On this issue, we adhere to the following position: The employer has the right to keep time sheets in electronic form, but only with the mandatory use of an appropriate electronic signature.

Answer prepared by: Expert of the Legal Consulting Service GARANT Naumchik Ivan

Response quality control: Reviewer of the Legal Consulting Service GARANT Kudryashov Maxim

January 30, 2015

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. For detailed information about the service, contact your service manager.

Do I need to draw up a separate timesheet for calculating the advance payment?

Questions and answers on the topic

Good evening? What document is the HR department required to provide to the accounting department for accrual of advance payments? I want to understand the responsibilities of the HR officer regarding the provision of payroll sheets for the first half of the month.

To date, Art. 136 of the Labor Code of the Russian Federation does not contain such a concept as “advance payment”.

Don't miss: the main article of the month from an expert practitioner

Five tips about a shift schedule when it is unclear how to fill out a timesheet.

An advance is an advance payment, i.e. payment “in advance” for a period of time not yet worked.

From October 3, 2021, a new version of Article 136 of the Labor Code of the Russian Federation will come into force. In this regard, there will be a change in the timing of salary payments in 2021. Article 136 of the Labor Code of the Russian Federation will continue to provide that wages

must be paid “at least every half month.”

However, a clarification will appear: “ Wages are paid at least every half month.

The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued .” Those. and the new version of Art. 136 of the Labor Code of the Russian Federation does not provide for prepayment of wages.

The concept of “advance” is mainly used in accounting literature and some explanations of Rostrud.

The establishment of advance payments is not prohibited by current legislation. But in this case, the employer bears certain risks associated with the return of amounts overpaid to employees.

Within the framework of Art. 136 of the Labor Code of the Russian Federation, it is more correct to talk specifically about settlements with employees for the first and second half of the month.

You can find out more about the advance payment for piecework wages

Thus, in accordance with Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee for each half of the month.

The time sheet is filled out for the period for which wages are paid.

This conclusion follows from the order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n (this condition is included in the instructions for filling out the timesheet)

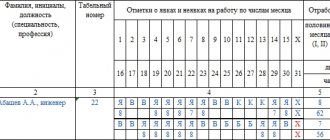

Also, the form of the T-13 time sheet and the instructions for filling it out were approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1, according to which the working time sheet is divided into two parts: from 1 to 15 and from 16 to 31.

The procedure for calculating half of the month is established in Art. 192 of the Civil Code of the Russian Federation, according to which “ a period defined as half a month is considered as a period calculated in days and is considered equal to fifteen days

».

From the above, we can conclude that, regardless of the number of working days in a month, the timesheet for the first half of the month is filled out from the 1st to the 15th.

Sample report card for half a month:

Popular questions

The timesheet for the second half of the month is filled out in the same way, but in the half of the month column, II must be indicated and the total time worked by the employee for the month is entered for the month.

In accordance with paragraph 3 of Article 226 of the Tax Code of the Russian Federation, you pay income tax when paying wages for the month.

Details in the materials of the Personnel System:

- Situation

:

Is it necessary to draw up a separate timesheet for calculating the advance payment?

The employer is obliged to keep records of the time actually worked by each employee (Part 4 of Article 91 of the Labor Code of the Russian Federation). For this purpose, the employer uses unified forms of time sheets approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1, or independently developed forms. It is assumed that the responsible specialist fills out the timesheet daily based on the presence or absence of employees.

The timesheet serves not only to display the attendance or absence of employees, but also to calculate their salaries. Salaries are calculated based on the results of the month, so unified timesheet forms are also designed to be filled out on a monthly basis.

The legislation does not provide for the obligation to draw up a separate time sheet for advance payment. Therefore, each organization has the right to independently determine the procedure for generating timesheets. In practice, two approaches are used:

- draw up a single timesheet on a monthly basis and agree on the procedure for submitting the timesheet to the accounting department twice a month: for calculating the advance and at the end of the month;

- draw up separate time sheets for every half month indicating the period.

The specific procedure for compiling and submitting a time sheet to the accounting department should be fixed in the local regulations of the organization, which stipulate the procedure for calculating and paying wages (Article 8 of the Labor Code of the Russian Federation).

Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health

How an advance is paid - new rules and payment procedures

And to record and confirm the time worked for the first half of the month, a time sheet is used. Thus, in accordance with Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee for each half of the month. First, you need to enter the employee’s serial number in the first column of this section, then in the second - his full name (preferably his full name and patronymic to avoid confusion and errors). In the third column you need to insert the employee’s personnel number assigned to him during employment (it is individual and never repeated).

Federal Law of 04/06/2011 N 63-FZ “On Electronic Signature” (hereinafter referred to as Law N 63-FZ), an electronic signature is information in electronic form that is attached to other information in electronic form (signed information) or is otherwise associated with such information and which is used to identify the person signing the information. At the same time, the Labor Code does not prohibit making advance payments more often than every half month, for example, 3 times a month (every decade) or 1 time a week.

This statement is only half true: it is important not only to correctly calculate employee salaries, but also to pay them correctly. At the same time, the stumbling block for many is paying advances to employees. Is it necessary to split the salary into an advance payment and a final payment if the amount is already small? Is an advance paid to external part-time workers? How to calculate the advance amount?

When using such a coefficient, you are guaranteed to have money left over, from which personal income tax can be withheld if, say, an employee gets sick in the second half of the month. After all, even in this case, at the end of the month he will have a charge equal to the amount of personal income tax from the salary for the first half of the month, which you will withhold in full.

The part of the salary that must be paid based on the results of the first half of the month cannot be less than the tariff rate or salary for the time actually worked or work performed (letters of Rostrud dated September 8, 2006 No. 1557-6, Ministry of Health and Social Development of Russia dated February 25, 2009 No. 22-2-709). That is, salaries need to be calculated for every half month in approximately equal amounts, excluding bonus payments, provided that the full standard of time is worked. But the payment of sick leave is precisely tied to the payment of wages: benefits must be paid on the day closest to the date of payment of wages after the award of benefits. If such the nearest day is the day of payment of the advance, then the benefits must be paid along with it.

Should the advance payment report be approved by the director?

Questions and answers on the topic

Our company pays an advance and wages, but not all employees want to receive an advance. The law clearly states that even if an employee has written a refusal of an advance payment, this does not serve as an excuse during an inspection. My question is the following: how to properly issue an advance, how are timesheets filled out, twice a month and on different forms, the first from the 1st to the 15th, and the second from the 16th to the 31st, or on one? Should the advance payment report be approved by the director? We have a larger number of employees who work piecework, which means I will most likely have to count work orders, because it will not be possible to roughly calculate the advance payment. Thanks in advance.

1. The detailed procedure for issuing an advance is given in the selected materials. There are examples.

2. About the time sheet. You have the right to approve your form and the procedure for filling it out, the one that is convenient for you. If you use a form approved by Goskostat, you must consider the following.

However, information from the Timesheet is still necessary for calculating the advance. Here you can do one of two things:

The first is to actually keep two time sheets per month.

The second (it is simpler) - the person responsible for maintaining the time sheet hands it over or a copy of it for calculating the advance payment, and gives the final document for the month for calculating wages. Thus, the requirements of Article 136 of the Labor Code of the Russian Federation and Rostrud regarding the payment of wages twice a month will not be violated. As well as the need to pay an advance in an amount no less than the time actually worked by employees.

3. According to the procedure for filling out the Timesheet, it is used to compile the Payroll Statement after approval by the manager. However, you have the right to change the form by replacing the manager with any responsible person whose powers are confirmed (for example, by order).

4. If you have people who work piecework, then calculate their payments according to the orders for piecework. That is, they need to keep track of production, not working time.

The rationale for this position is given below in the materials of the Glavbukh System

1. Recommendation: How to pay a salary advance

This is interesting: List of documents when applying for a job

Situation: when is it necessary to pay a salary advance?

The advance must be paid within the period established by the Labor Regulations, collective and labor agreements.

Specific dates for advance payment are not established by Russian labor legislation. Article 136 of the Labor Code of the Russian Federation only says that wages must be paid at least every half month.

At the same time, it is safer to set deadlines for payment of salary advances, taking into account the opinions of regulatory agencies and established judicial practice. Rostrud specialists, in oral explanations, recommend setting the advance payment deadline in the middle of the month (15th or 16th). However, if you set the advance payment date, for example, on the 25th, this will not be a violation. After all, the legislation does not provide for such restrictions. The main thing is that such a period is specified in the internal documents of the organization.

Thus, the employer has the right to set, at his discretion, the date for payment of the advance in the Labor Regulations. However, if the organization wants to avoid disputes on this issue, it is better to set such a date in the middle of the month (15th or 16th). It should be taken into account that compliance with labor laws is checked by Rostrud specialists, who allow a later payment date (for example, the 25th).

Situation: is it necessary to pay an advance on wages in a piece-rate wage system?

No, not necessarily. At the same time, there are no prohibitions on such actions.

Situation: is it possible to pay salaries once a month if written statements of consent to such an order have been received from employees

The frequency of payment of wages is established by the Labor Code of the Russian Federation. Therefore, paying wages at least every half month is not a right, but an obligation of the employer (Part 6 of Article 136 of the Labor Code of the Russian Federation). Moreover, it is possible to issue salaries more often than this frequency (for example, once every 10 days).

By paying wages only once a month, the employer violates the requirements of the law. This cannot be done, even if employees have written statements of consent with this procedure.

Attention: an organization that issues wages to its employees less than every half month violates labor laws.

Punishment for such actions (including violation of the rules for issuing wages) is provided for in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses in relation to:

- organizations - a fine in the amount of 30,000 to 50,000 rubles;

- entrepreneur - a fine in the amount of 1,000 to 5,000 rubles;

- officials of the organization (for example, a manager) - a warning or a fine in the amount of 1000 to 5000 rubles.

Repeated violation by a person who was previously punished for similar acts entails:

- for an organization – a fine in the amount of 50,000 to 70,000 rubles;

- entrepreneur - a fine in the amount of 10,000 to 20,000 rubles;

- officials of the organization (for example, a manager) - a fine in the amount of 10,000 to 20,000 rubles. or disqualification for a period of one to three years.

In addition, a situation where an employer pays wages less than every half month may be regarded as untimely payment of wages. An organization that pays salaries once at the end of the month untimely pays one of the two mandatory parts of the salary (Article 136 of the Labor Code of the Russian Federation). Therefore, during the period of delay, employees may demand compensation (Article 236 of the Labor Code of the Russian Federation).

Situation: how much to pay in advance on salary if the employee was on vacation or sick in the first half of the month

In an amount no less than the employee is entitled to for actual time worked. If there are no days worked in the first half of the month, then the advance may not be paid at all.

The employer can establish the specific procedure for calculating and paying the advance at his own discretion, since the current legislation does not establish the amount of the advance.

For example, you can pay a fixed advance amount for the first half of the month (say, 40% of the monthly salary) regardless of the number of days worked. And the salary at the end of the month is calculated taking into account days of illness or vacation, if the employee had any. Or you can calculate the advance strictly according to the number of days actually worked in the first half of the month.

Fix the chosen procedure in internal documents, for example, in the Labor Regulations or the Regulations on Remuneration.

An example of determining the amount of a salary advance if an employee was on vacation in the first half of the month. The advance is calculated in proportion to the time worked

Manager of Alpha LLC A.S. Kondratiev took a three-day vacation from November 5 to 7, 2014.

In the period from November 1 to November 15, 2014, Kondratyev worked for 5 days. Thus, the salary advance for November amounted to: RUB 11,111.10. (RUB 2,222.22 × 5 days).

Reflection in local acts

The chief accountant advises: despite the fact that there are no restrictions in labor legislation on the timing of advance payment, it is better if the due date falls approximately in the middle of the month.

Issue an advance payment using the same documents as the payment of the final salary payment. The list of documents that need to be completed when paying an advance depends on the method of issuing it:

When paying an advance in cash, do not draw up a statement in Form No. T-49. This form is designed to record accruals, payments and deductions for a full month. And the advance is paid only for part of the month. Therefore, issue an advance in cash using a statement in form No. T-53 or cash receipts in form No. KO-2.

The amount of the advance paid is not an expense (clause 3 of PBU 10/99). The reflection of advance payment in accounting depends on the method of its issuance.

Accounting: cash withdrawal

When paying an advance in cash, make the following entry:

Debit 70 Credit 50

- an advance has been paid from the cash register.

Accounting: transfer to account

Reflect the transfer of the advance to the employee’s bank account with the following entries:

Debit 76 Credit 51

– money was transferred to pay advance wages;

Debit 70 Credit 76

– the bank transferred money to employees’ salary cards.

When transferring an advance to an employee’s individual account, make the following entry:

Debit 70 Credit 51

– the advance is transferred to the employee by a separate payment order.

Accounting: advance payment of finished products

When issuing an advance on finished products or goods, make the following entries:

Debit 70 Credit 90-1

– revenue from the transfer of finished products (goods, works, services) towards advance payment of wages is reflected;

Debit 90-2 Credit 43 (41, 20, 23)

– the cost of finished products (goods, works, services) transferred as a salary advance is written off.

Accounting: transfer of other property

Reflect the transfer of other property (materials, fixed assets) as an advance payment as follows:

Debit 70 Credit 91-1

– revenue from the transfer of other property to pay the advance is reflected;

Debit 91-2 Credit 01 (08, 10, 21.)

– the cost of other property transferred as a salary advance is written off;

Debit 02 Credit 01

– depreciation on retired property is written off (when transferring fixed assets as an advance).

Personal income tax and insurance premiums

When issuing an advance, do not withhold personal income tax and do not charge insurance premiums.

Personal income tax must be calculated based on the results of the month for which income was accrued (clause 3 of Article 226 of the Tax Code of the Russian Federation). This tax must be withheld at the time of payment of income to the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation). The date of receipt of income in the form of salary is recognized as:

- the last day of the month for which it was accrued;

- the last day of work of an employee in the organization if he is dismissed before the end of the month.

This is stated in paragraph 2 of Article 223 of the Tax Code of the Russian Federation.

There is no need to rely on advances and contributions for compulsory pension (social, medical) insurance. After all, insurance premiums are calculated on the last day of the month based on the results of all payments accrued during this period (Part 3 of Article 15 of the Law of July 24, 2009 No. 212-FZ).

Contributions for insurance against accidents and occupational diseases must be calculated from the accrued salary (clause 4 of article 22 of the Law of July 24, 1998 No. 125-FZ). The advance is only part of the salary. When it is paid, no salary accrual occurs. Therefore, do not calculate contributions for insurance against accidents and occupational diseases when paying advances.

This is interesting: Chapter 46 of the Labor Code of the Russian Federation - Peculiarities of labor regulation for workers engaged in seasonal work

Situation: is it necessary to transfer contributions to compulsory pension (social, medical) insurance before paying wages to an employee who is going on vacation. The organization decided to issue salaries in advance, even before the month ended

Contributions for compulsory pension (social, medical) insurance, calculated based on the results of the month, must be transferred no later than the 15th day of the month following the month for which the contributions are calculated (Part 5, Article 15 of the Law of July 24, 2009 No. 212 -FZ).

Therefore, payment of insurance premiums can be postponed until the 15th of the next month.

2. Recommendation: How to keep track of working hours

There are two ways to track working time:

- daily (applies to a five- and six-day working week);

- summarized (used when production conditions do not allow employees to comply with the daily or weekly working hours established for employees, including for employees with harmful or dangerous working conditions)

Is it possible to issue an advance before the due date?

Payment of an advance within the time limits strictly specified by local regulations of the employer is not always possible, since sometimes the dates for issuing an advance or salary fall on weekends or non-working days. And then the employer is obliged to pay wages the day before. For example, an organization has a salary payment date set for the 23rd of each month, and 01/23/2021 falls on a Saturday. How is the advance paid in this case? The employer is obliged to pay employees on Friday, 01/22/2021.

A situation is possible when the employer, of his own free will, decides to pay the advance in advance on a date not established for this event. The Labor Code does not contain restrictions on early payment of an advance or salary. But when checking, the labor inspectorate may consider this method a violation, since formally the period until the next salary payment will be more than half a month. Therefore, when issuing an advance, it is better to adhere to the established deadlines. Or, then issue the next part earlier in order to meet the 15 days (letter of the Ministry of Labor dated January 25, 2019 No. 14-1/OOG-461).

We wrote more about the position of officials on this issue here.

Is it possible to pay an advance ahead of schedule at the request of an employee? As noted above, the Labor Code does not contain a direct prohibition. But the answer to this question depends on the amount of the advance requested by the employee.

If an employee with a salary of 30,000 rubles. asks to give him 100,000 rubles. against future salaries, then, firstly, the employer bears high risks, because the employee may quit without paying the full amount. Secondly, the labor inspectorate can fine you for violating the requirement to pay wages every six months. And a dispute will most likely arise with the tax authorities about the timing and procedure for paying personal income tax.

When issuing an advance, as we have already found out, personal income tax is not withheld. And if at the end of the month there is no salary to be paid, then there will be nothing to withhold personal income tax from. Also, tax authorities may regard the advance payment as an interest-free loan and charge the employee personal income tax at a rate of 35% of the savings on interest. And organizations will be fined for failure to fulfill the duty of a tax agent.

How to correctly reflect early salary in 6-NDFL, read here.

Sample timesheet for 1st half of the month

Law N 402-FZ) directly follows that the primary accounting document can be drawn up both on paper and in the form of an electronic document * (1), signed with an electronic signature * (2), or simultaneously in paper and electronic form. In addition, clause 7 of the Instructions for the application of a unified chart of accounts for state authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved by order of the Ministry of Finance of the Russian Federation dated 01.12. 2010 N 157n, it is determined that primary and consolidated accounting documents are drawn up on paper or, if the accounting entity has the technical capabilities, on machine media - in the form of an electronic document using an electronic signature (hereinafter referred to as the electronic document).

How to fill out a timesheet for the first half of the month?

From the above, we can conclude that, regardless of the number of working days in a month, the timesheet for the first half of the month is filled out from the 1st to the 15th. Sample timesheet for half a month: Timesheet (fragment). The employee is an internal part-time worker. The time sheet for the second half of the month is filled out in the same way, but in the half of the month column, II must be indicated and the total time worked by the employee for the month is entered for the month. In accordance with paragraph 3 of Article 226 of the Tax Code of the Russian Federation, you pay income tax when paying wages for the month. Details in the materials of the Personnel System:

- Situation: Is it necessary to draw up a separate timesheet for calculating the advance payment?

... The employer is obliged to keep records of the time actually worked by each employee (Part 4 of Article 91 of the Labor Code of the Russian Federation).

Responsibility for non-issuance or late payment of advance payment

Payment of an advance after the deadline established by local regulations (or failure to pay an advance at all) is subject to Art. 142 of the Labor Code of the Russian Federation, according to which the employer and officials bear administrative responsibility under clause 6 of Art. 5.27 Code of Administrative Offences:

- from 1,000 to 5,000 rub. for individual entrepreneurs;

- from 10,000 to 20,000 rub. for officials of the employer;

- from 30,000 to 50,000 rub. for legal entities.

IMPORTANT! The employer will be fined for failure to pay the advance even if he has a written application from the employee to pay wages once a month, since this approach contradicts Art. 136 Labor Code of the Russian Federation.

In addition, for late payment of wages, including advance payments, the employer will bear financial liability in the form of compensation for each day of delay in the amount of 1/150 of the Central Bank key rate (Article 236 of the Labor Code of the Russian Federation).

Find out how to calculate compensation for delayed wages in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Salary advance report card: is it necessary or not?

- Appointment of the person (or persons) responsible for maintaining the time sheet.

- The need to maintain separate time sheets by department.

- Approval of additional codes for exits or absences from work.

- Approval of the order of data reflection in the report card: all facts of presence/absence or only absences.

- Determining the order in which data on outputs/non-exits is reflected in complex or non-standard situations.

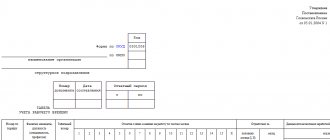

Filling out form T-13 The header part of form T-13 provides information about the employer (name, OKPO code, name of department), number and date of the document, and the period for which it was compiled. The basis for adding an employee to the time sheet is an order for his hiring, and for exclusion - an order for dismissal. The full name of each employee must be indicated in full.

Sample timesheet for 1st half of the month

However, after entering all the necessary information, it will still have to be printed for the signatures of the responsible persons. Form T-13. Features of the form Let's start with the T-13 form, which is now used much more often for maintaining time sheets. The unified form T-13 or electronic time sheet is well known to HR department employees.

This is not the only way, but it is definitely the most standard way to account for hours worked. If you keep records manually, you should use Form T-12. Timesheets are a common tool for tracking employee attendance.

Form T-13 allows you to record in detail the reasons for absence from work, including student leave during the session, advanced training and several types of disability leave. The period for which the document is completed may be less than 31 days. Let's consider what its features are and where to find this form. When the T-13 form is used Approval of the procedure for maintaining the T-13 form Filling out the T-13 form Where to get codes for the T-13 form When the T-13 form is used Every employer is required to keep records of the working hours of its employees (Article 91 of the Labor Code of the Russian Federation). For this purpose, he can use any form suitable to the peculiarities of his mode of operation, including those developed by himself.

There are 2 forms, approved by one resolution of the State Statistics Committee, which can be used for the purposes of recording time worked, either unchanged or modified:

- Form T-12, the 1st section of which is built as a time sheet.

- Form T-13, which, in fact, is called a time sheet.

Form T-13 was approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. You can download it on our website.

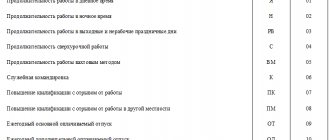

Other designations and codes

We present the letter designations used in the time sheet in the form of tables.

Presence at the workplace:

| I | Daytime work |

| N | At night time |

| RV | Work on weekends and holidays (used if the employee goes to work on days declared non-working due to quarantine |

| WITH | Overtime |

| VM | On a rotational basis |

IMPORTANT!

Remote and remote work is marked in the report card with the same symbols as regular work. If a remote employee has worked full time, indicate I (or 01 if indicated digitally) on the top line, and the number of hours actually worked according to the standard working time on the bottom line.

Business trips and advanced training:

| TO | Business trip |

| PC | Off-the-job training |

| PM | Advanced training with a break from work in another area |

Absence from work:

| B | Temporary disability (sick leave) with payment of benefits (also used if the employee is in quarantine) |

| T | Temporary disability without payment of benefits |

| Champions League | Shortened working hours in cases provided for by law |

| PV | Forced absenteeism due to illegal removal (dismissal) |

| G | Failure to appear in connection with the performance of state (public) duties |

| ETC | Absenteeism without good reason |

| NS | Part-time mode |

| IN | Weekends and holidays are non-working days (also included in cases where non-working days are established due to quarantine) |

| OB | Additional paid time off |

| NV | Additional unpaid day off |

| ZB | Strike |

| NN | Unexplained reason for no-show |

| RP | Downtime due to the employer's fault |

| NP | Downtime due to reasons beyond anyone's control |

| VP | Downtime due to employee fault |

| BUT | Suspension from work (paid) |

| NB | Disqualification without retention of salary |

| NZ | Suspension of work when a salary is delayed |

IMPORTANT!

If an employee goes to work on days declared by the president as non-working days due to the coronavirus quarantine (03/30-04/03/2020), it is recommended to enter the PB code in the timesheet indicating the hours worked.

We present only the main digital codes of types of remuneration (the full list is in the order of the Federal Tax Service of Russia dated October 13, 2006 No. SAE-3-04 / [email protected] ):

| 2000 | Labor payments (salary, remuneration) |

| 2010 | Payments under civil contracts |

| 2012 | Vacation pay |

| 2300 | Sickness benefit |

| 2530 | Payment in kind |

| 2760 | Financial assistance upon dismissal and retirement |

| 3020 | Interest on deposits |

Sample report card for the 1st half of the month, form 0504421

The time sheet is intended for entering information about the time actually worked by employees of organizations. It must be said that the time sheet form is not strictly mandatory - in principle, it can be arbitrary, that is, each enterprise is free to use its own time sheet form if such a need arises. However, the form was developed and recommended for use by the State Statistics Committee of the Russian Federation and is preferable. FILESDownload a blank form of the T-13 form .xlsDownload a sample of filling out the T-13 form .xlsand a sample of the T-13 form in the .zip archiveDownload a blank form of the T-12 form .docDownload a sample of filling out the T-12 form .doc Who fills out the time sheet Form filled out either by an employee of the HR department, or by the head of a structural unit, or by a timekeeper specially hired for this function. According to the provisions of Art. 136 of the Labor Code of the Russian Federation, the employer is obliged to notify in writing each employee when paying wages: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; 3) about the amount and grounds for deductions made; 4) about the total amount of money to be paid. Wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract. For reference. It should be said that sometimes those responsible for filling out the time sheet only enter information that relates to the days when the employee was absent from the workplace. However, this option may lead to personnel and accounting errors, so it is not advisable to use it. Date and signatures of responsible persons After the time sheet is completed, the employee responsible for it must indicate his position, as well as put a signature in the appropriate cells, which must be deciphered.

This is interesting: Accident at work

The report card must also be approved by the head of the structural unit or the director of the enterprise - also indicating the position and signature with a transcript.

Step-by-step filling instructions

Two rules apply for filling out a time sheet, the choice is made by the employer:

- continuous filling - all appearances and absences are recorded every day;

- filling in by deviations - only lateness and no-shows are noted.

Here are instructions on how to keep a time sheet manually - for the T-13 form using the continuous filling method.

Step 1. Name of the organization and structural unit

At the top, enter the name of the company (full name, individual entrepreneur) and the name of the structural unit: for example, sales department, marketing department, production department, etc.

Step 2. OKPO code

OKPO - All-Russian Classifier of Enterprises and Organizations. Contained in Rosstat databases, it consists of:

- 8 digits - for legal entities;

- 10 digits - for individual entrepreneurs.

Step 3. Document number and date of preparation

The document number is assigned in order.

The compilation date is usually the last day of the reporting month.

Step 4. Reporting period

The report card is submitted per month - the period from the first to the last day of June in our case.

Step 5. Employee information

A separate line is filled in for each department employee. Indicate the serial number, surname and position of the employee.

A personnel number is assigned to each employee and is used in all internal accounting documents. It is retained by the employee for the entire period of work in the organization and is not transferred to another person for several years after dismissal.

Step 6. Information about attendance and number of hours

Abbreviated symbols are used to fill out information about employee attendance and absence. You will find a list of them at the end of the article in a separate paragraph. In our example for employee Petrov A.A. 4 abbreviations used:

- I - attendance (in case of attendance, the number of hours worked is recorded in the bottom cell);

- On a weekend;

- K - business trip;

- OT - vacation.

Step 7. Total number of days and hours for the month

Here's how to correctly count hours on an organization's time sheet:

- in the 5th column indicate the number of days and hours worked for every half month;

- in the 6th column - the total number of days and hours for the month.

Step 8. Payroll information

The payment type code determines the specific type of cash payment, encrypted in numbers. For a complete list of codes, see the end of the article. The example uses:

- 2000 - salary (wages);

- 2012 - vacation pay.

Corresponding account is an accounting account from which costs for a specified type of remuneration are written off. In our case, the account for writing off salaries, travel allowances and vacation pay is the same.

Column 9 indicates the number of days or hours worked for each type of remuneration. In our case, the days of attendance and business trips are entered in the top cell, and the days on vacation are entered in the bottom cell.

If one type of remuneration (salary) is applicable to all employees during the month, then the code of the type of payment and the account number are written at the top, columns 7 and 8 are left empty, indicating only the days or hours worked in column 9. Like this:

Step 9. Information about the reasons and time of absence

Columns 10-12 contain the code for the reason for absence and the number of hours of absence. In our example, the employee was absent for 13 days:

- 3 days - due to a business trip;

- 10 days on vacation.

Step 10. Signatures of responsible persons

The report card is signed at the end of the month:

- employee responsible for maintenance;

- head of department;

- personnel worker.

Time sheet for the first half of the month

Timesheet - sample completion Management has the right to assign anyone to perform this task. To do this, an order is issued indicating the position and name of the responsible person. If an order to appoint such an employee is not issued, then the obligation to keep records must be specified in the employment contract. Otherwise, it is unlawful to require an employee to keep records. In large organizations, such an employee is appointed in each department. He fills out the form within a month, gives it to the head of the department for signature, who, in turn, after checking the data, passes the form to the personnel officer. The HR department employee verifies the information, fills out the documents necessary for his work based on it, signs the time sheet and passes it to the accountant. In small companies, such a long chain is not followed - the accounting sheet is kept by a personnel employee, and then immediately transferred to the accounting department.

How to fill out a timesheet for the first half of the month?

However, a clarification will appear: “Wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.” Those. and the new version of Art. 136 of the Labor Code of the Russian Federation does not provide for prepayment of wages.

The concept of “advance” is mainly used in accounting literature and some explanations of Rostrud. The establishment of advance payments is not prohibited by current legislation. But in this case, the employer bears certain risks associated with the return of amounts overpaid to employees.

Within the framework of Art. 136 of the Labor Code of the Russian Federation, it is more correct to talk specifically about settlements with employees for the first and second half of the month.

Personal income tax when issuing an advance to employees

But if the advance payment date is set on the 30th day and it is the last day of the month, problems cannot be ruled out, since tax authorities may recognize the last day of the month as the date of actual receipt of income, and judges may support them (see the Supreme Court ruling dated May 11. 2016 No. 309-KG16-1804). The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. For detailed information about the service, contact your service manager.

Sales manager salary - 25,000 rubles. He works on a five-day basis, 8 hours a day. An additional payment to the salary, depending on the sales volume at the end of the month, can be from 5,000 to 20,000 rubles. In the first half of September 2021 - 11 working days. The employee worked them out completely. In addition, in connection with visiting clients, he worked 2 days off for 6 hours each. If the length of the working day (shift) is unchanged, only deviations can be recorded, since the terms of the employment contract or internal labor regulations determine the number of working hours for each day of work.

How to make a timesheet for half a month?

Before marking vacation on your time sheet, it is important to know the following points:

- what type of leave to indicate;

- vacation period - from what date to what date the employee rests;

- what method is used to fill out the timesheet - continuous or only deviations are recorded?

Different types of leave are indicated in the report card by the following abbreviations: FROM regular paid leave OD additional paid TO administrative (without retaining salary) U educational with retention of salary HC training without interruption from work (reduced day) UD educational without retaining salary R for pregnancy and childbirth OZ for caring for a child under 3 years of age without retaining a salary in cases provided for by law DB additional without retaining a salary When using both methods of filling out a time sheet, the vacation symbol is affixed for each day of the employee’s absence.

Form T-13. time sheet

What is the difference between forms N T-12 and N T-13 Timesheets? The two approved forms differ, one of them (T-13) is used in institutions and companies where a special turnstile is installed - an automatic system that controls the attendance of employees. And the T-12 form is considered universal and contains, in addition, an additional Section 2. It can reflect settlements with employees regarding wages.

But if the company conducts settlements with personnel as a separate type of accounting, section 2 simply remains empty.

Salary advance report card: is it necessary or not?

This means that when paying an advance, it is necessary to take into account the actual presence of employees at the workplace, that is, rely on timesheet data. The legislation does not provide for the obligation to draw up a separate time sheet for advance payment. Therefore, each organization has the right to independently determine the procedure for generating timesheets.

In practice, two approaches are used:

- draw up a single timesheet on a monthly basis and agree on the procedure for submitting the timesheet to the accounting department twice a month: for calculating the advance and at the end of the month;

- draw up separate time sheets for every half month indicating the period.

The specific procedure for compiling and submitting a time sheet to the accounting department should be fixed in the local regulations of the organization, which stipulate the procedure for calculating and paying wages (Article 8 of the Labor Code of the Russian Federation).

Results

Wages must be paid to employees 2 times a month: from the 16th to the 30th - the advance part, from the 1st to the 15th - the final part of the salary. The timing of the advance payment, as well as the algorithm for calculating it, are set by the employer independently. When paying an advance, there is no need to withhold and transfer personal income tax to the budget.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.