Form and format for 2021

Starting from the report for 2016, simplifiers must use a new form adopted by order of the Russian Tax Service dated February 26, 2021 No. ММВ-7-3/99.

Get acquainted and.

The same order of the Federal Tax Service contains:

- technical description of the format for sending a declaration using the simplified tax system (Appendix No. 2);

- procedure for entering data into the report (Appendix No. 3).

Please pay special attention: the given form is the same for everyone! Both companies and individual entrepreneurs. Both with the object “income” and with the object “income minus expenses”.

Declaration of individual entrepreneurs on the simplified tax system for 2021

A large number of domestic individual entrepreneurs have switched to using or are already using a simplified taxation system. This is due to the advantages that the system offers: a minimum number of taxes, a small number of reports, and simple calculations of tax amounts to be paid. The use of the mentioned system obliges individual entrepreneurs to submit reports to the simplified tax system for 2021.

In accordance with current legislation, an individual entrepreneur must submit only one declaration per year, regardless of the chosen object of taxation: either income or income minus expenses. We emphasize that despite the need to pay quarterly advance payments, the individual entrepreneur simplified taxation system declaration for 2021 is submitted once.

In cases where an entrepreneur uses the labor of employees, he must submit tax returns in form 2-NDFL and 6-NDFL for all employees to whom he paid wages and withheld income tax. An entrepreneur does not have to file a 2-NDFL declaration for himself, since he is exempt from paying personal income tax. The individual entrepreneur does not provide any other reporting except in cases where the entrepreneur must pay any special taxes, for example, excise taxes.

Deadlines for submitting individual entrepreneur reports to the simplified tax system

The deadlines for submitting reports to the simplified tax system are the same for all individual entrepreneurs, regardless of the type of activity, as well as the number of employees or the object of taxation. The Tax Code has determined the deadline for submitting reports until April 30 of the year following the reporting year. The deadline for submitting information on the average number of employees is until January 20, the deadline for filing tax returns for employee income tax is until April 1.

Due to the coronavirus, there is no postponement of the deadline for filing a declaration under the simplified tax system.

The date of submission of the Declaration to the tax authority is considered:

- the date of receipt of the declaration by the tax authority if it is submitted personally or through a representative;

- date of sending the declaration by mail with a list of attachments;

- date of dispatch via telecommunication channels, recorded in the confirmation of a specialized telecommunications operator, when transmitted via telecommunication channels.

It is allowed to fill out the declaration either typewritten or handwritten using blue or black ink, but correcting errors using correction tools is not allowed. It is possible to print out the declaration on a printer.

Taxpayers using the simplified tax system who have chosen income as the object of taxation reduce the amount of tax (advance tax payments) calculated for the tax (reporting) period by:

- the amount of insurance contributions for compulsory pension insurance;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory health insurance;

- compulsory social insurance against accidents at work and occupational diseases, which were paid in a given tax period.

What's new

As you can see, from the report for 2016, the Federal Tax Service updated the declaration form. In principle, the form has changed insignificantly. So:

- the requirement to put a stamp on the title page is no longer valid;

- Section 2.1.2 has appeared for trade tax payers using the simplified tax system with the object “income” (for now it is only relevant for Moscow, where this tax applies):

- The simplified tax system “income” shows by what the final tax is reduced:

In general, as of 2021, legislators have finally prescribed which categories of spending allow the simplified tax to be legally reduced. We talked about this in detail here “Changes to the simplified tax system since 2017: what an accountant needs to know.”

What exactly to fill out

What is the “simplified” object, such sections in the declaration under the simplified tax system for 2016 need to be filled out. Of course, in all cases you need the very first page of the form - the title page.

Those on “income” take the following sections:

- 1.1;

- 2.1.1;

- 2.1.2 (if a sales tax can be deducted from the activity).

In 2021, inspectors expect the following section from the simplified tax system with “income minus expenses”:

- 1.2;

- 2.2.

We strongly recommend that you start filling out the declaration under the simplified tax system from sections 2.1 and 2.2. And then move on to 1.1 and 1.2. The latter are used to calculate totals based on indicators from sections 2.1 and 2.2

This might also be useful:

- The procedure for filling out a zero declaration according to the simplified tax system for individual entrepreneurs

- Unified simplified tax return 2021

- Rules for filling out the UTII declaration for individual entrepreneurs in 2021

- VAT accounting for individual entrepreneurs using the simplified tax system in 2021

- Individual entrepreneur reporting on the simplified tax system without employees

- simplified tax system for individual entrepreneurs in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Basics when filling out

Due to the instructions of the Federal Tax Service, the sample for filling out the simplified taxation system declaration for 2016 implies the presence of amounts only in whole rubles. This means that 50 kopecks or more are considered 1 ruble, and anything less does not need to be taken into account.

As already mentioned, depending on the object according to the simplified tax system, the composition of the sections and sheets to be filled out may vary. However, this does not mean that there may be gaps in the numbering. Only single through: 009, 010, 011, etc.

If you report on paper, use a classic colored pen. Corrective putties cannot be used. It is also prohibited to print a report on both sides of sheets and staple them.

In the simplified taxation system declaration for 2021, all text must be in capital printed characters. There are dashes in empty cells. When printing, the Federal Tax Service wants to see the font Courier New 16 - 18 point.

When to do it: deadlines

Please note that, based on Article 346.23 of the Tax Code of the Russian Federation, different deadlines have been established for submitting a declaration under the simplified tax system in 2021 and for this year in general for firms and entrepreneurs.

Thus, the report is submitted based on the results of the tax period. For the “simplified” version, this is a calendar year (clause 1 of Article 346.19 of the Tax Code of the Russian Federation).

| Payer type | Last day of delivery |

| Firm | 03/31/2017 (this is Friday) |

| Kommersant | 05/02/2017 (since April 30 is a Sunday, and May 1 is a non-working holiday) |

As you can see, the law gives entrepreneurs using the simplified tax system exactly 1 month more to successfully close a reporting company under this special regime for 2021.

There are 2 exceptions to the general rule about deadlines. Moreover, they apply equally to both companies and individual entrepreneurs (see table below).

| Situation | When is the last day for submission? |

| Business activity has been terminated and a notification has been submitted to the Federal Tax Service. | The 25th day of the month following the month in which the activity was terminated by notice |

| Lost the right to the simplified tax system | The 25th day of the month following the quarter in which such rights were lost |

In the latter case, we strongly advise you to read our review: “Changes to the simplified tax system since 2017: what an accountant needs to know.”

Please note: simplified companies submit a declaration at the place of their location, and individual entrepreneurs – where they live. Moreover, companies with separate divisions include “separate units” in their report on the simplified tax system. They do not generate or submit any separate declarations. Also see “Deadlines for payment of the simplified tax system in 2017”.

Responsibility for late reporting deadlines

At the moment, there is a dual position on the issue of applying penalties for late submission of the Unified Tax Code.

- For failure to submit the EUND on time, the taxpayer is held accountable under Art. 119 of the Tax Code of the Russian Federation. In this case, the fine is collected according to the amount of taxes specified in the Unified National Tax Code. Let us remind you that, according to this article, the fine is 5% of the tax amount reflected in this declaration, but not more than 30% and not less than 1,000 rubles. Since the simplified declaration does not contain information about the amount of tax payable, the fine under this article will be 1 thousand rubles. Thus, if 2 taxes are indicated in the EUND, the fine will have to be paid in double amount.

- Since the EUND is not by its nature a declaration containing information about the objects of taxation, the amount of tax calculated and paid, then the penalties under Art. 119 of the Tax Code of the Russian Federation cannot be applied for failure to submit this document. In this case, a fine is applied under Art. 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. for one document (Letter of the Ministry of Finance of the Russian Federation dated July 3, 2008 No. 03-02-07/2-118).

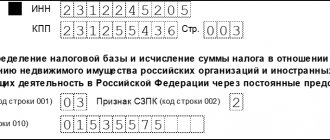

Codes

When filling out some details of the declaration under the simplified tax system for 2016, you do not need to enter specific information, but enter certain codes. They were introduced for simplification, so as not to overload the completed form and special programs could analyze it using their own means more quickly.

It is extremely important to enter the correct codes when filling out the declaration. The following tables will help with this.

| Tax period code | What does it mean |

| 34 | Calendar year |

| 50 | Last tax period for: • reorganization; • liquidation; • closing an individual entrepreneur's business. |

| 95 | Last tax period when switching to another tax regime |

| 96 | Last tax period upon termination of business activity |

| Place code | What does it mean |

| 120 | At the place of residence of the individual entrepreneur |

| 210 | At the location of the domestic company |

| 215 | At the location of the legal successor (provided that it is not the largest taxpayer) |

| Code of type of reorganization, liquidation | What does it mean |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Split + join |

| 0 | Liquidation |

| Feeding method code | What does it mean |

| 01 | On paper (by mail) |

| 02 | On paper (personal) |

| 03 | On paper + on removable media (personal) |

| 04 | By TKS with electronic signature |

| 05 | Other |

| 08 | On paper + on removable media (by mail) |

| 09 | On paper with a barcode (in person) |

| 10 | On paper with a barcode (by mail) |

Actually, in the simplified taxation system declaration for 2021, all these codes are present on the first sheet:

There are also a number of specific codes. They say that the simplifier received property, money, work, services within the framework of:

- charitable activities;

- targeted revenues;

- targeted financing.

Basically, these codes relate to specific simplifiers (non-profit organizations) and cases, so most people do not need to know them. Moreover: such information is shown only in the last 3rd section of the declaration under the simplified tax system:

Setting up the simplified tax system in 1C

Reporting under the simplified tax system is submitted both by organizations that have been using the simplified tax system from the very beginning, and by those who previously switched to the simplified tax system from the main tax system. Therefore, in the program “1C: Accounting 8”, ed. 3, it is now possible to specify the taxation system and rate both when creating an organization, and to change it in the “Main” section by going to the “Taxes and Reports”

, which will affect the organization’s accounting policy settings.

In the "Taxes and Reports"

You can also select or enter the simplified tax rate from the keyboard.

In accordance with Art. 346.20 of the Tax Code of the Russian Federation under the simplified tax system there are the following rates:

- 6% – if the object of taxation is the income of the organization;

- from 5% to 15% – if the object of taxation is income reduced by the amount of expenses.

Under the simplified system, the taxpayer has the right to choose the rate and, accordingly, the object of taxation, but only if he is not a party to a simple partnership agreement or a trust management agreement, as described in Art. 346.14 Tax Code of the Russian Federation.

When a taxpayer decides to switch from the main tax system to a simplified one, in the “Taxes and Reports”

In the

“Taxation regime”

, you must check the box

“Before the transition to the simplified tax system, the general tax regime was applied”

and enter the date of transition.

If accounting before the transition to the simplified tax system was kept in the same program (i.e. in “1C: Accounting 8”), then you can use the “Assistant for the transition to the simplified tax system”

, which will reflect in the program certain accounting operations related to the transition to the simplified tax system, and will also perform a number of technological actions, for example:

- will write off the remaining tax accounting data for corporate income tax;

- will write off balances from accumulation registers that are not used for accounting under the simplified tax system;

- will bring into compliance the batch accounting of inventory balances in the “Expenses under the simplified tax system”

and in the inventory accounting accounts.

How to check yourself

Whatever one may say, any sample of filling out the simplified tax system declaration for 2016 cannot be considered correct and complete without checking for control ratios. These are specific equalities or inequalities that must occur between specific strings. After all, in his report the simplifier constantly accumulates some amounts at the expense of others.

Control ratios are used by both tax authorities during desk audits of declarations under the simplified tax system, and simplifiers themselves when filling out the fields of the report. So, in 2017, for the 2021 report, the relevant ratios are those given in the letter of the Federal Tax Service dated May 30, 2016 No. SD-4-3/9567. Be sure to check with them.

Procedure for provision

The simplified tax system declaration is submitted by the entrepreneur to the Federal Tax Service at his place of residence. You can provide it in several ways:

- On paper . Such a declaration must be drawn up in 2 copies, one of which will remain with the tax authority, the second, with a mark of receipt by a Federal Tax Service employee, will be returned to the entrepreneur and will serve as confirmation of the fact of reporting. You can submit a declaration in this way personally or through a representative, whose authority must be confirmed by a notarized power of attorney.

- By post. When preparing a shipment, you should attach an inventory of the contents to it in order to prevent accidental loss of documents. With this method of submitting the declaration, confirmation of its delivery will be documents confirming the sending of the postal notification and an inventory of the attachment, certified by the seal of the post office.

- Electronic. In this case, reporting is provided via the Internet. You can send it through the service on the official website of the Federal Tax Service or operators providing services in the field of electronic document management.

Declaration of simplified tax system 2021: sample filling

EXAMPLE 1: “Income” (6% rate)

Let’s assume that in 2021, the simplified Guru LLC dealt with the following indicators:

| Period | Income on an accrual basis, rub. | Advance payment (tax), rub. | Incremental amounts that can be deducted, rub. | How much can you reduce the advance payment (tax), rub. | Advance payment (tax) to be paid additionally, rub. |

| I quarter | 300 000 | 18 000 (300 000 × 6%) | 10 500 | 9000 (10 500 ˃ 18 000/2) | 9000 (18 000 — 9000) |

| Six months | 800 000 | 48 000 (800 000 × 6%) | 18 500 | 18 500 (18 500 | 20 500 (48 000 — 18 500 — 9000) |

| 9 months | 2 000 000 | 120 000 (2 000 000 × 6%) | 50 000 | 50 000 (50 000 | 40 500 (120 000 – 50 000 – 9000 – 20 500) |

| 2016 | 3 000 000 | 180 000 (3 000 000 × 6%) | 102 000 | 90 000 (102 000˃180 000/2) | 20 000 (180 000 – 90 000 – 9000 – 20 500 – 40 500) |

Let us clarify that the amounts by which the tax can be reduced for the object “income” are listed in clause 3.1 of Art. 346.21 Tax Code of the Russian Federation. Limit: 50% tax on the simplified tax system. An exception is made only for individual entrepreneurs who work without staff. They can reduce the tax to any limit without restrictions, but at a fixed rate. We are talking about pension and medical contributions.

The following link shows a sample of filling out the simplified tax system declaration for 2016 for Guru LLC with the object “income”.

EXAMPLE 2: “Income minus expenses” (rate 15%)

Let’s assume that in 2021, the simplified Guru LLC dealt with the following indicators:

| Period | Income on an accrual basis, rub. | Expenses on an accrual basis, rub. | Tax base, rub. | Advance payment (tax) subject to additional payment/reduction, rub. |

| I quarter | 300 000 | 350 000 | 0 ((300 000 – 350 000) | 0 |

| Six months | 800 000 | 550 000 | 250 000 (800 000 – 550 000) | 37,500 additional payment (250,000 ×15%) |

| 9 months | 2 000 000 | 2 100 000 | 0 ((2 000 000 – 2 100 000) | 37,500 to decrease (0 – 37,500) |

| 2016 | 3 000 000 | 2 700 000 | 300 000 (3 000 000 – 2 700 000) | 45 000 (300 000 ×15%) |

The following link shows a sample of filling out the simplified tax system declaration for 2016 for Guru LLC with the object “income minus expenses”.

Also see “STS bets in 2021: bearish game.”

Read also

12.01.2017

Comments

Elena 04/10/2016 at 17:12 # Reply

declaration of the simplified tax system

Good afternoon. From April 10, 2021, another form is in effect, approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

ostapx1 04/11/2016 at 07:06 # Reply

Yes, Elena, you are right. And only today we managed to get it. The form has now been updated.

MARGARITA 04/21/2016 at 10:23 am # Reply

Please share the link to the new individual entrepreneur declaration form on the simplified tax system

Lyudmila 04/20/2016 at 05:22 # Reply

Good afternoon This is my first time filling out a declaration. Does it reflect advance payments of 6% tax on income?

Alexander 04/09/2017 at 15:22 # Reply

Declaration

Hello! I'm trying to fill out the Declaration for 2021. It turns out that I don’t have to indicate the taxes I actually paid anywhere? And line 100 indicates the amount of additional payment, despite the fact that I actually paid more taxes than I should have.

Natalia 04/09/2017 at 07:22 pm # Reply

Alexander, good afternoon. Actual taxes paid, i.e. Advance payments are not indicated in the declaration. The estimated values of advance payments are indicated. Line 110 - the amount of tax to be reduced for the tax period. In it you indicate the amount of overpayment. Then, in order to return this money or offset it against payment for future periods, you must submit a corresponding application to the Federal Tax Service.

Maria 05/02/2017 at 07:48 # Reply

exactly! I have the same confusion)

Alexander 04/11/2017 at 06:43 pm # Reply

Hello! Should I indicate the amount of the overpayment on line 110? Or is it still calculated according to formulas? The formulas do not take into account actual payments, only settlement and insurance payments. And what should I do with line 100? I get the amount for additional payment. And this despite the fact that in fact there should not be an additional payment on my part, but an overpayment

Natalia 04/12/2017 at 01:13 pm # Reply

Alexander, good afternoon. The report reflects only the estimated indicators of advance payments of the simplified tax system. You indicate insurance premiums in an amount not exceeding the advance payment of the simplified tax system. The amounts of insurance premiums on lines 140,141,142,143 may be less than or equal to lines 130,131,132,133, respectively. If you are an employer, then less than or equal to 130/2 and so on. I can’t say why you have 100 in the line for the additional payment without seeing your numbers. If you wish, send me the original numbers, I will help you figure out how to fill out the declaration.

Tatyana 04/20/2017 at 14:11 # Reply

Filling out the declaration

Good afternoon! I ask you to help. How can I fill out lines (140 - 130) in the declaration under the simplified tax system (6% income), if the cumulative total of income received was: 1st quarter - 108,000 2nd quarter - 153,000 3rd quarter. - 170,000 Q4 - 364,000? Insurance premiums were paid: for 1 sq. - 7717.78 (+ they also paid 1% for 2015 - 17,210.00 (can I include this amount in this line?)) for 2 sq. — 3,858.88 for 3 sq. - 5,788.33 for Q4 - 5,788.33 and also, please help, what amounts will be 020, 040,070, etc.? Do I need to pay anything else? Thank you very much in advance for your answer!

Natalia 04/20/2017 at 14:34 # Reply

Tatyana, good afternoon. Contributions in the amount of 17210 paid in 2016 reduce the advance payment for the 1st quarter of 2021, then everything is considered a cumulative total. The lines are filled in as follows, based on your data: page 130 6480 page 131 9180 page 132 10200 page 133 21840 page 140 6480 page 141 9180 page 142 10200 page 143 21840 In line 010, indicate the code OKTMO In lines 020, 040, 070, 080, 090, 100, 110 - put dashes.

02/12/2018 at 00:12 # Reply

Tax return

Hello! Tell me where the amount of 1% tax paid in 2021 for 2021 is taken into account. And is this amount recorded in the declaration?

02/12/2018 at 16:25 # Reply

Good afternoon. 1% of contributions over 300,000 rubles is taken into account in KUDIR; you write down the date, document number and amount in Section IV of the Book. In the simplified taxation system declaration Section 2.1.1. in lines 141,142, 143 and 144 you take into account the contributions paid. But it is necessary to record not the actual amount of contributions paid, but the amount of contributions used to reduce the advance payment of the simplified tax system. For example, the calculated advance payment for the 1st quarter, line 130 of Section 2.1.1 = 6,000 rubles, in the first quarter you paid an amount of contributions equal to 6,500 rubles, so in line 140 of Section 2.1.1 you should write not 6,500, but 6,000 rubles. But keep in mind that if you paid this additional contribution for 2017 in 2021, then this amount will be included in the declaration for 2021, but will participate in the calculation of advance payments for 2021. That is, you can reduce the advance payment for the 1st quarter by this amount if you pay the fee before March 31, 2018.

04/25/2018 at 09:40 # Reply

Tax return simplified tax system income minus expenses

Good afternoon. Please tell me. For the 2nd quarter of 2021, we actually paid an advance of 7,100 rubles. In section 1.2 in line 270 we did not have an advance payment because were at a loss in Q1. in line 271 the settlement advance is 6,300 rubles. In the declaration, write the advance amount in line 271, which I obtained according to the formula (6300 rubles), and pay the minimum tax taking into account the actual advance payment? Do I understand correctly?