the organization must calculate wages in a phased manner. This means that the required transfers for employees must be received at least 2 times a month. The relevant legislation in this regard has only advisory norms, which indicate that the timing of salary crediting is established in accordance with local rules. But the maximum gap between the two types of transfers should not exceed 15 days. The following will explain how an advance is made properly and whether a fixed tax should be withheld from it.

General payment rules

As already noted, the provided advance on the expected salary should not be subject to personal income tax or any other tax.

The procedure for paying an advance on wages is specified in Article 136 of the current Labor Code of the Russian Federation. In accordance with it, the employer is obliged to accrue the required salary at least 2 times a month. This means that the limit is broken into two parts, each of which is paid in the middle and at the end of the month. But this rule is not mandatory, so the deadlines in a particular organization can be shifted in any direction. The main requirement is that the maximum gap between two transfers does not exceed 15 days. In the standard form, payment must be made before the 15th of each month in the amount of 35-45%, and by the 31st of the current month the rest of the salary is paid. It is from the main part of the salary, which is indicated in the personal income tax, and which is provided for in the employment agreement, that the tax is calculated. Therefore, the employee receives remuneration after deduction of tax.

When to pay tax on salary advance 2021?

The second part of Article 223 of the Tax Code of the Russian Federation states that personal income tax should not be calculated from the advance payment to wages itself, because payment is expected from the final amount on the last day of receiving wages. It turns out that the stipulated transfers and deductions must be made to the budget from the final salary amount, and not from the advance payment. The deadline for transferring personal income tax on salary advances depends on when wages are paid in full to the organization.

How is tax withheld and paid in non-standard situations?

In the labor segment, such non-standard situations include, in particular, dismissal in the middle of the current month. This means that the tax should actually be calculated from the advance payment. In this case, a fixed 13% is deducted from the amount issued, after which the rest is given to the staff unit at its disposal. Consequently, there is no mandatory obligation for the employer to withhold the required tax from the full salary. Exceptions may be provided.

Advance on the last day of the month

This form is also allowed, but only if the rest of the salary was issued no earlier than 15 days ago. This has already been noted - organizations can independently set the terms for crediting salaries, but only if the permissible period between transactions is observed. This rule does not apply to employees working on a rotational basis.

Salaries are paid 3 times a month

The main requirement in provision 136 is the step-by-step procedure for the payment of wages. Here the emphasis is on the definition - “at least 2 times a month”, but nothing is said about the maximum values. Therefore, this form may well be used by a conditional organization. In practice, weekly accrual schemes are also used, which is also not considered a violation.

The award is issued along with an advance payment

The organization independently makes its decision on bonuses. Accordingly, such a preference in relation to a staff unit can be implemented at any time, regardless of the time of receipt of the advance or the main part. The premium may well be paid separately from these transactions, and the tax on it will also be calculated separately.

Responsibility of the employer for failure to pay the advance

The Labor Code does not establish the concept of advance payment. What we call this word is one of the parts of the salary. Therefore, failure to pay an advance is subject to the same liability as failure to pay all earnings.

The law determines that the culprit may be subject to three types of liability:

- Material - occurs immediately the next day after the fixed date of issue. The amount of the fine is calculated based on the amount not paid and the total period of delay as 1/150 of the debt for each day of delay. This compensation must be accrued and paid to each employee, regardless of the reason for which he was not paid on time.

- Administrative - imposed by inspection bodies when they detect a delay in payment of wages. Can be awarded to a responsible person, company or individual entrepreneur. The maximum amount of punishment is 50 thousand rubles, which can be increased if a similar violation is repeated.

- Criminal - imposed by a court decision in case of deliberate non-payment for more than 2 months. Applies to the director of the company or entrepreneur. The maximum penalty is a fine of 500 thousand rubles, or imprisonment for up to 3 years.

General rules

The algorithm for withholding and transferring personal income tax from wages is given in Chapter 23 of the Tax Code. It contains two concepts: “date of actual receipt of income” and “day of payment of income.” At first glance, it may seem that these are different formulations of the same event. But in reality we are talking about completely different things.

The date of actual receipt of income, in fact, means the day when the final amount of income became known. It is at this moment that the taxable base can be formed and personal income tax can be calculated. In the case of wages, this moment is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The income payment day is the date when money for salary or advance payment is debited from the current account or issued from the cash register. Each employer sets its own payment dates. Sometimes the advance is given on the 25th of the current month, and the salary is given on the 10th of the next month, sometimes the advance is given on the 15th, and the salary is on the 1st, etc.

The moment when the employer is obliged to withhold and transfer income tax to the budget depends on the date of payment of income. Thus, it is necessary to withhold personal income tax upon actual payment of money to an employee (clause 4 of Article 226 of the Tax Code of the Russian Federation). You must transfer money to the budget (with the exception of tax on vacation pay and sick leave) no later than the day following the day of payment (clause 6 of Article 226 of the Tax Code of the Russian Federation). From a literal reading of these norms, we can conclude that personal income tax should be withheld and transferred twice a month: from the advance payment and from the salary.

But officials have repeatedly explained: tax withholding and payment need to be made only once—at the final payment of wages for the month worked. This is explained by the fact that before the end of the month the date of actual receipt of income has not yet arrived. Consequently, the employer is not able to form a personal income tax base and calculate the amount of income tax. This will only be possible on the last day of the month. Therefore, there is no need to withhold and pay personal income tax on the advance payment. Such comments are contained, in particular, in the letter of the Federal Tax Service of Russia dated January 15, 2016 No. BS-4-11/320 (see “The Federal Tax Service reminded that personal income tax is not withheld from advances paid to employees”) and in the letter of the Ministry of Finance of Russia dated July 22, 2015 No. 03-04-06/42063 (see “Ministry of Finance: from an advance paid to an employee, personal income tax is withheld when paying the second part of the salary”).

Common Questions

Question 1: The HR service of the employing company has fixed the terms for payment of the advance payment amount and the final payment of wages in the collective agreement. Should changes be made to the document when indicating the timing of payment of bonuses and allowances?

To record calculations for employees' wages in clause 6 of Art. 136 of the Labor Code of the Russian Federation clearly states the conditions for earnings/advance payments and the dates of their payment. With regard to increasing/stimulating payments, the following should be noted. The source of the bonus is usually the company's profit. Its assessment requires some time, which deviates from the deadlines fixed in Art. 136 TK.

Having assessed the financial results that form the basis for calculating bonuses and other incentive accruals, payments are made separately. The rules for such accruals are specified in Part 2 of Art. 135 of the Labor Code of the Russian Federation, which contains requirements that indicate that bonus (incentive) accruals for successful labor results are fixed in:

- local acts of the company;

- collective agreement;

- wage regulations.

These documents should provide for the timing and frequency of payment of these accruals.

Non-standard situations

The advance is paid on the last day of the month

An exception to the above rules is the situation when the advance is issued on the last day of the month, and the salary is issued in the middle of the next month. For example, an advance payment for May is paid on May 31, and a salary for May is paid on June 15. In this case, the date of actual receipt of income and the date of payment of the advance coincide. This means that already when issuing an advance, you can create a personal income tax base, calculate the amount of tax and transfer the money to the budget.

If, under such circumstances, the employer transfers tax when paying wages and not an advance, inspectors have the right to fine him on the basis of Article 123 of the Tax Code of the Russian Federation. This conclusion was made in the ruling of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804 (see “The court explained when to transfer personal income tax if the advance is paid to employees on the last day of the month”).

Thus, an employer who issues an advance on the last day of the month is obliged to pay personal income tax on the advance no later than the next day. Then, when the second part of the salary is paid, the organization or individual entrepreneur will transfer the remaining tax for the month worked.

Let us add that the described schedule for payment of advance payments and salaries is very inconvenient from a practical point of view. The fact is that HR officers often close the time sheet and transfer it to the accounting department not on the last day of the month, but after one or two days. And before receiving the report card, accountants cannot determine the amount of income, taxable base and tax. To prevent violations, employers need to either change the salary payment schedule or ensure “early” closure and transfer of timesheets.

Salary is paid in three installments

It happens that employers pay wages not two, but three times a month. As a rule, this happens due to the fact that at the time of payment of the second part of the salary, the company or individual entrepreneur does not have enough funds to fully pay the staff. A debt remains, which the employer repays as soon as possible.

The Federal Tax Service commented on this situation in a letter dated March 24, 2016 No. BS-4-11/4999. According to officials, when faced with it, an accountant should act as follows. If the advance is paid before the end of the month, then there is no need to transfer personal income tax when issuing it. But for each payment made after the end of the month, income tax must be paid (see “The Federal Tax Service announced when personal income tax should be transferred if the monthly salary is paid in three installments”).

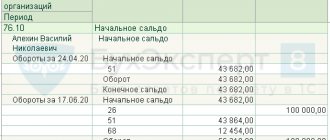

Let's explain with an example. Let’s say the advance payment for May was issued on May 25, and the salary for May was issued on June 10 and June 15. Then the accountant must first calculate the total amount of personal income tax for May. Then (if paid on June 10) determine what share of the total amount of the “May” personal income tax falls on the amount of the advance and the first part of the salary. The resulting value is the tax that must be withheld on June 10 and transferred to the budget no later than June 11. The remaining share of the total amount of the “May” personal income tax must be withheld on June 15 and transferred to the budget no later than June 16.

A bonus for labor achievements is issued along with an advance payment

Another exception to the general rules, according to officials, is the situation when, along with the advance payment, the employer pays a bonus for production achievements. The Russian Ministry of Finance is convinced that personal income tax on bonuses must be withheld at the time of their actual payment. And even if the bonus is issued before the end of the month, the tax must be withheld and transferred to the budget no later than the next day.

Financial department specialists explain their position as follows. The general algorithm for withholding and transferring personal income tax from advance payments and salaries applies only to income in the form of wages. But the bonus for labor success is not remuneration, but an incentive payment. Therefore, the date of actual receipt of income for a bonus is not the last day of the month, but the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). As a result, the taxable base must be formed and the tax withheld at the moment when the bonus is issued to the employee. This point of view was expressed by the Russian Ministry of Finance in a letter dated November 12, 2007 No. 03-04-06-01/383 and confirmed in a letter dated March 27, 2015 No. 03-04-07/17028 (see “Ministry of Finance: Personal income tax on bonuses must be withheld the day of its payment").

However, the judges have a different opinion. In arbitration practice, there are examples where an employer managed to defend its right to transfer personal income tax from a bonus when paying a salary, not an advance. The court recognized: a bonus for production achievements is an element of remuneration, since it was received within the framework of labor relations. If so, then the date of actual receipt of income for the bonus is the last day of the month. Before this date, there is no need to accrue and withhold personal income tax (resolution of the North-Western District Court of December 23, 2014 No. A56-74147/201; “The court resolved the dispute about the date of payment of personal income tax on bonuses for production results”). However, if a company or individual entrepreneur seeks to avoid disagreements with inspectors and possible litigation, it is easier to withhold and pay personal income tax when issuing a bonus.

Personal income tax from advance in 2021: changes

According to the code, salaries must be paid at least every half month (Part 6 of Article 136 of the Labor Code of the Russian Federation):

- Advance payment - wages for the first half of the month - from the 1st to the 15th. The advance payment period is from the 16th to the last day of the month (usually the 30th or 31st, except in leap years).

- The second part of the salary is payment for the second half of the month. The payment period is from the 1st to the 15th of the next month.

The gap between the two parts of the salary should be no more than 15 days. By paying the second part, the employer pays the employee in full for the month worked (letter of the Ministry of Labor dated 09.23.16 No. 14-1/OOG-8532, letter of Rostrud dated 26.09.16 No. TZ/5802-6-1).

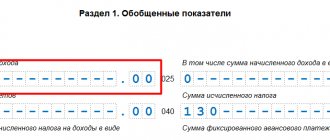

See 2021 Payroll Deadlines

Employers - tax agents are required to withhold personal income tax from employee income upon actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation). Since the date of receipt of the salary is considered the last day of the month for which it was accrued, personal income tax is not withheld from the advance payment. The tax is calculated and withheld from the full amount of salary on the last day of the month, and is paid no later than the date following the day the salary is paid. The Federal Tax Service reported this in a letter dated May 26, 2014 No. BS-4-11 / [email protected] ). The letter of the Ministry of Finance dated July 10, 2014 No. 03-04-06/33737 also states that personal income tax is calculated on the last day of the month, and it must be withheld once - when paying income after the end of the month.

Thus, personal income tax does not need to be withheld from the advance if the company issues it before the end of the month.

Note!

However, according to the Federal Tax Service, if a company paid an advance on the 30th of the month, and wages on the 15th of the next month, it is necessary to transfer personal income tax on the advances. According to tax authorities, if an advance is issued on the last day of the month, the employee already receives income on this date. This means that personal income tax must be withheld from both the first and second parts of the salary. Judges think the same (decision of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804).

What is the procedure for calculating advance payments for staff?

The earnings due for the first half of the month (advance) are paid in any way provided by the company:

- Cash from the cash register (based on payroll);

- By bank transfer to the employee’s bank account (based on the payment register).

Labor legislation does not establish a special method for calculating the advance, in contrast to the timing of its payment. But some regulations of the Ministry of Labor (dated 09/08/2006 No. 1557-6, dated 02/03/2016 No. 14-1/10/B-660) specifically indicate that the amount of the advance should be equated to the actual amount of earnings for the period of time worked. Therefore, the calculation must be based on the information recorded in the staff time sheet. This is also indicated by the comments of the Ministry of Health and Social Development in its information letter dated February 25, 2009 No. 22-2-709.

In some cases, the company’s internal regulations establish a fixed advance amount of 30-40% of the salary, a fixed ruble amount . In both cases, using these methods, there is a risk of overpayment of earnings if the employee is absent (vacation, business trip, days of temporary disability, absenteeism).

When to pay personal income tax on an advance in 2018

| Situation | Personal income tax payment deadline |

| Receiving cash from the bank to pay salaries | No later than the day following the day you receive cash |

| Transfer of salaries to employees' bank accounts | No later than the day following the salary transfer date |

| Payment of wages in kind | No later than the day following the day when personal income tax was withheld from the next cash payment |

Please take into account the explanations of the Ministry of Finance on how to withhold tax calculated from income in kind and other payments from an advance payment (see below).

How to pay personal income tax on an advance

| Method 1 | Method 2 |

| Accrue and pay an advance to the employee minus the personal income tax attributable to the advance. At the end of the month, accrue the remaining amount of salary and withhold the entire amount of personal income tax from it. | Charge the employee an advance, taking into account personal income tax, and withhold it immediately. Do not remit the tax. |

Early payment of personal income tax on advance payments and salaries is prohibited. The tax transferred ahead of schedule is not a tax as such. Therefore, you will have to remit the tax twice.

A document that will be useful if

Notifying employees about changes in advance payment terms

Results

To summarize the above, we can formulate the following: when paying an advance, personal income tax is not withheld by the tax agent. But when making an advance payment under a civil contract, you should carefully read the terms of the contract itself and make the appropriate decision - to withhold personal income tax or not.

This year, the procedure for paying salaries, including advances, is the same. But we must take into account the explanations of officials regarding the payment of personal income tax on advance payments in 2021. We will tell you how to transfer taxes and within what time frame.

Personal income tax from salary advance 2021: restrictions

For tax on income in kind or material benefits, no more than 50% of the payment can be withheld (clause 4 of Article 226 of the Tax Code of the Russian Federation). There is no special rule for personal income tax, which the company was unable to withhold from other income. Limits need to be looked at in other laws.

For wages and other payments for labor, there is a limit of 20% (Article 138 of the Labor Code of the Russian Federation). Employees may also receive rent money, cash gifts, or anniversary bonuses from the company. From such income, the company has the right to withhold all personal income tax, which it previously calculated from wages but did not withhold. Limits on withholding do not apply (letter of the Federal Tax Service of Russia dated October 26, 2016 No. BS-4-11/ [email protected] ).

Consider 50 or 20% of the income from which you withhold tax. The income from which you were unable to withhold personal income tax is not important. In this case, first withhold tax from your salary, and determine a 50% limit on the remainder.

Example

On May 29, the company forgave the director a debt of 250,000 rubles. and calculated personal income tax - 32,500 rubles. (RUB 250,000 × 13%). On May 30, she calculated personal income tax on the gift to the best sales manager - 8,580 rubles. ((RUB 70,000 – RUB 4,000) × 13%). On June 5, the company issued wages to employees.

Forgiveness loan. Director's salary - 50,000 rubles, personal income tax - 6,500 rubles. (RUB 50,000 × 13%). From the salary minus personal income tax, only 20% can be withheld as tax on the forgiven loan - 8,700 rubles. ((RUB 50,000 – RUB 6,500) × 20%). The difference is 23,800 rubles. (32,500 – 8,700) must be withheld from the following income. Including advance payment for June.

Present. Manager's salary - 30,000 rubles, personal income tax - 3,900 rubles. (RUB 30,000 × 13%). On account of personal income tax on a gift, the company has the right to withhold half of the salary minus tax - 13,050 rubles. ((RUB 30,000 – RUB 3,900) × 50%). This means that the company can immediately retain all 8,580 rubles.

What threatens a tax agent for violating the deadlines for transferring personal income tax to the budget?

If the tax agent transfers the fee later than the due date, then for each day of delay in payment, penalties will be charged under Art. 75 of the Tax Code of the Russian Federation. And under Article 123 of the Tax Code of the Russian Federation, the employer faces a fine of 20% of the amount not paid on time. To calculate the penalty, the amount of debt is multiplied by 1/300 of the Central Bank refinancing rate and the number of days of delay. The refinancing rate in 2021 is equal to the Key Rate of the Bank of Russia, which changes. To calculate the penalty, the value of the Key Rate that was in effect at the time of delay is taken. Please note that from June 14, 2021, the Central Bank rate is 10.5%, and from January 1, 2021 to June 14, its value was 11%.

For example, a company was 4 days late with the transfer of tax in the amount of 16,000 rubles (the amount was transferred on June 10, 2021, instead of June 6, 2016). The amount of the penalty is 16,000 * 11%/300 * 4 = 23 rubles 46 kopecks. And the fine for failure to fulfill the obligation to transfer tax will be 16,000 * 20% = 3,200 rubles.

If the personal income tax is paid ahead of schedule, and on the due date the tax is transferred from the salary minus the amount paid, then the inspectorate will consider the part unpaid. Penalties are accrued on the amount transferred ahead of time starting from the date of payment of the remaining tax.

Non-monetary personal income tax from advance in 2018

The tax that the company has calculated on material benefits or income in kind can be withheld from the salary advance. This conclusion was first made by the Ministry of Finance in letter dated 05.05.17 No. 03-04-06/28037.

Tax on material benefits, income in kind and any other personal income tax not withheld must be withheld from immediate cash income (clause 4 of article 226 of the Tax Code of the Russian Federation). The company does not withhold personal income tax from the advance payment itself (letter of the Federal Tax Service of Russia dated January 15, 2016 No. BS-4-11/320). It is not clear whether taxes calculated on income in kind and other payments can be withheld from the advance payment.

From what payments can personal income tax be withheld? In letter No. 03-04-06/28037, the Ministry of Finance came to the conclusion that the tax that the company calculated on non-cash income can be withheld from the advance payment. This is the logic of the officials. The company issues salaries to employees at least twice a month (Article 136 of the Labor Code of the Russian Federation). This means that each part is the employee’s income. It doesn’t matter that for personal income tax the date of receipt of income has not yet arrived. From the first part of the salary, you can still withhold personal income tax calculated from material benefits or gifts.

It’s another matter if the company issues a loan. Such a payment is itself exempt from personal income tax - it is not the employee’s income. Therefore, it is impossible to withhold tax from a loan that the company calculated from a benefit or gift. You need to wait for income or submit a certificate of unwithheld tax at the end of the year. In the memo, we have listed payments from which personal income tax can and cannot be withheld.

Important

From the letter from the Ministry of Finance, we can conclude that officials allowed the deduction of personal income tax from the advance payment itself. Actually this is not true. The date of receipt of salary income is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, there is no need to calculate and withhold tax from the advance payment itself.

From what payments should “non-monetary” personal income tax be withheld?

| Can be held | Can't be held |

| from salary, including advance | from child benefits |

| rent | daily allowance |

| anniversary awards | loans |

| sickness benefits | |

| dividends | |

| cash gift | |

| vacation pay |

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...