A desk tax audit is carried out for each declaration (calculation) submitted by a company or entrepreneur to the Federal Tax Service and does not require special orders from the inspection management. Such an audit is carried out without visiting the taxpayer’s location. Its essence lies in carrying out an automated reconciliation of the control ratios of the information of declarations and calculations with the database for past periods and financial statements. Often, a desk audit is limited to monitoring the correctness of arithmetic calculations in the submitted declarations.

If no discrepancies or errors are identified, then the check ends here. The legislation does not establish a norm dictating the mandatory drawing up of an act if there are no violations. But if facts of incorrect calculation of taxes, inconsistencies, discrepancies or errors are revealed, the inspector draws up a desk tax audit report, which is a document stating the identification of violations according to the declarations submitted by the company. Let's figure out what is reflected in this document, what legal requirements it must meet and within what time frame it must be drawn up.

Desk inspection report: when is it issued?

So, the preparation of the act is preceded by an inspection, which is carried out within 3 months from the date the company submits the declaration. For example, if declarations are submitted on March 20, then the audit deadline is June 20. The document should reflect only specific facts and conclusions based on the reality of violations of the Tax Code of the Russian Federation.

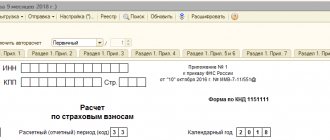

The report of the desk tax audit, recording the results of the control carried out, is drawn up within ten days after its completion, i.e., if the audit is completed on May 20, the report must be drawn up on May 30. Regulates the drawing up of the act of Art. 88 and 100 of the Tax Code of the Russian Federation. They also oblige the inspector to accept and consider the explanations and documents submitted by the taxpayer before processing the document. The desk tax audit report, a sample of which is presented below, is drawn up in 2 copies and in a strictly approved form. It is signed by two parties - the inspector of the Federal Tax Service and the authorized representative of the company being inspected. The head of the company in which the inspection was carried out must be familiarized with the act within 5 days after its preparation and certify with a signature the fact of familiarization.

What requirements must be met when drawing up an inspection report?

When drawing up an act, tax authorities must be guided by the Tax Code (clause 4 of Article 100), the regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation dated September 30, 2004 No. 506 (clause 1), and the requirements for drawing up a tax audit report set out in Appendix 24 to the order of the Federal Tax Service of Russia dated 05/08/2015 No. ММВ-7-2/ [email protected] (hereinafter referred to as the Requirements).

Here are the main requirements:

- drawing up an inspection report in 2 copies (clause 5 of the Requirements);

- compliance with the strictly approved form if the act is drawn up on paper (clause 4 of article 100 of the Tax Code of the Russian Federation, clause 2 of the Requirements);

- signing of the act by the inspector on the one hand and by the taxpayer being inspected or his representative on the other hand (clause 2 of article 100 of the Tax Code of the Russian Federation, clause 4 of the Requirements);

- 10 working days are allotted for drawing up a report from the date of completion of the inspection if, as a result of its results, violations were discovered (paragraph 2, paragraph 1, article 100, paragraph 6, article 6.1 of the Tax Code of the Russian Federation);

- delivery of a copy of the act to the taxpayer (his representative) within 5 working days from the moment it was drawn up.

Find out how to authorize a company employee to sign desk inspection reports here.

Should the inspector draw up a desk inspection report if the identified violations did not result in an understatement of the amount of tax payable? Find out the answer to this question in the ConsultantPlus Tax Guide by getting trial access for free.

Structure and content of the inspection report

The inspection report contains:

- introductory part, which provides general information about the inspection being carried out, the company (its branch) in which it is carried out;

- a descriptive block with the disclosure of facts of violations of tax legislation, based on documentary evidence, presented with maximum clarity and systematization;

- the final part, i.e. conclusions about the results of the audit and the presence of a tax offense, information about the consequences of the identified deficiencies, as well as making proposals for their elimination.

An integral part of the act are the annexes drawn up to it. This is evidence confirming facts of violations related to the calculation and payment of taxes and penalties. These include the necessary explanations, additions, certificates, calculations of discrepancies between the data declared by the company and those established during the audit, and other documents drawn up by the inspection inspector.

What are the consequences of failure to draw up an audit report by a tax inspector?

The position of the courts is that if the inspector does not draw up a desk audit report, this may serve as a basis for canceling the decision made by the tax authorities based on the results of consideration of the audit materials (such conclusions were made by the FAS Moscow District and the FAS North Caucasus District in resolutions dated September 23, 2009 No. KA-A40/8182-09-2 and dated 11/12/2009 No. A53-5911/2009, respectively).

Thus, if an inspector discovers facts of violation of tax legislation by a taxpayer, a report must be drawn up. Otherwise, the decision of the tax authority, based on the results of the desk audit, will be declared invalid (clause 14 of Article 101 of the Tax Code of the Russian Federation).

When else decisions of tax officials can be declared invalid, read the article “The Inspectorate must ensure the participation of the taxpayer in the consideration of audit materials .

Delivery of a desk tax audit report

It is necessary to familiarize the management of the company or individual entrepreneur with the desk inspection report within five working days after the date of its execution. Those being inspected sign all copies of the act. On a copy that remains with the Federal Tax Service, a representative of the company makes a record of receipt of the act and verifies it with a signature. The signature in the act is a confirmation of delivery of the act, and not an agreement with all the facts specified in it. Typically, tax authorities notify the taxpayer of the need to obtain a report.

If the receipt of the act is refused, the Federal Tax Service will send it by mail to the location of the company or the address of the entrepreneur, having previously made the appropriate mark on the last sheet and certified this fact with the signature of the inspector. The tax office is also obliged to send the report by mail within 5 days from the date of drawing up the report.

Results

A report based on the results of a desk audit is issued if errors and/or contradictions are found in the tax return submitted by the taxpayer. The act discloses facts of violation of tax laws with mandatory documentary evidence, as well as circumstances that make it possible to mitigate or aggravate liability for committing an offense.

If the taxpayer does not agree with the information contained in the report, he has the right to submit his objections.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Delivery and consequences

Each copy of the document confirming the desk inspection is signed by both parties (the inspector and the person being inspected). If the taxpayer does not agree with the inspector’s conclusions, he has the right not to sign the report. But this fact should be reflected in the document. If the desk audit is carried out repeatedly, then the report is drawn up in triplicate.

Drawing up an act is a norm of current legislation. 10 days are allotted for preparing the document. Within 5 days, the taxpayer must familiarize himself with it and certify with his signature. If the document is not available, the verification results are canceled.

The “camera chamber” act becomes the basis for drawing up an Objection. The taxpayer must formalize disagreement with the conclusions of the civil servant in writing and, within a month after familiarizing himself with the inspector’s decision, bring it in person to the tax office or send it by mail.

So, a desk audit report is drawn up if the inspector finds errors in the taxpayer’s reporting documents. It is created according to the approved sample in two copies on paper or electronic media. It must be signed by both the inspector and the person being inspected. Within 10 days, the tax office must provide one copy to an individual or the head of an organization.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Departmental target programs of Rospotrebnadzor 8. Payne NR, Finkelstein MJ, Liu M., et al. NICU practices and outcomes associated…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

Form

The act has its own sample form.

The document should consist of three parts: introductory, descriptive and concluding. In the first, you should indicate the number of the inspection report, the full name of the company and abbreviation, or the full name of the taxpayer being inspected. In the case of an inspection of a separate unit, its name and exact address are indicated.

It should also contain information, including the date and number of the decision of the head or his deputy to conduct a tax audit, the date of submission of the declaration or other documents to the tax office (and their list), the audit period, the list of taxes for which the inspection was carried out, dates the beginning and completion of the audit and data on tax control.

The second part contains data on confirmed facts of violations of the Russian Federation tax law or a record that there are no such violations, as well as a list of additional circumstances that mitigate or aggravate the liability of a company or individual for identified violations. All data must be objective and justified and exclude errors, and the wording must be accurate and prevent misinterpretation.

The last and final part of the document should contain data on the conclusions of tax inspectors, decisions to eliminate violations with references to articles and paragraphs of the Code of the Russian Federation, full names of inspectors with their positions and information about the tax authority they represent, as well as the possibility of submitting objections regarding act, reference to the exact number of sheets of the document, signatures of inspectors and the taxpayer or his representative.

The document is drawn up in two copies, one of which is sent to the tax office, and the second to the taxpayer or the head of the company.

Basic information ↑

The taxpayer must know what a desk audit is, in what cases it is carried out and how an act is drawn up on its basis.

What it is

Desk tax audit is one of the forms of tax service control. This concept is mentioned in Article 87 of the Tax Code of the Russian Federation.

Its purpose is to determine whether the taxpayer complies with his obligations and pays taxes and fees. After filing the declaration, verification begins.

It aims to:

- monitor the legal application of tax laws;

- detect and suppress violations of law;

- check the legality of benefits and subsidies.

Principles:

| Subject of desk inspection | Documents of taxpayers and those in the possession of the tax office |

| Check location | Tax office, and not at the place of work of the taxpayer being inspected |

| Inspections can only be carried out by officials | Having certain powers |

| Permissions | This type of verification is not required. |

| The inspection is carried out as long as indicated in the declaration | — |

The desk audit is carried out in several stages:

- Registration of the declaration.

- Control of the declaration.

- Carrying out document verification activities.

- End of desk inspection.

- Drawing up an act.

If at the time of the desk audit it turns out that the declaration and reporting documents contain contradictions, the taxpayer is obliged to explain this.

Changes must be made within 5 days. If the person conducting the inspection notices errors, a violation will be established.

The desk-type check is carried out as follows (rules):

- Without a declaration, it has no right to be carried out

- this check is mandatory, every taxpayer must be subject to it;

- the taxpayer is not informed about the upcoming audit;

- the calculation (declaration) is verified with other documents of the organization;

- the presence of errors must be explained by an individual or legal entity;

- When explaining, the taxpayer is required to provide evidence.

Reasons for verification:

- non-payment of taxes;

- detection by the tax authority of errors in the taxpayer’s reporting;

- use of tax benefits by individuals;

- maintaining double tax reporting;

- hiding real tax amounts.

The object of the desk audit is the tax return. Other documents and reports may also be submitted to the Federal Tax Inspection Service.

The inspectorate must carefully check all tax documents. During a desk audit, there are points that oblige a person to be held criminally liable:

- if the offense is contrary to the law;

- they have no right to prosecute a person twice for the same crime;

- After attraction, the individual is still obliged to pay the debts.

Until the guilt of an official is proven, he is considered innocent and cannot be held accountable.

During a desk tax audit, see the article: deadline for a desk tax audit. Read how to file an objection to the PFR desk audit report here.

If during a desk audit it turns out that the taxpayer hid his income or understated it, then there cannot be a repeat audit. He is immediately brought to justice.

Immediately after the inspection, it is necessary to draw up a report and hand it to the taxpayer. If he does not want to accept it, then a special entry is made in the act.

Purpose of the document

The purpose of the cameral verification act is to hold the taxpayer accountable for his illegal actions.

The document must be drawn up without fail (Article 100 of the Tax Code of the Russian Federation), regardless of the type of offense.

Main functions of the document:

| Is an integral part of the desk audit | Taking into account the conclusions of the tax authority’s act, the head of the inspectorate makes a decision on whether it is worth holding the taxpayer accountable |

| Target | Provide information to the taxpayer based on the results of a desk audit |

If the tax inspector does not draw up a desk audit document, the court may invalidate the decision to prosecute the person.

Legal grounds

The legal regulation of desk audits is reflected in Article 88 of the Tax Code. According to paragraph 2 of the same article, the audit is carried out by an authorized person of the tax authority.

The deadlines for consideration and decision-making on the desk audit report are set out in Article 101 of the Tax Code. The procedure for consideration is indicated in the same article.

and Chapter 15 of the Tax Code state that if a tax violation is detected, the tax inspectorate must inform about it.

Thanks to this approach, the taxpayer will be able to protect his rights. According to Article 115 of the Tax Code, tax authorities have the right to file a lawsuit if the taxpayer refuses to pay the debt.

Guided by Article No. 100, the act must be drawn up within several months after the inspection. The tax audit report of legal entities must be signed by both these persons and members of the tax authority.

According to the Federal Law adopted on November 26, 2008, a taxpayer can present to the tax inspectorate documents confirming his innocence.

The person who conducted the inspection must check them. If the taxpayer relied on tax benefits, he is required to provide supporting documents.

Article No. 172 of the Tax Code defines the standards that taxpayers must comply with when maintaining records.

According to the same article, the tax authority that conducted the desk audit has the right to demand these reports from the person.

If before the audit is completed, the taxpayer had other acts of desk audit, then they are terminated and new ones begin (Article 81 of the Tax Code).

How is a desk audit carried out?

- The data of all tax returns is entered into the automated information system of the tax authorities, and control ratios are verified. The Federal Tax Service of Russia publishes control ratios on its website so that the accountant can independently correct errors in the declaration.

- In automatic mode, desk control of the ratios is carried out.

- If inconsistencies are detected, an in-depth desk audit is carried out, for which additional documents from the taxpayer are requested.

At this stage the following are checked:

- tax return indicators with previous reporting periods;

- the indicators of the audited declaration are linked with the indicators of declarations for other types of taxes and financial statements;

- the reliability of the declaration indicators based on the analysis of all information submitted to the tax authority.

The declaration indicators are also compared with indicators for similar taxpayers and the industry average. If inconsistencies are not identified, then tax authorities do not inform taxpayers about the audit, since documents based on the results are not drawn up. If the indicators do not converge, an in-depth check is possible.

Conducting an in-depth review

Conducting an in-depth audit involves requesting additional data from various entities to supplement existing information. Simply put, if confirmation of certain facts is needed or doubts about the veracity of any information are so strong, service employees have the opportunity to:

- receive photocopies of primary documentation;

- conduct a conversation with witnesses of a particular case;

- find out information of interest from counterparties;

- order an examination or obtain additional information in other available ways determined by law.

Why is an in-depth check needed?

The need for an in-depth audit arises in the following situations.

- If the tax payer has the right to use any benefits. Usually, information from outside is needed just to confirm the required information about the ownership of the right to receive government “indulgences” when paying taxes.

- If a value added tax refund was claimed on the return form, the tax office often insists on conducting an in-depth desk audit. The fact is that usually representatives of the entrepreneurial category avoid VAT refunds. Starting from 2015, it became possible to postpone value added tax deductions for three years, so that an in-depth desk audit was not carried out, and it was possible to avoid reimbursement.

- If inside the value added tax declaration form there are data on transactions performed that contradict other information obtained from the same form. Or there is a discrepancy between the information on the same transactions from the value added tax declaration form, which was provided for verification by another entity. Let's give an example. You and the company that is your counterparty simultaneously submit declarations for verification. In the same transaction in which both of you took part, the value added tax indicators according to the documentation proposed for verification turned out to be different. Previously, such a state of affairs would have required compensation, but now it is not required.

- If, after two years have passed from the last day on which the declaration was submitted, you submit for verification a declaration form with updated information, inside of which the indicator of losses received has increased or the amount of tax collection has been reduced. Of course, this state of affairs may seem far-fetched, and the tax service will want to find out how true the new data is.

- Most often, declarations drawn up for tax deductions related to the use of resources given to man by nature are subject to in-depth desk audits.

Note! If none of the above circumstances occur in your case, you have the right not to provide the tax service with additional information on completely legal grounds. However, if you are really clean and have the opportunity to explain yourself, it is better to do so so as not to aggravate the situation.

How to fill it out correctly

The template for the desk tax audit report is drawn up according to the approved sample in cases where the Federal Tax Service inspector has discovered errors in the taxpayer’s reporting documentation. The sample can be on electronic or paper media. At least 10 days are allotted for its preparation. The taxpayer is given 5 days to familiarize himself with the form.

The act is drawn up in Russian, usually in printed form. Abbreviations are permitted on the official sheet. It is worth noting that the first time you mention a company, you must indicate the name in full. Subsequently, it is allowed to shorten it.

Also, when filling out the template you must:

- Decipher monetary units of foreign currency and convert them into the corresponding equivalent in rubles. The exchange rate must correspond to the one set by the Central Bank.

- Enter dates in the format DD.MM.YYYY.

- Eliminate errors completely. In some cases, corrections are permitted. But they must be certified by the signatures of the inspector and the person being checked. An example of a desk tax audit report is filled out as a regular document. The first part contains the form number, the name of the enterprise (in full or abbreviated), and its details.

If the check is carried out in relation to an individual, then you will need to indicate:

- full initials;

- TIN.

In both cases, the inspector additionally indicates the place and time of the inspection. The first part contains information about the citizen: full name, documents that served as the basis for the inspection, period and list of activities carried out. The second part contains data confirming or refuting the fact of a violation, as well as facts mitigating the punishment for the offense. Please note that the information must be objective, reasonable and true.

The third part specifies penalties and their amount, as well as information about the inspector (full name, position).

What to pay attention to

Let us remind you that the document is drawn up only after preliminary verification. In cases where the person being checked does not agree with the results of the check, he can file an objection. You have 1 month to prepare the form. The sheet is drawn up in written form. You can send it via email or submit it in person to the Federal Tax Service. The block of objections is compiled in free form. At the same time, it must clearly formulate points and protests of points with which the person being checked does not agree. If the decision made on the objection does not satisfy the citizen, he can file an appeal within 30 days.

Federal Tax Service employees must notify the taxpayer about the order in which the results of the audit are considered.

How to determine the deadline for filing an objection?

For example, an enterprise was issued an act on April 10, 2021. In this case, the last day to file an objection is April 20, 2021 for office and June 10, 2021 for offsite.

There are cases when the deadline falls on a date that does not exist in that month, then the last day for filing an objection is the last calendar day of that month.

For example, the tax inspectorate presented the company with an on-site inspection report on July 31, 2021. This means that the last day for an objection will be September 30, 2021.

Previously, the requirements for meeting deadlines were more stringent, now you can object later, but it is still recommended to meet the deadlines.

If, nevertheless, the entrepreneur is delayed, objections can be prepared at the time of consideration of the inspection materials, where a representative of the party being inspected is invited. It is at this meeting that objections should be accepted and taken into account during the discussion.

How and where to send an objection?

The prepared document is sent in writing to the address of the territorial tax inspectorate that carried out the audit (clause 6 of Article 100 of the Tax Code of the Russian Federation), or transmitted directly to the office. This can be done by a leader or a trusted person (vv. 27, 29). It is advisable to prepare two copies, one for the tax office, the other with a mark of acceptance remains with the applicant of objections.

If it is not possible to submit the document in person, it can be sent by registered mail by regular mail. Here it is very important to pay attention to the timing when the date of delivery is considered the sixth day from the day of mailing (clause 5 of Article 100 of the Tax Code of the Russian Federation).

Timing of the inspection and established procedure

The conduct of the required process, like other activities in the field of tax legal relations, is regulated by the Tax Code of the country, more precisely, by its article number 88.

Article 88. Desk tax audit

The audit begins immediately from the moment the taxpayer submits declaration forms and related documents to the tax office for verification. To initiate it, specialists do not need to obtain permission or a documented decision from the management of a particular service department or the tax payer who provided the data.

In addition, representatives of the tax system have no obligation to send taxpayers notifications stating that a desk audit has started.

The duration of the required process is 3 months from the moment the declaration is submitted for consideration to the tax office

If the inspection has already begun and during its implementation some inaccuracies, errors or any other discrepancy between the information submitted for processing and reality were discovered, inspectors are obliged to notify the citizen whose documents are being checked and provide him with the following two options for further developments:

- or come to the service department to give oral and written explanations for inaccuracies in the declaration;

- or provide a new declaration form, which plays the role of correcting an incorrect document.

We would like to draw your attention to the fact that additional submission of information or an invitation to receive clarification are situations that arise quite rarely. Usually, during a desk audit, all inaccuracies or points previously unclear to tax officials are clarified, and the work continues at full speed.

If there is a need to provide clarification, you can do the following.

- Appear in person at the tax office and, in the presence of employees involved in your case, draw up a written explanation. A very convenient option, since the inspectorate workers present during writing will help you indicate all the necessary clarifications and first explain in detail what the inaccuracies actually are.

- Send a written explanation via mail. To do this, you must write a registered letter as soon as you receive the requirements, since the maximum period for providing clarification is five working days.

- In addition to sending by post, clarifications can be sent using electronic communication channels, that is, using a scanner and the Internet, sending clarification to the e-mail of a specific tax office.

According to the law, you have the right to transfer data using any of the methods listed above. However, we recommend that you consult with the tax specialists involved in your case. Do what is convenient for both parties and establish friendly relations with your employees, which will certainly affect the degree of diligence in working with you.

If you do not have to give explanations, but enter corrective information using a new declaration form, you will have to fill it out again. According to the letter of the law, the tax service has the right to request a clarifying declaration and other accompanying documents in the following cases.

- if there was a statement of the amount of value added tax that needs to be reimbursed;

- when the declaration form states some benefits due to the taxpayer;

- if reporting is carried out on tax collections directly related to the use of natural resources;

- if the declaration form for collection from the profit of an organization or personal income tax was submitted for verification by a person participating in the investment partnership.

The right to receive additional information during a desk audit from tax officials extends not only to taxpayers providing documents. They can also obtain information of interest from other additional sources.

- First of all, the tax service has the right to clarify and supplement existing information with the help of taxpayers themselves, however, only in cases where such a right arises in accordance with legislative norms.

- Representatives of the tax inspectorate also have the right to demand the provision of information and additional documents from counterparties and other entities.

- In particularly complex cases, it is also possible to conduct interrogations of persons who are witnesses in a particular case.

- Another way to obtain additional information is to conduct an examination.

- If necessary, to clarify certain circumstances, tax officials may invite a professional translator or an expert in the desired field of activity to take part in the process.

- With the consent of the tax payer, service employees also have the right to inspect the submitted documentation and any items related to the case.

No violations

If, based on the results of a desk audit, the inspectorate comes to the conclusion that the organization has not committed violations of tax laws, then the results of the audit will remain undocumented. Tax legislation does not oblige the inspectorate to draw up any document in this case (Articles 88, 100 of the Tax Code of the Russian Federation). The inspection is also not obligated to notify the organization of the completion of the desk audit if there are no violations. The Tax Code of the Russian Federation does not contain such a requirement (Article 88, 100 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated May 21, 2009 No. 20-14/4/051403). There is only one exception to this rule. If the subject of a desk audit is a VAT return using the application procedure for tax refund, then the inspection is obliged to notify the organization in writing about the completion of the desk audit and about the absence of identified violations of the law. The inspection must send such a notification, drawn up in any form, within seven working days after the end of the desk inspection. This follows from paragraph 12 of Article 176.1 of the Tax Code of the Russian Federation.

Advice: there is a way to receive written notifications from the inspectorate about the completion of desk audits of declarations and the absence of tax offenses in relation to any taxes.

To do this, contact the inspectorate in any written form with a request to inform you about the results of a desk tax audit in order to find out whether you are applying tax legislation correctly. This possibility is provided for in subparagraph 1 of paragraph 1 of Article 21 of the Tax Code of the Russian Federation. The inspectorate is obliged to respond to such an appeal from the organization and give a specific answer to the question posed in a clear and understandable form (subclause 4, clause 1, article 32 of the Tax Code of the Russian Federation, clause 4.3.2.4 of the regulations, approved by order of the Federal Tax Service of Russia dated September 9, 2005 No. SAE-3-01/444).

The fact that the provisions of Article 88 of the Tax Code of the Russian Federation do not oblige the inspectorate to inform the organization about the results of a desk audit in the absence of violations does not exclude the organization’s right to receive such information upon written request. Arbitration practice confirms the legitimacy of this conclusion (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated June 5, 2009 No. VAS-6946/09, the resolution of the FAS of the Volga District dated February 18, 2009 No. A55-10190/2008).

Thus, despite the fact that the provisions of Article 88 of the Tax Code of the Russian Federation do not oblige the inspectorate to inform the organization about the results of the desk audit if there are no violations, the organization has the opportunity to obtain such information upon written request. Arbitration practice confirms the legitimacy of this conclusion (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated June 5, 2009 No. VAS-6946/09, the resolution of the FAS of the Volga District dated February 18, 2009 No. A55-10190/2008).

Sending the act by mail

If an organization (its representative) avoids receiving a desk inspection report, the inspection reflects this fact in the report and sends it by registered mail to the organization (separate unit). In this case, the date of receipt of the act by the organization is considered to be the sixth working day from the date of sending the registered letter. This follows from the totality of the provisions of paragraph 2 of paragraph 5 of Article 100 and paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Moreover, the countdown of the six-day period begins from the day following the day of sending the act (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

Tax legislation does not contain an unambiguous answer to the question of whether the inspectorate has the right to send a desk audit report by registered mail if the organization does not evade receiving it (paragraphs 1, 2, clause 5, article 100 of the Tax Code of the Russian Federation).

Situation: is it possible to cancel the decision of the inspectorate based on the results of a tax audit if the organization has not received a report from a desk (on-site) audit?

Answer: yes, it is possible, provided that the organization did not receive a tax audit report and at the same time was not notified of the time of consideration of the audit materials.

The decision on a tax audit is subject to cancellation if the inspection violates the essential conditions of the procedure for considering audit materials. Thus, the inspection decision is canceled if the inspection does not provide the organization with the opportunity to participate in the consideration of the inspection materials and provide explanations on them. This is stated in paragraph 2 of paragraph 14 of Article 101 of the Tax Code of the Russian Federation.

The fact that the organization has not received a tax audit report deprives it of the opportunity to submit its written objections to the report (clause 6 of Article 100 of the Tax Code of the Russian Federation). At the same time, the organization still has the opportunity to present its objections and explanations during the consideration of the inspection materials (clause 14 of Article 101 of the Tax Code of the Russian Federation). Consequently, the absence of a tax audit report from an organization cannot in itself be a sufficient basis for canceling the decision of the inspection inspectorate.

The situation is different if the organization did not receive a tax audit report and at the same time was not notified of the time for consideration of the audit materials. In this case, the organization is completely deprived of the opportunity to give its objections and explanations, which is unacceptable. The decision based on the results of such an audit is subject to cancellation. This follows from the provisions of paragraph 2 of paragraph 14 of Article 101 of the Tax Code of the Russian Federation. The established arbitration practice confirms the legitimacy of such a conclusion (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated December 23, 2009 No. VAS-16522/09, dated October 29, 2009 No. VAS-13489/09, decisions of the FAS Central District dated October 21, 2009 No. A35-8070/08-C26, dated June 26, 2009 No. A48-2263/08-18, North Caucasus District dated December 28, 2009 No. A32-7437/2009-25/52, Moscow District dated September 29, 2009 No. KA-A40/8296-09, dated March 6, 2008 No. KA-A40/1247-08, West Siberian District dated September 14, 2009 No. F04-5654/2009(19864-A70- 14), East Siberian District dated April 7, 2009 No. A33-8783/08-F02-1244/09, Northwestern District dated November 14, 2008 No. A56-1230/2007, dated February 9, 2007 No. A05-11114/2006-12).