The patent tax system is the only special regime available only to individual entrepreneurs. Often, buying a patent turns out to be more profitable than paying taxes under other regimes.

Read more: Patent for individual entrepreneurs for 2021: types of activities

However, in 2021, the constituent entities of the Russian Federation received the right to establish the potential annual income for PSN without restrictions. This has led to the fact that the cost of patents in some regions has increased significantly (for example, in the Stavropol Territory up to 10-12 times).

But there is also a positive aspect - from 2021, an individual entrepreneur can reduce the cost of a patent for insurance premiums transferred for himself and his employees. Therefore, we recommend first using a patent calculator to compare the tax on PSN with the tax burden on other taxation systems. If necessary, you can contact us for a free consultation.

Free tax consultation

If you are convinced that PSN is the best option for you, then you need to submit an application for a patent to the inspectorate, its other name is form 26.5-1.

Please note: from January 11, 2021, a new application form is in effect, approved by Federal Tax Service order No. KCh-7-3 dated December 9, 2020/ [email protected] All previous forms (from Federal Tax Service order No. MMV-7- dated July 11, 2017 3/ [email protected] , letters dated 02/18/2020 SD-4-3/ [email protected] and dated 12/11/2020 N SD-4-3/20508) have lost their validity.

Who can apply the patent tax system and on what grounds?

The patent taxation system or patent for individual entrepreneurs is the only special regime available only to individual entrepreneurs who operate in the region where the law of the constituent entity of the Russian Federation has decided to introduce a patent taxation system.

PSN can be applied simultaneously with other taxation regimes, but only in relation to the types of business activities specified in paragraph 2 of Art. 346.43 Tax Code of the Russian Federation.

There are restrictions on the transition to a patent - the average number of employees for all types of business activities carried out by an individual entrepreneur should not exceed 15 people , annual income cannot exceed 60 million rubles .

Who has the right to use a patent

Only individual entrepreneurs have the right to acquire a patent. There are a number of restrictions:

- activities of individual entrepreneurs under an agreement on joint activity, simple partnership or trust management of property (clause 6 of Article 346.43 of the Tax Code of the Russian Federation);

- retail sale of a number of excisable goods, such as cars, motorcycles with a power of 150 hp or more. pp., gasoline, some types of fuels and lubricants;

- sales of products subject to mandatory labeling with identification means (medicines, fur products);

- the average number of hired personnel of individual entrepreneurs for PSN for the tax period is a maximum of 15 people;

- if an individual entrepreneur is engaged in retail trade or catering services, then the area of the premises used for business activities from 01/01/2021 should not exceed 150 m2.

An exhaustive list of types of activities for which the use of PSN is possible is contained in clause 2 of Art. 346.43 Tax Code of the Russian Federation.

Advantages of PSN

The benefits of a patent include:

- fixed cost of a patent, which does not depend on the actual income received and is calculated based on the amount of potential annual income established by regional law, taking into account the following indicators: the number of employees or vehicles, the area of a store or cafe, etc.;

- the use of PSN provides for exemption from the obligation to pay VAT and personal income tax, property tax for individuals (in terms of property used in carrying out types of business activities in respect of which the patent taxation system is applied);

- An individual entrepreneur has the right not to submit a tax return;

- stage-by-stage patent payment;

- “tax holidays” are established by regional laws for individual entrepreneurs registered for the first time as individual entrepreneurs.

Features of PSN in 2021

Law No. 373-FZ dated November 23, 2020 introduced changes to a number of articles of the Tax Code of the Russian Federation. The main changes in the patent system from January 1, 2021 are the following:

- PSN payers now have the right to reduce the amount of tax by the amount of insurance premiums;

- the list of activities for which it is possible to obtain a patent has been expanded with repair, maintenance and car washing, as well as parking services;

- for retail trade and catering, premises area restrictions have been increased from 50 m2 to 150 m2.

Useful information from Consultant Plus

See a typical situation on how to switch to PSN and apply this tax regime.

Conditions for using PSN

To apply the PSN, it is necessary to submit an application for the use of a patent to the tax office at the place of implementation of the planned activity.

An application is submitted for each type of planned activity no later than 10 days before the start of application of the PSN.

If an individual entrepreneur plans to apply a patent from the date of his registration as an individual entrepreneur, then an application for a patent is submitted simultaneously with the documents for registering an individual as an individual entrepreneur. In this case, the validity of the patent begins from the day of its state registration as an individual entrepreneur.

Application methods:

- personally or through a representative;

- direction in the form of a postal item with a list of attachments;

- transmission in electronic form via telecommunication channels.

A patent is issued from any date, for a period from one to twelve months inclusive, within a calendar year.

Payment of the patent cost

The period for paying for a patent depends on how long it was issued. If for less than 6 months, then you need to pay its cost in one amount until the end of the validity period. If the patent is valid for 6-12 months, then its cost is paid in 2 stages:

- 1/3 - within 90 days after it began to act;

- 2/3 - until the expiration date.

Note! Previously, if the full cost was not paid, the individual entrepreneur lost the right to apply the patent. This rule has now been canceled. That is, you will have to pay for the patent in any case, but in case of delay, penalties will be charged.

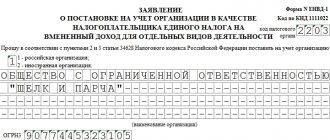

Patent application form according to form 26.5-1

The patent application form (Form N 26.5-1) was approved by Order of the Federal Tax Service of the Russian Federation dated July 11, 2017 No. ММВ-7-3/ [email protected] The same document regulates the procedure for filling out the form.

IP patent applications (PDF)

IP patent applications (XLS)

The application must be filled out:

- handwritten in black, purple or blue ink;

- using a computer.

It is not allowed to correct errors, double-sided printing of a paper document, or stapling together sheets of documents.

The pages of the Application and its annexes are numbered consecutively, starting from the first page.

NEWFORMES.RF

In this article we will look at the patent taxation system for an individual entrepreneur and the procedure for obtaining a patent for an individual entrepreneur independently step by step.

- What is a patent for an individual entrepreneur?

- What are the advantages of a patent for an individual entrepreneur?

- What types of activities are covered by a patent for individual entrepreneurs?

- What taxes does a patent exempt an individual entrepreneur from?

- What are the requirements for obtaining a patent for an individual entrepreneur?

- What is the validity period of a patent for an individual entrepreneur?

- What is the tax period of a patent for an individual entrepreneur?

- How to calculate the cost of a patent for an individual entrepreneur?

- Calculator for calculating the cost of an IP patent

- How to switch to a patent tax system?

- How to obtain a patent for an individual entrepreneur?

- How to pay for a patent for an individual entrepreneur?

- How to renew a patent for an individual entrepreneur?

- When is the right to use an individual entrepreneur’s patent lost?

- Step-by-step instructions for obtaining a patent for individual entrepreneurs

Patent Application 2021

To obtain a patent, an individual entrepreneur must submit to the tax authority an application for a patent in the form approved by order of the Federal Tax Service of Russia dated November 18, 2014 No. ММВ-7-3/ [email protected] (with the exception of taxpayers applying a tax rate of 0% (reduced tax rate)).

— new application form for an IP patent 2021 (valid from 02/09/2016)

From February 9, 2021, an individual entrepreneur applying a tax rate of 0% (reduced tax rate established by the law of a constituent entity of the Russian Federation) submits an application for a patent in accordance with the Explanations of the Federal Tax Service of Russia dated July 1, 2015 No. GD-4-3/ [email protected ] “On filling out the recommended patent application form for taxpayers applying the 0% tax rate (reduced tax rate)” according to the recommended form.

- new recommended application form for IP patent 2021, applying a tax rate of 0% (reduced tax rate)

What is a patent for an individual entrepreneur?

The patent taxation system was introduced on January 1, 2013 in relation to a number of activities carried out by individual entrepreneurs. This special tax regime can only be applied by individual entrepreneurs operating in the region where the law of the constituent entity of the Russian Federation has decided to introduce a patent taxation system. PSN is designed to make the life of an individual entrepreneur as easy as possible; it provides for the exemption of the entrepreneur from a number of taxes, is voluntary and can be combined with other taxation regimes.

What are the advantages of a patent for an individual entrepreneur?

Convenience is the main advantage of the patent. I bought a patent for an individual entrepreneur and there is no longer a need to appear at the tax office. No declarations, no taxes, just insurance premiums. That is why, even at the start, many businessmen rushed to acquire coveted patents.

When applying the patent taxation system, individual entrepreneurs have the right not to keep accounting records, and may also not use cash register systems when making cash payments or payments using payment cards.

The calculation of the amount of tax to be paid is made by the tax authority directly in the patent and, accordingly, is clear to the taxpayer.

Thus, there are obvious advantages of using the patent taxation system in its simplicity, transparency, and the possibility of application for many types of business activities.

What types of activities are covered by a patent for individual entrepreneurs?

The list of types of business activities subject to taxation within the patent tax system is limited. To find out what types of services are subject to the patent tax system in a particular subject of the Russian Federation, you need to familiarize yourself with the law governing the application of a special tax regime in this subject. The Classifier of types of business activities in respect of which the law of a constituent entity of the Russian Federation provides for the use of a patent taxation system (KVPDP), which contains types of patents for individual entrepreneurs and the laws of constituent entities of the Russian Federation that provide for the application of a patent taxation system, will help you with this.

What taxes does a patent exempt an individual entrepreneur from?

Individual entrepreneurs who have switched to a patent tax system are exempt from paying three taxes: VAT, personal income tax, and personal property tax.

What are the requirements for obtaining a patent for an individual entrepreneur?

Only individual entrepreneurs with an income of up to 60 million rubles, whose average number of employees for all types of activities does not exceed 15 people, have the right to apply the patent taxation system. For them, you must continue to pay insurance contributions to the pension fund and the compulsory health insurance fund. An individual entrepreneur under the patent taxation system is required to maintain an Income Book.

What is the validity period of a patent for an individual entrepreneur?

A patent is issued from any date, for a period from 1 to 12 months inclusive within a calendar year. This means that a patent for a year can only be obtained from the beginning of the year.

What is the tax period of a patent for an individual entrepreneur?

The tax period of a patent for an individual entrepreneur is one calendar year. If a patent is issued for a period of less than a calendar year, the tax period is the period for which the patent was issued. In the event of termination of a business activity in respect of which the patent tax system was applied before the expiration of the patent, the tax period is recognized as the period from the beginning of the patent until the date of termination of such activity.

How to calculate the cost of a patent for an individual entrepreneur?

The tax rate is 6% and does not depend on the amount of income actually received by an individual entrepreneur, but is determined based on the amount of potential annual income established for each type of activity, determined by the law of the constituent entity of the Russian Federation. To find out the amount of potential annual income and calculate how much a patent costs for an individual entrepreneur, you need to familiarize yourself with the law governing the application of a special tax regime in this constituent entity of the Russian Federation or use the calculator for calculating the cost of a patent for an individual entrepreneur, which is presented in this article.

An example of calculating the cost of a patent with a validity period of 12 months:

PD * 6% = SP

where PD is potentially receivable income, 6% is the tax rate, SP is the cost of a patent for an individual entrepreneur.

Let's consider the cost of an annual patent for performing translations from one language to another without employees in the Rostov region:

100,000 rub. * 6% = 6000 rub.

If the patent was issued for less than a year, for example, an individual entrepreneur’s patent for 2016 when switching to PSN from May:

(PD / 12 months * number of months of the period for which the patent was issued) * 6% = SP

(100,000 rub. / 12 * * 6% = 4,000 rub.

* 6% = 4,000 rub.

Calculator for calculating the cost of an IP patent

GO TO FULL SCREEN MODE

How to switch to a patent tax system?

To switch to a patent taxation system, you must submit the appropriate application no later than 10 days before the start of application of the patent taxation system - Form 26.5 1.

How to obtain a patent for an individual entrepreneur?

An application for a patent can be submitted simultaneously with the registration of an individual entrepreneur, or no later than 10 days before the start of application of the patent tax system to the individual entrepreneur (Clause 2 of Article 346.45 of the Tax Code of the Russian Federation). When an individual entrepreneur conducts several types of business activities, a patent must be purchased for each type of activity separately. When carrying out activities at the place of residence, the application is submitted to the tax authority at the place of residence, and when carrying out activities in a subject of the Russian Federation in which the entrepreneur is not registered with tax authorities, the individual entrepreneur submits an application for a patent to any territorial tax authority of this subject of the Russian Federation of his choice. The period for issuing a patent by the tax authority is 5 days from the date of filing the application for a patent.

How to pay for a patent for an individual entrepreneur?

An individual entrepreneur who has switched to a patent taxation system pays tax at the place of registration with the tax authority.

If the patent is received for a period of up to 6 months:

- in the amount of the full amount of tax no later than the expiration date of the patent.

If the patent is received for a period of 6 to 12 months:

- in the amount of 1/3 of the tax amount no later than ninety calendar days after the patent comes into effect;

- in the amount of 2/3 of the tax amount no later than the expiration date of the patent.

How to renew a patent for an individual entrepreneur?

To renew an individual entrepreneur’s patent for the next year, you must submit an application to the territorial tax authority before December 20 of the current year. The patent is paid for using the details of the tax office where it was received. Patent renewal must be done in a timely manner. If the patent was not paid on time or the payment amount was less than the established one, then the individual entrepreneur loses the right to use the patent. An individual entrepreneur who has lost the right to use a patent switches to OSNO and will be able to switch again to the patent taxation system for the same type of business activity no earlier than the next calendar year.

When is the right to use an individual entrepreneur’s patent lost?

1. If, since the beginning of the calendar year, the taxpayer’s income from sales for all types of business activities to which the patent taxation system is applied has exceeded 60 million rubles;

2. If during the tax period the average number of employees for all types of business activity exceeded 15 people;

3. If the taxpayer did not pay the tax on time.

An application for loss of the right to use the patent taxation system and for the transition to a general taxation regime, form 26.5-3, is submitted to the tax authority within 10 calendar days from the date of the occurrence of the circumstance that is the basis for the loss of the right to use the patent taxation system.

In case of termination of business activity in respect of which the patent taxation system is applied, deregistration is carried out within 5 days from the date the tax authority receives the Application for termination of business activity in respect of which the patent taxation system was applied, form 26.5-4.

Step-by-step instructions for obtaining a patent for individual entrepreneurs

1.

If you have not yet registered as an individual entrepreneur, then read the article Self-registration of an individual entrepreneur.

2.

Download the current patent application form form 26.5-1 in PDF format. Or the recommended form 26.5-1 of an application for a patent for individual entrepreneurs applying a tax rate of 0% (reduced tax rate, if established by the law of your constituent entity of the Russian Federation).

3.

We fill out the form, a sample of filling out the application form 26.5-1 will help you with this. Follow the instructions in the footnotes.

Information required when filling out form 26.5-1:

— find out the code of your tax authority;

— find out the postal code of the address;

— find out the code of the subject of the Russian Federation;

— find out the OKTMO code;

— name of the type of business activity and its identification code established by the law of the subject of the Russian Federation;

— the address of residence is indicated in accordance with the passport;

— sheet 3 of the application must be filled out and printed when carrying out any type of business activity, except for those specified in subparagraphs 10, 11, 19, 32, 33, 45, 46 and 47 of paragraph 2 of Art. 346.45 Tax Code of the Russian Federation;

— sheets 4, 5 of the application are filled out and printed when carrying out the types of business activities specified in subparagraphs 10, 11, 32, 33 and 19, 45, 46, 47, paragraph 2 of Art. 346.45 of the Tax Code of the Russian Federation, respectively;

— the filing date of the application must be indicated at least 10 days before the patent commencement date.

4.

We go to the tax office, taking our passport with us, and submit an application to the inspector at the registration window. We receive a receipt for the documents submitted by the applicant to the registration authority.

5.

A week later (5 working days) we go with a passport and a receipt to the tax office and receive a patent, and also ask for details for paying for the patent.

6.

We pay for a patent if the patent is received for a period of up to 6 months:

- in the amount of the full amount of tax no later than the expiration date of the patent.

If the patent is received for a period of 6 to 12 months:

- in the amount of 1/3 of the tax amount no later than ninety calendar days after the patent comes into effect;

- in the amount of 2/3 of the tax amount no later than the expiration date of the patent.

7.

We keep tax records of income from sales in the income book of an individual entrepreneur who uses the patent tax system. The form and procedure for filling out the income accounting book are approved by Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n.

Do you want to prepare an application for an individual entrepreneur patent, but you don’t want to understand the intricacies of filling out Form 26.5-1 and are afraid of being refused? Then a new online document preparation service from our partner will help you prepare an application for an individual entrepreneur patent without errors for 1,290 rubles. The price includes a review of the application by a lawyer. You will be sure that the documents are prepared correctly, the lawyer will send you the results of the check, recommendations and comments. All this within one working day.

IP patent - all about the patent tax system

We have a video on this topic:

The official requirements for obtaining an individual entrepreneur patent can be found on the Federal Tax Service website.

You may also be interested in the following articles: Registration of an individual entrepreneurChanges to an individual entrepreneurClosing an individual entrepreneurExtract from the Unified State Register of EntrepreneursPrint of an individual entrepreneur's account Leave your comments and suggestions for improving this article in the comments.

Procedure and sample for filling out a patent application

A patent application consists of five sections:

- title page - general information about the entrepreneur and the validity period of the patent;

- page 002 – name of the type of activity for which the individual entrepreneur plans to obtain a patent, availability of hired personnel, tax rate;

- sheet A – information about the place of business activity;

- sheet B - information about vehicles used in carrying out activities for the transportation of goods and passengers;

- sheet B - information about the objects used in the implementation of activities for leasing premises; retail; provision of catering services.

The first two sections are completed by all applicants, and then only the section on the relevant line of business is completed.

For example, let’s fill out a patent application for an individual entrepreneur planning to provide services to the public for the supervision and care of children and the sick. The start date of activity is 07/01/2019 (6 months).

Title page

On the title page we fill in the registration data of the individual entrepreneur:

- individual number (TIN) of an individual entrepreneur;

- INFS code at the place of activity (you can find out here);

- last name, first name and patronymic of the individual entrepreneur (without abbreviations);

- OGRNIP (indicated only if the Unified State Register of Individual Entrepreneurs registration sheet has already been issued);

- full IP registration address;

- declared number of months of patent validity;

- date of commencement of application of the PSN;

- number of completed sheets.

The lower left block is intended to confirm the entered information, indicate a contact phone number and the date of submission.

Please note: a patent can be issued from 1 to 12 months within one calendar year. When obtaining a patent for a year, you must indicate 12 months, and the validity period is from the first of January. For the new calendar year, you must fill out a new application.

Page 002 Statements

We write down the full name of the type of activity and the identification code of the type of entrepreneurial activity in accordance with the “Classifier of types of entrepreneurial activities in respect of which the law of the constituent entity of the Russian Federation provides for the use of a patent taxation system (KVPDP)” (approved by Order of the Federal Tax Service of Russia dated January 15, 2013 N MMV-7 -3/ [email protected] ).

How to fill out an application using Elba if you have already registered an individual entrepreneur

To do this, go to the “Details” section → “For reporting” → “Submit a patent application” or click on the “Create a patent application” link in the “Current tasks” section.

A step-by-step task will open. Fill out the form, Elba will take the rest of the data from the details.

Step 1. Fill in the details

The patent can begin on any date, but we recommend specifying the first of the month. Many tax authorities do not accept applications with a different date.

The tax rate is almost always 6%. This does not mean that you will pay 6% on proceeds. For each type of activity on a patent, the regions determine the amount of expected income. It is from this fixed amount that you will pay the rate.

If you fall under a tax holiday, choose a 0% rate. Indicate the clause and article of the regional law that introduced holidays for your business. A 0% rate means that you do not need to pay for a patent.

In Crimea and Sevastopol the rate is 4%. Elba will substitute it automatically when you select a region.

Step 2: Specify objects

What this step will be depends on your type of activity.

If your business is retail or public catering , select an object, fill in its address, indicate the object's characteristics and area.

It is sometimes difficult for retailers to determine the difference between a store and a pavilion. Clause 3 of Article 346.43 of the Tax Code of the Russian Federation provides the following definitions:

- Store - a specially equipped building (part of it) intended for the sale of goods and provision of services to customers and provided with retail, utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale;

- Pavilion is a building that has a sales area and is designed for one or more workplaces.

To fill in the sign and area, the regional patent law will be useful. In some regions, the cost of a patent depends only on the area of the sales floor or service area, and in others - on the total area of the store or cafe.

There are eight attributes of an object, but retail and catering need to choose one of three. The first sign is intended for rental, 2-4 - for retail, 5-7 - for catering, and the last one - for parking lots.

| Code | Sign | When to indicate |

| 1 | The area of the rental property. | You rent out residential or non-residential premises, a garden house or a plot of land. |

| 2 | The area of a stationary retail chain facility with a sales floor. | There is a trading floor. In your region, potential income depends on the total area of the store or pavilion. |

| 3 | The area of the trading floor for the object of trade organization. | There is a trading floor. In your region, potential income depends on the size of the sales floor. |

| 4 | The area of a retail space in a stationary retail chain facility that does not have a sales floor. | There is no trading floor. Trade at a retail market, fair or kiosk. |

| 5 | The area of a catering facility that has a customer service hall. | There is a service hall. In your area, the potential income depends on the total square footage of the restaurant, bar, cafe or eatery. |

| 6 | The area of the customer service hall at the catering facility. | There is a service hall. In your region, potential income depends on the size of the service area. |

| 7 | Area of a catering facility that does not have a customer service hall | There is no service hall. You sell through a kiosk, tent or culinary department at a restaurant, bar, cafe or other catering outlets. |

| 8 | Vehicle parking area | Activities of parking lots for vehicles |

If you are renting out real estate , click on the “Add property” button and select what you are renting out: land, residential or non-residential premises. Fill in the address and select the attribute “1 - area of the property being rented out.”

If you transport cargo or passengers , you will see the “Add vehicle” button. Select the type of vehicle and indicate the characteristics from the documents for it.

For other types of activities, simply indicate the address where you plan to work. If there is no specific address, do not fill in anything, but proceed directly to the next step to submit the application.

Step 3. Submit the application to the tax office

Sign and submit the application. If you do not have an electronic signature, print it out and submit it on paper. In 2021, the tax office accepts applications until December 31.

Once submitted, you will receive an acceptance receipt or rejection notice. The inspection does not send the patent electronically, so after 5 days it is better to pick it up on paper - the cost and payment details will be indicated there. In addition, the counterparty may ask for a scan of the patent to make sure that you are working in a special mode without VAT.

In fact, it is not necessary to go to the tax office. You can calculate the cost of a patent using a calculator, and create a payment using the tax service. If you are worried that you might make a mistake with the payment, pick up the patent on paper.

Information about the patent will appear in the taxpayer’s personal account: number, validity period and payment calendar.

From 2021, patent laws will change. On Elba's blog we talked about the changes and answered frequently asked questions.