Conservation of an unfinished construction project is necessary in cases where the construction work of the facility cannot be completed within the planned period. The reason may be a lack of money to complete the project in full, unfavorable weather conditions, and so on. Conservation is a process that involves the resumption of construction work in the future. That is why contract agreements are not terminated, but are suspended for a certain period.

Many people confuse the concept of conservation and stopping construction work. In the latter case, activities can be resumed, but a mandatory condition is the replacement of the investor. In conservation, the person who financed the project remains unchanged. In addition, stopping construction allows the construction to be implemented or liquidated in the future.

To understand the topic, we will consider the features of conservation of an object, the procedure for performing such work, the necessary documents, the subtleties of drawing up a cost report (estimate) and other nuances.

Introductory information

It doesn’t matter what the reason is - either the approaching winter, or the lack of need for buildings. There should always be a conservation project for buildings and structures. It is also necessary to clearly understand what goals are being pursued and what tasks are facing the people carrying out the process. Let's look at the introductory information from which we will build. Let's assume that a building is being constructed. But there is no way to complete it before the start of the winter period. And according to technology, construction processes must be carried out at above-zero temperatures. Therefore, it became necessary to postpone the entire range of necessary work until a better time. And for this it is necessary to protect the object from precipitation and temperature changes.

Nuances of paying taxes

As part of conservation, both transport tax and property tax are paid. If the organization is on OSNO, the tax burden is reduced by this amount. There is no need to reinstate VAT. However, sometimes such a need arises:

- Mothballed fixed assets are transferred to the authorized capital of another company.

- The company switches to a different tax system.

- The property, after the termination of conservation, will be used in work that is not subject to VAT.

In all these cases, you need to look for primary documentation and then restore VAT.

Main goal pursued

The highest priority should be protection from moisture. Why? As you know, water, when it turns into ice, increases in volume. If you do not protect the joints and seams from moisture, then the structural elements will begin to collapse and deform after the onset of frost. To protect against precipitation, temporary simple structures made of inexpensive and accessible materials are erected over unfinished objects. Window and door openings must be closed using roofing felt or glassine. You can use plywood panels and, in very rare cases, polyethylene film (it is convenient to seal non-standard shaped holes). In order not to resolve issues during the process, it is necessary to create an adequate and detailed project for the conservation of the building.

Recommendations for preserving building materials for the winter

No matter what stage of construction the house is in winter, there will be materials on the site for which low temperatures do not bode well. Therefore, it is worth taking care of their safety in advance according to the advice of professionals.

Wood is stored in stacks. Waterproofing coatings and roofing must either be covered with film or laid under a canopy. The main thing is that the storage area is dry. Antiseptics and paints are stored in tightly closed containers. Otherwise, they will either dry out or erode, losing their consumer properties. Bulk materials - cement, lime, alabaster cannot be stored outdoors, only indoors, where there is no cold and moisture.

Refusal of conservation is associated with a high probability of damage to building materials. Moisture and frost will do their job, it will be impossible to use such materials. Constructed walls may become warped. Therefore, refusing to preserve a house for the winter in order to save a small amount of money can lead to severe material losses after the cold season.

EVEREST

About the foundation

Let's start with the very basics. It is better to leave the foundation and ground floor of a stone house (as well as concrete and brick) for a year without load. This is necessary so that it settles and settles. Wooden buildings do not need such a period of time. After all, they are lighter and create less load on the base. Considering that in our latitudes the snow cover regularly exceeds 0.5, the foundation must be prepared in the most careful manner. The first step is to carefully inspect the base. If you find cracks and leaks into which water can seep, they must be sealed. If weather conditions no longer allow working with cement mortar, then the foundation walls must be closed. For this, as a rule, roofing material is used. If waterproofing is already provided, then you just need to close its upper part so that precipitation does not fall on it. You also need to take care that melt water does not accumulate near the foundation strip. To do this, grooves are laid around the perimeter. If the terrain does not allow this, then it is necessary to take care of waterproofing.

Investor accounting

If the construction of an object is financed by an attracted investor, he reimburses the developer for costs associated with the conservation of an unfinished construction project (Article 10 of the Law of December 30, 2004 No. 214-FZ).

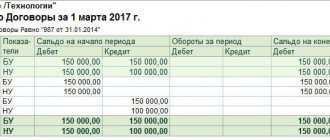

Situation: how can an investor reflect in accounting the costs associated with the conservation of an unfinished construction project?

These costs, including the costs of maintaining mothballed property, should not be included in the cost of construction (clause 3.1.7 of the Regulations approved by letter of the Ministry of Finance of Russia dated December 30, 1993 No. 160, clause 8 of PBU 6/01). Such costs form the investor’s other expenses (clause 11 of PBU 10/99). Reflect them on account 91 “Other income and expenses”. This procedure follows from paragraph 11 of PBU 10/99, Instructions for the chart of accounts and letter of the Ministry of Finance of Russia dated January 13, 2003 No. 16-00-14/7.

Make the following entries in accounting:

Debit 76 subaccount “Settlements with the developer” Credit 50 (51...) – funds were transferred to the developer to compensate for the costs of mothballing an unfinished construction project, as well as the costs of maintaining a mothballed object;

Debit 91-2 Credit 76 subaccount “Settlements with the developer” - expenses for the conservation of an unfinished construction project, as well as the costs of maintaining a mothballed object, are taken into account as part of other expenses as reports are received from the developer.

About the foundation with a basement

In this case, quite serious problems arise. Preservation of a building requires that the temporary shelter be secure. After all, if water leaks, it can tear the entire structure. In this case, there is one popular method: you need to throw plastic bottles, one-third filled with water, into the basement. Then, when the water freezes, most of the expansion forces will be taken on by bottles immersed in the volume of ice and more susceptible to compression, and the basement will not be damaged. This method allows you to ensure the safety of the structure, but it is desirable to have 3-4 large containers per square meter.

What is unused property

Unused property is considered to be property that is temporarily not involved in the main activities of the organization. The reasons why this may be the case are various:

- change in production volumes;

- transition of the organization to another type of activity;

- property being repaired;

- seasonal activities of the organization;

- obsolescence of fixed assets (obsolescence), etc.

REFERENCE! Such fixed assets can be equipment or (more often) real estate.

If it is planned to use this asset again after a certain time, this means that from an accounting point of view it is “mothballed”. You can rent out an unused OS or sell it - that is, one way or another, bring it back into economic circulation.

Temporary roofing

Construction may stop during the construction of walls and interfloor ceilings. In this case, it is necessary to protect horizontal sections of the structure from precipitation. This is especially true in cases where the walls are made of slotted bricks or are multi-layered (for example, stone and concrete blocks are combined). It is necessary to put together a lattice of boards over the unfinished building. It is covered with roofing felt on top. This is a temporary roof. You can also build a rafter structure with a sheathing of uncut boards and cover it with roofing felt on top. There is no need to cover the outside walls with anything. Nothing will happen to facing or rough brickwork in winter. Water will drain from vertical surfaces. And the moisture that the pores do absorb has an insignificant volume. Therefore, it will not cause destruction.

Specific issues with the roof

The easiest way to carry out building conservation work is with log houses. After all, they are built from a material that is naturally well adapted to changes in temperature and humidity conditions. Wood, depending on weather conditions, can both absorb moisture and give it back. Therefore, in log houses, only the upper crown is protected from direct precipitation. If the house does become damp during the winter, then in fact it will suffer almost no damage. Unless the shrinkage process will take an additional few years. Not the worst option. For example, complete insulation of wooden walls thanks to plastic film only creates the illusion of safety. In reality, such “protection” causes more harm. After all, moisture, due to the tightness of the film, will not be able to evaporate, but will condense on the surface. In places where the walls and polyethylene come into contact, drops of condensation will be absorbed, preventing the wood from drying out. Therefore, a log house covered with film rots faster than just an open one. A situation may arise when the roof of the house is partially completed by the end of the construction season. For example, rafters have been made and there is sheathing, but the actual roofing material has not been laid. In this case, it is necessary to make a temporary shelter on top to protect the building from partial destruction. Roofing material is laid over the finished rafters, which is secured with slats. This is a particularly important rule for frame houses. After all, if they get wet and iced up, their weight will increase significantly. And due to thrust forces, an unfinished frame house may collapse.

Required documents

Inventory is only the first stage of registration of conservation procedures. After this, an act on the “freezing” of construction work is drawn up, drawn up in the form KS-17 (approved by the Resolution of the State Statistics Committee of the Russian Federation). The finished document reflects the following information:

- The name and purpose of the object, the construction of which is “frozen”.

- The day when construction began.

- Estimated price of work according to agreement.

- Actual cost of completed activities.

- Customer costs.

- The costs that the contractor has to endure when conserving the structure, as well as its security.

See also: Examination of design documentation for a residential building: how to pass it without problems

On the basis of the act, another document is drawn up - an estimate of future work. After completing the required calculations, the developer’s accounting department pays the funds to the contractor. At the same time, specialists work with company accounts and submit reports to supervisory authorities.

About bureaucratic issues

If a person builds a house on his own, then he is accountable only to himself. But in the company things are a little different. So, it is necessary to issue an order for the conservation of the building. It should contain information on how to carry out this process. An alternative option is that there is a link to a standardized document that contains all the necessary data. After the process has been completed, you need to draw up a conservation act for the building. It must contain information about what actions were taken, where and what was fixed, and similar data, so that if the group of builders changes next year, they can quickly decide on the scope of work. Many people think that this is a burden. And you don’t need to create and fill out documents. Preservation of a building is a specific process. Even if the papers are justified only in some cases, they are necessary to avoid delays and negative consequences.

Single inventory object

As representatives of the Ministry of Finance of Russia indicated in Letter No. 03-03-06/1/8 dated January 16, 2008, if in accounting a building is accounted for as a single object of fixed assets, then in tax accounting it is an object of depreciable property as a whole. And in this situation, from the moment the order is issued to begin partial reconstruction of the building, depreciation on it is not accrued as a whole until the completion of the relevant work. Consequently, we can conclude that similar consequences occur when part of such a building is conserved.

According to clause 6 of PBU 6/01, the accounting unit of fixed assets is an inventory item. This is recognized as:

- object with all fixtures and fittings;

- a separate structurally isolated object designed to perform certain independent functions;

- a separate complex of structurally articulated objects, representing a single whole, which is intended to perform a specific job. A complex of structurally articulated objects is understood as one or more objects of the same or different purposes, which have common devices and accessories, common control and are mounted on the same foundation. As a result, each item included in the complex is capable of performing its functions only as part of this complex, and not independently.

Moreover, only if one object has several parts, the useful lives of which differ significantly, each such part is taken into account as an independent inventory object.

Based on this, the Ministry of Finance, in its explanations regarding real estate objects, to which the building belongs, indicates that their components can be taken into account as independent inventory objects if:

- such property does not require installation;

- it can be used separately from the property complex;

- its purpose does not coincide with the functional purpose of the entire complex;

- its dismantling will not affect their purpose.

These criteria, in particular, include elevators, built-in ventilation systems, local networks, and other building communications (Letters of the Ministry of Finance of Russia dated October 23, 2009 N 03-03-06/2/203, dated September 23, 2008 N 03- 05-05-01/57).

In addition, for tax accounting purposes, financiers appeal to the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 N 1. The presence in it of different useful life periods of parts of the operating system, such as, for example, an elevator and a building, they indicate, may indicate about the possibility of independent accounting of these objects. It is this approach that the judges support (Resolutions of the FAS Moscow District dated September 16, 2011 in case No. A40-130812/10-127-755, dated January 21, 2011 N KA-A40/16849-10, FAS Ural District dated February 17 2010 N Ф09-564/10-С3; FAS Volga District dated January 26, 2010 in case N A65-8600/2009; FAS Central District dated September 10, 2009 in case N A08-8752/2008-16) . However, such parts of the OS as individual premises of the building (levels, floors) are not named in the Classification.

In this sense, the building for which a single certificate of ownership has been issued (is being issued), which is a single object according to technical documentation, with a single cadastral number, by and large, should be taken into account as a single object in both accounting and tax accounting. And the company has no right to divide it only on the basis of conservation of its individual premises. This means that in this case, depreciation should be suspended for the building as a whole.

On the other hand, nothing prevents the organization from dividing the building, including in accounting, by re-registering the ownership rights to it as separate premises.

O. Kutko

Closing access

It is necessary to protect an unfinished house not only from negative weather influences. You should also remember about uninvited guests. General safety rules stipulate that access to the facility must be closed. And this is done not so much out of concern for lovers of easy money and homeless people, but for children who can sneak onto the construction site. To do this, it is necessary to block window and door openings, as well as completely cut off power to the object. This is done using rough frames made of boards. Ruberoid, glassine or plywood are stretched over them. It is better not to use plastic film for this purpose. This is due to the fact that it breaks easily. As a last resort, it is better to opt for reinforced film. Although if we are talking about log houses that need a certain time to shrink, then it is better to leave them with open window openings. This is necessary so that they are well ventilated. Of course, this is not always possible, and it is better to decide to do this only in a protected area. Attention should also be paid to the laid communications. So, if there is an autonomous water heating system, then it must be blown out with a compressor before the onset of winter in order to remove liquid and help preserve the pipe. The matter is not over yet. The water supply system should also be drained. In cases where the structure is preserved for more than one year, it is advisable to properly treat unventilated areas. These are ceilings from the basement and corners. For them you need to use antifungal and antibacterial compounds. If the conservation of the building is carried out only for one winter, then there is no need for this - at this time of year microorganisms practically do not multiply.

Documenting

The transfer of the mothballed facility to the developer (technical customer) also needs to be documented. There are no special forms of documents used to formalize the transfer of an unfinished construction project. You can use a unified form that is used to document a completed construction project (form No. KS-11). On its basis, the organization has the right to develop and approve in the accounting policy the form necessary for a given case, making appropriate changes.

The procedure for accounting for the costs of mothballing an unfinished construction project differs between the developer, the investor and the contractor.