Home / Labor Law / Payment and benefits / Wages

Back

Published: March 16, 2016

Reading time: 8 min

1

3971

The business trip is related to the employee’s performance of labor functions, so it is subject to mandatory payment. Certain peculiarities arise in this case if any of its days coincide with weekends.

We will determine what the payment procedure is and how the employee can be compensated for his lost day off.

- Rules for paying for business trips on weekends and holidays

- Payment procedure and calculation example

- How to take payment into account when calculating income tax?

- How to compensate an employee for a lost day off

Where does it say about payment for a business trip?

The general rules for paying a posted employee for days off are regulated by the Labor Code and the Regulations on the specifics of sending employees on business trips, which was approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel).

In particular, it says how to pay daily allowances and how to pay for work if the employee was at the place of business trip on a weekend or holiday. Compose HR documents using ready-made templates for free

How to calculate daily allowance for weekends on a business trip

According to paragraph 11 of the Business Travel Regulations, per diem must be paid for each day of a business trip, including weekends and non-working holidays, as well as for days spent en route, including during a forced stop. Thus, the employee must receive daily allowance for each calendar day of the business trip, including the days he spent on the road when traveling to and from the business trip.

IMPORTANT. Each employer can set the amount of daily allowance that it considers necessary. In practice, the amount of daily allowance usually does not depend on what day it is paid for - a working day, a weekend or a holiday. This means that calculating daily allowances for weekends on a business trip is no different from calculating daily allowances for working days.

To determine how much the employee should receive, you need to multiply the amount of daily allowance established in the organization by the number of calendar days of the business trip, which starts from the day of departure and ends on the day of arrival.

The rules for determining the day of departure and day of arrival are established in paragraph 4 of the Regulations on Business Travel. The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the posted employee. The day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work. When a vehicle is sent before 24.00 inclusive, the day of departure for a business trip is considered the current day, and from 00.00 and later - the next day. The day the employee arrives at his place of permanent work is determined similarly.

How to calculate average earnings for weekends on a business trip

The Regulations on Business Travel do not directly say whether it is necessary to pay the average salary for weekends or holidays on which the business trip occurred. It is only stipulated that payment for a seconded employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation.

Automatically calculate the salary of a posted worker according to current rules Calculate for free

However, from this general phrase we can draw the following conclusion: it is necessary to calculate average earnings for weekends and holidays only if the person was actually involved in work on these days. This means that if an employee, while on a business trip, rests on weekends and holidays, then the average salary for these days is not paid to him.

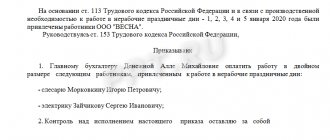

If the employer decides that the posted worker must work every day, including on weekends, then he will have to pay for work on those days that are intended for rest. Moreover, in an increased (at least double) size. Or the employee must be given a day off for each day he worked on his day off (subject to his written application). Then the work itself on a day off is paid at a single rate (Article 153 of the Labor Code of the Russian Federation).

REFERENCE. According to Article 153 of the Labor Code of the Russian Federation, work on a weekend or a non-working holiday is paid at least double the amount. Specific amounts of payment for work on a specified day can be established by a collective agreement, local regulations, or employment contract.

Taking into account the above, the rule for paying for days off on a business trip is as follows: if the employee is resting on these days, no payment is made (average earnings are not calculated). If, by decision of the management, a posted employee works on a weekend or holiday, then this day must be paid at least double the amount, or, at the request of the employee, be given a day off (then work on a day off is paid at a single rate). Please note that it is more correct to pay for “working weekends” during a business trip not according to average earnings, but based on the remuneration system established for the employee - salary, tariff rate, etc. (Article 153 of the Labor Code of the Russian Federation, clause 9 of the Regulations on business trips).

Calculate “complex” salaries with coefficients and bonuses for a large number of employees

Results

Payment for a business trip on a weekend, provided that the documents are completed correctly, is paid in no less than double the amount.

To reimburse travel expenses, an employee must collect all payment documents: checks, receipts, payment orders, and then all his expenses will be compensated. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to pay for days off while traveling

Accountants often have difficulty calculating average earnings for the weekends that a posted worker spent on the road. This situation can arise not only by the decision of management, who planned the employee’s trip in this way, but also unintentionally, for example, due to a flight delay or cancellation, employee illness, etc. Do days spent on the road count as work? Do I need to pay them double?

The Labor Code and the Regulations on Business Travel do not provide answers to these questions. Judges and officials believe that days of departure, arrival, as well as days en route during a business trip that fall on weekends or non-working holidays are paid in accordance with Article 153 of the Labor Code of the Russian Federation at least double the amount, unless the employee is given another day of rest. Such clarifications are contained in the decision of the Supreme Court of the Russian Federation dated June 20, 2002 No. GKPI2002-663, in letters of the Ministry of Labor of Russia dated October 13, 2017 No. 14-2/B-921, dated September 5, 2013 No. 14-2/3044898-4415 and dated December 25. 13 No. 14-2-337.

Thus, if an employee leaves for or arrives from a business trip, and is also on the road on a day off (according to the schedule of the sending organization), then this is regarded as being hired to work on a day off. This means that you need to pay for this day and provide time off, or pay double for work on this day. It is also more correct to pay for weekends on the road not according to average earnings, but based on the wage system established for the employee.

These provisions apply subject to the rules mentioned above for determining the day of departure and arrival. For example, if an employee left on a business trip on Friday and arrived at his destination no later than 24:00 on the same day, then the average earnings do not need to be calculated for Saturday and Sunday (unless, of course, he will work on these days as directed by management). But if a train (plane, bus) leaves the place of work or arrives at the place of business trip after 00.00 on Saturday, then you will have to pay for this day (with the provision of time off or at an increased rate).

ADVICE. If possible, plan your business trips so that your arrival and departure dates do not fall on weekends or holidays.

When to take time off

An employee has the right to take time off at his own discretion. This can be one of the days of the month of the trip, or any of the subsequent ones. An employee can also add time off to his annual leave. However, in this case you need to be careful, because if the employee accumulates a large number of days off and the employee quits, he will have to provide them or compensate them. The employer can provide for this point in the company’s internal regulations, for example, by setting a specific period during which the employee must take advantage of the existing right to time off. For example, within one year after the corresponding right to take time off arises. This may also be stated in an employment or collective agreement when establishing the amount of compensation for working on a day off. The employer can provide a larger amount of compensation, the main thing is that it is not less than that provided for by labor legislation (

How to reflect weekends during a business trip in the report card

In the Timesheet, each calendar day of a business trip is marked with a special code (K or 06) without indicating the number of hours. This code is also indicated for the weekends on which the business trip occurred (remember that usually weekends are marked in the Timesheet with code B or 26).

ATTENTION. For a posted employee, codes B and 26 are not used in the Timesheet. If an employee worked on a business trip on a weekend or holiday, then for this day an additional code РВ or 03 is entered into the Timesheet. The number of hours of work is entered only if there is an order from the employer (at the main place of work) indicating the number of hours that this The employee must work on a specific weekend or holiday.

As for weekends (holidays) on which the employee was on the way to the place of business trip or back (including if the day of departure or arrival fell on a holiday or day off), they are marked in the Timesheet with the double code K/RV or 06/ 03 without specifying the number of hours.

Such explanations for filling out the Working Time Sheet are given in paragraph 2 of the letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291.

Maintain timesheets and calculate salaries in the Vesti web service for free

How to fill out a time sheet

The day of departure on a business trip (or the day of return from it), coinciding with a weekend or holiday, must be correctly reflected in the working time sheet (unified form No. T-13, approved by Resolution of the State Statistics Committee of the Russian Federation dated 01/05/04 No. 1). The personnel officer must make two marks in the corresponding cell at once, separating them with a “/” sign. The first is a “business trip”, which is designated by the letter code “K” or the digital code “06”. The second is the “duration of work on weekends and non-working holidays,” which is indicated by the letter code “РВ” or the digital code “03.”

Keep timesheets for free in an accounting web service

It is also necessary to indicate on the timesheet the number of hours that are paid by the employer. If payment is made based on an hourly rate, then you need to put the number of hours that the person actually spent on the road (in our example 1 this value is 21). If payment is made based on the daily rate (as in our example 2), then the number 8 should be entered.

Next, you need to correctly take into account such a day when entering the final information into the timesheet. In particular, in columns 5 and 6 (intended to indicate days and hours worked), enter the numbers that took into account the hours and days of departure on a business trip and return from it. Based on this indicator, the accountant will calculate the employee’s salary for the time spent on the road. Plus, the hours and days of departure on a business trip and return from it must be taken into account when filling out columns 10-13 (intended to indicate the reasons for non-appearance). Based on this indicator, the accountant will accrue the employee’s daily allowance for days spent on the road.

Accounting for travel expenses

The fact that the business trip “occupies” weekends or holidays does not in any way affect the accounting procedure for the corresponding expenses incurred by the employer. Daily allowances accrued for weekends (including days en route, including the day of departure and day of arrival) are not subject to personal income tax and insurance premiums according to the same rules as daily allowances accrued for working days. Namely: they are exempt from personal income tax and insurance contributions up to 700 rubles. for each day of a business trip in Russia, and within 2,500 rubles. for each day of being on a foreign business trip (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

The average earnings accrued for the weekends on which the posted employee was involved in work or was on the road (including the day of departure or arrival) are subject to personal income tax and insurance contributions in the same way as the average earnings accrued for weekdays (letter of the Federal Tax Service of Russia dated April 17, 2018 No. BS-4-11/ [email protected] ).

ATTENTION. For tax accounting purposes, the average earnings paid to a posted employee on weekends are regarded as wages.

For personal income tax purposes, the date of actual receipt of income in the form of average earnings paid for a day off on a business trip will be considered the last day of the month for which this income was accrued. The date of actual receipt of income in the form of daily allowances paid in excess of the non-taxable rate is the last day of the month in which the business trip report is approved. Tax must be withheld when paying (transferring) the corresponding amounts (subclause 6, clause 1 and clause 2, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). Insurance premiums must be calculated simultaneously with the calculation of average earnings and excess daily allowances in accounting (clause 1 of Article 424, clause 1 of Article 421 of the Tax Code of the Russian Federation). The entire amount of payment for a business trip in 2021 is taken into account as part of expenses both under the OSNO (clause 6 of Article 255, subclause 12 of clause 1 of Article 264 of the Tax Code of the Russian Federation) and under the simplified tax system (subclauses 6 and 13 of clause 1 of Art. 346.16 Tax Code of the Russian Federation). In particular, this amount includes daily allowances for all days of the business trip. It also includes the average earnings for work on a business trip on weekends and holidays and for the time spent on the road on these days. The basis for writing off costs will be the Time Sheet and business trip documents.

Payment procedure and calculation example

As for payment, part of the amount (advance) is paid before departure, and the rest after return. The employee must document all expenses incurred (housing, travel, food), after which the employer will be obliged to reimburse them. If the advance amount was too little or too much, the excess is compensated by one of the parties.

Increased payment is established depending on the payment system adopted at the enterprise:

- for piece workers - no less than double the piece rate;

- employees receiving a salary - no less than one daily or hourly rate in addition to the established salary;

- employees who receive wages at rates of no less than double the daily or hourly wage rate.

In this case, the increased payment occurs only for those days or hours that fall on a day off.

For example, employee Lokoshko D.O. was sent on a business trip for the period from March 17 to March 19, 2021. The following data is available:

- the employee works on an eight-hour working day and a five-day working week;

- the official salary is 28,000 rubles;

- Average daily earnings are 1,300 rubles;

- March 17 and 18 were fully worked;

- On March 19, I dealt with work issues for 5 hours.

Since March 19 falls on a Saturday, that is, a day off, it requires increased payment.

To calculate it, you need to determine how much money the employee receives in 1 hour:

H = 28,000 / 22 / 8 = 160 rub.

For regular days of business travel, the employee receives his average daily earnings, so the total amount payable will be:

K = 1300 + 1300 + 160 * 5 * 2 = 4200 rub.

For three days of a business trip, the employee must receive payment of at least 4,200 rubles. It is worth considering that this amount does not include other additional payments that the employee is also entitled to: daily allowance, money for travel, accommodation and other necessary expenses.