General rules for deducting VAT on fixed assets

The amount of VAT paid by an enterprise when purchasing fixed assets or equipment for use in production activities is legally allowed to be fully deducted. It is possible to deduct VAT on fixed assets by observing the provisions set out in paragraph 2 of Art. 171 Tax Code of the Russian Federation, clause 1, art. 172 of the Tax Code of the Russian Federation and Art. 169 of the Tax Code of the Russian Federation. It is allowed to deduct VAT on fixed assets if:

- The objects were acquired for use in the activities of the enterprise subject to VAT.

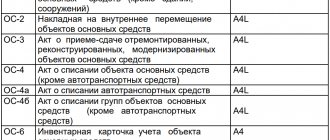

- Objects are registered as fixed assets, for which there is documentary evidence, for example, acceptance certificates (OS-1).

- The VAT amount is confirmed by an invoice issued accordingly.

For some reasons for refusal to deduct VAT, see our material “What is the procedure for applying (accepting) tax deductions for VAT: conditions?”

Is it possible to deduct VAT on fixed assets that have not been put into operation? The answer to this question, as well as some of the nuances of filing a VAT deduction, were explained by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

What asset can be recognized as OS?

Value acquired for payment may be included in fixed assets if:

- The facility will be in use for a long time.

- The object will not be consumed like MPZ.

- The asset will not be sold for at least the next year, as is the case with a commodity.

- The property is planned to be used for profit.

- The cost of acquisition is not less than the limit established by the organization (within 40 thousand rubles for accounting, for tax purposes this figure increases to 100 thousand rubles).

Important! The accountant’s task is to establish the presence of the designated criteria and correctly identify the purchased value.

If the criteria are not met, then the object can be recognized as either a material or a product without depreciation charges.

Moment of deduction of VAT on fixed assets

The peculiarity of accepting a VAT deduction on fixed assets lies in the correct determination of the moment of this operation. One of the conditions for presenting tax for deduction, according to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, is to register an object as a fixed asset. But the Tax Code of the Russian Federation does not have clear characteristics on the basis of which an object can be accepted for accounting as a fixed asset. Therefore, the question of the moment of deduction is not clear-cut.

Thus, initially the regulatory authorities insisted that when purchasing fixed assets, VAT deduction is possible only after the property is reflected in account 01 “Fixed assets” (see, for example, letters of the Ministry of Finance of the Russian Federation dated 02.12.2015 No. 03-07-11/6141, dated 24.01 .2013 No. 03-07-11/19). Later, the position of the Ministry of Finance changed - see “Deduction for fixed assets on account 08 is not a problem.” Now officials consider it possible to accept VAT for deduction within 3 years after entry into account 08 (letter of the Ministry of Finance dated 04/11/2017 No. 03-07-11/21548).

Judicial practice proceeds from the fact that the account into which fixed assets are accepted for accounting does not matter. The thing is that in accounting, acquired property goes through several stages of being reflected in accounting before becoming a fixed asset. Transactions for the purchase of property are initially reflected in account 08 “Investments in non-current assets”. The transfer of an object to 01 account is carried out only after its initial value has been fully formed. Therefore, if the taxpayer decides to receive a deduction for fixed assets placed on account 08, then there is a possibility of a dispute with the tax authorities. However, there is a good chance of defending your point of view in court.

For more information about the arguments, see our material “What is the procedure for deducting VAT when purchasing fixed assets?”

Purposes of property acquisition

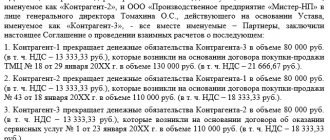

In accordance with paragraph 2 of Article 171 of the Tax Code of the Russian Federation, a taxpayer has the right to apply a tax deduction for VAT in the case of the acquisition of goods (work, services) on the territory of the Russian Federation or paid by the taxpayer when importing goods into the customs territory of the Russian Federation in relation to goods (work, services) purchased for carrying out transactions recognized as objects of taxation in accordance with Chapter 21 of the Tax Code of the Russian Federation, as well as goods (works, services) purchased for resale.

It should be noted that before the changes (which came into force on July 1, 2002) made to Article 171 of the Tax Code of the Russian Federation by Federal Law No. 57-FZ dated May 29, 2002, the basis for claiming VAT was the fact of the acquisition of goods (work, services) for the implementation of production activities or other transactions recognized as objects of taxation in accordance with Chapter 21 of the Tax Code of the Russian Federation.

An analysis of the given editions of paragraph 2 of Article 171 of the Tax Code of the Russian Federation allows us to conclude that its content has not undergone any changes. The previously valid (before Law No. 57-FZ) version of Article 171 of the Tax Code of the Russian Federation indicates the need to purchase goods (work, services) for the purpose of carrying out production activities or other operations recognized as an object of taxation. The legal construction “... or other operations...” used by the legislator indicates that in order to legally submit VAT for reimbursement, it is necessary that production activities also lead to the emergence of an object of VAT taxation. Thus, we can conclude that the previous version of this article linked the right to VAT refund to the purpose of using the purchased good to carry out any operations leading to the emergence of an object of VAT taxation.

After the amendments, Article 171 of the Tax Code of the Russian Federation received some clarification, however, even in the new edition, the legislator binds the right to VAT refund for the purpose of carrying out transactions that lead to the emergence of an object of taxation.

Taking into account the above, the position of the Russian Ministry of Taxes and Taxes, expressed in a number of media, seems far-fetched that from July 1, 2002, the procedure for applying the VAT tax deduction has radically changed, since the new version of Article 171 of the Tax Code of the Russian Federation more strictly links the right to deduction with the actual use (and not for the purpose of such use) of purchased goods for carrying out transactions leading to the emergence of an object of taxation.

At the same time, it is necessary to pay attention to the correct understanding of the provisions of Article 171 of the Tax Code of the Russian Federation. Both before and after the mentioned changes, Article 171 of the Tax Code of the Russian Federation provides for the right to a tax refund in the event of the acquisition of a good for carrying out transactions recognized as an object of taxation. It is the concept “...for carrying out transactions...” that is the most controversial basis for applying a tax deduction.

The Ministry of Taxation and the Ministry of Finance of Russia have always consistently defended the point of view that the right to deduction can only be applied if fixed assets are fully used for taxable transactions. If a fixed asset is written off before its full depreciation or the said fixed assets are not used to carry out taxable transactions (switching to UTII, simplified tax system, etc.), in their opinion, the taxpayer, the amount of VAT relating to under-accrued depreciation is subject to restoration (see ., in particular, letter of the Ministry of Finance of Russia dated February 26, 2003 No. 04-03-11/19, letter of the Ministry of Finance of Russia dated March 22, 2004 No. 04-05-12/14).

However, the Presidium of the Supreme Arbitration Court of the Russian Federation, in its Resolution No. 7473/03 dated November 11, 2004, indicated: from the analysis of Articles 39, 146, 170-172 of the Tax Code of the Russian Federation, it follows that if property is acquired and used for production activities or other operations recognized as objects of taxation, the right to a tax deduction arises, which is not subsequently lost due to a change in the use of the property. “If the property was actually acquired as a contribution to the authorized capital, then there is no right to a tax deduction for the amount of value added tax paid to the supplier...” And although this judicial act is a law enforcement act on a specific dispute, the document reveals the universality of the approach of the Supreme Arbitration Court of the Russian Federation to assessing the right to apply a tax deduction for VAT: the right to deduct is not related to the fact of using property to carry out taxable transactions, but for the purpose of such use.

The most curious thing is that after the adoption of the said Resolution, the Ministry of Taxes of Russia, by its order dated March 11, 2004 No. BG-3-03/190, canceled the provisions of paragraph 3.3.3 of the Methodological Recommendations on VAT (approved by order of the Ministry of Taxes of Russia dated December 20, 2000 No. BG-3-03 /447) regarding the taxpayer’s obligation to restore VAT attributable to the residual value of the fixed asset contributed to the authorized capital (that is, the Ministry of Taxes of Russia actually agreed with the position of the Supreme Arbitration Court of Russia). In this regard, the letter of the Ministry of Taxes of Russia dated March 31, 2004 No. 03-108/876/15 (three weeks after the issuance of the said order dated March 11, 2004) cannot but cause bewilderment, by which the Ministry of Taxes of Russia states the taxpayer’s obligation to restore the “input” VAT relating to the residual value of fixed assets contributed to the authorized capital.

Due to the ambiguity of the position of the Ministry of Taxes of Russia, we will analyze the arguments of tax authorities about changing the procedure for applying VAT deductions on property contributed to the authorized capital from July 1, 2002.

The initial position of the Supreme Arbitration Court of the Russian Federation regarding the need (or rather, the lack of need) to restore VAT was reflected in Resolution No. 7473/03 of November 11, 2003. It was the conclusions of the court set out in this Resolution that were questioned by the Russian Ministry of Taxes and Taxes, since, in their opinion, they relate to the case of filing VAT before July 1, 2002 (the date of entry into force of Law No. 57-FZ).

At the same time, after all the orders and letters of the Ministry of Taxes of Russia given above, the Supreme Arbitration Court of the Russian Federation adopted Resolution No. 15511/03 dated March 30, 2004, which recognizes as legitimate the position of the taxpayer who switched to a simplified taxation system from January 1, 2003 in accordance with Chapter 26.2 of the Tax Code of the Russian Federation, which on the date of transition to a special tax regime did not restore the amount of VAT attributable to the residual value of fixed assets. Certain exceptions to the procedure for presenting “input” VAT occur when acquiring fixed assets that during the production process can be used to carry out operations as recognized an object of taxation that is not recognized as such. The procedure for presenting tax refund in this case is regulated by the provisions of paragraph 4 of Article 170 of the Tax Code of the Russian Federation, according to which the amounts of “input” VAT subject to reimbursement and accounting as expenses when calculating income tax are determined based on the ratio of the volumes of shipped taxable and non-taxable goods (works, services). At the same time, a certain problem associated with the presentation of VAT on fixed assets in such cases comes down to the fact that the decision to present the tax (or include it in expenses) is made by the taxpayer only once (in the tax period in which the right to present it arose). tax). If the fixed asset in the tax period in which the right to apply a VAT deduction arose is used for taxable and non-taxable turnover, then the fate of the “input” tax is determined according to the rules of paragraph 4 of Article 170 of the Tax Code of the Russian Federation. If in the tax period in which the right to present “input” VAT on the purchased fixed asset arose, there were no non-taxable turnovers, then the taxpayer has the right to present VAT in full without its subsequent adjustment, since the Tax Code of the Russian Federation does not provide for a mechanism for recalculating the amounts of the presented for tax reimbursement in subsequent tax periods.

Thus, based on the consistent enforcement position of the Supreme Arbitration Court of the Russian Federation, we can conclude that the decision on the legality of filing VAT on fixed assets depends solely on establishing the purposes for acquiring the relevant property.

VAT deduction on fixed assets requiring installation

For objects that require installation to bring them into working condition, the law allows for deduction of tax paid to third-party organizations performing work on the assembly or installation of objects, as well as suppliers of equipment and materials used in installation work. This is clearly stated in paragraph 6 of Art. 171 Tax Code of the Russian Federation.

Assets requiring installation and assembly are initially recorded in accounting account 07 “Equipment for installation” with further debiting to account 08 as the equipment is transferred for installation. Capitalization to account 01 occurs only after the assembled objects are completely ready for use. In this case, it is allowed to deduct “input” VAT already at the time the object is reflected on account 07 (letter of the Ministry of Finance of Russia dated January 29, 2010 No. 03-07-08/20).

Write-off of OS as a result of physical or moral wear and tear

Wear and tear can be physical - this can include the failure of equipment due to a long period of use.

Obsolescence can be moral - for example, computer technology often becomes obsolete, so companies write off obsolete computers and replace them with modern ones.

The write-off of OS due to wear and tear is recorded with the following entries:

Debit 01 subaccount “Disposal” Credit 01 - the original cost is written off;

Debit 02 Credit 01 subaccount “Disposal” - accrued depreciation is written off;

Debit 91 Credit 01 subaccount “Disposal” - the residual value is written off.

VAT deduction on fixed assets subject to state registration

Fixed assets subject to state registration deserve special attention: buildings, structures and other real estate. As noted above, one of the conditions for obtaining a VAT deduction on fixed assets is the registration of these objects and documentary confirmation of this fact, as stated in paragraph 1 of Art. 172 of the Tax Code of the Russian Federation. Confirmation of the registration of such objects is a signed acceptance certificate. VAT deduction can be claimed during the period of signing the relevant act and without waiting for state registration.

When there is no right to deduct VAT on fixed assets

Amounts of “input” VAT are not deductible, but are included in the cost of fixed assets if such objects are acquired for operations (clause 2 of Article 170 of the Tax Code of the Russian Federation):

- not recognized as sales in accordance with clause 2 of Art. 146 Tax Code of the Russian Federation;

- carried out outside the territory of the Russian Federation;

- exempt or not subject to VAT;

- carried out by persons who are exempt or who are not tax payers.

When simultaneously carrying out both taxable operations and those exempt from the calculation and payment of tax, the enterprise deducts VAT on fixed assets in proportion to the use of acquired objects in these operations in accordance with clause 4 of Art. 170 Tax Code of the Russian Federation. The specified proportion is determined based on the cost of shipped goods (work, services performed), property rights, transactions for the sale of which are subject to taxation (exempt from taxation), in the total cost of goods (work, services), property rights shipped during the tax period.

In this case, the taxpayer is obliged to keep separate records of tax amounts on acquired fixed assets used to carry out both taxable and non-taxable (tax-exempt) transactions.

If the taxpayer does not have separate accounting, the amount of tax on acquired fixed assets is not deductible.

The taxpayer has the right not to apply these rules in those tax periods in which the share of total costs for the production of VAT-free goods (works, services), property rights does not exceed 5 percent of the total total costs of production. In this case, all amounts of “input” tax are subject to deduction.

See also our material “When is separate accounting of “input” VAT not carried out?”

Conditions for receiving a tax deduction

First condition. Purchased goods (work, services), property rights must be acquired for production activities or other operations subject to VAT, or for resale.

Second condition. Purchased assets must be acquired on the territory of the Russian Federation and accepted for accounting, that is, capitalized on the company’s balance sheet.

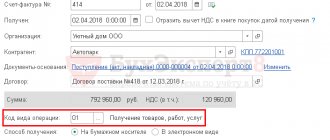

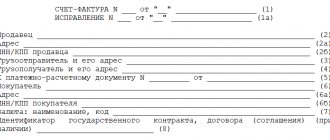

Third condition. The buyer (customer) must have documents confirming the right to deduct. First of all, this is an invoice issued by the supplier in accordance with paragraph 3 of Article 168 of the Tax Code. In addition, VAT should be highlighted as a separate line in primary documents (invoices, acts of work performed and services rendered, payment orders, etc.).

Results

So, if a fixed asset is acquired for an activity subject to VAT, and there is an invoice with allocated VAT, the deduction is made as follows:

- For fixed assets that do not require installation and assembly work, the deduction is carried out during the period when the object is registered as a fixed asset. It may well be declared during the period of registration under account 08. In case of a dispute, you can defend your position in court.

- For fixed assets that require installation, VAT can be deducted already in the period when the object is reflected on account 07.

- For fixed assets that require state registration, the deduction can be claimed already during the period of signing the property acceptance certificate, without waiting for state registration.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.