Many organizations provide their employees with bonuses in addition to the established salary. Reflecting them in 6-NDFL has its own rules. Some bonus payments are based on performance results, while others do not depend in any way on the results of work (for example, incentives on the occasion of anniversaries). In the 6-NDFL report, these types of bonuses are introduced differently. It is better to consider recommendations for correct recording of data on various options for bonus payments.

- 2 How to fill out 6-NDFL when issuing a one-time bonus

2.1 Table: initial data in the 6-NDFL report - 2.2 Examples of fixing premiums

- 4.1 Example of recording awards

4.1.1 Video: correctly filling out form 6-NDFL

Bonuses in 6-NDFL: types and characteristics

Depending on the frequency, bonuses are awarded:

- systematic;

- one-time

The first type is paid based on the results of work, for the fulfillment of the production plan for a month, quarter or year, the second (as a rule) - as encouragement, gratitude or on the occasion of a significant event.

Read more about what types of bonuses and employee benefits there are, here .

How does the type of bonus affect its reflection in 6-NDFL and what errors are possible here?

When a one-time bonus is paid along with the basic salary, there is a risk when compiling 6-NDFL that the bonus and salary are considered equal components of the salary. Personal income tax on them is also transferred at the same time, so someone may forget about the different dates of actual receipt of income.

The date of receipt of income in the form of a one-time bonus is the day of its payment (letter of the Ministry of Finance of Russia dated March 27, 2015 No. 03-04-07/17028, Federal Tax Service of Russia dated June 8, 2016 No. BS-4-11 / [email protected] ), and in the form salary - the last day of the month for which it was accrued (clause 2 of article 223 of the Tax Code of the Russian Federation).

This approach can be arrived at by comparing clause 2 of Art. 223 of the Tax Code of the Russian Federation and Art. 129 Labor Code of the Russian Federation. In accordance with the Labor Code of the Russian Federation, the salary consists of:

- from remuneration for labor;

- compensation payments (for example, for work in difficult conditions, harmful to health, etc.);

- incentive payments (including bonuses).

In paragraph 2 of Art. 223 of the Tax Code of the Russian Federation provides the wording “income for fulfilled labor duties,” that is, it refers to the first component of the salary under Art. 129 Labor Code of the Russian Federation. Bonuses not related to the performance of work duties (for example, for a holiday, anniversary, etc.), under the conditions of clause 2 of Art. 223 of the Tax Code of the Russian Federation are not suitable, therefore the requirements of subsection must be applied to them. 1 clause 1 art. 223 Tax Code of the Russian Federation. Thus, the earnings date for such bonus payments is the day they are paid.

For information on the rules for taxing bonus payments with personal income tax, read the article “Are bonuses subject to personal income tax?” .

Responsibility when filing reports

For refusal to fulfill the duties of a tax agent in the form of providing information on the taxation of individuals, sanctions are imposed under Article 126 of the Tax Code of the Russian Federation. The fine is 1,000 rubles for each monthly period from the date of due submission of the calculation. Full and partial months of missing the deadline are taken into account.

Errors made during the generation of reporting data also entail the imposition of sanctions. If the deadlines for calculating taxes and transferring the amount to the budget are violated, penalties are imposed for each day of delay. The arrears identified in the calculation must be included in the budget. If erroneous information is discovered by the taxpayer himself and the updated calculation is submitted in a timely manner after payment of the arrears, no fine will be assessed.

Drawing up 6-NDFL when paying a one-time bonus

Let's consider the procedure for displaying the deadline for paying tax in 6-NDFL on bonuses not related to the performance of work duties in the 6-NDFL report.

| Line number | Operation | Operation time | Link to the Tax Code of the Russian Federation |

| 020 | Income accrual | On the day of payment | In accordance with the date of calculation of personal income tax |

| 040 | Calculation of personal income tax | On the day of payment | Clause 3 Art. 226 |

| 100 | Date of actual receipt of income | On the day of payment | Subp. 1 clause 1 art. 223 |

| 070, 110 | Withholding personal income tax | On the day of payment | Clause 4 art. 226 |

| 120 | Transfer of personal income tax | No later than the day following the day of payment of income to the employee | Clause 6 Art. 226 |

When calculating the bonus, you need to show it in a separate block of cells 100–140 in section 2.

Check whether you filled out 6-NDFL correctly using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Let's consider the entry in the calculation of different types of one-time bonuses in a specific situation.

Example 1

On 05/08/2020XX, employees were paid a bonus for the May 9 holiday in the amount of RUB 174,000. (Personal income tax - 22,620 rubles). The tax payment deadline is the first working day, 05/12/20XX.

On 05/21/20XX, the shop manager P.O. Voronkov was paid an anniversary bonus in the amount of 9,500 rubles. (Personal income tax - 1,235 rubles). The tax payment deadline is 05/22/202XX.

Below is a fragment of the calculation showing the payment data (reporting period - 6 months).

Reflection of unpaid amounts

Bonuses of a one-time nature are reflected in the reporting upon actual issue. Amounts assigned by order and not paid to persons are indicated in section 1 when calculating amounts and calculating tax. Due to the fact that the amounts were not paid on time, data is not presented in section 2 when preparing reports. Failure to pay the calculated tax when accrued but not paid will result in the imposition of a penalty.

Tax agents do not have the right to contribute to the budget an amount calculated ahead of schedule that is not withheld from the recipient. The Federal Tax Service has the right to establish the fact of non-payment of tax when transferring funds at the expense of the employer. In this case, the amount will need to be returned to the organization’s current account and the arrears must be paid again, additionally calculating penalties.

Systematic bonuses: what is the tax payment deadline?

As for bonuses related to the performance of work duties, at first everything was ambiguous. The regulatory authorities in their explanations did not divide bonuses into those related to the performance of labor duties and those not related. The requirement to recognize the date of payment of bonuses received for the performance of job duties as the date of receipt of income led to legal disputes .

It should be noted that the courts did not agree with the regulatory authorities. Read about this in the material “When to transfer personal income tax from bonuses to employees to the budget .

But then officials developed the following approach:

- Monthly bonuses. The date of receipt of income is considered to be the last day of the month for which the bonus was accrued (letter of the Ministry of Finance dated September 29, 2017 No. 03-04-07/63400). It does not matter what month the bonus order is dated or when the bonus was issued.

Read more about this here and in this publication .

- One-time bonuses (annual, for production results). The date of income for them is the day of payment (letter from the Ministry of Finance dated September 29, 2017 No. 03-04-07/63400, Federal Tax Service dated October 5, 2017 No. GD-4-11 / [email protected] ).

Read about the nuances of bonuses issued after dismissal here .

This must be taken into account when reflecting bonuses in 6-NDFL.

Regulations on bonuses

The procedure for calculating and paying bonuses in an institution must be regulated in detail, including the determination and evaluation of bonus indicators.

To do this, you need to develop an internal local regulatory act “Regulations on bonuses” in the form of an independent document or as an appendix to the Regulations on remuneration.

The bonus system should be clear to the staff of the institution; everyone should know why and on what basis they receive a bonus. All bonus terms, bonus amounts, frequency, sources of funding must be reflected in the Bonus Regulations. The standard form of this document is not approved by law; the institution develops it independently (taking into account its statutory activities).

So, the Regulations on bonuses, developed by the commission or the manager and presented to the team for review, is a normative act of the enterprise.

The document is a local act, which allows you to include positions that best reflect the specifics of the enterprise’s activities.

Payment of bonuses with basic salary: example of reflection in 6-NDFL

Now let’s look at an example when a bonus related to the performance of job duties is paid along with the basic salary.

Example 2

On 11/09/2020, employees were paid the basic salary for October in the amount of RUB 578,400. (Personal income tax - RUB 75,192)

On the same day, the monthly bonus based on the results of work, accrued for September 2021 in accordance with the order dated October 23, 2020, was paid in the amount of RUB 356,700. (Personal income tax - RUB 46,371)

Below is a fragment of the second section of the calculation of 6-NDFL when paying a bonus, indicating the lines in which the remuneration data should be displayed (reporting period - year).

Solutions options

Unfortunately, there are no official explanations or recommendations from government bodies on what employers can do in this situation. We do not rule out that by the time the new law comes into force (by October 3), such clarifications will appear. But while they are not there, let’s try to independently evaluate several possible options for employers’ actions.

Transfer of bonuses

Let’s assume that the employer does not have time to pay the monthly bonus for October by November 16, 2021. In this case, theoretically, the bonus for October can be issued later - in December 2021, along with the salary for November. However, in the order not to pay the bonus, it should be called the November bonus. And then everyone will be happy: the employee will receive a well-deserved bonus, and the employer, at least formally, will not violate the requirements of the new Article 136 of the Labor Code of the Russian Federation in terms of meeting deadlines.

With quarterly bonuses it is more difficult. You can postpone the payment of bonuses for the 3rd quarter of 2021, for example, to January 2021 (when the bonus will be paid for a year). Thus, the quarterly bonus for 9 months of 2016 can be “veiled” in the annual bonus. But then employees will receive their bonus for the quarter with a significant delay. Many people may not like this. Another option is to pay the bonus for 9 months not in October, but in November (along with salary). But then the bonus will need to be posted as a monthly bonus for October. As for the annual bonus for 2021, if you do not have time to pay it before January 15, then, theoretically, you can make the payment along with the payment of the monthly bonus for January (that is, in February 2017).

With such transfers, premiums will always have to be called premiums for other periods. This is, at a minimum, very inconvenient for accounting. Moreover, the legislation will be observed only formally. And it is possible that such an approach will be revealed during inspection by labor inspectorates.

Material aid

An employer has the right to provide an employee (or a member of his family) with financial assistance. If financial assistance is provided to employees in connection with some event (for example, in connection with the birth of children), then such payment is not part of earnings, since it is not related to work. Accordingly, financial assistance can be provided to employees without taking into account the deadlines determined by Article 136 of the Labor Code of the Russian Federation (as amended, applicable from October 3, 2021).

However, constantly paying financial assistance instead of bonuses (for example, monthly) is quite strange and, moreover, dangerous. The fact is that if you constantly provide financial assistance with a certain frequency, then inspectors may regard such payments as part of your earnings. And, accordingly, bring the employer to the above responsibility. Moreover, financial assistance is a fixed payment. And bonuses can often be of different sizes.

Abandon the bonus system

In connection with the adoption of the commented law, employers can completely change the bonus system. More precisely, to completely abandon it. And pay employees only salaries, evaluate employees and increase salaries next year. A similar recommendation from Elena Kozhemyakina, managing partner of the BLS law firm, can be found on the BFMRU website.

“I am shocked by this law. 15 days after the end of the period, it is impossible to pay the premium, either quarterly or annually, because final payments must arrive and all measurements must be taken. Most companies motivate their people with quarterly and annual bonuses. I will only recommend one thing to my clients: to move away from the bonus system, that is, to pay only salaries, evaluate employees and increase salaries next year, although this will also be contrary to labor legislation, because we have labor legislation requirements - for equal work equal pay. Now employers are faced with the most difficult problem of how to remake the bonus system. Or the second way is to no longer comply with the law, but it is unacceptable. I think that everyone will suffer from this law, because people who now receive bonuses work for bonuses, and for many the bonus is an equal part of their salary. And the employer will not be able to guarantee the employee such a high salary, because the result is needed, no one knows their result after a year. We have a very large number of sales manager professions that are motivated by bonuses, but bonuses should close after the sales result and the calculation of the sales result. For example, in our company, payments to clients are deferred for 60-90 days, I don’t quite understand how we can pay the annual premium.”

Where to submit: nuances

Typically, the calculation is submitted by tax agents to “their” Federal Tax Service, that is, at the place of registration of the company or at the place of registration of the individual entrepreneur. But for certain cases, separate rules are established.

Separate units

A legal entity that has separate divisions submits a calculation at the place of registration of each of them. The form includes the income and personal income tax of employees of this division.

If two separate divisions are registered with the same Federal Tax Service, but they have different OKTMO codes (belong to different municipalities), then 6-NDFL is submitted separately for each of them. If the situation is the opposite, that is, two separate divisions with one OKTMO are registered with different Federal Tax Service Inspectors, then a legal entity can register with one of the inspectorates and report to it under 6-NDFL for both divisions.

It happens that an employee managed to work in different branches during one tax period. If they have different OKTMOs, then you will have to submit several forms.

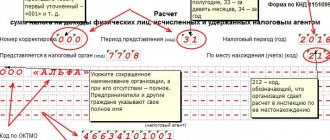

On the title page of 6-NDFL, if there are divisions, you must indicate:

- TIN of the parent organization;

- Checkpoint of a separate unit;

- OKTMO of the municipality in whose territory the employees’ place of work is located (indicate it in the payment order).

Change of address

If during the tax period to another Federal Tax Service, then at the new place of registration it is necessary to submit two forms 6-NDFL :

- the first - for the period of stay at the previous address, indicating the old OKTMO;

- the second - for the period of stay at the new address, indicating the new OKTMO.

The checkpoint in both forms indicates the one assigned to the new Federal Tax Service.