Many multi-storey buildings today are maintained and operated by management companies, which must provide high-quality utilities and carry out cosmetic and major repairs. Accounting in a management company is carried out with specific features, which will be discussed below.

Features of accounting in a housing and communal services management company

The functions of the management company also include:

Settlements with owners of residential premises.- Tax accounting.

- Accounting for materials.

- Employee remuneration issues.

- Settlements with other counterparties.

When purchasing and selling resources, accounts receivable and some expenses arise. This is an inevitable point.

In this regard, accounting in the management company takes place in several stages:

- Selecting an accounting policy. Here a list of rules is established and prescribed to take into account all income, expenses and other assets of the organization. The more accurately and thoroughly all the nuances are formed and all the issues are sorted out, the easier it will be to maintain accounting records at the enterprise.

- Development and selection of a chart of accounts. This document is generated and updated based on the order of the Ministry of Finance No. 94n. The plan should include only those accounts that will actually be used in the work activities of the management company.

- Approval of forms of primary documents. Management companies can use their own letterheads, having previously produced and approved them, or standard unified forms of documents. In both cases, all documentation must be enshrined in the company’s accounting policies.

- Accounting. These duties are performed by authorized site employees.

- Providing reports. The main documents are the financial report, balance sheet and others provided for by Federal Law No. 402.

The main job responsibilities of the chief accountant include:

Control of all areas of accounting.- Control over cash discipline and operations.

- Payment of insurance premiums.

- Tax policy analysis.

- Carrying out financial analysis.

- Formation of accounting information systems.

- Organization of accounting in the company.

- Preparation and approval of forms of various documents, work plans and other related documentation.

- Providing information to internal and external users.

- Carrying out inspections and audits.

- Monitoring the timely transfer of taxes to the budget.

- Formation of accounting policies at the enterprise.

- Control over the implementation of business transactions.

- Formation of documentation on shortages and illegal waste of residents’ funds.

The responsibilities of the chief accountant are not particularly different from the responsibilities of the same position in other areas of activity.

Postings in the accounting of the management company

Now let's look at the accounting entries, the number of which exceeds other calculations in the management company. To make it more convenient, we will divide them into two subsections, which we outlined earlier:

Purchasing resources:

- D20 K60 – purchase of electricity, water and gas from resource supply organizations;

- D19 K60 – VAT on purchased resources is reproduced;

- D68 K19 – VAT is omitted for deduction;

- D60 K51 – money was transferred as payment for purchased resources.

Providing services to residents of apartment buildings:

- D62 K90/1 – invoicing of utility organizations;

- D 90/2 K20 – displays the cost of the provided CG;

- D90/3 K68 – VAT calculated by the company;

- D51 K62 – payment from residents;

D60 K62 – transfer of money transferred from residents to resource supply companies.

This posting example is effective for management companies that use OSNO. When accounting using simplified accounting, the third and seventh points are excluded. VAT benefits under the general system are reflected in calculations in the following way:

- D20 K19 – VAT on purchased resources is reflected in the cost price.

The third and seventh points are also excluded. All these operations occur more often than others at the management company, but other transactions also occur. If such cases arise, please refer to the instructions for the chart of accounts, which is included in Order No. 94n of the Ministry of Finance.

What are the main wiring?

To purchase resources, management organizations use the following transactions:

- Debit 19, Credit 60 accounts.

- Debit 60, Credit 51 accounts.

- Debit 20, Credit 60 accounts.

- Debit 68, Credit 19 accounts.

The scope of provision of housing and communal services involves the use of:

Debit 90/2, Credit 20 accounts.- Debit 60, Credit 62 accounts.

- Debit 62, Credit 90/1 account.

- Debit 90/3, Credit 68 accounts.

- Debit 51, Credit 62 accounts.

All of the above postings are used if the management company has chosen the simplified tax system or OSNO.

However, under the simplified tax system there is a VAT exemption, so some of the above transactions do not apply.

OKVED

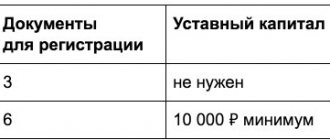

When a management company is registered, you need to select a code in the All-Russian Classifier of Types of Economic Activities (OKVED). This is necessary so that regulatory authorities are aware of the company’s activities. For management companies, this is code 70.32.1 (Management of housing stock activities). But often management companies set the value 70.32 (Real estate management), which connects three subtypes of activity.

To summarize, let's say that the accounting policies of the housing and communal services management company do not cause difficulties in calculations, since they are the same type of operations. The main thing is to maintain order and conduct housing and communal services and accounting at enterprises regularly without interruptions, and also act in accordance with the regulations and current laws. Then the controlling organizations will not ask any questions.

Everything about the accounting policy of the management company

UP is regulated by the Accounting Regulations and the Tax Code of the Russian Federation. The nuances of the procedure include:

- If there are no references to any specific features in the legislation, the Criminal Code has the right to independently develop instructions, regulations, etc.

- The company's accounting policy must include a note about the chosen taxation system.

- The activities of the management company are carried out taking into account the norms of tax legislation.

The accounting policy of the management company must include:

- Tax payments.

- Income and expenses.

- Wage.

- Accounting for materials.

- Settlements with resource suppliers.

So, we have looked at all the basic accounting rules. The simpler the organization’s management program is, the easier it is to keep records.

Postings used by the management company under the simplified tax system

For organizations that have introduced a simplified taxation system, only three accounts are used:

- Current account No. 51.

- Profit/Loss of enterprise No. 99.

- Tax payments, fees, deductions and calculations No. 68.

There are only two wires:

- Tax accrual No. 99.

- Display of tax payment No. 68.

We talked in more detail about how payments are made in housing and communal services in this article.

Taxation of housing and communal services management companies

All management companies can independently decide which taxation system to choose. There may be two options: simplified tax system or OSNO. Both options contain two types of tax:

- at a profit;

- Additional cost.

For the activities of management companies, this percentage is very large and very unprofitable. After all, everyone knows that some new management companies sometimes work negatively at first.

However, the advantage is the fact that VAT does not apply to services provided by management companies. This point is clearly explained by Article 149 of the Tax Code of the Russian Federation. At the same time, all provided management services have a single price, so the company is not particularly able to earn any profit from this.

If we talk about the simplified tax system, it is used by small companies. As a rule, the income of such companies does not exceed 60,000,000 rubles, and the staff is no more than 100 people. The simplified tax system is the most beneficial for management companies, which is why many companies work with it.

OKVED in the housing and communal services sector

Any management company conducts its activities with the aim of making a profit. In this regard, all companies are required to undergo appropriate registration and receive a code from the All-Russian Classifier.

This code is assigned so that the tax authorities are aware of what activities a particular organization is engaged in. Legal entities do not have the right to start their activities without receiving a code. The following codes are relevant for the Criminal Code:

These figures indicate that the company carries out activities related to real estate management, accounting and inventory.

To summarize, we note that maintaining accounting records in a management company is not difficult if a competent, educated and experienced specialist does it. The main thing that needs to be done is to correctly formulate an accounting policy, decide on the taxation system and know the basic transactions. An up-to-date chart of accounts should always be at the accountant’s workplace. You should also keep up to date with ongoing accounting updates. As a rule, changes occur quite often.

By following these rules, you will prevent problems with maintaining accounting and tax records in management companies, as well as difficulties with the tax authorities.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

As you know, providing the population with public services, repairs and maintenance of housing stock is a troublesome and very expensive task. In this regard, it is quite understandable that management companies, created, as a rule, on the basis of former housing and communal services and housing complexes, want to apply a simplified taxation system that allows them to legally minimize tax liabilities. Our experience in tax consulting shows that management companies should pay special attention to the specific tax consequences of transactions they enter into in the interests of citizens.

Its main objectives are to ensure favorable and safe living conditions for citizens, proper maintenance of common property in an apartment building, resolving issues regarding the use of said property, as well as providing utilities to citizens living in an apartment building (Part 1 of Article 161 of the RF Housing Code).

The Housing Code of the Russian Federation provides for three forms of management of an apartment building (Part 2 of Article 161 of the Housing Code of the Russian Federation): directly by citizens, a homeowners' association (another specialized consumer cooperative) and a management company. The first two of these methods are beyond the scope of this study, so we will only consider legal relations that arise within the framework of management with the involvement of the Managing Organization.

In fact, housing legislation contains three cases when an apartment building can be managed by a management organization:

Part 1 of Article 162 of the Housing Code of the Russian Federation stipulates that a management agreement must be concluded in writing with each owner of premises in an apartment building.

As a general rule, the specific terms of the management agreement are determined by the general meeting of owners. However, if such a meeting does not approve such conditions, or the management agreement is concluded on the basis of a notification from the local government body (Part 4 of Article 161 of the RF Housing Code), the latter approves the form of the management agreement by its decision.

The subject of the management agreement is that the Customers undertake to pay, and the Management Organization undertakes to provide services and perform work on the proper maintenance and repair of common property in the house, provide utilities, and carry out other activities aimed at achieving the goals of the Management.

Thus, the management agreement, by its legal nature, is a mixed agreement with elements of contracting and paid services. This conclusion is confirmed by paragraph 3 of the Rules for the provision of utility services to citizens, which defines the contractor (which may be the Managing Organization) as a legal entity (individual entrepreneur) providing utility services, producing or purchasing utility resources and being responsible for servicing in-house engineering systems, with the use of which utility services are provided to the consumer.

In general, the activities of the Management Organization can be divided into two main components.

1. PROVISION OF PUBLIC SERVICES.

Thus, if the Managing Organization does not have its own facilities for the production of utility resources, it enters into a purchase and sale agreement with the resource supplying organization.

Obviously, with such a scheme for formalizing contractual relations (due to the requirements of the current legislation), it is impossible to say that the Management Company, in relations with the resource supply organization, performs the functions of an agent performing the task of the owners of residential premises.

Consequently, resource supply organizations are responsible for the proper fulfillment of the terms of the contract only to the Management Company.

In turn, the Management Company, in relations with citizens, cannot refer to a violation of the terms of the contract by the resource supplying organization.

If we consider the tax consequences of this type of activity, it should be noted that the revenue of the Management Organization must consist of all amounts received from residents, since they are income from sales (Article 249 of the Tax Code of the Russian Federation).

Particular attention should be paid to the fact that fees for utilities do not include remuneration to the Management Company (Article 154 of the Housing Code of the Russian Federation). In practice, this means that the acquisition of utility resources and the provision of utility services to citizens is carried out at one tariff approved in accordance with the established procedure (clause 15 of the Rules for the provision of utility services to citizens), that is, after settlements with the resource supplying organization, the Management Company does not have any profit, its income for tax purposes is equal to expenses.

2. MAINTENANCE, CURRENT AND OVERHAUL REPAIRS OF COMMON PROPERTY IN THE HOUSE.

The content of this type of activity is regulated by the Rules for the maintenance of common property in an apartment building, which determine the composition of common property and the requirements for its maintenance, as well as a list of types of work that do not relate to the maintenance of common property.

The management company may have the necessary capacity and labor resources to carry out maintenance and routine repairs on its own. At the same time, it may involve third parties to perform the specified work, unless a prohibition on this is established by the management agreement.

The type of activity under consideration contains both elements of a contract (current and major repairs) and paid services (maintenance of property). In this regard, relations related to the involvement of third parties are regulated by the rules on the general contractor and subcontractor.

In accordance with Article 154 of the Housing Code of the Russian Federation, fees for the maintenance and repair of residential premises include, among other things, fees for services and work on managing an apartment building. As a general rule, the amount of payment for the maintenance and repair of common property is determined by the general meeting of owners. However, in the case where the owners have not made a decision on choosing a management method, the amount of such fees is approved by local government bodies.

The specificity of this type of activity of the Management organization is that the owners pay for current and major repairs here and now, but in fact these works will be performed in the future, that is, the Management company accumulates these funds in its accounts until the general meeting of owners makes a decision on the need for repairs.

Of course, the question immediately arises: how should the Management Company determine its revenue?

Regarding the payment for housing maintenance, everything is clear: it is taken into account as part of the income from sales, since these services are provided in the current period. As for funds for repairs, they are also income from sales, but their accounting for tax purposes depends on the method used by the Management Company for determining income.

If the Management Organization applies a general taxation system and determines income on an accrual basis, it has the opportunity to classify funds for major repairs as deferred income in the form of advance payment for work and, on the basis of subparagraph 1 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, not to take them into account when forming the taxable base .

If the Managing Organization determines income using the cash method, the amount of payment for repairs must be taken into account by it in the period when they actually arrived at the cash desk (clause 2 of Article 273 of the Tax Code of the Russian Federation). The possibility of attributing these amounts to expenses is associated with the moment of actual completion and payment of repair work (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Management companies using the simplified taxation system must keep similar records. Since, by virtue of paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation, the date of receipt of income is the day of receipt of funds at the cash desk (cash method), payments for housing repairs should be taken into account in the period of its actual receipt from residents.

It seems that payment for repairs cannot be recognized as property received within the framework of targeted financing, since the list of cases of such financing given in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation is closed and is not subject to broad interpretation.

The Ministry of Finance of the Russian Federation comes to a similar conclusion, considering in a letter dated June 26, 2006 No. 03-11-04/2/128 the issue of taxation of repair fees received by HOAs: “... funds received from HOA members to pay for the cost of maintenance, maintenance and repair of housing stock, as well as payment of utilities, are not targeted revenues.

It should be noted that there is an alternative point of view discussed in this article, based, in particular, on the letter of the Ministry of Taxes of Russia dated 06.10.03 No. 22-2-16/8195-ak185, as well as on letters of the Ministry of Finance of Russia dated 14.11.05 No. 03-11-05/100 and dated June 26, 2006 No. 03-11-04/2/128.

Supporters of this position consider it possible to take into account only the amount of its remuneration as part of the income of the Management Organization, that is, they actually allow the use of the agency institution in the housing and communal services sector.

In conclusion, I would like to note that the need to include in the income of the Managing Organization all amounts received from citizens, as well as the high probability of losing the right to use the simplified tax system, encourage companies managing apartment buildings to seek legal ways of tax optimization of their activities, which, of course, exist .

Protect yourself from tax audits. An online course from a former employee of the Department of Economic Crimes, and now a well-known tax consultant, is now with a 50% discount. Now for only 2750 rubles.

You will learn to withstand the pressure of tax authorities, behave competently during interrogations and seizures, and protect yourself from criminals and subsidiaries.

Lots of practical advice and a minimum of theory. Training is completely remote, we issue a certificate. Hurry up to buy (we have five more courses at a discount).

Many management companies and homeowners associations want to work under a simplified taxation system. But not everyone knows how to switch to it and how it can turn out. On May 16, we held an online seminar at which Yuriy Romanchenko, a tax lawyer, spoke about the risks, opportunities and rules for operating a management company and homeowners association under a simplified taxation system.

General rules and features of maintaining accounting documents in the Housing and Communal Services

A management company is a commercial organization created to manage an apartment building and maintain it in proper condition (you can find out about the responsibilities of housing and communal services for the maintenance and repair of housing here). Most often, the management company also mediates between homeowners and organizations that supply resources.

Homeowners themselves choose the form of management of the management company or HOA. Accounting in housing and communal services organizations does not have a special legislative framework. Organizations themselves draw up a local regulatory document - the company's accounting policy based on PBU standards, recommendations and clarification letters from the Ministry of Finance.

MPZ

Inventory accounting is carried out in accordance with the standards of PBU 5/01 and is carried out using account 10 “Materials”. Receipt of goods and materials is recorded by posting Dt 10 Kt 60 (71), write-off - Dt 20 (25, 26) Kt 10 and is documented by a demand invoice.

Expenses

Expenses are accounted for on the basis of PBU 10/99 (approved by order of the Ministry of Finance dated May 6, 1999 No. 33n). Costs for repairs and maintenance of household property are recorded in Dt 20 accounts in correspondence with accounts of settlements with suppliers, accountable persons, etc., postings Dt 20 Kt 10 (60, 68, 69, 70, 71, 76, etc.) . If there are several divisions in a management company, then expenses are taken into account for each division and each house.

Costs that relate to the management of each structural unit are collected on account 25 “General production expenses” according to expense items: depreciation, wages, insurance premiums, rent, etc. All administrative costs for servicing the management apparatus are debited to account 26 “General expenses” .

At the end of the month, the balance of accounts 25 and 26 is closed in Dt 20, and 20 is distributed into the cost of sales Dt 90.2.

Mutual settlements

Since there are several types of mutual settlements: with home owners, with companies supplying various resources, their accounting differs. The most common of them is enshrined in clause 6.2 of Art. 155 of the Housing Code of the Russian Federation, when the Criminal Code is a party to an agreement on the provision of paid services. In this case, all funds received from apartment owners are classified as the organization’s revenue, and payments for services and resources from third-party companies are classified as expenses .

If a company receives targeted funds from the budget, for example, for major repairs, then these calculations are recorded on the 86th account “Targeted Financing”.

Postings:

- Dt 50 (51) Kt 86 - target DS received from the budget.

- Dt 20 Kt 10 (60) - materials written off (services received) to perform targeted work.

- Dt 86 Kt 20 - actual costs incurred are reflected in the composition of target funds.

The concept of a simplified tax system

The simplified taxation system or simplified taxation system is one of five special tax regimes, according to paragraph 2 of Art. 18 Tax Code of the Russian Federation. This regime is aimed at small businesses, and its goal is to simplify the calculation and payment of taxes when conducting business activities. The procedure for applying the simplified taxation system is regulated by the norms of Chapter 26.2 of the Tax Code of the Russian Federation.

Nevertheless, judicial practice has developed when courts recognize receipts of payments for utilities and housing services as income from management entities, homeowners' associations, and housing complexes. Therefore, there is no stable opinion about whether the simplified tax system makes their life easier.

We also note that under the simplified tax system, the taxpayer has the right to choose one of two objects of taxation specified in Art. 346.14 Tax Code of the Russian Federation:

- income;

- income reduced by expenses.

The procedure for switching to the simplified tax system

The transition to a simplified taxation system is voluntary. This can be done by organizations and individual entrepreneurs.

You can switch to the simplified tax system if, based on the results of 9 months of the year in which you submit an application to switch to the simplified tax system, the organization’s income did not exceed 45 million rubles excluding VAT, and from January 1, 2017 - 112.5 million (clause 2 of Art. 346.12 Tax Code of the Russian Federation).

In accordance with Art. 346.13 of the Tax Code of the Russian Federation, you can switch to the simplified tax system only from January 1 of the new year. To do this, an organization or individual entrepreneur must notify the tax authority about the change in taxation regime no later than December 31 of the year preceding the year of transition.

Newly created organizations and individual entrepreneurs can notify the tax authority about the application of the simplified tax system within thirty days from the date of registration of the person.

To switch to the simplified tax system, an application is submitted to the tax authority. The recommended forms for such applications are approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] If you do not want to use the order forms, write the application in any form. In this case, be sure to indicate in it:

- information about the organization,

- type of taxable object,

- average number of employees,

- cost of fixed assets.

Which organizations are not entitled to use the simplified tax system?

For management companies, homeowners' associations and residential complexes there are no restrictions on the use of the simplified tax system, since they do not engage in banking, microfinance activities and do not work with securities.

However, they may not be allowed to switch to the simplified tax system if:

- the average number of employees for the tax period exceeds 100 people;

- the residual value of fixed assets according to accounting data exceeds 150 million rubles;

- the organization is registered outside the Russian Federation;

- the organization did not notify about the transition within the established time frame;

- the organization has branches.

You will find a complete list of conditions under which it is impossible to switch to the simplified tax system in clause 3 of Art. 346.12 Tax Code of the Russian Federation.

Rent calculation

Rent calculations and housing and communal services accounting are automatically carried out in 1C. This is modern software that allows you to automate the calculation of utilities, rent, and tax accounting.

“1C: Calculation of rent and accounting for housing and communal services” - meets all the basic requirements of various enterprises in the housing and communal services sector, such as:

- UK.

- HOA.

- Cash settlement centers.

- Housing and maintenance departments.

- Subscriber departments of service providers.

The software is developed on the basis of 1C, the most popular accounting tool in Russia. This minimizes the cost of setting up, implementing and maintaining the program.

Advantages of switching to the simplified tax system for management units, homeowners' associations, residential complexes

In accordance with paragraphs 2, 3 of Art. 346.11 of the Tax Code of the Russian Federation, the use of a simplified taxation system exempts from payment of certain types of taxes:

1. Value added tax.

The exception is the import of goods into Russia.

2. Tax on property of organizations.

An exception is the calculation of the tax base based on cadastral value.

3. Corporate income tax.

An exception is tax paid on income taxed at the tax rates provided for in clauses 1.6, 3 and 4 of Art. 284 of the Tax Code of the Russian Federation - when paying dividends and securities.

Other taxes under the simplified tax system are paid on a general basis.

Reporting

On the basis of (clause 1 of Article 6 of the Law of December 6, 2011 No. 402-FZ), the Housing and Communal Services Management Company, like any other legal entity, is required to keep accounting records and submit reports .

The financial statements of the management company include:

- Balance sheet.

- Income statement.

- Explanations for the Report and Balance Sheet in text or tabular form.

- Statement of changes in equity.

- Cash flow statement.

Such a list is established by part 1 of article 14 of the Law of December 6, 2011 No. 402-FZ, paragraphs 2 and 4 of the order of the Ministry of Finance of Russia of July 2, 2010 No. 66n. If the management company is a small enterprise, then it submits only the Balance Sheet. (clause 85 of the Regulations approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

If the management company uses a simplified accounting procedure (clause 2, part 4, article 6 of Law No. 402-FZ of December 6, 2011), then financial statements must be submitted using simplified forms.

Find out useful information about housing and communal services from our experts. Read about free housing and communal services, as well as job descriptions for a plumber, foreman, chief engineer and emergency dispatcher.

Changes in the work of management bodies, homeowners' associations, residential complexes under the simplified tax system in 2021

From 2021, management companies, homeowners' associations and residential complexes that use a simplified taxation system will not be able to take into account as taxable income amounts received from owners to pay for utility services provided by third-party organizations (clause 4, clause 1.1, article 346.15 of the Tax Code of the Russian Federation) ). To do this, a resource supply agreement must be concluded between the management and resource supplying organizations.

This is good news for management companies, homeowners' associations and residential complexes, although it is not without difficulties. Thus, if the resource supply agreement is of an intermediary nature, the amount of the agency fee will have to be included in income. At an online seminar, Yuriy Romanchenko explained in detail how to correctly calculate tax expenses in such a relationship. You will find detailed recommendations in the recording of the online seminar.

When calculating income under the simplified tax system in the form of income reduced by the amount of expenses, receipts for utility services will not be taken into account in income and expenses.

At the same time, management companies, homeowners' associations and residential complexes still need to take other income into account as taxable income. Including:

- payment for the maintenance and repair of common property of the apartment building;

- payment for additional services.

Revenue still does not need to include:

- Budget funds allocated for shared financing of capital repairs of apartment buildings.

- Owner funds for targeted financing of capital repairs of the common property of the apartment building.

- Membership dues paid to a partnership or cooperative as a non-profit organization that are not associated with specific targeted programs.

- Contributions and donations from members of a partnership or cooperative for the formation of a tax reserve for current and major repairs of the common property of apartment buildings.

If there is non-taxable income of a management company, homeowners association, or residential complex, it is necessary to keep separate records, otherwise you will not be able to take advantage of the benefits and all income will have to be taken into account when calculating the simplified tax.

Yuri Mikhailovich noted that when using the simplified tax system, it is important not to miss a single nuance of such a system, otherwise the organization may lose the right to use it.

Work of an accountant in housing and communal services

An accountant in the housing and communal services sector is a separate specialization of an accountant. It is important for an employee to know his rights, responsibilities and powers. The management of the organization approves the job description. A local regulatory act is drawn up based on legislation, taking into account the peculiarities of the work of an accountant in this organization.

Rights

The list of rights must be included in the job description. Possible list of rights of an accountant in an organization:

- A housing and communal services accountant has the right to propose proposals for optimization of accounting or other departments of the company for discussion by the organization’s management.

- Receive information necessary to perform duties from other employees, including those higher in position.

- Represent the accounting department and its interests when interacting with other departments of the company.

Responsibilities

It is necessary to work through this list very carefully. An employee has the right not to perform those duties that are not specified in the job description.

An example of a list of responsibilities of a housing and communal services accountant:

- Conducting and developing events organized to improve the financial well-being of the company.

- Controlling the consumption of various resources and organizing accounting within the company.

- Maintaining and developing documentation that reflects the economic and financial activities of the organization.

- Calculation of the cost of various services provided by the organization.

- Optimization of accounting and formation of the company's accounting policy.

- Development and implementation of measures to improve and optimize the company’s financial activities.

- Carrying out professional instructions and instructions from the head of the organization.

The list may include several dozen items, depending on the amount of work expected.

Requirements

The main competencies of an accounting employee in housing and communal services usually include:

- PC proficiency at least at the user level.

- Knowledge of a foreign language at least at a basic level.

- Professional training of an accountant.

- Team communication skills.

- In a large organization - management skills.

- Resourcefulness.

An employee partially acquires or develops these skills during the course of work; only an ideal employee can fully possess them.