Business lawyer > Accounting > Accounting and reporting > Zero 6-NDFL: sample filling and main nuances of use

Since 2021, employees of organizations submit reports using form 6-NDFL, which complements another document - 2-NDFL. This innovation helps ensure that the employer's accounting calculations are indeed correct. However, there remains uncertainty as to whether and how to complete this form in the absence of indicators.

Do I need to take it?

This report is sent to the Federal Tax Service by tax agents who paid income to individuals. This is not only wages, but also:

- dividends;

- material aid;

- rent under lease agreements with individuals;

- other taxable payments.

If there were no such payments, there is no need to submit 6-NDFL to the tax office. But if during the accounting year the company paid income and withheld income tax, it will have to report to the Federal Tax Service: the first section reflects the information on an accrual basis.

IMPORTANT!

The Tax Code of the Russian Federation and the letter of the Ministry of Finance No. BS-4-11 / [email protected] dated 08/01/2016 indicate whether it is necessary to submit 6-NDFL if there are no employees - no, the organization has the right not to report to the territorial inspection. If there are no employees, then there are no accruals and no basis for calculation.

Features of 6-NDFL and submission procedure

A distinctive feature of entering data into 6-NDFL is the generalized (rather than personalized) quarterly provision of information about employees. The document consists of two sections:

- Information collected since the beginning of the current year

- Data for the last quarter (3 months)

The completed form is submitted to the Federal Tax Service on the last day of the month following the end of the quarter. If the date falls on a weekend, it is moved forward to the next working day.

Providing reporting

The electronic version of the document using TCS (telecommunication channels) is transmitted to the department of the Federal Tax Service where the legal entity or individual was registered. If the company has up to 25 employees, it is possible to transfer the form to paper and fill it out in this form.

In cases where the organization does not carry out any activities (at first from the moment of registration, during a period of temporary difficulties, at the liquidation stage) and employees do not receive income, the company does not have data that could be displayed in 6-NDFL (the document becomes zero ).

According to the explanations of the Federal Tax Service, organizations that did not make wage payments have the right not to provide reports. Tax officers cannot demand the opposite, but if the tax agent himself decides to provide a zero 6-personal income tax for several quarters or for a year, then it will have to be accepted.

Zero reporting is completed quickly and does not require much effort from accounting employees. However, by providing it, the organization largely protects itself from many problems and unwanted interest from law enforcement agencies.

What are the possible risks if you decide not to submit a zero report?

The calculation is submitted only if the company made payments to individuals subject to income tax. If there are no payments in any month of the accounting year, then zero personal income tax reports are not required to be submitted to the tax office.

But the tax authorities do not have information about whether the organization made payments to employees or not. The fact that there are no such payments and the company has not lawfully submitted a report must be notified to the Federal Tax Service. This can be done in simple written form by bringing the letter in person, sending it by mail or electronically.

If you do not do this, the tax authorities will decide that the taxpayer did not report unlawfully. In this case, the inspectorate will block the company's bank accounts.

To correctly report on personal income tax, use the instructions and samples from ConsultantPlus for free. Experts have discussed how to fill out the form in different situations.

Sample explanatory letter

An explanatory letter to the tax authority with information that you are not going to submit the 6-NDFL calculation for 2021 (with an explanation of the reasons) will help avoid such negative consequences as suspension of account transactions (electronic money transfers) or a fine for failure to submit a report ( clause 3.2 of article 76, clause 1.2 of article 126 of the Tax Code of the Russian Federation).

The letter stating that there is no obligation to submit 6-NDFL in the reporting period does not have a unified form. It is drawn up in free form indicating:

- Full name of the head of the inspectorate to which it is sent;

- data from the organization or individual entrepreneur providing explanations;

- reasons why the 6-NDFL report has not been submitted to the tax authority;

- Full name of the general director or individual entrepreneur;

- date and signature of the person who wrote the letter.

Sample explanatory letter

This letter must be sent to the Federal Tax Service before the deadline for submitting 6-NDFL for the reporting period. For calculations for 2021, this is 03/01/2021. This reporting date falls on a working day, therefore transfers under clause 7 of Art. 6.1 of the Tax Code of the Russian Federation will not exist.

Is it possible to send a blank report?

The calculation is filled in with a cumulative total from the beginning of the year. Before you find out from the Federal Tax Service whether you need to submit 6-NDFL with zero reporting, you need to check whether there have been payments previously. That is, if an organization paid taxable income in the 1st or 2nd quarter of 2021, then submit the calculations for the 1st quarter, and for six months, and for 9 months, and for the year. Such clarifications are given by the Federal Tax Service in letter No. BS-4-11/ [email protected] dated 03/23/16.

Instead of a letter to the Federal Tax Service about the absence of an obligation to submit calculations, the company has the right to submit zero reports 6-NDFL. In this case, the Federal Tax Service is obliged to accept it (letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 05/04/16).

Do I need a sample for filling out a zero report?

As we have already found out, you do not need to submit zero 6-NDFL reporting, so you do not need a sample for filling it out. A sample is needed to fill out a report with numbers. You can find the latest one here. And we want to remind you of the rules for filling out 6-NDFL.

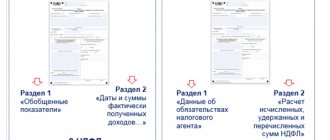

So, section 2 shows the data from the last quarter of the reporting period:

- in specific figures, if payments and tax accrued on them take place;

- putting a zero instead of a digital value if there is no information about payments and tax accruals for these payments (clause 1.8 of the Procedure for filling out form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ).

How to correctly fill out section 2 in the 6-NDFL calculation, read here.

Section 1 is filled in with data that includes values corresponding to the entire reporting period. At the same time they:

- will coincide with the data in section 2 for the first payment period, including if this period did not occur at the beginning of the year;

- will remain the same as in the previous reporting period if there were no payments in the last quarter of the reporting period.

Read about common errors in filling out 6-NDFL in the publication “Errors in 6-NDFL (full list).”

We’ll tell you how to correctly correct errors in 6-NDFL here.

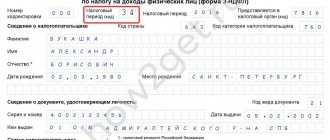

How to fill out zero 6-NDFL

Here's how to submit zero personal income tax reporting (filling out rules):

- On the title page indicate the name of the company and its details, the period for which the report is being filled out, and the Federal Tax Service code to which it is submitted.

- In all lines of sections 1 and 2 that provide total indicators, enter “0”.

If accruals were made during the year, the organization is required to submit a report for 9 months. The first section indicates cumulative indicators from the beginning of the year.

Submission form: paper or electronic. Institutions with 10 or fewer employees submit a report on paper. If there are more than 10 people on staff, then the organization submits the reporting form electronically (325-FZ dated September 29, 2019).

Results

The obligation to submit 6-personal income tax zero is not established by current legislation. However, this rule only applies to situations where there are no income accruals to employees throughout the year. In intermediate options, reporting must be submitted (although it is possible to submit it for less than a full year), but it will no longer be completely zero.

Read more about zeros:

- “If the salary is not paid, fill out 6-NDFL correctly”;

- “The procedure for submitting 6-NDFL for individual entrepreneurs without employees”.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Explanation from the Federal Tax Service

In case of prolonged absence of the taxable object, the zero 6-NDFL report can be replaced with a written notification. The notification letter is drawn up in any form. The purposes of sending it to the tax authority:

- report that in the current period the enterprise has zero reporting on Form 6-NDFL;

- highlight the reasons why the tax agent did not have obligations to calculate and withhold tax (lack of personnel, activities, etc.);

- indicate the boundaries of the period in which 6-NDFL is “zero”.

Procedure for submitting a report and sanctions for violations

The regulations for submitting form 6-NDFL are established in clause 2 of Art. 230 Tax Code of the Russian Federation. The law does not provide any special features for the “zero” form. You must submit 6-NDFL for 9 months of 2021 no later than 10/31/2018.

If the number of income recipients does not exceed 25 people, then the report can be submitted on paper. If this limit is exceeded, then only in electronic form. It should be noted that there may be problems with submitting the “zero” 6-NDFL electronically. The programs that tax authorities use to automatically receive reports often complain about zero indicators in this form.

However, if a company has more than 25 employees, then it is unlikely that it has completely ceased operations, so it does not face the problem of submitting a “zero” report.

In general, you need to submit Form 6-NDFL at the place of registration of the tax agent (clause 2 of Article 230 of the Tax Code of the Russian Federation). Other options are possible only for companies with a branch structure and for entrepreneurs operating in territories under the jurisdiction of different Federal Tax Service Inspectors. But in all these cases, reporting is also unlikely to be zero.

Strictly speaking, because A zero 6-NDFL report in the absence of accruals and payments is “optional”, and sanctions for its delay should not be applied. However, if the tax agent has not reported in any way about the termination of activities, then the tax authorities can apply all measures to him “on a general basis”

First of all, this is a fine under clause 1.2 of Art. 126 of the Tax Code of the Russian Federation. It is 1000 rubles for each month of delay.

In addition, officials may be fined from 300 to 500 rubles. according to Art. 15.6 Code of Administrative Offences.

But the most unpleasant “surprise” for a tax agent may be the blocking of accounts. Clause 3.2 art. 76 of the Tax Code of the Russian Federation gives tax authorities this right if the delay exceeds 10 days.

How to file 6 personal income taxes if there are no charges

With a long absence of economic activity, without payments to employees, the management and founders of the company have a natural desire to remove the obligation to provide “blank” reporting. But only the complete liquidation of the enterprise, carried out in accordance with the norms of domestic legislation, will allow the end of mutual relations with inspection and control authorities.

It is known that incorrect execution of the 6NDFL report can be fined 500 rubles. At the same time, even the most careful study of thematic standards will not allow us to obtain an unambiguous answer to this definition. In fact, sanctions are allowed not only for errors in records. Damage to paper or absence of a dash mark in an empty cell are also considered violations.

That is why experienced entrepreneurs want to get an exact answer to the question of what they should do with the 6 personal income tax report if there are no employees, in other situations when it is necessary to minimize costs and eliminate unnecessary hassle. To prevent mistakes, let's turn to the primary sources. Let's study the responses of the Federal Tax Service, which are regularly published in the form of official letters. The information we are interested in is in document No. BS-4-11/ [email protected] , which is dated March 23. 2016.

It discussed the issue of drawing up a report using this form in the case when payments of planned dividends to individuals are made only in one quarter. We will present some points of this explanation to make it easier to understand the requirements of the Federal Tax Service for the preparation of 6 personal income taxes without accruals:

- The response was compiled with reference to the 2015 Federal Tax Service order on the new reporting form No. ММВ-7-11/ [email protected] dated October 14 and the following articles of the Tax Code: 214 (subsections 1, 3 and 4); 224; 226; 226.1; 230. If necessary, this issue can be examined in more detail by referring to the relevant parts of the original documents.

- It is noted that not only individual entrepreneurs, organizations, but also lawyers who have officially registered their activities, divisions of foreign enterprises are tax agents. They are recognized as such if they paid income (without indicating the form) to an individual.

- The same category, tax agents, includes those who carry out financial transactions with securities.

- The duty of tax agents is to timely submit quarterly 6NDFL reports to the Federal Tax Service according to the time schedule specified by law. This requirement comes into force from 01.01. 2021

- An explanation for a specific case is provided. Form 6 of personal income tax, in the absence of accrual of dividends earlier than the second quarter, is submitted only based on the results of work for 6 months of the current year and then according to the standard schedule.

Similar information is given in letter No. BS-4-11/4901. Based on them, the following conclusions can be drawn:

- A report on 6 personal income taxes without employees is not needed. In this case there are no taxpayers. An individual entrepreneur or organization is not obliged to calculate taxes and make corresponding transfers in favor of the budget.

- The second option is when a certain staff is available, but there have been no payments. There is no subject of taxation, income, so the reporting will be “empty”.

- There will be no need to submit information on Form 6 of personal income tax to the tax office if there is no activity. In such a situation, there is no source of income, so it is not possible to accrue them and subsequently withhold tax.

There is no need to provide 6 personal income taxes if there are no employees, salary payments, dividends, economic activities, or other signs that define a tax agent in accordance with the norms of the current legislation of the Russian Federation.

Who is recognized as a tax agent?

The Tax Code in Article 226 clearly defines this concept - these are entities that are sources of income for individuals. They act as intermediaries between the state and individuals. persons, withhold personal income tax and transfer it to the treasury. These include all legal entities of the Russian Federation, including branches of foreign companies in Russia, and individual entrepreneurs.

It is important! Income can be paid in kind or cash. Legal relations with individuals persons are formalized by employment contracts or work contracts. When paying dividends, the business entity also acts as a tax agent.

Do I need to fill out a zero personal income tax certificate 2

What to pay attention to

If a company or individual entrepreneur was a tax agent in at least one month of the year, then 6-NDFL must be submitted throughout the year. The fact is that form 6-NDFL is filled out with an accrual total. Therefore, even if the only time an organization or individual entrepreneur accrued wages, say, in February 2021, then personal income tax will need to be transferred to the INFS for the first half of 2021, 9 months and a year. It will no longer be possible to get away with an explanatory letter or a calculation with zero indicators. At a minimum, in section 1 you will need to show one-time accrued income for the entire year on line 020.

Read also

27.07.2016

Where to submit zero calculation 6-NDFL for 2021

Calculation of 6-NDFL, whether zero or normal (with indicators) is submitted to the Federal Tax Service at the place of registration of the tax agent (clause 2 of Article 230 of the Tax Code of the Russian Federation):

- organizations rent it out at their location;

- Individual entrepreneur - at the place of residence.

But depending on the status of the organization or individual entrepreneur (or source of income), the procedure for submitting the report may change:

| Who receives income and where? | Where to submit 6-NDFL |

| Head office employees | To the Federal Tax Service at the location of the head office |

| Employees of separate units (OP) | To the Federal Tax Service at the location of each OP. If the organization notified the tax authorities about the centralized payment of personal income tax through a responsible separate division, then 6-personal income tax according to the OP is submitted (clause 2 of article 230 of the Tax Code of the Russian Federation):

|

| Employees of the largest taxpayers, including their OP | To the Federal Tax Service at the place of registration of the parent organization |

| Individual entrepreneurs on UTII or PSN | To the Federal Tax Service at the place where the individual entrepreneur operates on an imputed or patent basis. If the activity in the special regime is terminated, the calculation is submitted for the period from the beginning of the year until the day of termination of activity |

| Employees of individual entrepreneurs combining UTII and simplified tax system |

|

Useful information from ConsultantPlus

See detailed instructions on how to submit personal income tax reports to a tax agent.

How to apply for zero personal income tax

In the letter from the Federal Tax Service dated May 4, 2021, there is a small clause: if a zero calculation is submitted, the tax authorities are obliged to accept it. This means that by decision of the head of the organization, the declaration can be submitted. This will help avoid erroneously blocking an account and imposing an administrative fine on the organization.

The deadlines for submitting a zero calculation are approved by law. Once the report is received by the inspector, the information will be taken into account.

In the sample you can see how to fill out the zero calculation.