The concepts of “credit” and “loan”

Accounting for loans and borrowings in accounting is regulated by PBU 15/2008. The accountant should periodically recheck the document, since changes made to it entail adjustments to accounting. It is important to understand the difference between the concepts of “credit” and “loan”. A loan can only be issued by a specialized organization that has a license for this type of activity, for example, a bank (clause 1 of Article 819 of the Civil Code of the Russian Federation). It is issued only in cash and only at interest. The loan can be issued by any organization, individual entrepreneur or individual. There are no restrictions on the form of issuance for it: it can be either monetary or real. He may not have interest for use.

Accrual of a loan provided to an organization or a third-party individual

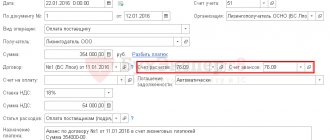

When transferring the loan amount to the current account of an organization (or a third-party individual) in the bank statement generated in 1C Accounting 8.3, in the “Type of transaction” column, you need to select the type “Issue of a loan to a counterparty”. In this case, in the “Settlements account” column, account 58.03 “Loans provided” will be automatically indicated. In the “Agreement” column, you need to indicate the loan agreement that we created for the counterparty at the previous stage.

In the column “Item of expenses” we indicate the DDS article “Provision of loans to other persons”.

Short-term and long-term loans

Accounting for loans in accounting depends on the time of use by the borrower. To make payments on short-term loans (issued for a period of up to 1 year), account 66 is used. For long-term loans (issued for a period of more than 1 year), account 67 is used. If it happens that long-term loans are repaid in less than 365 days, then they must be transferred to score 66.

Accounting for loans in accounting should be divided into analytics:

- by type of funds received;

- by sources of funds;

- for basic and additional costs.

Repayment of a loan provided to an organization or a third-party individual

When you select “Type of operation” - “Repayment of loan by counterparty”, account 58.03 is automatically indicated in the “Settlement account” column. In the “Income Item” column, you need to indicate the DDS article, whose “Movement Type” will be “Proceeds from the repayment of loans, from the sale of debt securities.” If this article is not in the list, create it. Let’s create it and call it “Receipt from loan repayments”. After creating a new DDS article, the program will offer to use it by default in certain operations. We agree that this article should be indicated in documents of this type.

Postings on loans and borrowings

Costs are reflected as part of other expenses of the enterprise. If they were received for the investment activities of the enterprise, then the costs for them are included in the cost of the asset being created until the asset is put into operation (this condition does not apply to small businesses on the simplified tax system).

Loan entries in this article imply loan entries, since commercial organizations, as already mentioned, cannot issue loans.

It is necessary to create subaccounts for accounts 66 and 67 to account for the amount of principal and interest debt. For example, to account for the principal debt, use account 66-1 (67-1); to account for interest debt, use account 66-2 (67-2).

Credit received, posting:

- Debit 51, 50, 41, 08, 10 Credit 66-1, 67-1 - loan received (long-term loan, transactions);

- Debit 91-2 Credit 66-2, 67-2 - the amounts of basic costs are included in operating expenses;

- Debit 67-1 Credit 66-1 - long-term loan transferred to short-term;

- Debit 91-2 Credit 60, 76 - the amounts of additional costs are taken into account;

- Debit 60, 76 Credit 51 - additional costs paid.

Loan repaid, posting:

- Debit 66-1, 67-1 Credit 51, 50, 41, 08, 10 - loan repaid (loan repayment, posting);

- Debit 66-2, 67-2 Credit 51 - interest on loans repaid.

Regulations PBU 15/2008 do not contain precise instructions on what date must be indicated when reflecting debt. Typically, accountants use the date the contract was signed or the date the loan was actually received. Both options are correct. When receiving a loan in kind, there is no difference from a tax point of view. But some nuances are worth noting.

Issuing a loan to a counterparty: regulatory regulation

Under a loan agreement, one party transfers money (or other material assets) to the other party, and the second party undertakes to return them (or the equivalent) after a certain period of time (Article 807 of the Civil Code of the Russian Federation).

The lender, a legal entity, enters into written loan agreement (Article 808 of the Civil Code of the Russian Federation), in which it indicates (Articles 807, 809 of the Civil Code of the Russian Federation):

- the amount and duration of the contract;

- the amount of interest, the procedure for their calculation and payment;

- other conditions - at the request of one of the parties (clause 1 of Article 432 of the Civil Code of the Russian Federation).

If the agreement does not specify the amount of interest, it is calculated in the amount of the key rate of the Bank of Russia that was in effect during the periods of interest accrual (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Interest is calculated from the day following the day the loan was provided (Article 191 of the Civil Code of the Russian Federation) until the day of its repayment (inclusive).

BOO . Interest-bearing loans provided to other organizations are classified as financial investments (clause 3 of PBU 19/02).

Loan interest:

- relate to other income of the organization (clause 34 of PBU 19/02, clause 7 of PBU 9/99);

- are accrued for each expired month in accordance with the terms of the agreement and are recognized in income during the term of the agreement on a monthly basis , regardless of the actual payment (clause 16 of PBU 9/99).

Interest-free loans do not meet the definition of financial investments, since they do not bring economic benefits (clause 2 of PBU 19/02) and are reflected in accounts receivable on account 76 “Settlements with various debtors and creditors.” Account 58 “Loans provided” is not applicable in this case.

WELL . Bank interest is recognized as part of non-operating income at the end of each month of the corresponding reporting (tax) period, regardless of the actual payment (clause 6 of Article 250, clause 6 of Article 271, clause 4 of Article 328 of the Tax Code of the Russian Federation).

USN . Interest on the loan is recognized as income on the date of actual receipt (clause 6 of Article 250, clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

VAT . The issuance of loans is not recognized as subject to VAT (clause 1, clause 2, article 146, clause 1, clause 3, article 39 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated April 29, 2013 N ED-4-3/7896, Ministry of Finance of the Russian Federation dated November 29 .2010 N 03-07-11/460).

The accrual of interest under a loan agreement refers to transactions that are not taxed (exempt) from VAT (clause 15, clause 3, article 149 of the Tax Code of the Russian Federation).

Read more Loans issued: general accounting issues

Features of a loan in kind

When receiving a loan in kind, an enterprise is forced to purchase consumables or fixed assets associated with the use of the loan received. They should be taken into account in the amount of actual costs without including VAT. When returning, the cost of the property must be calculated equal to the expenses at the time of purchase. Thus, there will be a price difference between the assets received and the assets reimbursed to the borrower.

The accountant must include this difference in other expenses or income:

- Debit 91-2 Credit 66, 67 - the price difference that arose as a result of an increase in the value of property was written off;

- Debit 66, 67 Credit 91-1 - the price difference resulting from a decrease in the value of the property is written off.

Loan agreement with an organization or third-party individual

To create a loan agreement in 1C Accounting 8.3, you need to add an agreement of the appropriate type to the list of agreements of the counterparty to whom the loan will be issued. To do this, in the sections panel, go to the “Directories” section and open the “Counterparties” directory. We open the counterparty we need (or create it), go to the “Agreements” tab and click the “Create” button.

In the window that opens, you need to indicate: our organization, counterparty, number, name of the agreement and its date.

In the contract type , select “Other”. Click the “Record” button.

Control points when accounting for a loan

There are nuances to consider:

- The accrued interest must correspond to the refinancing rate established by the Central Bank for the write-off period.

- The amounts and conditions for writing off interest must be comparable to credit obligations and loans under the terms of the agreements.

- The tax difference and the amount of tax liabilities must be calculated in accordance with PBU 15/2008 and reflected in accounting and reporting documentation.

An accountant should monitor changes in regulatory documents, since new rules may be introduced by law regulating the accounting of loans and borrowings, canceling previously existing ones. If the accounting of loans and borrowings is carried out incorrectly, then the tax authorities may regard this as incorrect accounting with the application of appropriate penalties.

Employee loan accounting

Among other things, the organization also has the right to issue a loan to an employee. Debit account 73 is used for this - issuing a loan; credit - return. Interest accrued at the time of borrowing is recorded in the same accounts.

However, if an employee is given an interest-free loan, he will receive a benefit in the form of savings on interest. This results from the fact that the organization acting as a tax agent must withhold personal income tax and transfer it to the budget in the amount of 35%. If the rate at which the amount is issued is not established, this does not mean its absence. In this case, it is equal to the standard refinancing rate.

In addition, you always need to take into account several nuances when issuing a debt to an employee:

- the contract must be drawn up in free and written form

- calculation of the validity period of the contract and the date of its conclusion is the actual transfer of funds

- Issue only in rubles is allowed - other currencies are available only to credit institutions

When drawing up an agreement, it is also necessary to correctly formulate and indicate the purpose of the loan. In its absence, the company has every right to issue a refusal.

What is the borrower’s material benefit from saving on interest?

In connection with the issuance of loans without interest or at a very low rate, the concept of material benefit to the borrower arises due to savings on interest payments. According to the definition of the Tax Code, the borrower receives a material benefit if the interest on his loan is less than 2/3 of the Central Bank refinancing rate. Today it is 7.75%, and 2/3 of it is 5.16%. If the borrower took out a loan below this rate, for example, at 3% per annum, then the difference between 5.16% and 3% will be considered a material benefit. An employee who receives an interest-free loan will receive a benefit of 5.16% per annum. Income tax is withheld from her at a rate of 35%.

Until 2021, the material benefit was calculated at the time of redemption. On the day when the employee returned the last part of the money and fully fulfilled his obligations, the accountant had to calculate how much interest he would have paid based on 2/3 of the refinancing rate, subtract from it the amount of interest actually paid and withhold 35% of personal income tax from the difference. Since the founders did not repay the loans, the moment of repayment did not occur and no tax was charged.

Starting from 2021, material benefits, according to changes made to the Tax Code, are calculated monthly. If you do not repay the interest-free loan for a long time, you will have to pay monthly tax on material benefits. For founders, this method of withdrawing money is now becoming less attractive.

Tax and accounting

Based on what type of loan appears in the transaction process, you need to properly account for it.

Accounting

When all postings have been completed, it is necessary to provide the VAT payer with an invoice from the island. Failure to comply with this condition may result in penalties from the relevant authorities.

Accounting for interest should be carried out in parts, and not entirely upon expiration of the term.

Taxes

The emergence of this type of lending, a loan, has made life much easier for those who often need certain amounts of money. The only nuance that you should pay attention to is the calculation of taxes. To avoid possible troubles, you need to take into account all the points in advance.

If the parties to the agreement are individuals, then payment of the loan will not trigger an additional tax burden. As for interest-free loans to legal entities. person, then there is a risk of non-operating income. It often becomes the cause of conflicts between those who pay taxes and special authorities.

If an interest-free loan was provided to an individual. person, then he must pay personal income tax of 35%. If funds are needed to purchase real estate, then taxes are reimbursed by personal income tax.

Calculation of an interest-free loan provided to an organization or a third-party individual

The accrual of an interest-free loan in 1C Accounting 8.3, as well as the accrual of an interest-bearing loan, is carried out using a bank statement document. In the “Agreement” column we indicate the interest-free loan agreement. In the column “Settlement account” we do not indicate the account for accounting for financial investments ( account 58.03 ), but indicate the account for settlements with other debtors and creditors ( account 76.09 ) or, in the case of transferring a loan to an individual, the account for accounting for other settlements with individuals (account 76.09) count 76.10).

When reflecting the issuance of an interest-free loan in cash in 1C Accounting 8.3, we make similar changes to the “Cash Issuance” document we previously reviewed (when issuing an interest-bearing loan in cash). We indicate the interest-free loan agreement and settlement account 76.09 (or 76.10).

Receipt of interest on a loan provided to an organization or a third-party individual

The receipt of interest on a loan (repayment of interest on a loan) to the organization's current account in 1C Accounting 8.3 is generated by bank statement documents with the “Type of transaction” - “Other settlements with counterparties.” In the “Settlement account” column, the same account is indicated as when calculating interest on the loan of this counterparty. In the “Item of Income” column we indicate the DDS article with the “Type of movement” - “Receipts from dividends, interest on debt financial investments.” If such an article is not in the list, then it needs to be created.

Is it possible to repay loan interest by offset?

As one of the methods of mutual settlements when repaying interest under a loan agreement, counterparties have the right to choose the offset of mutual claims. Offset of claims is possible if 3 conditions are met (Article 410 of the Civil Code of the Russian Federation):

- the lender and the borrower have counterclaims against each other;

- the requirements of both companies are similar;

- the deadline for fulfilling the counterclaim has already arrived.

For offset, a statement from one of the parties is sufficient.

The concept of a homogeneous requirement is not legally established. According to paragraph 7 of the information letter of the Presidium of the Supreme Arbitration Court dated December 29, 2001 No. 65, it is indicated that the requirement for offset may not correspond to obligations of one type. It follows from this that obligations associated with the execution of various contracts, but with the same method of repayment and expressed in the same currency, are recognized as homogeneous.

Example:

received an interest-bearing loan from Alliance LLC in the amount of 20 million rubles. at 15% per annum for a period of 1 year with interest payment at the end of the loan period. That is, Stroimaster is obliged to return 20 million rubles. principal debt and 3 million rubles. percent (20 million rubles * 10%).

For this transaction, the company recorded the following entries:

Alliance LLC purchased office space for 3 million rubles. The companies recorded the following transactions in their accounting records:

sent an application for offset of mutual claims in the amount of 2 million rubles.

Transactions from counterparties will look like this:

What to consider when concluding a contract

Careful study of the clauses of the contract is an important condition. This is in the interests of both parties. The parties can agree on the terms of the contract independently.

When studying the contract, special attention should be paid to the following:

:

- provision;

- the purposes for which funds are needed;

- loan terms.

The loan term is set based on the terms of the contract and can range from several hours to several years. Among them we can distinguish short-term (for a period of one year), medium-term (from 1 year to 5 years) and long-term contracts (more than five years).

Short-term loans are considered the most expensive of all these. They are often issued by various enterprises. The most unclaimed are long-term loans. They have the right to be issued by state banks, which occupy an honorable place in the Russian financial market.

You can distinguish types of loans according to target characteristics:

- targeted. The purpose for which the money is needed is known and clearly described. This could be, for example, the purchase of goods or equipment;

- non-targeted. Unlike targeted loans, these loans are more popular. They are much easier to process due to the minimum number of documents.

Non-targeted loans have one significant disadvantage. These are unfavorable interest rates, which can sometimes amount to up to 65% per year.

Results

Accounting for received loans and borrowings is reflected in the accounts: 66 - for short-term contracts, 67 - for long-term ones, and issued loans are reflected by the lender in the accounts: 58 - for interest-bearing loans, 76 - for interest-free loans. Interest on loans and borrowings are non-operating income for the lender and non-operating expenses for the borrower.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

- Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 N 65

Repayment of the loan in cash to the organization's cash desk

Repayment of a loan in cash to the organization's cash desk in 1C Accounting 8.3 is formed by the document “Cash Receipt” (and the “Cash Receipt Order” serves as the document that serves as the basis for reflection in accounting). We fill out the “Cash Receipt” document in the same way as we filled out the “Receipt to Current Account” documents. We indicate the same DDS article. In the “Printed form details” tab, in the “Bases” column, indicate the number and date of the loan agreement under which cash is deposited into the organization’s cash desk.

Main types

Loan is a fairly broad concept.

There are several features of this type of lending:

- based on receiving funds from private individuals and legal entities. persons lies the legislative framework;

- withdrawal of interest is optional;

- the object of transfer can be not only cash, but also goods;

- the terms are established through an agreement between both parties.

If an agreement is concluded with an organization, it must be in writing. All conditions must be clarified before concluding a contract. All parties to the contract are required to adhere to them.

In case of violation of one of the clauses of the contract, the transaction may be terminated. As for paying interest, this also needs to be taken care of in advance.