What is a bill of exchange?

A bill of exchange is a security containing an obligation to pay its holder the amount specified in it. The features of how a bill of exchange is reflected in accounting are influenced by the fact that it can be:

- own or someone else's;

- simple (drawn up between 2 persons) or transferable (drawn up with the participation of a third party who will make the payment, repaying his debt to the drawer);

- discount (transferred at a price different from that indicated in it), interest (providing for the accrual of a certain percentage on the amount reflected in it) or interest-free (with a zero interest rate);

- a debt obligation, a means of payment, borrowing or investment.

It is extremely important for this document to comply with the requirements for the rules of execution and, in particular, to indicate in it (clauses 1 and 75 of the provisions “On bills of exchange and promissory notes”, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated 08/07/1937 No. 104/1341) :

- its name;

- dates and places of its compilation;

- offers or promises to pay a certain amount;

- the name of its payer;

- payment deadline;

- place of payment;

- to whom or on whose order the payment is made;

- signatures of the person issuing the bill.

Acceptable:

- Do not indicate payment deadline. Then the bill is paid upon presentation.

- Do not provide places of origin and payment. In this case, they will be considered the location of the payer, reflected next to his name.

- Additionally, enter information about the interest rate and the start date of its application for a bill of exchange that is interest-bearing.

- The existence of contradictions between the payment amount entered in the bill in numbers and in words. The amount indicated in words will be considered correct.

- Transfer not only a bill of exchange, but also a promissory note.

A bill of exchange can only be issued on paper (Article 4 of the Law of the Russian Federation “On Bills of Exchange and Promissory Note” dated March 11, 1997 No. 48-FZ). The fact of its transfer is reflected in the relevant agreement and act. The existence of an agreement is not necessary when issuing your own bill.

simplified tax system

The issuance of your own bill of exchange does not affect the calculation of the single tax, regardless of what object of taxation the organization applies. For tax purposes, this operation is a guarantee of payment for purchased goods (works, services) with deferred payment. That is, when issuing your own bill of exchange, there is no payment for purchased goods (works, services) or repayment of other obligations. This follows from Articles 815 and 823 of the Civil Code of the Russian Federation and Article 346.17 of the Tax Code of the Russian Federation.

At the same time, to calculate the single tax, take into account the peculiarities of accounting for certain types of expenses when simplifying. For example, purchased goods for which a bill of exchange was received must not only be paid, but also sold (subclause 23, clause 1 and clause 2, article 346.16, subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Accounting for own bills

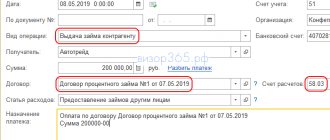

A promissory note is usually issued by the buyer to the supplier in a situation where he cannot pay for the delivery in cash. Such a bill in the relationship between these two parties has the nature of a promissory note and is not taken into account as a security until it is transferred to a third party. Its issue and receipt is reflected by the buyer and supplier on the same settlement accounts as the principal debt. Only the analytics changes:

- from the buyer:

Dt 60calc Kt 60veks,

Where:

60calculation - subaccount for reflecting the debt for supplies,

60veks - subaccount of debt on the issued own bill;

- from the supplier:

Dt 62veks Kt 62calculation,

Where:

62veks - subaccount of debt on the buyer’s own bill of exchange received,

62calculation - subaccount for reflecting the debt for shipment.

At the same time, both parties show the appearance of such a bill on their balance sheet:

- buyer - as security issued:

Dt 009;

- supplier - as security received:

Dt 008.

If the bill is interest-bearing, then income will be accrued on it monthly, increasing the amount of the buyer’s debt on the bill:

- from the buyer:

Dt 91 Kt 60veks,

where 60veks is a subaccount of debt on the issued own bill;

- from the supplier:

Dt 62veks Kt 91,

where 62veks is a subaccount of debt on the buyer’s own bill of exchange received.

Payment on the bill will be reflected as the closure of the debt on it:

- from the buyer:

Dt 60veks Kt 51,

where 60veks is a subaccount of debt on the issued own bill;

- from the supplier:

Dt 51 Kt 62veks,

where 62veks is a subaccount of debt on the buyer’s own bill of exchange received.

At the same time, the bills will be written off from off-balance sheet accounts:

- from the buyer:

Kt 009;

- from the supplier:

Kt 008.

Read more about off-balance sheet accounts in the article “Rules for maintaining accounting records on off-balance sheet accounts.”

Features of bills of exchange as securities

Being an unconditional debt document, a bill of exchange can be:

- Simple, i.e. drawn up between two persons and having the nature of a promissory note of the direct debtor;

- Transferable – a document, the preparation of which takes place with the participation of a third party (used to formalize the transfer of receivables).

Both a simple and a bill of exchange can be:

- Someone else's or your own;

- Discount – interest rate, i.e. providing for an interest rate at which interest will be calculated on the amount of the bill, or interest-free.

Both types of bills of exchange can be commodity, i.e., confirm the debt under a contract for the supply of goods and materials, or financial. In this case, the subject of the transaction is the bill itself. The difference in the purpose of using bills of exchange affects the accounting accounts that will be used to account for bills of exchange.

Accounting for other people's bills of exchange as part of financial investments

The signs of financial investments correspond to bills purchased at a price below par or interest-bearing, i.e. capable of generating income (clause 2 of PBU 19/02, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n).

They are taken into account in a separate subaccount of account 58-2 (accounting chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) in a valuation corresponding to the amount of acquisition costs (clause 9 of PBU 19/02) or the agreed, market, estimated value ( paragraphs 12–17 PBU 19/02).

Bills of exchange can arrive in several ways, and this will determine the posting of the bill of exchange in accounting. For example:

- when purchasing this security:

Dt 58-2 Kt 76;

- payment by the buyer for delivery by third party bill:

Dt 58-2 Kt 62;

- receiving it as a contribution to the management company:

Dt 58-2 Kt 75;

- property exchange transactions:

Dt 58-2 Kt 91,

Dt 91 Kt 10 (01, 04, 41, 43, 58);

- free admission:

Dt 58-2 Kt 91.

You can see examples of how bills are reflected in accounting in various situations in ConsultantPlus:

Get trial access to K+ for free and proceed to the material.

Since each debt security is individual, bills of exchange are reflected in accounting individually and the valuation upon disposal is made at the cost of each unit. The disposal process is carried out through account 91, forming the financial result from this operation on it. In this case, the debit of account 91 includes the book value of the bill:

Dt 91 Kt 58-2.

And for the credit of account 91, the amount is formed depending on the way in which the disposal occurs. For example, via:

- redemption or sale:

Dt 76 Kt 91;

- payment by delivery bill:

Dt 60 Kt 91;

- contribution to the management company:

Dt 58-1 Kt 91;

- issuing a loan:

Dt 58-3 Kt 91;

- exchange of property:

Dt 10 (01, 04, 41, 43, 58) Kt 91.

The sale of bills of exchange is not subject to VAT (subclause 12, clause 2, article 149 of the Tax Code of the Russian Federation).

Whether it is necessary to keep separate VAT records when transactions with bills of exchange, find out from the Ready-made solution from ConsultantPlus by getting trial access to the system for free.

Income on a bill with an acquisition cost below its face value can be accounted for in one of two ways, the choice between which must be reflected in the accounting policy:

- or the book value of the bill will not change (clause 21 of PBU 19/02) and will be taken into account at the time of its disposal, reflected in the financial result;

- or the increase in the book value to the par value will be done evenly during the circulation period of the bill (clause 22 of PBU 19/02):

Dt 58-2 Kt 91.

Interest on a bill is accrued monthly, but they do not increase the accounting value of financial investments (clause 21 of PBU 19/02) and are therefore reflected in the settlement accounts:

Dt 76 Kt 91.

The amount of this interest will be included in the book value of the bill upon disposal:

Dt 91 Kt 76.

Read about the analytics of account 58 and its relationship with the data of the balance sheet lines in the article “Financial investments in the balance sheet are...”.

OSNO and UTII

The procedure for accounting for goods (work, services) for which the organization paid with its own bill of exchange when combining UTII with the general taxation system depends on the type of activity for which the goods (work, services) were purchased, for which the organization issued its own bill of exchange to the counterparty.

If goods (work, services) were purchased to conduct transactions subject to UTII, transactions with your own bill of exchange will not affect the calculation of the single tax (Article 346.29 of the Tax Code of the Russian Federation).

If goods (work, services) were purchased for the organization’s activities on the general taxation system, take into account the costs for them when calculating income tax.

If goods (work, services) are purchased for both types of activities, the amount of expenses for their purchase must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation). For more details, see What taxes to pay with UTII.

Accounting for other people's bills that are not financial investments

Interest-free bills purchased at par or at a price above par do not meet the profitability condition established for accounting for them as financial investments (clause 2 of PBU 19/02). For this reason, they are not taken into account in account 58, but in calculations using account 76.

The ways of their receipt and disposal may be the same as for revenue bills, but in the receipt transactions, instead of account 58, account 76 will be used, and from account 76, when such bills are retired, their accounting value will be written off to the debit of account 91.

About the features of accounting for settlements with bills when applying the simplified tax system, read the material “List of expenses under the simplified tax system “income minus expenses”” .

The company receives a bill of exchange from the buyer

If your buyer issues you his own bill, then this transaction formalizes a deferred payment. After all, by issuing a bill of exchange, he guarantees you payment within the terms specified in this paper.

To account for such bills, the selling company must use account 62 “Settlements with buyers and customers” subaccount “Bills received”.

The bill must be reflected at the contractual value, that is, at the price of the goods for which it was received.

In addition, the bill must be included in the balance in account 008 “Securities for obligations and payments received.”

note

The face value of a bill of exchange may be greater than the value of the goods for which it is issued.

This discrepancy means that the bill provides for a discount.

The payer of the bill can be either the buyer himself or a third-party company.

An example will show you how to discount a promissory note.

EXAMPLE Let's use the conditions of the previous example, but assume that Aktiv JSC issued a bill of exchange to Passiv LLC. Pride LLC accepted the bill in July, thereby confirming its obligation to pay the bill. On the day of acceptance, Aktiv's accountant must make an additional posting: DEBIT 62 subaccount “Bills accepted” CREDIT 62 subaccount “Bills issued” – 236,000 rubles. – the bill of exchange “Passive” is accepted. When “Passive” pays off the bill, the accountant will have to make the following entry: DEBIT 51 CREDIT 62 subaccount “Bills accepted” – 236,000 rubles. – funds were received to repay the bill.

The buyer may pay interest on his bill of exchange. They are taken into account by wiring:

DEBIT 51 CREDIT 91-1

– interest on the bill has been credited to the current account.

In a similar way, when repaying a bill, you can take into account the excess of its nominal value over the amount of the contract (discount).

The amount of interest or discount on the bill is indicated in line 2340 “Other income” of the Statement of Financial Results.

In March, Aktiv JSC shipped a batch of furniture worth RUB 590,000 to Passiv LLC. (including VAT - 90,000 rubles). In the same month, “Passive” issued a promissory note to “Aktiv” with a nominal value of 600,000 rubles. The accountant of “Aktiv” must make the following entries: DEBIT 62 CREDIT 90-1 – 590,000 rubles. – furniture has been shipped; DEBIT 90-3 CREDIT 68 subaccount “VAT Calculations” – 90,000 rubles. – VAT is charged; DEBIT 62 subaccount “Bills received” CREDIT 62 – 590,000 rub. – bill received; DEBIT 008 – 600,000 rub. – the bill is taken into account on the balance sheet at face value. When the bill is repaid, the entries will be as follows: DEBIT 51 CREDIT 62 subaccount “Bills received” – 590,000 rubles. – the bill “Liability” was repaid; DEBIT 51 CREDIT 91-1 – 10,000 rubles. (600,000 – 590,000) – the discount amount is reflected; LOAN 008 – 600,000 rub. – the write-off of the bill of exchange is reflected. Line 2340 of the financial results statement will indicate the amount of discount on the bill of exchange – 10,000 rubles.

Read how the drawer's accounting is structured in Berator

Results

Bills of exchange in accounting have their own reflection features. These features are due both to the existence of one’s own and other people’s bills, and to the division of the latter into profitable and non-income-generating.

Sources:

- Federal Law of March 11, 1997 N 48-FZ

- Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

BASIC

Take into account purchased goods (works, services) secured by your own bill of exchange when calculating income tax, depending on the following factors:

- tax accounting rules that apply to the corresponding type of expenses;

- the method that the organization uses when calculating income taxes (accrual method or cash method).

This follows from articles 252, 272 and 273 of the Tax Code of the Russian Federation.

Input VAT on purchased goods (works, services) is deductible in the general manner - after the goods are accepted for registration, if there is an invoice and other necessary conditions are met (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation) . For more information about this, see How to pay VAT when paying by bill of exchange.

Calculation scheme

The form of payment by bills of exchange has its own procedure, according to which you can find out the specifics of working with these documents. First of all, there are two participants: the giver and the holder, the buyer and the supplier, respectively. At the first stage, an agreement is formed between them, which stipulates the obligation to repay on time. The second part is the exchange of the document for goods or previously defined services, that is, items specified in the main agreement.

When the specified time arrives, banks' transactions with bills occur. Their holder transfers the paper to his bank, and this intermediary, in turn, sends it to the institution serving the person who issued the paper. Next, the funds are transferred to the holder’s account and the procedure is completed. There is a modified scheme that includes mediation between the banks of the domicile - a third party who must repay the paper at the place of residence (domicile) of the payer; this procedure is called domiciliation of existing bills. But any other place can be chosen, documented and in writing, the latter is required to eliminate the risk.

Features of the procedure

The nuances of how settlements will be carried out with a promissory note or its transferable type completely depend on the characteristics of this document. First of all, it is abstract - the text does not include the reasons for issuing the money or the paper itself. Even if the reason for the issue was a trade transaction, exchange or other events during which it is necessary to pay off, the purpose is not indicated in any way on the bill, so it does not lose relevance when transactions are canceled and remains effective. The only information will be the obligation to pay a certain amount of funds within a clearly defined period.

Settlements can be made by transferring a bill of exchange

It is also important that the bill has a contractual nature, but it is not the declaration that resulted in the security being issued that is being considered. Its subject is the agreement of both parties that there are debts that one of them is obliged to accept at a specified time, and the other is obliged to repay. The bill is also distinguished by its indisputability, since although the text does not indicate the reason or reason for making the transfer, it is enough for the holder to have a guarantee of the return of funds, and for the payer to receive the obligation to pay off the paper, for the latter this is rather a disadvantage.

Important! The justification or unjustification of taking on an obligation does not matter, since the document only indicates the need to fulfill it, but the holder can ensure an extension of the obligation if there is such a need.

Bills of exchange are also one-sided documents that only record the obligation of one person to make payment. In this case, the holder of the bill can present paper to receive funds, send a protest appeal in case of non-compliance with the rules, but these are only conditions that can lead to the exercise of existing rights. One-sidedness is manifested in the absence of additional conditions, but in the translation type it becomes more complicated.

Responsibilities of participants

The drawer, who will issue the transfer document, assumes that he is the one who must pay if the payer does not do so. In order for the intermediary to undertake an obligation, he needs to confirm the bill by accepting it; this step cannot be skipped, since then there will be no official evidence of cooperation. Each obligation specified in the bill of exchange is formal and for its viability it is necessary to put the agreement in writing, which also requires taxation for the correct calculation of personal income tax.

If there is none, then the obligation does not exist, and in this case it is necessary not only to issue a debt document in writing, but also to draw up an endorsement and acceptance. In addition, the formal component is also introduced by the need to draw up a bill according to a specific structure; if this is not followed, then the document loses official force and no penalty is expected for its violation.

All obligations of the parties must be documented

Transfer rules

One of the main features is also the transferability of the document, when the first acquirer can give it ownership to another person; in the future, the right does not end and it can be used as many times as desired. The process of transferring a bill of exchange is carried out with an endorsement, that is, a signature certifying the transfer of the right of disposal. In this case, there are the following situations in which a bill of exchange can be used:

- transfer into full ownership of another person;

- issuing an order to cancel a bill of exchange to another person, but in the interests of the original holder;

- provide a bill of exchange for a pledge of a different order, for example, as a guarantee if you want to issue a loan product at a bank.

Despite the three categories of transferability, the phenomenon is based on the first point, that is, the fact that it is possible to change the owner of a security; the Central Bank allows this to be done to other financial institutions. The endorsement is simple and unconditional, just like the original document, and even if it contains a specific condition, it will not have any consequences from a legal point of view. It is also impossible to transfer the right to part of the bill amount, since such an endorsement will not be valid. If the transfer is correct, the endorser is deprived of the right to demand collection (payment) from the issuer of the bills, and the holder at the same time receives the right to demand collection.

Another feature of a bill of exchange is its monetary value, since the obligation consists in the need to pay a certain amount, but not to transfer a physical object, that is, property; this can be done either by bank transfer or in cash; in any case, a check is issued. And finally, a nuance of this paper is the right to protest for non-payment, refusal to accept and some other problems that should be checked by specialists who make their own conclusion.

When carrying out operations, the main rules should be followed

Disputes in this area are handled by a notary office, which requires acceptance or payment, and in case of refusal, creates an entry in the register and a note about the current situation. If a person has not paid a promissory note, you should know what to do; if a claim arises, you must pay the paper under the control of a notary, then the dispute will be settled and the bill must be returned to the issuer, even if settlement occurred late.

You should know! If there is no payment, then a claim process will begin, which will lead to forced repayment of the bill.