Concept and rules of accounting

Regulates the accounting of financial investments PBU 19/02 with the same name. It was approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n.

According to paragraphs 2-4 of PBU 19/02, financial investments are assets that do not have a material form, which generate income in the form of:

- percent;

- dividends;

- increase in value.

For example, these could be issued loans, contributions to authorized capital, shares, bills.

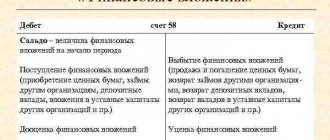

Financial investments are accounted for in account 58:

- by debit – receipt;

- for the loan - disposal.

It is intended to summarize information about the availability and movement of an organization’s investments:

- in government securities;

- shares, bonds and other securities of other organizations;

- authorized (share) capitals of other enterprises;

- loans provided to other organizations.

For account 58, it is allowed to open, for example, the following subaccounts:

- 58-1 “Units and shares”;

- 58-2 “Debt securities”;

- 58-3 “Loans provided”;

- 58-4 “Deposits under a simple partnership agreement”, etc.

Income and expenses arising from the disposal of financial investments are reflected in account 91 “Other income and expenses”.

Analytical accounting for account 58 is carried out by type of financial investments and the objects in which they were made. For example:

- organizations that sell securities;

- other organizations of which the enterprise is a member;

- borrowing organizations, etc.

KEEP IN MIND

The construction of analytical accounting should provide the ability to obtain data on short-term and long-term assets. At the same time, accounting for financial investments within a group of interrelated companies, the activities of which are compiled by consolidated accounting statements, is kept separately on account 58.

At least the following information must be generated for accepted securities:

- name of the issuer and name of the security;

- number, series, etc.;

- nominal price;

- purchase price;

- expenses associated with the acquisition of securities;

- total amount;

- date of purchase;

- date of sale or other disposal, storage location.

Also see “The concept of financial investments and what applies to them.”

Accounting for financial investments in a management company or a simple partnership

Financial investments that are the primary contribution to the management company (simple partnership) are taken into account at a value agreed upon between the founders (partners) . A contribution to the management company can be made in money, property or property rights.

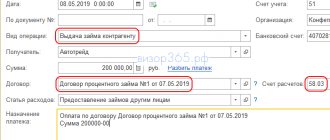

With an initial deposit, at the time of registration of an established legal entity, the founder accrues a debt on his deposit in the accounting of financial investments (Dt 58 Kt 76), which is repaid depending on the method contained in the founders’ agreement:

- By transfer of money: Dt 76 Kt 50 (51).

- By contributing property (for depreciable property - at its residual value, if the contributor has depreciated it): Dt 76 Kt 01 (04, 10, 11, 21, 41, 58). At the same time, the VAT on it is restored (Dt 76 Kt 68), and the entire assessment is brought to the level determined by the founders (Dt 76 Kt 91 or Dt 91 Kt 76).

Subsequently, this contribution may be increased or decreased in accordance with legal requirements or by decision of the participants. In accounting for financial investments in accordance with a specific situation, this will be expressed as follows:

- Dt 50 (51) Kt 58 upon return of the deposit in cash.

- Dt 01 (04, 10, 11, 21, 41, 58) Kt 58 upon return of the deposit with property.

- Dt 91 Kt 58, if the return of money or property does not occur.

- Dt 58 Kt 50 (51) with additional payment up to the required deposit amount.

- Dt 58 Kt 76 and Dt 76 Kt 01 (04, 10, 11, 21, 41, 58) with additional VAT charge (Dt 76 Kt 68) and adjustment to the required estimate (Dt 76 Kt 91 or Dt 91 Kt 76), if additional carried out by property.

- Dt 58 Kt 91, if the increase occurs at the expense of the profit of the established legal entity.

Read more about how to increase the authorized capital at the expense of profits in the material “Increasing the authorized capital at the expense of retained earnings .

A contribution to the management company can be purchased. In accounting for financial investments, this will be reflected as the amount of all expenses for its purchase: Dt 58 Kt 60 (76). Such a deposit from the buyer is not adjusted to its nominal value.

The sale of a contribution to the capital company in the accounting of financial investments will be reflected by the entries: Dt 76 Kt 91 and Dt 91 Kt 58. The retiring contribution is assessed at its book value.

The income from such financial investments is periodically paid dividends (Dt 76 Kt 91). If there is a possibility that dividend receipts will stop, you can create a reserve to reduce the value of the contribution to the capital company, attributing it to the financial result: Dt 91 Kt 59.

Assessment of financial investments

Please note that as part of the organization of accounting for financial investments, most of them do not need to be revalued. The fact is that only securities listed on the stock exchange are taken into account at market value. The remaining financial investments - at least once a year on December 31 - must be checked for impairment and, if necessary, a reserve must be created (clauses 20 and 38 of PBU 19/02).

Also see “Which account are financial investments recorded in?”

Read also

28.05.2019

Accounting for financial investments in the form of securities

The complexity of accounting for financial investments made in the Central Bank depends on whether they are traded on their market or not:

- In both situations, financial investments into account according to the total amount of investments in their purchase: Dt 58 Kt 60 (76). At the same time, securities traded on the market must be revalued in accounting monthly or quarterly in order to bring their accounting valuation to the current market price (Dt 58 Kt 91 or Dt 91 Kt 58). SMEs that have established such a procedure in their accounting policies may not overestimate financial investments

- Expenses incurred in connection with the purchase of securities, if they are insignificant in comparison with the contractual purchase price, can not be added to the formed price of financial investments in accounting , but included in the financial result as they arise: Dt 91 Kt 60 (76). Similarly, for debt securities not traded on the market, the difference between the purchase price and the par value during their circulation period can be attributed to the financial result: Dt 58 Kt 91 and Dt 91 Kt 58.

- If there is a systematic decrease in their prices for the Central Bank (which is more often found for circulating securities), then a reserve can be created that takes into account the amount of impairment (Dt 91 Kt 59), which will be equal to the difference between the estimated and book value.

- When disposing of (redemption, sale, entry into the management capital, donation) securities that are not traded on the market, they are written off from the accounting of financial investments at one cost of their three possible values: each unit, average or FIFO. The method of determination is established in the accounting policy. Market-traded financial investments deregistered from In a similar assessment (at the latest market price), the accounting for financial investments shows circulating securities for which the determination of their market price has been discontinued. You cannot change the assessment method during the year. The disposal will be reflected by the entry: Dt 76 Kt 91 and Dt 91 Kt 58.

Scope of application of FSBU 26/2020

The scope of application of the standard has been clarified:

| WHAT IS SPECIFIED | EXPLANATION |

| The standard applies to property intended for use in the process of acquiring, creating, improving and/or restoring OS objects | Previously, such property was accounted for, as a rule, as part of inventories until it was used in the process of acquiring, creating, improving and/or restoring fixed assets |

Standard does not apply for costs associated with:

| Previously, developers who specialized in the construction of facilities took into account the costs of their services, as a rule, as capital investments |

| Capital investments include costs for improving and/or restoring an asset (in particular, replacement of parts, repairs, inspections, maintenance) if such costs comply with the conditions for recognizing capital investments | Previously, only the costs of modernization and reconstruction of the OS facility, as a result of which the initially adopted standard indicators of the functioning of the OS facility were improved (increased). Restoration costs were recognized as expenses of the period to which they related. Now capital investments do not include:

|

Write-off of capital investments

FSBU 26/2020 also established general rules for writing off capital investments from accounting. In particular:

- write-off cases;

- moment of reflection of the write-off in accounting;

- the procedure for accounting for the costs of dismantling, recycling of capital investment objects and environmental restoration;

- the procedure for determining the amount of income or expense from writing off capital investments.

Previously, these points were not formulated.

Features of the formation of reserves

A reserve for depreciation is created and adjusted to account 59. The movement of investments occurs on the same account. The correspondence is account 91. The formation of the reserve is carried out using posting DT91 KT59. If the estimated value increases or investments are disposed of, reverse posting is applied: DT59 KT91.

Financial investments can be long-term or short-term. The first involves receiving income after 12 months after the deposit, the second – up to a year. The attachment type determines the rows and sections used. Long-term and short-term deposits may not be separated, but it is advisable to do so. For long-term deposits, account 59 with subaccount 1 is opened, for short-term deposits - account 59 with subaccount 2.

Regulations on accounting for long-term investments

The content and composition of an organization's accounting objects depends on its investment activities. Main accounting tasks:

- complete and timely reflection of expenses incurred in the formation of long-term investments;

- tracking of funds used during construction, commissioning of production facilities, fixed assets, intangible assets;

- correct determination and reflection of the inventory value of acquired and commissioned fixed assets and intangible assets;

- monitoring the availability and correct use of sources of financing for long-term investments.

Legal regulation of accounting in Russia is based on a four-level system of regulations:

- Laws, presidential decrees and government regulations of the Russian Federation establishing uniform legal standards for organizing and maintaining domestic accounting. Provisions affecting accounting issues contained in other federal acts must comply with the Federal Law “On Accounting”.

- Russian standards “Accounting Regulations” are approved by the Government of the Russian Federation and federal executive authorities.

- Instructions, guidelines, recommendations and other similar documents that are developed and approved by ministries, federal and other executive authorities on the basis of laws and regulations of the first and second levels. The documents of the third level include “Charts of accounts for accounting of financial and economic activities of organizations,” as well as instructions for their use.

- Documents relating to the organization and maintenance of accounting for obligations, business transactions, and certain types of property. They are intended for internal use by specific organizations. Documentation of reporting, content, status, principles of construction, procedure for preparation and approval are determined by the management of enterprises within the framework of the existing accounting policy.

According to the definition of current legislation, long-term investments are securities, targeted bank deposits, cash, shares, technologies, equipment, licenses, intellectual values, property rights invested in objects of economic activity for the purpose of making a profit. They can be used for:

- capital construction, reconstruction and technical re-equipment of an existing enterprise or non-production facility;

- acquisition of buildings, structures, vehicles, equipment and other objects classified as fixed assets;

- purchase of land plots, environmental management facilities;

- creation of intangible assets.

Accounting for long-term investments is regulated by such basic documents as:

- Tax Code of the Russian Federation;

- Civil Code of the Russian Federation;

- “Regulations on accounting and reporting in the Russian Federation”, approved by order of the Ministry of Finance of Russia No. 34n dated July 29, 1998;

- “Regulations on accounting of fixed assets” (PBU 6/01), approved by order of the Ministry of Finance of Russia No. 26n dated March 30, 2001;

- “Regulations on accounting for long-term investments” (“Regulation 160”), approved by letter of the Ministry of Finance of Russia No. 160 dated December 30, 1993;

- “Regulations on accounting for intangible assets” (PBU 14/2007), approved by order of the Ministry of Finance of Russia No. 153n dated December 27, 2007;

- “Instructions for the application of the chart of accounts for accounting of financial and economic activities of organizations”, approved by order of the Ministry of Finance of Russia No. 94n dated October 31, 2000.

One of the important components of the reform of the Russian accounting system is the transition to International Financial Reporting Standards. A comparison of IFRS and PBU shows a number of fundamental differences. Russian regulations are focused primarily on compliance with the requirements of domestic legislation. They do not take into account the inflation rate. In international standards, the priority is a truthful reflection of the economic activity of the subject.

Financial statements prepared in accordance with PBU must satisfy, first of all, the needs of tax and other regulatory authorities. It contains a lot of obscure and unnecessary information for investors. Reports prepared according to international standards are aimed at satisfying the requests of external users of these documents. Therefore, the transition to IFRS implies stricter self-control in the activities of managers, as well as improving the methods of analyzing business transactions and assessing risks.

The main difference between PBU and IFRS lies in the methods for assessing and reporting assets and liabilities. In addition, Russian standards do not contain key concepts inherent in IFRS, such as fair value, adjustments for hyperinflation, impairment of assets, etc.

There is no single, approved or recommended “Chart of Accounts” in IFRS. Each company reporting according to international standards develops its own chart of accounts, based on the specifics of the activity and financial detail of the information. In Russia, all companies are required to use a single “Chart of Accounts” approved by order of the Ministry of Finance. If any organization wants to use an account number not provided for by the plan, it can only do so with the permission of the Ministry of Finance. In the case when reporting is prepared according to IFRS, any company has the right to use the chart of accounts according to RAS.

Transitional provisions

The consequences of changes in the organization’s accounting policies in connection with the start of application of FAS 26/2020 are reflected retrospectively . That is, as if this standard were applied from the moment the facts of economic life affected by it arose.

To facilitate the transition to a new procedure for accounting for capital investments in accounting, starting from which FAS 26/2020 is applied, an organization can apply prospectively new requirements for the formation of information on capital investments in accounting. That is, only in relation to facts of economic life that occurred after the start of application of FAS 26/2020, and without changing previously generated accounting data.

The method chosen by the organization to reflect the consequences of changes in accounting policies is disclosed in the first financial statements prepared using FAS 26/2020.

Source: information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-28.

Read also

05.11.2020

Capex costs

A general has been established to determine the costs of acquiring, creating, improving and/or restoring fixed assets, in the amount of which capital investments are recognized ( previously , a general approach was not formulated).

Thus, expenses are considered to be the disposal (decrease) of an organization’s assets or the occurrence (increase) of its liabilities associated with capital investments. In this case, advance payment to the supplier (contractor) until he fulfills his contractual obligations to provide property, property rights, perform work, or provide services is not considered

Conditions for the formation of the reserve

A reserve may not be created in every case. This is possible only with a stable reduction in the cost of investments. The stability of the decrease can only be recognized if these points are simultaneously present:

- As of the past reporting date and the date of valuation, the estimated value is lower than the estimated value.

- Throughout the year, the estimated value either remains the same or decreases. If it increased, the reduction cannot be called stable.

- At the reporting date there is no data on subsequent multiplication of the value of assets.

Investment depreciation is observed in these cases:

- Bankruptcy or state before bankruptcy of the company itself.

- The bankruptcy or state before bankruptcy of the firm that was financed.

- The amount of dividends/interest is reduced or they stop being paid altogether.

- Securities similar to those purchased by the company appeared on the market. However, their cost is lower.

- Information has appeared about the revocation of the license for the main line of activity.

- Net assets reached a negative value.

- The main activity of the company suffers losses.

- There is a reasonable probability of a decrease in income from the deposit.

Depreciation involves a decrease in the profitability of deposits to the point where they cease to generate financial profit.