- Process-based costing method

- The incremental costing method

- Custom costing method

Product cost calculation is carried out using various methods. The calculation method is understood as a system of techniques used to calculate the cost of a calculation unit. The choice of method for calculating the cost of production depends on the type of production, its complexity, the presence of work in progress, the duration of the production cycle, and the range of products produced.

According to the objects of cost accounting (according to the specifics of the technological process), the following are distinguished:

a) process-by-process method; b) transversal method; c) custom method.

Basic cost accounting methods

The efficiency of a company's activities can be assessed through proper accounting of current costs. The choice of cost accounting method is carried out by the organization independently by fixing the method in the accounting policy, taking into account current legal requirements. When regulations change, the company's accountant needs to make appropriate changes to the accounting. The main methods used by company accountants in the Russian Federation are the following:

- Regulatory - widely used in enterprises with mass or serial production, in manufacturing industries, in light industry, and mechanical engineering. Based on the use of specified standards.

- Process-based - most often used at power plants, in the mining or chemical industries, that is, where the range of products is narrow and semi-finished production is completely absent or limited. Allows you to accurately calculate each individual process.

- Custom - used in small-scale, individual production of complex products; for repair and experimental services. For example, these are shipbuilding and machine-building enterprises. The cost of each product is calculated based on direct and indirect costs.

- Transverse - common in mass production, which is characterized by sequential multi-stage processing of materials and raw materials. For example, these are the textile industry, the metallurgical industry, as well as chemical and oil refining. Calculation is carried out using the non-semi-finished method or the semi-finished method, with the calculation of cost at each limit (stage) of production.

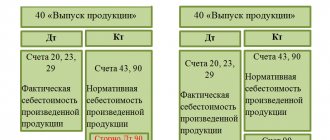

The essence of the standard method of accounting for production costs

The peculiarities and concept of the normative cost accounting method are that the formation of normative cost estimates for products is carried out on the basis of norms developed in advance and valid at the beginning of a given period (usually a year according to methodological recommendations). In this case, absolutely all types of existing costs are taken into account according to the given values. Deviations of actual costs from current standards are reflected separately - the reasons (justifications) for such discrepancies, places and culprits are necessarily given. This is done in order to make appropriate changes to the calculations and determine the impact of indicators on the final cost of production.

In the process of manufacturing GP, the standard method of accounting for production costs uses the following formula:

Actual costs = Costs according to standards + Deviations from standards + Changes in standards.

As is clear from the names of the values, in order to calculate the actual cost, it is necessary to sum up the costs according to the established standards with existing deviations (both in the form of savings and overruns) and changes in indicators made during the period. It should be taken into account that the standards are laid down at the beginning of the period, and the calculation of products during the period is carried out based on the approved values. But if changes are made for various reasons, such a difference is subject to special accounting, and recalculation can only be done as of the beginning of the next year. All standard values are approved by the head of the enterprise or an authorized responsible person.

Deviations are determined in terms of direct costs. These are raw materials, materials, wages, wear and tear, etc. As for other indirect costs, the amount of deviations for them at the end of the month is distributed among all types of products. The disadvantage of this method is the impossibility of ongoing monitoring of production costs.

Cost concept

Costs are an integral element of the management and functioning of any company on the market.

Production costs are the cost of living labor and the costs of subsequent sales of products. In practice, the term "cost" is used to describe all production costs incurred by a company over a period of time.

Costs are a monetary assessment of resources (material, labor, financial, natural, information) that the organization uses for production and sales purposes.

The main characteristic features of the cost category are the following:

- can be measured by the amount of resources used (material, labor, financial);

- the volume of resources used should be presented in monetary terms to ensure their comparison;

- the concept must be related to specific goals and objectives of production.

Costs add up to cost. The cost of production is the total value of all expenses that are associated with organizing the production process. To control cost, it is necessary to plan and estimate costs, analyze the composition of individual elements and monitor changes in the cost of each element.

From the concept of “costs”, the concept of “expenses” should be highlighted, which is disclosed in PBU 10/99 “Costs of the organization”.

An organization's expenses, in accordance with this accounting register, are a reduction in the company's profit as a result of the disposal of assets and the emergence of liabilities, which leads to a decrease in the organization's capital. Expenses take into account only those costs that are associated with the formation of profit for a certain period, and the rest of the expenses are deposited in the active part of the company's funds in the form of products in the warehouse.

Expenses are costs of a temporary period, documented, economically justified, and fully allocated to the cost of products sold for this period.

PBU 10/99 establishes a unified classification of costs for all commercial organizations according to economic elements:

- materials costs;

- cost of labor resources;

- deductions from wages;

- depreciation expenses;

- other costs.

Material costs include:

- the cost of purchased raw materials and material costs used in the production of products;

- cost of purchased components and semi-finished products;

- applied services of external organizations, costs of production or transportation of materials;

- the cost of fuel and energy resources that were used in the production process.

Basics of applying the process method of cost accounting and calculation

The essence of the process-by-process method of cost accounting and product calculation is that the cost calculation in an organization is carried out without breaking down into types of products, that is, with the determination of costing for the entire production process as a whole. In this case, both direct and indirect costs are not subject to distribution and are written off against the entire output of GP (finished products) under the relevant items. The object of accounting is not a specific product, but a production process, hence the name of the method.

No special formulas are used in the calculations, and the average cost of one product is determined by dividing the total costs incurred during the period by the number of units produced. If production has a long cycle, calculations are performed for each month, and the final cost is determined upon completion of the process. Administrative costs and those attributable to auxiliary production are accounted for under general operating items.

The use of this method is justified in those organizations where there are no semi-finished products, that is, unfinished products; homogeneous products are mass produced; The technological process is characterized by a short period. The nuances of the calculation vary depending on how many product items exist in production. If only one type of product is produced, the cost of one unit is calculated by simply dividing the total costs by the number of units.

If several different types of products are produced, costing is determined item by item, broken down by product, and total costs are distributed according to the accepted methodology. If there is a work in progress in production, WIP balances are taken into account according to the company’s valuation method at the beginning and end of the period, and current expenses for the month are adjusted according to the balance of work in progress.

Calculation is

Direct costing method

Used in companies with low fixed costs, with easily defined and quantifiable performance results. Russian accounting standards do not allow the full use of this accounting system for the purposes of preparing external reporting and calculating taxes. It is used in internal accounting to analyze and justify management decisions regarding break-even production and pricing.

This method is based on the calculation of the reduced cost of production and the determination of marginal income.

Looking for ideas for study work on this subject? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Using the custom method

The custom method of cost accounting and calculation is used to accurately determine the cost of certain types of products, as well as when carrying out equipment repairs and auxiliary work. The object of accounting in this method is not the type of product, but the order itself for a specified quantity of goods. The scope of application of the custom cost accounting method is individual production or small-scale production, consisting of the same range of products. If large products are produced in a long cycle, order calculation is performed not for the entire object as a whole, but for its parts - components, assemblies and other completed structures.

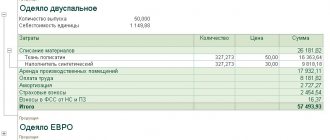

Example of a custom cost accounting method

Let's assume that a furniture manufacturing enterprise has released 2 orders in a month: the first includes 5 cabinets, the second 7 tables. Direct costs are equal: for the first order - 120,000 rubles, for the second - 50,000 rubles; indirect = 70,000 rub. There is no work in progress, let’s do the calculations:

- Total cost of 1 order = 120,000 + (70,000 x 120,000 / 170,000) = 169,411.76 rubles.

- Total cost of 2 orders = 50,000 + (70,000 x 50,000 / 170,000) = 70,588.24 rubles.

In the above methodology, the production cost of products was calculated with the distribution of indirect costs to the base for which direct costs were taken. But a method is also allowed when individual types of production costs are taken into account evenly by dividing by the entire number of products produced. In this case, the distribution of indirect costs will be the same.

Standard costing method

This method is widespread in Western countries, and is now successfully used in Russia. It is mainly used in industries where prices for the resources used are relatively stable and products do not change for a long time. The method is similar to calculating standard cost.

The basis of this system is the following principles:

- preliminary standardization of costs by elements, as well as cost items;

- drawing up standard cost estimates for the product and its individual parts;

- separate accounting of costs and standard deviations;

- deviation analysis;

- making adjustments to calculations when standards change.

Cost rates are pre-calculated by expense items:

- basic materials;

- remuneration of production workers;

- general production expenses;

- business expenses.

Features of the incremental method of accounting for production costs

The incremental method of cost accounting is the calculation of costs not by product, but by redistribution. It is used in industries with homogeneous raw materials. The object of cost accounting in the cross-cutting method is not the unit of product, but the individual phases of processing materials. And redistribution in the complex use of raw materials is recognized as a set of working technological operations, as a result of which an intermediate semi-finished product or already a semi-finished product is produced.

The procedure for using this method may vary in each organization depending on the method of reflection. What is common is that direct costs are formed for each processing stage; within different stages, products (semi-finished or finished) are combined into appropriate groups according to the degree of homogeneity of the raw materials and the complexity of their processing, and indirect costs are distributed according to the chosen principle. A decision is made independently on which processing stages and stages of production the cost is calculated, as well as which product items are included in each phase.

The basis for applying the incremental cost accounting method are two common options - semi-finished and unfinished. The first is characterized by determining the cost of semi-finished products at each stage of processing, which allows for more economically accurate calculation and control of the cost of finished products. In the second case, calculation of semi-finished products is not carried out, the cost of production is determined after release from production, and the movement of such objects is carried out between workshops in kind without making entries on accounting accounts.

Difference between semi-finished and semi-finished cost accounting methods

In accounting, the unfinished method of cost accounting is distinguished by the fact that products that have not undergone full technological processing, released from one stage, but used in the further production of GP, are not reflected in account 21, but are included in the work in progress in the account. 20. The internal movement of semi-finished products between workshops is controlled using data in physical terms, which are recorded by responsibility centers. During the calculation process, the cost of production is determined based on the total costs at all stages (redistributions) of production.

In contrast to the non-semi-finished method in accounting, the semi-finished method of cost accounting involves the initial entry of manufactured semi-finished products into the organization's warehouse and the subsequent write-off (transfer) of objects to other workshops for further use in the production of state enterprises. An account is used to reflect transactions. 21, and calculating the cost at each stage separately is necessary for the correct release of products. There are different options for calculating the unit cost - by the cost of inventories, by direct costs, by standard or actual, as well as accounting price. The optimal methodology is selected by the enterprise and enshrined in the accounting policy.

How to calculate the cost

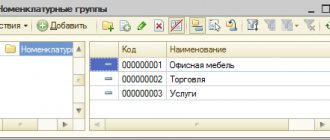

Costs associated with the production of products should be taken into account on account 20 “Main production”. In this case, use the following costing methods or combinations thereof:

- custom;

- process-by-process;

- transverse.

The custom method is used:

- for single or small-scale production;

- when performing work under contracts or paid services;

- in the production of technically complex products. For example, in shipbuilding, aviation industry, etc.;

- when producing products with a long production cycle. In particular, in construction, power engineering, etc.

With the order-by-order method, all costs are taken into account for a specific order or for a group of similar orders. For each order, a card is opened. Since there are no standard forms of cards, you can develop them yourself. The card usually indicates the order number, description of the work, the time required to complete the order, as well as the number of units of product that need to be produced. Costs for each order are recorded as the product moves through the stages of production.

Direct costs that are directly related to the fulfillment of the order are reflected in the debit of account 20 in correspondence with the expense accounts. To ensure analytical cost accounting, it is worth opening separate sub-accounts for each open order. These subaccounts can be named, for example, by order numbers: “Order No. 1,” “Order No. 2,” etc.

Record costs as follows:

Debit 20 Credit 10 (70, 69, 60...) – direct costs of executing the production order are taken into account.

Indirect, that is, general production and general business expenses, accumulate on accounts 25 and 26 of the same name. At the end of the month in which the order was completed, write off these amounts as a debit to account 20. At the same time, distribute these expenses for each order in proportion to the indicators that must be established in the accounting policy for accounting purposes (clause 7 of PBU 1/2008). For example, in industries with a significant share of manual labor, it is advisable to distribute indirect costs in proportion to the salaries of the main production workers.

When assigning indirect costs to the cost of production, make the following entries:

Debit 20 Credit 25 (26) – general production (general business) expenses are taken into account as part of the costs of order fulfillment.

When accounting for general business expenses, do not use this procedure if you take them into account immediately into account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

An example of reflecting in accounting the costs of a structural unit of an organization to fulfill a production order. The organization uses the order method of cost accounting. The structural unit fulfills an internal order

In July, the tool shop of OJSC Proizvodstvennaya completed an in-house order for the production of 200 steel fasteners for the assembly shop. Master's accounting policy provides for the use of the order method of accounting for actual costs. To reflect the actual costs of the tool shop to complete the order, a subaccount “Order No. 1” was opened to account 20.

In July, the tool shop received 240 kg of steel from the warehouse to fulfill the order. The cost of 1 ton of steel is 11,500 rubles. (without VAT).

The direct costs of order fulfillment include:

- cost of materials used - 2760 rubles. (0.24 t × 11,500 rub./t);

- salary of production workers in the tool shop - 40,000 rubles;

- contributions for compulsory pension (social, medical) insurance, as well as insurance against accidents and occupational diseases - 12,080 rubles.

General production costs attributable to the order (depreciation on fixed assets used in production) amounted to 2,866 rubles.

The following entries were made in the “Master’s” accounting:

Debit 20 subaccount “Order No. 1” Credit 10 – 2760 rub. – materials were written off to fulfill the order;

Debit 20 subaccount “Order No. 1” Credit 70 – 40,000 rub. – wages were accrued to the workers of the tool shop;

Debit 20 subaccount “Order No. 1” Credit 69 – 12,080 rub. – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases have been accrued;

Debit 20 subaccount “Order No. 1” Credit 25 – 2866 rub. – depreciation on fixed assets used in production is written off as costs for order fulfillment.

The actual cost of the completed order is reflected by the posting:

Debit 10 Credit 20 subaccount “Order No. 1” – 57,706 rubles. (RUB 2,760 + RUB 40,000 + RUB 12,080 + RUB 2,866) – the cost of fasteners manufactured according to order No. 1 and transferred to the warehouse was written off.

All costs for the intercompany production order were reflected in the card.

The use of the process method is typical for industries in which finished products are created as a result of sequential processing of raw materials. The process can take place in one or more technological departments. At the same time, the results of processing raw materials at intermediate stages cannot definitely be considered either finished products or semi-finished products. The method is often used in the mining and textile industries, in the production of cement, chemical fiber, plastics, paints and varnishes, etc.

With the process-by-process method, cost accounting is carried out for each process. For this purpose, so-called calculations are opened. In practice, it is convenient to use production cost sheets as calculations. They must be maintained for the entire production output or for each division. There are no standard forms for production cost accounting sheets, so you can develop them yourself. The statements are filled out on the basis of primary accounting documents. Such as invoices, payroll statements, advance reports, etc. For example, costs for raw materials and supplies can be reflected on the basis of limit cards or invoice requirements. For which you can use standard forms No. M-8 or No. M-11.

Reflect direct costs in the debit of account 20 in correspondence with the expense accounts:

Debit 20 Credit 10 (68, 69, 70, 60...) – direct costs of the production process are taken into account.

At the end of the month, write off general production expenses accumulated on account 25 of the same name to the debit of account 20:

Debit 20 Credit 25 – general production expenses are taken into account as part of the costs of the production process.

General business expenses accumulated on account 26 of the same name are also written off to the debit of account 20 at the end of the month:

Debit 20 Credit 26 – general business expenses are taken into account as part of the costs of the production process.

This procedure is not used if costs are taken into account immediately into account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

The volume of work in progress using the process-by-process method of cost accounting can be assessed using conditionally natural indicators. For example, by the equivalent number of finished products. To calculate the equivalent quantity of finished products, you need to know the product readiness ratios at each stage of the production process. The value of these coefficients is set by the manufacturer’s technological service (i.e., yours).

An example of reflecting the costs of producing finished products in accounting. The organization carries out cost accounting and cost calculation using a process-by-process method.

OJSC "Proizvodstvennaya" is engaged in the production of cotton fabrics. Master's accounting policy provides for the use of a process-based method of cost accounting and cost calculation.

The production process includes four stages. Work in progress is valued at an equivalent quantity of finished goods (fabric). For raw materials completely processed at each of the four stages, the organization’s chief technologist has approved the following availability factors:

- primary processing of cotton – 37 percent;

- preparation of cotton fibers – 58 percent;

- spinning (production of cotton threads) – 91 percent;

- production of finished fabric – 100 percent.

The output of finished products is measured in meters. In accordance with the technical documentation, the cotton consumption rate for fabric production is 0.2 kg/m.

According to the accounting policy, the organization's general business expenses are written off as expenses in proportion to the area of production premises. The area of workshops involved in the fabric production process occupies 70 percent of the entire area of the “Master”.

In April, 2,000 kg of cotton were put into production with a total cost of 81,000 rubles. (without VAT). According to technological standards, 10,000 m of fabric should be produced from this amount of raw material (2000 kg: 0.2 kg/m). As of April 30, 8,000 m of fabric were delivered to the finished products warehouse.

Direct costs for fabric production in April were:

- cost of materials – 81,000 rubles;

- wages of production workers and contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases - 243,000 rubles.

The amount of overhead costs is RUB 96,840.

The amount of general business expenses for the organization as a whole is 230,000 rubles.

In April, the following entries were made in the “Master’s” accounting:

Debit 20 Credit 10 – 81,000 rub. – materials for fabric production were written off;

Debit 20 Credit 70 (69) – 243,000 rub. – wages for production workers and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are accrued;

Debit 20 Credit 25 – 96,840 rub. – general production expenses are written off;

Debit 20 Credit 26 – 161,000 rub. (RUB 230,000 × 70%) – part of general business expenses was written off for production.

As of April 30, the remains of raw materials that had undergone complete intermediate processing were recorded in the amount of 350 kg, including:

- at the stage of primary processing of cotton – 90 kg;

- at the stage of preparation of cotton fibers – 180 kg;

- at the spinning stage – 80 kg.

The total volume of raw materials released into production, but not undergone intermediate processing, amounted to 50 kg. Processing of this raw material will be completed next month.

Based on these data, the accountant determined the equivalent amount of finished goods in the balances at each stage of the production process. The volume of work in progress in equivalent units was:

- at the stage of primary processing of cotton - 167 m (90 kg: 0.2 kg/m × 37%);

- at the stage of preparation of cotton fibers - 522 m (180 kg: 0.2 kg/m × 58%);

- at the spinning stage – 364 m (80 kg: 0.2 kg/m × 91%).

The volume of work in progress in equivalent units as of April 30 was: 167 m + 522 m + 364 m = 1053 m.

Total production output for April (including work in progress) is equal to: 8000 m + 1053 m = 9053 m.

The total amount of production costs (including the cost of purchasing raw materials that have not undergone intermediate processing) for April is: 81,000 rubles. + 243,000 rub. + 96,840 rub. + 161,000 rub. = 581,840 rub.

The actual cost of finished products delivered to the warehouse is reflected by the posting:

Debit 43 Credit 20 – 514,163 rub. (RUB 581,840: 9053 m × 8000 m) – the actual cost of finished products for April was written off.

The cost of work in progress balances at the end of April is equal to: 581,840 rubles. – 514,163 rub. = 67,677 rub.

In May, 500 kg of cotton worth 20,250 rubles were transferred to production. At the end of the month, 4,500 m of fabric were delivered to the finished products warehouse. Thus, in May, all released raw materials were processed, including raw materials, the processing of which began in April: 8000 m + 4500 m = (2000 kg + 500 kg): 0.2 kg/m.

Direct costs for fabric production in May were (the cost of purchasing raw materials that did not undergo intermediate processing in April is not taken into account):

- cost of materials – 20,250 rubles;

- wages of production workers and contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases - 100,000 rubles.

The amount of overhead costs is RUB 73,800. The amount of general business expenses for the organization as a whole is 150,000 rubles.

As of the end of May, there were no balances of work in progress in the “Master” workshops.

The following entries were made in the organization’s accounting records in May:

Debit 20 Credit 10 – 20 250 rub. – materials for fabric production were written off;

Debit 20 Credit 70 (69) – 100,000 rub. – wages for production workers and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are accrued;

Debit 20 Credit 25 – 73,800 rub. – general production expenses are written off;

Debit 20 Credit 26 – 105,000 rub. (RUB 150,000 × 70%) – part of general business expenses was written off for production;

Debit 43 Credit 20 – 366,727 rub. (RUB 20,250 + RUB 100,000 + RUB 73,800 + RUB 105,000 + RUB 67,677) – the actual cost of finished products for May was written off.

The actual cost of a batch of fabric produced in April–May (12,500 m) is equal to 880,890 rubles. (RUB 514,163 + RUB 366,727). The cost of 1 m of finished fabric is 70.47 rubles. (RUB 880,890: 12,500 m).

The object of cost calculation when using the incremental cost accounting method is one or another stage of the production process. That is, redistribution. If the production structure is organized in such a way that each processing stage is performed by a specialized workshop, section or team, then determine the cost for each of them. Thus, the object of cost calculation using the step-by-step method can be both finished products and semi-finished products manufactured at each technological stage.

The step-by-step method is usually used for production processes in which groups of constantly repeating technological operations can be distinguished. For example, in metallurgy, oil refining, chemical, food industries.

With the transfer method, take into account direct expenses on account 20:

Debit 20 Credit 10 (21, 23, 29, 69, 70...) – direct costs of production are taken into account.

Write off general production expenses accumulated on account 25 of the same name to the debit of account 20 at the end of the month:

Debit 20 Credit 25 – general production expenses are taken into account as part of the costs of the production stage (process).

General business expenses accumulated on account 26 of the same name are also written off to the debit of account 20 at the end of the month:

Debit 20 Credit 26 – general business expenses are taken into account as part of the costs of the production stage (process).

Take into account general business expenses this way if you do not immediately reflect them on account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

An example of reflecting in accounting the costs of producing finished products using the incremental costing method. The organization uses the semi-finished method of consolidated cost accounting

The Master oil refining organization produces straight-run and high-octane gasoline. The organization has certificates for the production and processing of straight-run gasoline. The accounting policy of “Master” provides for the use of a semi-finished method of cost accounting using account 21.

“Master” has a workshop production structure. In shop No. 1, straight-run gasoline is produced (processing unit No. 1). Workshop No. 2 produces Premium-95 gasoline (processing unit No. 2). Straight-run gasoline is used as the feedstock for the production of Premium-95 gasoline, to which various additives are added at processing stage No. 2. To reflect the actual costs of production stages, sub-accounts “Workshop No. 1” and “Workshop No. 2” were opened to accounts 20, 21 and 25.

In the reporting period, Master produced 1,250 tons of straight-run gasoline:

- 500 tons (40% of production) were sold to an organization that has a certificate for processing straight-run gasoline, at a price of 15,000 rubles/t (including VAT and excise tax);

- 750 tons (60% straight-run gasoline) were transferred to workshop No. 2 for further processing.

Direct costs for the production of straight-run gasoline in workshop No. 1 during the reporting period amounted to RUB 9,602,000.

Direct costs for the production of Premium-95 gasoline in workshop No. 2 amounted to RUB 3,517,800.

The total amount of direct costs for two workshops is 13,119,800 rubles. (RUB 9,602,000 + RUB 3,517,800).

The amount of overhead costs is:

- for workshop No. 1 – 391,280 rubles;

- for workshop No. 2 – 144,720 rubles.

The amount of general business expenses is RUB 360,000.

The accounting policy of “Master” provides for the distribution of general business expenses between production areas (shops) in proportion to direct costs. The share of direct costs for each stage in the total amount of direct costs is:

- for workshop No. 1: RUB 9,602,000. : RUB 13,119,800 = 0.73;

- for workshop No. 2: RUB 3,517,800. : RUB 13,119,800 = 0.27.

The organization's accountant distributed the amount of general business expenses for the reporting period between divisions in the following proportion:

- for workshop No. 1: RUB 360,000. × 0.73 = 262,800 rubles;

- for workshop No. 2: RUB 360,000. × 0.27 = 97,200 rub.

The following entries were made in the organization's accounting:

Debit 20 subaccount “Workshop No. 1” Credit 10 (69, 70...) – RUB 9,602,000. – expenses for the production of straight-run gasoline were written off;

Debit 20 sub-account “Workshop No. 1” Credit 25 sub-account “Workshop No. 1” – 391,280 rubles. – general production expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 20 subaccount “Workshop No. 1” Credit 26 – 262,800 rub. – general business expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 21 sub-account “Workshop No. 1” Credit 20 sub-account “Workshop No. 1” – 10,256,080 rubles. – straight-run gasoline was capitalized at actual cost;

Debit 62 Credit 90-1 – 7,500,000 rub. (500 t × 15,000 rubles/t) – revenue from the sale of straight-run gasoline of our own production is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1,144,068 rubles. (RUB 7,500,000 × 18/118) – VAT is charged on the sale of straight-run gasoline;

Debit 90-4 subaccount “Excise taxes” Credit 68 subaccount “Calculations for excise taxes” - 2,359,500 rubles. (500 t × 4719 rub./t) – excise duty is charged;

Debit 90-2 Credit 21 subaccount “Workshop No. 1” – 4,102,432 rubles. (RUB 10,256,080 × 40%) – the cost of straight-run gasoline sold was written off;

Debit 20 sub-account “Workshop No. 2” Credit 21 sub-account “Workshop No. 1” - 6,153,648 rubles. (RUB 10,256,080 – RUB 4,102,432) – straight-run gasoline was transferred for further processing;

Debit 20 subaccount “Workshop No. 2” Credit 10 (69, 70...) – RUB 3,517,800. – expenses for the production of Premium-95 gasoline (processing unit No. 2) were written off;

Debit 20 subaccount “Workshop No. 2” Credit 25 subaccount “Workshop No. 2” – 144,720 rubles. – general production expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 20 subaccount “Workshop No. 2” Credit 26 – 97,200 rub. – general business expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 43 Credit 20 subaccount “Workshop No. 2” – 9,913,368 rubles. (RUB 6,153,648 + RUB 3,517,800 + RUB 144,720 + RUB 97,200) – Premium-95 gasoline was credited to the finished products warehouse at actual cost.

Based on the completeness of cost accounting, the following methods are distinguished:

- Direct costing – in this method, costs are divided into fixed and variable. The cost price of a GP includes only variable costs - materials, raw materials, wages and general production variables (utilities, equipment maintenance costs, salaries of general shop personnel, etc.). Fixed costs not related to the production process are attributed directly to the financial result. The marginal method of cost accounting is used to regulate the volume of product output, analyze the workload of equipment, calculate sales prices and determine the minimum volume of GP output to cover current costs.

- The full cost accounting method consists of assigning all current production costs to the cost of products. With this method, direct and general production costs are directly written off to cost, and general operating costs are charged to costs without dividing them into types of products.

Current methods for calculating products were gradually developed and implemented at enterprises. The ancestor of modern calculations can be called the boiler method of cost accounting, which consists of summing up all costs incurred during a period into a common boiler. At the same time, neither the types of products produced nor the places where costs occurred were taken into account, which did not make it possible to determine the cost correctly and taking into account the characteristics of the manufactured products. Currently, this technique continues to operate only at those enterprises where one type of GP is produced and there is no need to calculate the exact cost.

The ABC cost accounting method is not widespread in Russia and is used mainly not for calculating costs, but for the purpose of financial analysis of the success of an enterprise. This method consists of calculating individual types of work (functions) with subsequent partial attribution to the price of the product. In this case, the entire technological process is divided into simple components with calculation of the consumed resources. Based on the results, all expended resources determine the final cost of the GP.