What applies to financial investments?

When accounting for this category of existing assets, economic entities rely on the norms adopted by law, which are reflected in the current PBU 19/02 “Accounting for financial investments.”

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

In order for an asset owned by a subject to be recognized as a financial investment, the following basic conditions must be met:

- Documentary evidence of ownership/receipt of assets.

- Organizational risks associated with assets: insolvency, liquidity, price changes.

- Availability of potential economic benefits (interest accrual, increase in initial cost).

Based on the above signs, financial The following instruments are considered investments: securities (including government securities, bonds and bills of exchange of other enterprises), contributions to the authorized capital of other entities (except for subsidiaries), loans provided to other entities, deposits with credit institutions, receivables in the form of assignment of claims. .

The following are not recognized as financial investments:

- Own shares purchased from employees, settlements using bills of exchange.

- Property used to generate income under rental agreements.

- Works of art, jewelry purchased not for resale.

- Intangible assets of entities, fixed assets and inventories (MPI).

Examples of transactions and postings on account 59

Let's consider an example when an organization made a contribution to the authorized capital of an LLC. What subsequently happened in the LLC:

- Decrease in net assets;

- And later it was liquidated.

Example 1. Creation of a reserve for impairment of the deposit made

Let’s say an organization made a contribution to the authorized capital of an LLC - 200,000 rubles. The net assets of the LLC at the time of making the contribution are 56 million rubles. Authorized capital - 1 million rubles. For two years, the LLC participant did not receive income. Having requested the balance of the LLC, the participant discovered a decrease in net assets to 20 million rubles. As a result, it was decided to create a reserve for the impairment of financial investments in proportion to the decrease in the value of the LLC’s net assets.

The following transactions should be reflected in the accounting:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| 91.2 | 59 | 128 600 | A reserve has been created for impairment of the deposit made | Accounting certificate calculation 20/56=35,7% (200 000-(200 000*35,7%)=128600 |

Example 2. Write-off of the reserve for impairment of the deposit made

Then, after another two years, the organization requested reporting from the LLC, but received no response. Then the organization on the Federal Tax Service website in the Electronic Services section, going to the “Business Risks: Check Yourself and the Counterparty” section, searching for an LLC by TIN, discovered that the LLC had ceased its activities.

The following transactions should be reflected in the accounting:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| 91.2 | 58 | 200000 | The amount of the contribution invested in the authorized capital of the liquidated LLC was written off | Extract from the Unified State Register of Legal Entities |

| 59 | 91.1 | 128600 | The reserve formed for the disposed deposit is written off | Extract from the Unified State Register of Legal Entities |

Financial investments in accounting policies

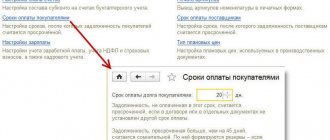

The list of assets that can be recognized as financial investments is not limited by law. Each organization independently decides on the possible composition of assets of this type. All information must be reflected in the accounting policies.

Formation of financial assets of the organization

| Asset criteria | Possible | Units |

| By time of use | Short term and long term | Short-term - repayment period less than 12 months; if the circulation period is longer, the assets are classified as long-term |

| Unit of account | Series, batch | The organization independently determines the unit of measurement. But at the same time, the principles of transparency in accounting and control over the movement of assets must be observed. |

| Acceptance for registration | Initial cost | Acquisition costs include the volume of actual costs, including purchase, delivery and others, excluding refundable taxes. |

| Determination of current market value | Assets with determinable and indeterminable market values | For assets with a certain market value, periodic adjustments to the existing price are required. If the current market value cannot be determined, the original cost is taken into account. |

All methods for determining financial investments should be reflected in the accounting policies. This applies to periods of use, units of measurement and other conditions.

To evaluate assets accounted for as financial investments, the actual costs of their acquisition are taken. Costs may involve more than just payments to suppliers. At the same time, the provisions of PBU 19/02 exclude general business expenses from costs to determine the initial cost, if these expenses were not directly related to the acquisition.

What reserves are created in each account?

| Type of reserve | Accounting | Tax accounting | ||

| For vacations and benefits based on the results of the year | Mandatory, with the exception of those who have the right to conduct simplified accounting (clause 3 of PBU 8/2010) | Created voluntarily (Article 324.1 of the Tax Code of the Russian Federation) | ||

| For doubtful debts | Mandatory for all companies (clause 70 of the Accounting Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n) | Created voluntarily (clause 3 of article 266 of the Tax Code of the Russian Federation) | ||

| For warranty repairs | Mandatory, with the exception of those who have the right to conduct simplified accounting (clause 3 of PBU 8/2010) | Created voluntarily (Article 267 of the Tax Code of the Russian Federation) | ||

| For repairs of fixed assets | Not created | Created voluntarily (clause 3 of article 260, clause 2 of article 324 of the Tax Code of the Russian Federation) | ||

| To reduce the cost of goods and materials | Mandatory, with the exception of those who have the right to conduct simplified accounting (clause 25 of PBU 5/01) | Not created | ||

| Under the depreciation of financial investments | Mandatory if the company has learned that the value of investments is significantly reduced (clauses 21, 38 of PBU 19/02). Those who have the right to conduct simplified accounting have the right not to create (clause 19 of PBU 19/02) | Not created | ||

| For R&D | Not created | Created voluntarily (Article 267.2 of the Tax Code of the Russian Federation) | ||

Valuation of securities

When purchasing securities, there are the following types of expenses: payment of the contract price to the seller and other expenses. If other expenses when purchasing securities are considered insignificant compared to the contractual value, their amount can be taken into account as part of the entity’s other expenses in the reporting period of acquisition. Institutions can determine the level of materiality independently by prescribing accepted criteria in their accounting policies.

For securities related to trading on the market, it is possible to determine the current value. It is calculated based on market trading data. In the financial statements, the timing of revaluation is determined independently. This could be a month, a quarter, etc.

If the revaluation of securities can significantly distort data on the financial condition of the enterprise, entities have the right not to adjust the value of assets. These actions must be reflected in the notes to the financial statements.

If it is not possible to determine the current market value of securities, the reporting shall indicate the initial cost of the financial investment.

How to show reserves in financial statements?

| Type of reserve | How to show in reporting | |

| On balance | In the income statement | |

| For vacations and benefits based on the results of the year | According to line 1540 “Estimated liabilities” | On line 2120, 2210, 2220 or 2350, depending on which account the reserve was accrued on |

| For doubtful debts | On line 1230 or 1240 minus the reserve | On line 2350 “Other expenses” |

| For warranty repairs | According to line 1540 “Estimated liabilities” | |

| To reduce the cost of goods and materials | According to line 1210 “Inventories” minus reserve (clauses 25, 35 of PBU 4/99) | |

| Under the depreciation of financial investments | On line 1170 (for long-term investments) or 1240 (for short-term investments) minus the reserve | |

Source:

"Clerk"

Heading:

Accounting

reserves reserve for doubtful debts instructions for an accountant

- Tatyana Ozerova, accounting and taxation expert

Sign up 7800

9750 ₽

–20%

Account 59 in accounting “Creation of reserves for the depreciation of investments in securities.” Postings

To record changes in the value of securities in organizations, account 59 is used. It is intended to summarize information about impairment for each asset position.

Impairment of securities is recognized as a sustainable decrease in their original value, which does not allow obtaining further economic benefits. Account 59 reflects the difference between the accounting and initial prices for available financial investments.

The formation of the reserve occurs after analyzing the financial condition of the securities. It is preferable to create in cases where there is a steady decrease in value, at the reporting date the price is significantly lower than the original one, or there is information about an inevitable decrease in the value of the asset in question in the future.

The creation of reserves, as well as an increase in the value of financial assets, is accompanied by the posting:

Debit 91 - Credit 59.

The basis for reducing the volume of newly accepted reserves is considered to be an increase in the value of these assets, as well as their disposal partially or entirely as a result of sale.

If the amount of the previously established reserve decreases or a disposal of financial investments occurs, the posting takes the following form:

Debit 59 - Credit 91.

About account 91, read the article: “Accounting for other income and expenses (account 91). Postings.”

Why is the reserve created?

So, the reserve is necessary to cover expected losses from the sale of existing securities. Impairment refers to a decrease in the estimated value of an investment, especially if the estimated income is less than what is expected to be received from the investment. Monitoring the market value of investments plays an important role; firms monitor price fluctuations, often independently determining the estimated price of investments. This is especially true for unlisted shares.

Calculations are carried out taking into account the aspects enshrined in the UP, but at least once a year. The criteria for sustainable decline include the following factors:

- The book value of the investment exceeds the estimated value;

- The estimated price in the period under review is steadily decreasing;

- There is evidence of a subsequent decline in the value of the investment and therefore a reduction in the benefits received.

Under what conditions should a reserve be formed?

In accordance with the above standards, the criteria for creating a reserve are as follows:

- The inventories available to the enterprise show signs of decreasing value:

- obsolete (no longer used in the production of manufactured products);

- have lost their original properties completely or partially;

- market prices for similar MPZs decreased.

- Inventory inventories do not belong to the separate consolidated groups of inventory accounting, named in clause 20 of the guidelines of the Ministry of Finance of the Russian Federation, namely:

- are not a group of basic production materials;

- are not a group of auxiliary materials for main production;

- do not relate to finished products or goods;

- do not relate to the reserves of a specific segment (geographical or operational).

- The amount of the reserve can be estimated with a sufficient degree of reliability. The basis for forming an expert opinion on the estimated value of the reserve can be:

- internal official documents (office memos, acts confirming, for example, the loss of useful properties of MPZ located in the warehouse);

- external information (for example, price lists of other sellers, confirming the fact of a decrease in prices on the market for one or another type of materials);

- enterprise accounting registers (for example, data from accounts with suppliers, confirming a stable decrease in the purchase price of inventories).

If the inventory in question has most of the characteristics listed above, then a reserve must be created for it for the difference between the actual cost of acquisition (capitalization) and the real market price of this inventory as of the reporting date.

Account characteristics

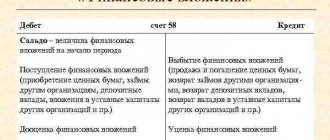

Financial investments, account 58 is an active accounting account. That is, when the volume of the indicator increases, the operation is formalized as a debit turnover, and the disposal is recorded as a credit turnover. For example, if an organization purchased debt bonds, then the accountant must record the cost of the purchase as a debit to account 58, and when repaying an interest-bearing loan or selling bonds, as a credit.

Order of the Ministry of Finance No. 94n provides for the opening of additional sub-accounts to account 58:

- 58-1 - for accumulating information on purchased units and shares.

- 58-2 - to reflect information on debt securities, both public and private.

- 58-3 - to generate information about interest-bearing loans provided.

- 58-4 - to collect data on deposits under simple partnership agreements.

As we noted earlier, all of a company’s financial investments can be divided into two types: long-term, with a turnover period of more than 12 months, and short-term, with a duration of less than one year.

If the company's activities involve both short-term and long-term financial investments, which account should be used in this situation? In this case, the company’s accounting policy, and then in the accounting itself, should provide for analytical detail on accounting account 58. That is, the company must independently divide financial investments according to their turnover periods and reflect this information in accounting.

What is it for? When preparing annual and interim accounting reports, data on short-term and long-term financial investments are reflected in different lines of the balance sheet. Thus, deposits with a maturity of up to 12 months should be included in line 1240, and investments with a validity period of more than a year should be included in line 1170.