From the beginning of 2021, statistical authorities will oblige the small business sector to report on updated statistical reporting forms. According to the amended rules, legal entities will report to statistical authorities on six annual reports, two quarterly and three monthly.

Order No. 414 of 08/11/2014 The Federal State Statistical Services has changed a number of forms for statistical data. Therefore, in the coming tax period, you should expect both new rules and forms, as well as changed deadlines for submitting statistical data.

What OKVED codes to enter?

In reports submitted to statistical authorities, it is necessary to indicate codes of types of economic activity.

When preparing financial statements for 2021, transitional difficulties may arise. They are due to the fact that in 2021 the OKVED classifier was in effect (OK 029-2007 (NACE Rev. 1.1)). Starting from January 2021, it was replaced by the OKVED2 classifier (OK 029-2014 (NACE Rev. 2)). It is not entirely clear which classifier companies and entrepreneurs (also called respondents) should use when filling out forms for the past year. Recently, Moscow City Statistics Service published a letter dated January 11, 2017 No. OA-51-OA/4-DR. It states that in the annual statistical observation forms for 2021, the codes of the old OKVED (OK 029-2007 (NACE Rev. 1.1)) should be indicated. Whereas the codes of the new OKVED2 need to be used later, namely, when filling out forms, starting with the reporting periods of 2017 (see “The capital branch of Rosstat reported which OKVED codes to indicate in statistical reporting for 2021”).

To fill out and submit reports, it is most convenient to use web services, where all relevant details are installed automatically, without user intervention. Accordingly, the accountant does not need to monitor changes in legislation and independently install updates in his program. If an accountant, when filling out a form, indicates an outdated or invalid value, the web service will indicate the error and tell him what to do.

Fill out and submit all reports to Rosstat for free via the web service

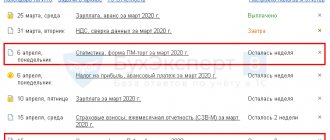

Deadlines

There are certain deadlines for submitting reports:

- 1–IP – until 2.03 of the following year for the reporting period;

- 1–IP trade – until 17.10 of the following year for the reporting period;

- PM-prom. – up to 4 months reporting period.

There is also a specific calendar on the Rosstat website where this information is presented.

What surveys will Rosstat conduct in 2021?

In 2021, statistical monitoring of small businesses will be selective. This means that Rosstat will form a sample that will include organizations and individual entrepreneurs who, in addition to the usual forms, also need to submit additional reports.

In addition, federal statistical observation of production and sales costs (input-output observation) is scheduled for 2021. This examination is provided for by the order of the Government of the Russian Federation dated February 14, 2009 No. 201-r, the frequency of which is once every five years. For non-financial commercial organizations (except small enterprises), federal input-output observation will be continuous, for small enterprises (including micro-) - selective.

Rosstat specialists should inform him that the respondent was included in the sample. They are also obliged to inform the respondent about the forms and methods of reporting. But an accountant can take the initiative and obtain information using the Rosstat service statreg.gks.ru, or by calling the territorial statistics office.

What determines the composition of statistical reporting?

The composition of statistical reporting depends not only on the fact of participation (or non-participation) in Rosstat surveys, but also on the category of the respondent: micro-enterprise, small or medium-sized enterprise. The criteria for each category are given in the article of the Federal Law of July 24, 2007 No. 209-FZ. Thus, the category is established depending on revenue, the average number of employees and the fact of participation in the authorized capital of government agencies, foreign companies and some other persons (see “The criteria for classifying organizations and individual entrepreneurs as small and medium-sized businesses have changed” and “Ministry of Economic Development clarified who is a small business").

Tax authorities assign one category or another to organizations and entrepreneurs. The results are reflected in the unified register of small and medium-sized businesses. As the name suggests, this register includes small and medium-sized enterprises. Those who do not belong to them are not in the register.

Also, the composition of statistical reporting depends on the type of activity that the company or individual entrepreneur is engaged in. Let's consider what innovations are provided in 2021 for each category, taking into account industry characteristics.

Penalties for late submission of reports to statistics

In accordance with Part 1 of Article 13.19 of the Code of Administrative Offenses of Russia, the following fine is provided:

- 20–70 thousand rubles for the company;

- 10–20 thousand rubles for officials.

A similar penalty is imposed on those who disclose false information.

Microenterprises

Changes await micro-enterprises engaged in retail trade. Previously, they submitted the TORG (micro) form, but this report has been canceled since January of this year. Organizations with a license for the retail sale of alcohol from 2021 will no longer submit the “1-accounting” form to Rosstat, and companies with a license for the production, storage and supply of ethyl alcohol will not fill out the “1-alcohol” form.

Microenterprises included in the sample in connection with the observation of small businesses will have to fill out the form “MP (micro)” (Information on the main performance indicators of a microenterprise). The form was approved by Rosstat order No. 414 dated 08/11/16, and instructions for filling it out were put into effect by Rosstat order No. 704 dated 11/02/06. The report must be submitted no later than February 5, 2021. Most of the individual entrepreneurs included in the sample need to report in the “1-IP” form no later than March 2 (approved by Rosstat order No. 414 dated August 11, 2016). We add that the territorial statistics body has the right to request other forms.

Fill out and submit “MP (micro)” and “1‑IP” for free via the Internet

Micro-enterprises included in the sample as part of the federal input-output monitoring will have to report in the form “TZV-MP” (Information on the costs of production and sale of products (goods, works and services) and the results of the activities of a small enterprise for 2016). The form and instructions for filling it out were approved by Rosstat order No. 373 dated July 29, 2016. The report must be submitted no later than April 1, 2017.

Main indicator

Submitting reports to statistics is a mandatory action for organizations that are included in the Rosstat register. Reporting to statistics 2021 is currently being reported for 2021. But many organizations still cannot understand how to correctly determine the main indicator, especially for individual entrepreneurs.

Now you can understand the main indicator using the following criteria:

- average number of employed people. According to the timesheet, it is worth adding up the number of specialists for each day of the period and dividing by days in the same period;

- average number of specialists. To do this, it is worth adding up the average number, external part-time workers and all citizens working under the GPC agreement;

- payroll fund. It is worth calculating the turnover according to D accounting 20.26 or 44 and according to K 70. Expenses for social payments are subtracted from the indicator;

- social payment. It is worth summing up all social benefits to employees;

- time worked. Using the timesheet, you can calculate the number of hours worked;

- revenue from sales of goods and services. To do this, it is worth looking at the revenue line in the financial report;

- shipment of own goods. Can be calculated using accounting for loan 90 subaccount with the same name;

- sale of goods not produced in-house. That is, this is a loan 90 with a revenue subaccount;

- investment process in fixed assets. That is, turnover according to debit 01.

The last day of delivery falls on a non-working day

If mandatory statistics fall on a weekend, then the deadlines are transferred to the first working day that follows a non-working day or holiday in accordance with Resolution of the State Statistics Committee of Russia dated March 7, 2000 No. 18.

Small enterprises (except micro)

Quite a lot of innovations are provided for small businesses. Those involved in road transport of goods will no longer submit the “1-APT” form. Organizations with a license for the retail sale of alcohol from 2021 will no longer submit the “1-accounting” form to Rosstat, and companies with a license for the production, storage and supply of ethyl alcohol will not fill out the “1-alcohol” form. Companies selling alcohol wholesale will stop submitting the “1-alcohol (wholesale)” form.

Legal entities belonging to small wholesale trade enterprises, starting with reporting for the first quarter of 2021, will not submit form “3-sb” (export). Another form for wholesalers will change significantly (Information on the export of products (goods)). From now on, there is no section “Certificate on production, sales and product balances in kind”. At the same time, you will have to submit this form not once a year, as before, but quarterly on an accrual basis. For January-March, January-June, January-September, information is provided no later than the 5th day after the reporting period; for the year - no later than March 1 after the reporting year.

Fill out and submit the current “1-export” form via the Internet Submit for free

Subjects included in the sample in connection with the observation of small businesses need to fill out the “PM” form (Information on the main performance indicators of a small enterprise). The form was approved by Rosstat order No. 414 dated 08/11/16, and instructions for filling it out were put into effect by Rosstat order No. 37 dated 01/25/17. The report is submitted quarterly until the 29th day after the reporting period. Most of the entrepreneurs included in the sample need to report no later than March 2 in form 1-IP (approved by Rosstat order No. 414 dated August 11, 2016). We add that the territorial statistics body has the right to request other forms.

Small enterprises included in the sample as part of the federal input-output monitoring will have to report on the TZV-MP form (Information on the costs of production and sale of products (goods, works and services) and the results of the activities of a small enterprise for 2016) . The form and instructions for filling it out were approved by Rosstat order No. 373 dated July 29, 2016. The report must be submitted no later than April 1, 2017.

Decoding abbreviations

The following reporting abbreviations exist:

- LE – legal entities;

- SMP – small businesses:

- MP – small companies;

- MIP – micro enterprises;

- OP – separate department;

- Peasant farms – peasant farms;

- agricultural – agricultural type;

- FKO – financial and credit institutions;

- JSC – joint stock companies;

- STS(o) – organizations that apply simplified taxation.

Entities not related to small and micro enterprises

Companies (except small and micro ones) engaged in road transportation of goods will no longer submit the “1-APT” form. Organizations with a license for the retail sale of alcohol from 2021 will no longer submit the “1-accounting” form to Rosstat, and companies with a license for the production, storage and supply of ethyl alcohol will not fill out the “1-alcohol” form. Legal entities selling alcohol wholesale will stop submitting the “1-alcohol (wholesale)” form.

Wholesale organizations (except small and micro), starting with reporting for the first quarter of 2021, will not submit the “3-sb” (export) form. Another form for wholesalers has changed significantly (Information on the export of products (goods)). From now on, there is no section “Certificate on production, sales and product balances in kind”. At the same time, you will have to submit this form not once a year, as before, but quarterly on an accrual basis. For January-March, January-June, January-September, information is provided no later than the 5th day after the reporting period; for the year - no later than March 1 after the reporting year.

There are innovations for commercial and non-profit organizations that provide paid services to the population (including management companies, housing and housing-construction cooperatives, as well as homeowners associations). In 2017, instead of Appendix No. 3 to the “P-1” form, they will submit “P (services)” (Information on the volume of paid services to the population by type). The form and instructions for its use were approved by Rosstat order No. 388 dated August 4, 2016. The frequency of reporting depends on the average number of personnel. If this figure exceeds 15 people, the form must be submitted monthly. If the average number of employees is 15 people or less, the form must be submitted quarterly.

All non-financial commercial organizations (except small and microenterprises) must report under federal input-output surveillance no later than April 1, 2021. In particular, it is necessary to submit an appendix to Form 11 “Information on the species composition of commissioned fixed assets” (approved by Rosstat order No. 289 dated June 15, 2016). In addition, you need to submit one of the annexes to the form “1-enterprise TZV” (Information on expenses for the production and sale of products (goods, works and services)). The application must correspond to the main type of activity. Thus, companies engaged in printing and publishing activities submit an application in the form TZV D-22, construction organizations submit an application in the form TZV F-45, etc. These forms were approved by Rosstat order No. 374 dated July 29, 2016.

How to submit reports to Rosstat

In 2021, statistical reporting forms can be submitted in the same way as last year: “on paper” (in person, through a representative or by mail), or electronically. Electronic reporting, in turn, can be transmitted in one of two ways.

The first way is through a special operator providing electronic document management services. The second way is through the reporting collection system, if it is organized on the website of the territorial division of Rosstat (at the moment, reporting in this way is possible only in 7 regions). To do this, you need to submit an application and receive a login and password to access the service.

Both the first and second methods of transmitting electronic statistical reporting require a qualified electronic signature key certificate (CES).