The article discusses the procedure for reflecting transactions related to deductions from employee salaries for various reasons.

At the beginning, we note that deductions from employee salaries are made only in cases provided for in Art. 137 of the Labor Code of the Russian Federation and other federal laws (for example, Law No. 229-FZ[1]).

Reasons for retention may be:

1) orders of the employer (for example, regarding repayment of damage within the average monthly salary);

2) writs of execution (for example, regarding the repayment of alimony arrears and other legal claims brought against the employee);

3) statements from employees (regarding the transfer of trade union dues, loan repayment and other reasons).

To record calculations for deductions from employees' salaries of various periodic payments for non-cash transfers, account 0 304 03 000 “Calculations for deductions from wage payments” is used (clause 273 of Instruction No. 157n[2]).

In accounting, operations to withhold amounts from wages are recorded as an entry to the debit of account 0 302 11 83X and the credit of account 0 304 03 737 (clause 167 of Instruction No. 183n [3]).

Note that the institution maintains analytical accounting for account 0 304 03 73X in the card for accounting for funds and settlements (f. 0504051) in the context of recipients of withheld amounts and types of withholdings.

Next, we will consider the features of deduction from employee salaries based on:

1) orders of the employer;

2) executive documents.

Accounting for deductions from wages: postings and examples

According to the law, various deductions can be made from employees' wages. For proper deduction, you need to know the nuances of the types of deduction and their accounting.

Let's consider an example of calculating deduction from wages, as well as accounting entries generated when withholding personal income tax, according to writs of execution, when repaying a loan issued to an employee and withholding union dues.

Grounds and procedure for deduction from wages

Types of possible deductions from an employee’s salary:

Income not subject to withholding

These types are established by Art. 101 of Law No. 229-FZ. The main types of such income:

- Compensation for damage caused to health or in connection with the death of the breadwinner;

- Compensation for injury to an employee and family members if they die;

- Compensation from the budget as a result of disasters (man-made or radiation);

- Alimony;

- Amounts of business travel, moving to a new place of residence;

- Financial assistance in connection with the birth of a child, marriage, etc.;

Deduction order

Deductions from an employee's salary are made in the following sequence:

- personal income tax;

- Writs of execution for alimony for minor children, for compensation for harm to health, death of the breadwinner, crime or moral harm;

- Other writs of execution in the order of receipt (other mandatory deductions);

- Retentions at the initiative of the manager.

Limiting the amount of deductions

The amount of mandatory deductions cannot exceed 50% of the wages due to the employee. In some cases, the amount of deductions may be increased. For example, deductions based on writs of execution. These deductions are subject to a 70% limit:

- On alimony for minor children;

- Compensation for damage caused to health, death of the breadwinner;

- Compensation for criminal damage.

Also, when calculating deductions, you should take into account:

- If the amount of mandatory deductions exceeds the limit (70%), then the amount of deductions is distributed in proportion to the mandatory deductions. No other deductions are made;

- The amount of limitation on deductions initiated by the employer is 20%;

- At the request of the employee, the amount of deductions is not limited.

Example of calculating salary deduction

In the name of employee Vasilkov A.A. 2 writs of execution were received: alimony for the maintenance of 3 minor children - 50% of earnings and compensation for damage to health in the amount of 5,000.00 rubles. The salary amount was 15,000.00 rubles. The personal income tax deduction for 3 children amounted to RUB 5,800.00.

We will calculate deductions based on writs of execution:

- Personal income tax tax base = 15,000.00 – 5,800.00 = 9,200.00 rubles;

- Personal income tax = RUB 1,196.00;

- Amount of earnings for calculating deductions = 15,000.00 – 1,196.00 = 13,804.00 rubles;

- Limit amount = RUB 9,662.80.

Get 267 video lessons on 1C for free:

Deductions in the amount of =11,902.00 rubles, of which:

- For alimony = 6,902.00 rubles. (58% of the total withholding amount);

- Compensation for damage = 5,000, rub. (42% of the total withholding amount).

As a result, deductions are made according to writs of execution in the amount of:

- For alimony – 9,662.80 *0.58 = 5,604.42 rubles;

- Compensation for damage – 9,662.80 *0.42 = 4,058.38 rubles.

Mandatory deductions

Personal income tax is withheld from each employee’s salary at the following rates:

- 13% - if the employee is a resident of the Russian Federation;

- 30% - if a non-resident of the Russian Federation;

- 35% - in case of winning, savings on interest, etc.;

- 15% - from dividends of a non-resident of the Russian Federation;

- 9% - from dividends until 2015; interest on mortgage-backed bonds until 2007, from the income of the founders of the trust management of the mortgage coverage.

It does not matter in what form the income was received, cash or in kind. Let's look at an example:

Employee Vasilkov A.A. wages of 30,000.00 rubles were accrued, personal income tax was withheld from it at a rate of 13%, since Vasilkov A.A. is a resident.

Postings for mandatory withholding of personal income tax:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 30 000,00 | Salary accrued |

| 70 | 68 | 3 900,00 | Personal income tax withheld |

According to executive documents

The amount under the writ of execution is withheld from wages, taking into account personal income tax. The amount of additional expenses under the writ of execution (for example, transfer fees) is debited from the employee.

Let's look at an example:

Employee Vasilkov A.A. wages were accrued in the amount of 20,000.00 rubles, of which 25% was withheld according to the writ of execution. Amount of deduction under the writ of execution = (20,000.00 – 13%) * 25% = 4,350.00 rub.

Deduction from wages of Vasilkov A.A. according to the writ of execution is reflected by posting:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 20 000,00 | Salary accrued |

| 70 | 68 | 2 600,00 | Personal income tax withheld |

| 70 | 76.41 | 4 350,00 | The amount under the writ of execution was withheld |

| 76.41 | 50 | 4 350,00 | The amount according to the writ of execution was transferred from the cash register |

At the initiative of the employer

Deductions for the purpose of debt repayment are regulated by the Labor Code and other federal laws. In this case, it is necessary to issue an order no later than a month from the date of payment and obtain written permission from the employee.

If upon dismissal the amount of deductions is not completely written off, then, by agreement with the employee, the amount can be repaid:

- Judicially;

- By depositing funds into the cash register;

- Gift to an employee (in this case, expenses are not taken into account when calculating income tax);

- At the request of the employee, write off 20% of the salary monthly.

Typical entries for deductions from wages at the initiative of the employer:

| Dt | CT | Operation description |

| 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 73.2 | The amount of compensation for the shortage is withheld |

| 70 | 71 | Unreturned accountable amount withheld |

| 70 | 73.1 | Repayment of the issued loan |

Let's look at an example:

From employee Vasilkov A.A. RUB 1,500.00 was deducted from wages to repay the loan. The salary amounted to 10,000.00 rubles. The limit amount is = 8,700.00 * 0.2 = 1,740.00 rubles.

Posting the deduction of a loan from the salary of Vasilkova A.A.:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 73.1 | 1 500,00 | Deduction for loan repayment |

According to the employee

At the request of the employee, the manager can deduct the necessary amounts from wages, but the manager can also refuse such deductions. At the same time, the amount of deductions at the request of the employee is not limited.

Deduction from wages at the request of an employee posting:

| Dt | CT | Operation description |

| 70 | 76 | Amount withheld at the request of the employee |

Let's look at an example:

Employee Vasilkov A.A. wrote an application to withhold union dues in the amount of 2%. The salary amounted to 10,000.00 rubles. The amount of the union contribution is (10,000.00 – 1,300.00) *2% = 174.00 rubles.

Withholding of trade union dues from the wages of Vasilkova A.A. wiring:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 76 | 174,00 | Union dues withheld |

Source: https://BuhSpravka46.ru/buhgalterskie-provodki/uchet-uderzhaniy-iz-zarabotnoy-platyi-provodki-i-primeryi.html

Rubric “Question and answer”

Question No. 1. An employee of Kompanion LLC, Savelyev, pays monthly alimony on the basis of a writ of execution. In April 2021, Savelyev went on vacation for 12 days, during which he fell ill and took sick leave (5 days). Does Kompanion need to recalculate the amount of alimony?

There is no need to recalculate alimony payments. In this case, the “Companion” needs to reschedule vacation days taking into account the period of illness (+ 5 days for vacation). The calculation of alimony should be made from the total amount of income (salary + vacation pay) minus tax.

Question No. 2. Based on the writ of execution, Start-1 JSC withholds the amount of alimony from Kablukov’s salary on a monthly basis and transfers it to the recipient. Also, “Start-1” bears the costs of transferring funds (2.3% of the payment amount). Is it necessary to withhold from Kablukov the amount of expenses for the transfer of alimony?

Yes. When paying Kablukov's salary, Start-1 needs to withhold not only the basic amount (alimony), but also additional costs associated with paying the withholding to the recipient (costs of transferring funds).

Personal income tax withheld: posting tax withholding from wages

When personal income tax is withheld, the posting is made to the credit of account 68 in correspondence with the debit of one of the accounts for settlements with individuals. The article contains correspondence of accounts and examples, free reference books and useful links.

The following reference books will help you pay salary taxes without any problems; you can download them:

In the most common case of tax calculation, when personal income tax is withheld from wages, accounting entries are made to the personnel payroll account in correspondence with the budget settlement account.

In other cases, when less common income of individuals is subject to taxation, the correspondence of accounts may differ. For example, tax agents withhold personal income tax not only from wages, but also from financial aid, dividends, benefits, bonuses, etc.

Further in the article - details about frequently encountered transactions for accrued personal income tax.

Other tax references

After familiarizing yourself with the personal income tax transactions, do not forget to look at the following reference books, they will help in your work:

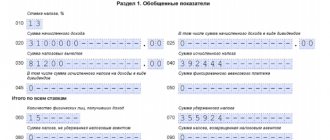

Personal income tax reporting – online

Traditionally, the most problematic form of income tax reporting for employers is the calculation on the 6-NDFL form. It was approved in 2015, but starting with the reporting for 2021, changes were made to the title page and the procedure for filling out the calculation.

It is possible that these amendments are not the last, since tax legislation is constantly being improved. In order not to track all changes and save time on filling out the report, it is more convenient to prepare it automatically - in the BukhSoft program.

Calculation according to form 6-NDFL can be generated in the BukhSoft program in 3 clicks. It is always drawn up on an up-to-date form, taking into account all changes in the law. The program will fill out the calculation automatically. Before sending to the tax office, the form will be tested by all Federal Tax Service verification programs. Try it for free:

6-NDFL online

Personal income tax accrued: posting

The accrual of personal income tax is reflected in the accounting records of the tax agent upon the fact of tax withholding from the income of an individual. In what amount should personal income tax be accrued, posting involves the application of a certain formula for calculating tax. If personal income tax is withheld from the income of an individual resident of Russia, then the following formula is applied:

When calculating tax, account 68 for settlements with the budget is credited. By debit for transactions in which personal income tax is accrued, the posting will be made to the accounts that reflect the taxable income of individuals. For example:

- if the tax agent withholds personal income tax from the salary, then account 70 of wage settlements is debited;

- if tax is withheld from an employee’s non-productive income, then the transaction is reflected in the debit of account 73 of settlements with personnel for other transactions.

Read more about personal income tax withholding in Table 1.

Table 1.

Personal income tax accrued: posting

| Dt | CT | Source of tax withholding |

| 70 | 68 | Withholding by the employer from the following payments to the employee:

|

| 73 | 68 | Withholding by the employer from other payments to hired employees, except for amounts reflected in account 70 |

| 75 | 68 | Withholding by a tax agent paying dividends to an individual |

Let us illustrate the correspondence of accounts from Table 1 with a numerical example.

Example 1

Personal income tax accrued: posting

On July 5, Symbol LLC paid the accountant an additional salary for June, the total amount of which is 60,000 rubles, and for the first time in a year, issued financial assistance for the July vacation in the amount of 10,000 rubles. If we assume that the accountant is a tax resident of Russia and does not have the right to deductions, for transactions in which personal income tax is accrued, the posting will be made as follows:

Dt 70 Kt 68 subaccount “Calculations for personal income tax”

– 7800 rub. – tax is withheld from the accountant’s salary;

Dt 73 Kt 68 subaccount “Calculations for personal income tax”

– 780 rub. ((RUR 10,000 – RUR 4,000) x 13%) – tax is withheld from the taxable part of financial assistance to the accountant.

Personal income tax is withheld from wages: posting

As you know, the employer is obliged to pay wages at least twice a month, while withholding income tax is required only upon the final payment at the end of the month. As a result, peculiarities arise in the reflection of transactions in accounting, which can be seen in example 2.

Example 2

Personal income tax is withheld from wages: posting

Trading paid the accountant an advance on his salary on June 20 in the amount of 25,000 rubles. and the remaining amount of the salary was accrued on July 5 in the amount of 35,000 rubles.

Symbol transfers payments to employees to their bank accounts with the execution of separate payment documents.

If we assume that the accountant is a tax resident of Russia and has no right to deductions, the tax amount is 7,800 rubles. ((RUR 25,000 + RUR 35,000) x 13%).

Read about tax withholding operations in Table 2.

Table 2.

Personal income tax is withheld from wages: posting

| Dt | CT | Sum | The meaning of the operation |

| 70 | 51 | 25,000 rub. | Advance payment for June salary transferred |

| 44 | 70 | 35,000 rub. | Payroll accrued for June |

| 70 | 68 | 7800 rub. | Tax withheld from the total wages for June |

| 70 | 51 | RUR 27,200 | The final settlement was made with the accountant for wages for June |

Posting: personal income tax withheld from vacation pay

Calculations for vacation pay are reflected in account 70 payroll calculations. In this case, the source of financing payments for vacation is the estimated liability reflected in account 96. As a result of which transactions the personal income tax withholding from vacation pay is posted, see example 3.

Example 3

Posting: personal income tax withheld from vacation pay

The production department accrued vacation pay to the accountant for the July holiday in the amount of 30,000 rubles. Symbol transfers payments to employees to their bank accounts. If we assume that the accountant is a tax resident of Russia and has no right to deductions, the tax amount is 3,900 rubles. (RUR 30,000 x 13%).

Read about tax withholding operations in Table 3.

Table 3.

Posting: personal income tax withheld from vacation pay

| Dt | CT | Sum | The meaning of the operation |

| 96 | 70 | 30,000 rub. | Vacation pay accrued |

| 70 | 68 | 3900 rub. | Income tax withheld from vacation pay |

| 70 | 51 | RUR 26,100 | Payment for vacation was transferred to the accountant |

Posting: personal income tax withheld from sick leave

Calculations for payment for periods of temporary disability are reflected in the debit of account 70. In this case, the source of financing for “sick leave” payments can be both funds from the social insurance fund and the employer’s own funds. As a result, personal income tax withholding from sick leave is posted as part of the following operations:

Dt 20 (26, 44, …) Kt 70

– part of the benefit is accrued at the expense of the employer;

Dt 69-1 Kt 70

– part of the benefit was accrued from the Social Insurance Fund budget;

Dt 70 Kt 68 subaccount “Calculations for personal income tax”

– income tax withheld.

Posting: personal income tax is transferred to the budget

Firms, entrepreneurs and individuals must pay taxes to the Russian budget in rubles. At the same time, according to the general rule, legal entities - tax agents for personal income tax make tax payments in non-cash form. Therefore, the posting of income tax payments to the budget is made within the framework of the following operations:

Dt 70 (73, 75) Kt 68 subaccount “Calculations for personal income tax”

– income payment is withheld;

Dt 68 subaccount “Personal Tax Payments” Kt 51

– income payment is transferred to the budget.

Source: https://www.BuhSoft.ru/article/2121-uderjan-ndfl-provodka

If you are unable to withhold excess payments

For example, the employee did not agree to the deduction or upon his dismissal, 20% of the “severance” payments were not enough to pay off the entire debt. Then it is possible to recover wages and equivalent payments from the employee in court only in three cases (Article 137 of the Labor Code of the Russian Federation; clause 3 of Article 1109 of the Civil Code of the Russian Federation; Determination of the Primorsky Regional Court dated December 20, 2011 N 33-12174; Determination of the Supreme Court of the Russian Federation dated 05/28/2010 N 18-В10-16; Supreme Arbitration Court of the Russian Federation dated 10/08/2008 N 12227/08):

(or) a counting error was made;

(or) there were dishonest actions of the employee (for example, the employee unlawfully accrued his salary, abusing his official position (Determination of the Sverdlovsk Regional Court dated July 12, 2012 N 33-8492/2012), unlawfully received a salary after dismissal (Cassation determination of the Trans-Baikal Regional Court dated December 27. 2011 N 33-4545-2011), provided false information that affected the amount of wages, or fabricated documents for calculating wages in a larger amount (Appeal ruling of the Krasnodar Regional Court dated 08/28/2012 N 33-17581/2012));

(or) the court finds the employee guilty of failure to comply with labor standards or downtime (if excessive payments are collected from the employee for downtime and underperformance).

In the absence of such circumstances, the courts generally refuse employers to collect excess payments from employees (Decisions of the Supreme Court of the Komi Republic dated July 23, 2012 N 33-2899AP/2012, St. Petersburg City Court dated November 3, 2011 N 33-16437/2011; Appeal rulings of the Volgograd Regional Court dated 03/15/2012 N 33-2387/2012; Moscow City Court dated 08/06/2012 N 11-16329; Yaroslavl Regional Court dated 07/05/2012 N 33-3460; Pskov Regional Court dated 05/15/2012 N 33-749/2012).

Opposite decisions are rare (Appeal ruling of the Court of the Jewish Autonomous Region dated July 27, 2012 N 33-366/2012; Cassation ruling of the Bryansk Regional Court dated February 24, 2011 N 33-507/11). Moreover, sometimes it is possible to recover excess payments from the employee as material damage (Cassation ruling of the Supreme Court of the Republic of Tatarstan dated October 24, 2011 N 33-12920/11).

* * *

If we are not talking about excessive payments to an employee within the framework of an employment relationship, but about his debt on other grounds, then, of course, there is the possibility of collecting it from the employee. For example, if:

(or) the employee caused material damage to the company (in particular, he did not return the property entrusted to him, work clothes upon dismissal, overused his work Internet traffic for personal needs, damaged the company’s property) (Articles 248, 392 of the Labor Code of the Russian Federation). Moreover, if the amount of damage does not exceed the employee’s average monthly earnings, then it can be withheld from his salary without his consent (Article 248 of the Labor Code of the Russian Federation);

(or) the employee did not fulfill the obligation under the civil law contract (for example, did not repay the loan) (Article 15, clauses 1, 2 of Article 393 of the Civil Code of the Russian Federation) or you overpaid the employee amounts also under the civil law contract (Clause 1 Article 1102 of the Civil Code of the Russian Federation).

Consultations on the topic: Paying salaries to employees ahead of schedule

Checking the correct calculation of compensation for unused vacation Consequences of receiving a “gray” salary for an employee How to calculate vacation pay in 2014 The employee has several certificates of incapacity for work

Accounting entries for salaries

The chart of accounts (Order of the Ministry of Finance No. 94n dated October 31, 2000) provides account 70 “Settlements with personnel for wages” to reflect the accrual, payment of wages and deductions from them. It is on this basis that salary accounting entries are generated in correspondence with other accounts.

The account is passive, and its loan balance reflects the amount of wages the organization owes to its employees. The credit of the account reflects the accrual of payment for the performance of labor duties.

The debit reflects the transfer from the current account or the payment of wages from the cash register, a posting reflecting the amount of deductions.

Analytical accounting should be organized for each employee separately. This will allow you to obtain up-to-date information on the accruals and debts of each individual company employee at any time.

https://www.youtube.com/watch?v=2EOLdMNg7UI

The main stages of organizing payroll accounting include:

- Calculation of wages.

- Calculation and accounting of deductions from salaries.

- Calculation of insurance premiums.

- Payment of wages.

- Transfer of personal income tax and insurance premiums.

The accountant repeats all stages every month. And for each case, its own wiring is formed. Below are the correspondence accounts that are used most often.

Payroll entries

The accrual of wages is reflected in the credit of account 70. Corresponding accounts when calculating wages reflect the direction of cost accounting depending on the labor functions performed by the employee. Also, on the credit of account 70, accruals of payment for the time the employee is absent due to illness or vacation are reflected.

Debit Credit

| Wages accrued to employees of main production, posting | 20 | 70 |

| Workers of auxiliary production | 23 | 70 |

| Employees of departments serving the main production received wages, posting | 25 | 70 |

| Employees of the management and general business units were accrued salary, posting | 26 | 70 |

| The construction work of the new administrative building is being carried out on our own: salaries and wiring have been calculated | 08 | 70 |

| Calculated salaries of employees of a trade organization | 44 | 70 |

| Calculated payment for sick leave at the expense of the employer (first three days) | 20, 25, 26, 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the Social Insurance Fund | 69 | 70 |

| Reflects accrued payments that are not directly related to work activities (for example, an employee’s anniversary bonus) | 91 | 70 |

| If a reserve is formed for vacation pay | ||

| A deduction was made to the reserve on the date when wages were accrued to employees, posting | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

Deduction from wages: postings

Deductions from wages are reflected in the debit of account 70. The main ones are:

- personal income tax;

- alimony, other deductions under writs of execution;

- contributions to a trade union organization;

- compensation to the enterprise for damage or loss.

Debit Credit

| Personal income tax calculated | 70 | 68 |

| Payments under writs of execution (alimony, fines) are withheld | 70 | 76 |

| Amounts of compensation for shortages and damages due to the fault of the employee are withheld | 70 | 73 |

| Upon dismissal, payment for unworked vacation days is withheld, reversal | 96 (20, 25, 26, 44) | 70 |

Salary issued: posting

At the request of the employee, wages can be given to him in cash or by bank transfer. Regardless of whether the PO is transferred to the card or issued from the cash register, the posting is generated by the debit of account 70.

Debit Credit

| Salaries issued from the cash register, posting | 70 | 50 |

| Salaries were paid from the bank account to employee cards, posting | 70 | 51 |

| Alimony and other deductions under writs of execution have been paid | 76 | 51 |

Personal income tax and insurance premiums: calculation and payment

From payments to employees, employers are required to calculate and transfer to the state:

- personal income tax (rate for residents - 13%);

- insurance premiums (22% - compulsory medical insurance, 5.1% - compulsory medical insurance, 2.9% - compulsory social insurance).

The Chart of Accounts uses account 68 for accounting for tax payments, and account 69 for calculating and accounting for insurance premiums.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Insurance premiums have been calculated | 20, 23, 25, 26, 44 | 69 |

| The withheld personal income tax was transferred to the budget | 68 | 51 |

| Insurance premiums transferred to the budget | 69 | 51 |

Postings for PO: reflection in accounting registers

Forms of registers for recording business transactions are developed and approved by a commercial organization independently. They must ensure that they can obtain up-to-date information about the company's assets and liabilities at any time.

As mentioned above, the salary register must provide detailed data for each employee. It is also advisable to detail the data on the types and amounts of charges, deductions and payments.

You can organize such detailed accounting in an independently developed form, or you can use Form T-54, approved by the State Statistics Committee in Resolution No. 1 of 01/05/2004.

The basis for calculating wages and filling out registers for its accounting may be:

- time sheets;

- employment contracts;

- bonus orders;

- vacation orders;

- writs of execution and statements of deductions;

- other documents on labor standards and remuneration.

Form T-54

Also, according to Article 136 of the Labor Code of the Russian Federation, the employer is obliged to notify staff about accruals and deductions before transferring wages. This can be done by issuing a pay slip to the employee.

Its form should allow the employee to learn in an understandable form about accruals, deductions and amounts to be received.

You can inform the employee both on paper and in electronic form, for example, by sending a payslip by email.

Payroll example: calculation and postings

Let's look at an example of the procedure for generating transactions for payment of remuneration to employees. LLC "Company" employs two people. The organization is engaged in wholesale trade and the salaries of all employees are included in account 44. Salaries are paid on the 10th of the next month. On the same day, personal income tax and alimony are transferred. Insurance premiums were transferred on December 14, 2018.

Manager Petrov P.P. pays alimony according to the writ of execution - 25% of the salary. All are tax residents, that is, the personal income tax rate for everyone is set at 13%. The organization pays insurance premiums at regular rates (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS). All employees are paid salaries via bank cards.

Information on accruals and deductions for November 2019

| FULL NAME. | Job title | Accrued based on salary | Sickness benefit (all payment at the expense of the Social Insurance Fund) | Personal income tax | Alimony | To payoff | Insurance premiums | |

| OPS | Compulsory medical insurance | OSS | ||||||

| Ivanov I.I. | Director | 40 000 | 10 000 | 6500 | 43 500 | 8800 | 2040 | 1160 |

| Petrov P.P. | Manager | 30 000 | 3900 | 6525 | 19 575 | 6600 | 1530 | 870 |

| Total | 70 000 | 10 000 | 10 400 | 6525 | 63 075 | 15 400 | 3570 | 2030 |

The accountant will generate the following entries:

Amount Debit Credit

| November 30, 2019 | |||

| Salary accrued | 70 000 | 44 | 70 |

| Disability benefits | 10 000 | 69 | 70 |

| Personal income tax withheld | 10 400 | 70 | 68 |

| Child support withheld | 6525 | 70 | 76 |

| Insurance premiums accrued (15,400 + 3570 + 2030) | 21 000 | 44 | 69 |

| December 10, 2019 | |||

| Salary paid | 63 075 | 70 | 51 |

| Alimony payments listed | 6525 | 76 | 51 |

| Personal income tax paid to the budget | 10 400 | 68 | 51 |

| December 14, 2019 | |||

| Insurance premiums listed | 21 000 | 69 | 51 |

Source: https://clubtk.ru/bukhgalterskie-provodki-po-zarplate

Types of excess payments

From the salary (Article 129 of the Labor Code of the Russian Federation), the employee is allowed to deduct:

- vacation pay for unworked vacation days. Such debt may arise if an employee is dismissed before the end of the working year for which he has already received annual paid leave. You can deduct the employee's debt from the “severance” payments due to him. However, upon dismissal for some reasons, overpaid vacation pay cannot be withheld. For example, upon dismissal:

- in connection with a reduction in staff or number of employees (Clause 2 of Article 81 of the Labor Code of the Russian Federation);

- the employee’s refusal to transfer to another job, which is necessary for him according to a medical certificate, or the employer’s lack of appropriate work (Clause 8 of Article 77 of the Labor Code of the Russian Federation);

- conscription for military service (Clause 1 of Article 83 of the Labor Code of the Russian Federation);

- reinstatement at work of an employee who previously performed this work (Clause 2 of Article 83 of the Labor Code of the Russian Federation);

- unearned salary advances. This debt may arise, for example, when an employee was paid an advance payment of wages for that month at the beginning of the month, and the employee, without having worked it, went on vacation at his own expense or on sick leave before the end of the month;

- unspent and unreturned accountable amounts, including those issued when sent on a business trip (Letter of Rostrud dated March 11, 2009 N 1144-TZ);

- payments for failure to comply with labor standards or idle time (Articles 155, 157 of the Labor Code of the Russian Federation). Such a debt will arise if you pay an employee for downtime or shortcomings on the basis that they occurred through your fault or for reasons beyond the control of both parties, and then it turns out that the employee was to blame. In this case, excess payments can be withheld only after you go to court and the court establishes the employee’s guilt in idle time or underperformance (Determination of the Moscow Regional Court dated December 15, 2011 N 33-25895);

- amounts overpaid due to an accounting error. Moreover, this is not necessarily a salary. This also includes any amounts erroneously paid to an employee as part of or in connection with the employment relationship. Rostrud specialists also think the same.

There is no definition of a counting error in the Labor Code. The courts and Rostrud believe that only arithmetic errors in calculations are countable, that is, errors made as a result of incorrect application of the rules of mathematics (Letter of Rostrud dated October 1, 2012 N 1286-6-1). Therefore, courts, as a rule, do not recognize the following errors as counting:

- the same amount was transferred twice due to a technical error (Determination of the RF Armed Forces dated January 20, 2012 N 59-B11-17);

- the previously paid amount is not taken into account in the calculation (Determination of the Sverdlovsk Regional Court dated 02/16/2012 N 33-2365/2012; Cassation Determination of the Krasnodar Regional Court dated 02/14/2012 N 33-3340/12);

- incorrect initial data were used in the calculation (for example, the wrong tariff or coefficient (Appeal ruling of the Oryol Regional Court dated June 20, 2012 N 33-1068), the wrong number of days (Cassation ruling of the Khabarovsk Regional Court dated 02/08/2012 N 33-847/2012) );

- the salary in the program was doubled due to an error in the calculation algorithm (Appeal ruling of the Bryansk Regional Court dated 05/03/2012 N 33-1077/12);

- when calculating, the norms of the organization’s local regulatory act were incorrectly applied (Appeal ruling of the Moscow City Court dated July 16, 2012 N 11-13827/12).

Courts reach other conclusions extremely rarely. For example, the Samara Regional Court indicated that counting errors include not only arithmetic errors, but also software failures (Determination of the Samara Regional Court dated January 18, 2012 N 33-302/2012).

And the Rostov Regional Court, reviewing a case in which “severance” payments were transferred to a dismissed employee by mistake, came to the conclusion that there was a counting error. Since the total amount of transfers exceeded the amount accrued in favor of the employee (Cassation ruling of the Rostov Regional Court dated September 12, 2011 N 33-12413).

The fact that a counting error was made when calculating payments in favor of the employee must be documented. For example, an accountant may write a memo addressed to the manager. Or let a specially created commission from among the company’s employees draw up a report on the discovery of a counting error.

Accounting for payroll deductions: entries and examples – Business Ideas

According to the law, various deductions can be made from employees' wages. For proper deduction, you need to know the nuances of the types of deduction and their accounting.

Let's consider an example of calculating deduction from wages, as well as accounting entries generated when withholding personal income tax, according to writs of execution, when repaying a loan issued to an employee and withholding union dues.

- 2.1 Mandatory deductions

What is a social tax benefit and how is it calculated?

It should be noted here that for some categories of the population a social tax benefit for personal income tax is provided, which exempts part (or all) of the income of such citizens from paying this tax. At the moment, this benefit is equal to 50% of the minimum wage established on January 1 of the year in which income is calculated. However, it applies only if the income of these citizens does not exceed the established limit. In general, the rule for determining income to which this benefit can be applied is as follows. The cost of living for an able-bodied person is taken as of January 1 of the year in which the salary is calculated and multiplied by a factor of 1.4 and rounded to the nearest 10 UAH. During the year, the size of the benefit and the maximum permissible income do not change. This is not affected in any way by the increase in the minimum wage and the cost of living throughout the year.

In special cases, when employees working at an enterprise have special merits or are the mother or father of many children, the amount of personal income tax benefits for them can be increased by 1.5 or 2 times, with a corresponding increase in the maximum allowable income. Benefits in any amount are provided only upon a written application from the employee to the accounting department of the enterprise.

Postings for deduction from wages. Accounting for deductions from wages: postings and examples

Deductions from wages are divided into three groups: mandatory (prescribed by law), at the initiative of the employer (also regulated by labor law), at the request of the employee. Let's look at the main typical entries for salary deductions.

Mandatory withholdings include taxes on employee income - personal income tax. Different categories of employees have their own tax rate.

Reflected by wiring:

Is issued by the entry:

Payment of withheld obligations in favor of the claimant is made in a writ of execution or within three days and is recorded by recording:

Transfer costs are borne by the employee (bank commission, etc.).

Example of postings: personal income tax withheld from wages

In the amount of 35,000 rubles. He is a resident, the personal income tax rate is 13%. Alimony in the amount of 7,000 rubles is withheld from him monthly.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 35 000 | ||||

| 68 personal income tax | 4550 | Payroll statement | ||

| 76 | Child support withheld | 7000 | Performance list | |

| 66 | Monthly repayment of loan debt | 112 500 | Payment order ref. |

Employer-initiated deductions

Occurs in case of damage or loss of property (Debit Credit 73.2), debt on accountable amounts (Debit Credit 71). The employer can also deduct part of the funds from the employee’s salary to repay a previously issued loan (Debit Credit 73.1).

Sometimes an employer may mistakenly pay a larger salary. Then part of the overpayment is withheld from the employee.

Another situation: an employee took full paid leave, but quit before the end of the period for which it was taken. Amounts of vacation pay for those days to which the employee is not entitled are withheld (Debit Credit 73).

The employee has funds withheld from his salary (RUB 000) to repay a loan in the amount of RUB 5,500.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Employee salary accrued | 000 | Payroll statement | ||

| 68 personal income tax | Personal income tax withheld | 3640 | Payroll statement | |

| 73.1 | Loan amount withheld | 5500 | Loan agreement Accounting certificate |

Deductions initiated by the employee

The employee may request that a certain amount be withheld from his salary each month. These could be amounts to repay a loan from an employer, for charity, voluntary insurance or trade union dues (Debit

Operations for withholding personal income tax, the entries below, are formed in the accounting accounts of the employing enterprises. For calculations, the Chart of Accounts provides an account. 68 “Calculations with the budget”, to which sub-accounts are opened depending on the purpose. Let's look at examples of generating income tax entries when reflecting various situations - payment of wages, dividends, benefits, etc.

According to stat. 226 clause 4 of the Tax Code, tax agents (employers) are required to withhold tax when paying any types of income to employees. Non-taxable transactions are listed in stat. 217 of the Tax Code and include benefits under the BIR, other types of state benefits, pensions, compensation payments for personal injury and others.

It is mandatory to withhold personal income tax from the following payments:

- Employees' salaries.

- Vacation and sick leave, except those excluded.

- Amounts for writs of execution.

- Amounts of travel allowances - for Russian trips from 700 rubles, for foreign trips - from 2500 rubles. in a day.

- Financial assistance over 4000 rubles. employee, 50,000 rub. at the birth of a child.

- Income in kind.

- Dividends.

- Credit interest.

- Payments for material benefits (the procedure for determination in Article 212 of the Tax Code).

– wiring is performed in various ways, examples are given below. The credit of the account will always be 68, the debit changes depending on the types of deduction.

Analytical accounting is carried out according to tax rates, employees, and payment grounds.

Personal income tax – postings:

- Personal income tax is withheld from wages - posting D 70 K 68.1 is carried out when making payments to employees employed under employment contracts. The deduction for vacation pay is reflected in the same way.

- Personal income tax withheld under GPA agreements - posting D 60 K 68.1

- Personal income tax was accrued for material benefits - posting D 73 K 68.1.

- For financial assistance, personal income tax is assessed - D 73 K 68.1.

- Personal income tax is withheld on dividends - posting D 75 K 68.1, if the individual is not an employee of the company.

- Personal income tax is withheld on dividends - entry D 70 K 68.1, if the recipient of the income is an employee of the company.

- For short-term/long-term loans provided, the accrual of personal income tax is reflected - D 66 (67) K 68.1.

- Personal income tax was transferred to the budget - posting D 68.

1 K 51.

An example of calculating income tax and generating standard transactions:

Employee Pankratov I.M. Earnings for January were accrued in the amount of 47,000 rubles. An individual is entitled to a deduction for one minor child in the amount of 1,400 rubles. We will calculate the amount of tax to be withheld and make accounting entries.

Personal income tax amount = (47000 – 1400) x 13% = 5928 rubles. There are 41,072 rubles left to hand over to Pankratov.

Postings:

- D 44 K 70 for 47,000 rubles. – earnings for January have been accrued.

- D 70 K 68.1 for 5928 rub. – personal income tax withholding is reflected.

- D 70 K 50 for 41072 rub. – reflects the cash payment of earnings from the company’s cash desk.

- D 68.1 K 51 for 5928 rubles. – the tax amount has been transferred to the budget.

Let's add the conditions of the example. Suppose Pankratov I.M. provided a loan to his organization in the amount of 150,000 rubles. with interest payment in the amount of 8,000 rubles. We will charge personal income tax on interest at an estimated rate of 13%.

Personal income tax amount = 8000 x 13% = 1040 rubles.

Postings:

- D 50 K 66 for 150,000 rubles. – the loan is reflected.

- D 91 K 66 for 8000 rubles. – interest is reflected.

- D 66 K 68.1 for 1040 rubles. - tax charged.

- D 66 K 50 for 151040 rub. – taking into account the due interest, the loan is repaid in cash.

Conclusion - calculating personal income tax using postings is a mandatory procedure for paying any income to individuals, with the exception of non-taxable transactions. Tax rates are regulated at the legislative level and vary by employee category.

, please select a piece of text and press Ctrl+Enter

.

The chart of accounts and instructions for its use for accounting for all payments made by the organization to its employees are provided.

Maintaining salary on account 70

It takes into account all settlements with personnel:

- on wages, including basic and additional wages, as well as incentive and compensation payments;

- for, benefits and compensations;

- for payment of vacation pay and compensation for unused vacation;

- on deductions from wages to compensate for losses from marriage, shortages, theft, damage to material assets, etc.;

- on payment by employees of trade union dues, utilities and other services;

- based on a court decision, etc.

By credit, the entries in account 70 display the amount of debt of the enterprise/organization to the employee, by debit - the reduction of such debt due to the payment of wages or other amounts due to employees in accordance with the law, or the occurrence of debt by the employee to the enterprise.

Analytical accounts for account 70 can be opened for groups of employees (by divisions) and for each employee separately.

The main corresponding accounts to account 70 when calculating salaries are determined by the type of activity of the enterprise (organization):

- in production – (for workers in main production), (for workers in auxiliary production), 25 (for workers involved in the management and maintenance of workshops and/or sections), 26 (for employees of plant management and specialists), 29 (for workers in service production and farms);

- in trade and service sector - .

When calculating benefits, accounts intended for settlements with extra-budgetary funds are used (). When calculating vacation pay and amounts of remuneration for long service, it is used, etc.

All listed accruals are made on the debit of the indicated accounts and on the credit of account 70.

See step-by-step instructions for calculating and paying salaries in 1C 8.3:

Postings: wages accrued

Basic payroll calculations:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 (23, 25, 26, 29) | 70 | Posting: wages accrued to employees of the main production (auxiliary, maintenance, management and maintenance workers of workshops and the enterprise as a whole) | 150000 | Help-calculation |

| 44 | 70 | Salaries accrued to employees of a trade or service enterprise | 60000 | Help-calculation |

| 69 | 70 | (due to illness, work injury, pregnancy and childbirth, etc.) | 20000 | Help-calculation |

| 91 | 70 | Wages accrued to employees engaged in activities not related to the usual for the enterprise (for example, maintenance of leased facilities) | 30000 | Help, calculation, lease agreement |

| 96 | 70 | Payments to employees are accrued from the reserve for upcoming expenses and payments (vacation pay, long service benefits, etc.) | 40000 | Help-calculation |

| 97 | 70 | Wages were accrued to employees engaged in work classified as deferred expenses (development and testing of new products, scientific research, market research, etc.) | 35000 | |

| 99 | 70 | Salaries have been accrued to employees of the enterprise involved in eliminating the consequences of emergencies, disasters, accidents, natural disasters, etc. | 15000 | Certificate of calculation, certificate of completion of work |

An enterprise (organization), in the event of a shortage of funds, can partially pay employees in kind, but such payments should not exceed 20% of the accrued amount of wages.

When paying for labor with products of own production, it is taken into account at market prices in accordance with Art. 40 Tax Code of the Russian Federation.

Personal income tax and unified social tax on payments to employees in kind are paid on a general basis based on the market value of products or other material assets issued to employees.

Calculation of individual types of earnings.

Primary documents are used to calculate salaries

.

time sheet - with a time-based wage system

;

documents for recording production - with a piecework system

.

The calculation of an employee’s earnings depends on the remuneration system established at the enterprise.

With time-based

In the form of remuneration, employees who have worked the entire month are paid

a salary. If the month is not fully worked, earnings are calculated

by dividing the monthly salary by the number of working days in the month. The resulting average daily earnings are multiplied by the number of working days to be paid.

With piecework wages

the amount of earnings is determined by multiplying the established piece rates by the volume of work performed - the number of parts manufactured or operations performed.

Along with the wages accrued for the time worked or for the quantity of products produced, workers and employees are also made compensation payments according to the labor law.

Compensation payments included in salary include

additional payments for working conditions that deviate from normal:

- for work in difficult climates. conditions (North);

— for difficult, harmful and (or) dangerous working conditions;

- for overtime work (for the first 2 hours at one and a half times the rate, and for all subsequent hours at double the rate);

- for work on weekends and holidays (paid at least double the amount or, at the request of the employee, he may be given a day of rest);

- for work at night.

Vacations

are provided to employees in accordance with current labor legislation.

Annual basic paid leave is 28 calendar days. Temporary disability benefits

are a special type of payment for unworked time. It is paid partly from the wage fund, and partly from the social insurance and security fund. As a general rule, benefits are issued if an employee falls ill during work. Employees working on a probationary period are entitled to receive benefits. If an employee falls ill on the day of dismissal, he also has the right to receive benefits.

Responsibility

Article 87 of the Federal Law provides for the liability of officials of the organization, as well as persons who are obliged to pay alimony.

Responsibility is provided for failure by officials and citizens to comply with the legal requirements of a bailiff, for the loss of a writ of execution or sending it untimely, providing incorrect information about the income, property status of the debtor, failure by the debtor to report dismissal from work, a new place of residence or work.

In such cases, bailiffs subject officials to fines of up to 100 times the minimum wage. The bailiff's decisions are approved by the senior bailiff. You can appeal it in the appropriate court within 10 days.

If a citizen or official deliberately refuses to comply with the requirements of a bailiff, or interferes with the performance of their official duties, the bailiff has the right to submit a resolution to the relevant authorities to bring the guilty person to criminal liability.

Inability to withhold money

The legislation of the Russian Federation provides for the moments in which deductions cannot be applied to monetary amounts:

- when compensating for harm caused to health and compensation to persons who have lost their breadwinner;

- persons who were injured during the performance of official duties, and in the event of their death - their families;

- at the birth of a child, to a single father or mother, mothers of many children, or custodians of minors during the search for parents;

- for the care of disabled people of group I and pensioners;

- when paying victims, for treatment in a sanatorium and the manufacture of a prosthesis;

- when paying alimony obligations;

- when paying for work in conditions of increased health hazard, as well as in extreme situations.

Basic Rules

At the same time, according to Article 137 of the Labor Code of the Russian Federation, the employer issues an order to withhold overpaid wages from the employee. If the amount is large, you will need to withhold for several months, since the company has the right to withhold no more than 20% of the accrued monthly salary.

The employee must be familiarized with this order against signature and indicating the date of familiarization. with written confirmation of your consent to withhold the specified amount in the agreed monthly amounts (if the amount is large and it is not possible to withhold it within one month).

The second option is also possible - the employee himself writes an application addressed to the head of the organization with a request to withhold overpaid wages (indicating the percentage). According to him, this could be more than 20% per month.

If a counting error is detected regarding a resigned employee. It is necessary to notify him about it by registered mail within one month from the date of discovery of the error. At the same time, reflect the request to independently return the excess amount received. It should also be warned that in case of refusal of a voluntary return, an appeal to the court will follow to forcefully collect the amount.