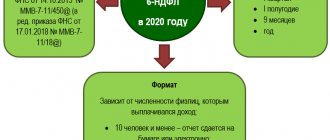

Information on the income of individuals from whom personal income tax is withheld is transmitted to the Federal Tax Service on a quarterly basis by the organizations and individual entrepreneurs paying them. Form 6-NDFL was approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450. Let us remind you that a new form has now been approved; you can read how to fill it out for 2021 here.

If a company or individual entrepreneur does not have employees and does not pay income and remuneration, then they do not bear the obligation to submit a zero calculation.

The document contains summary information:

- on the amount of income and deductions provided to taxpayers,

- on withholding tax on personal income.

6-NDFL - reporting of tax agents

To increase control over the payment of personal income tax, form 6-NDFL was introduced in 2016. This form is quarterly for submission to the tax office. The penalties for failure to submit this report will be as follows:

| Violation | Fine amount |

| If you forgot to submit tax calculation 6-NDFL | 1000 rub. for each calendar month starting from the day specified for filing (clause 1.2 of Article 126 of the Tax Code of the Russian Federation) |

| The report was submitted to the inspection late | Likewise |

| Presence of inaccurate information in the report | 500 rub. for each report with false information |

| Violation of the method of submission (submission in paper form instead of electronically) | 200 rub. for each incorrectly submitted report |

In addition, if the report is not received within 10 days from the deadline for submission, the regulatory authorities may block the current account.

As you can see, this report is quite important for inspectors: it is with its help that additional control is carried out on the calculation and payment of personal income tax. Therefore, if after submitting the report you find any errors (if income or tax data has changed, for example), you must submit a corrective report.

Standards by law

According to the Tax Code, each legal entity must provide conclusions on the amount of taxes based on the income of individuals to whom bonuses, dividends and salaries are paid.

Form 6 personal income tax is divided into two sections, the first indicates the total for all periods on an increasing basis. The second reflects transactions for the reporting period that were carried out in the last three months.

Referring to the tax code of the Russian Federation, the tax agent is obliged to deduct the amount of the required payment from the income of the payer himself. The very fact of payment must also satisfy all the special requirements established by this paragraph.

Due to these features, if the employer paid the salary for March at the beginning of August, then the tax will also be calculated for the date when the money arrived in the individual’s account. It follows from this that the operation will be reflected in the first section, but the agent may forget about it in the second section, since the operation will ultimately be taken into account in the calculation in Form 6-NDFL for the direct payment of wages.

The procedure for filling out line 110 of section 2 of form 6-NDFL

A general idea of filling out the second section can be obtained from this material. And here we will take a detailed look at filling out line 110 “Tax withholding date” and related fields.

In accordance with our legislation, personal income tax must be withheld at the time of income issuance. This function is assigned to tax agents, that is, persons who calculate and pay this income. At the same time, these agents are prohibited from paying tax for the taxpayer from their own funds. There is a risk that fines will be imposed for this during inspection. This means that the date of withholding, and, accordingly, the date of transfer, cannot possibly come before the payment of income.

The main income and tax withholding periods are presented in the table.

| Type of income received | Date of receipt of income for personal income tax | Tax withholding period |

| Salary | Last day of the month worked | Day of delivery of income in hand |

| "Dismissal" payments | Last working day | |

| Payments of sick leave and vacation pay | On the day of payment | |

| Dividends | On the day of payment | |

| Bad debt write-off | Debt write-off date | On the next income payment date |

| Travel expenses (not documented, excess daily allowance) | Last day of the month of approval of the advance report | |

| Income in kind | On the day of provision of this income |

EXAMPLE from ConsultantPlus : Date of deduction of personal income tax from excess daily allowance. Excess daily allowance: according to the advance report approved on February 21, 2020 - 2,100 rubles. Personal income tax - 273 rubles. (RUB 2,100 x 13%) was withheld on 03/05/2020 from the salary for the second half of February; according to the advance report approved on March 27, 2020 - 2,400 rubles. Personal income tax - 312 rubles. (RUB 2,400 x 13%) was withheld on 04/03/2020 from the salary for the second half of March. In Sect. 2 6-NDFL for the 1st quarter of 2021, excess daily allowance for a February business trip is reflected as follows... For the continuation of the example, see K+. You can get trial access to K+ for free.

So:

- in line 110 you will need to indicate the date on which the payment of income from the cash register or from a current account was documented;

- the amount of the income itself will be reflected in field 130;

- field 140 will reflect the amount of tax withheld for each date reflected on line 110.

On line 120 we indicate the deadline for transferring the tax. It is also regulated by law.

IMPORTANT! Personal income tax must be transferred to the budget no later than the day following the day the income is paid. The exceptions were vacation and sick pay. The tax on these payments must be transferred before the last day of the month in which they took place (Article 226 of the Tax Code of the Russian Federation).

In line 120 of section 2 you need to indicate the deadline for transferring the tax amount. Let's look in the table at some of the most common types of income with tax payment deadlines.

| Date of receipt of income | Deadline for paying taxes to the budget |

| Salary | Day following tax withholding |

| Payments upon dismissal | |

| Sick leave and vacation pay | Until the end of the month of payment |

| Dividends | In an LLC - the next day after payment of taxable income. In JSC - no later than the last day of the month following:

(whichever date comes first) |

| Bad debt write-off | No later than the next day after the day on which the tax was successfully withheld |

| Travel expenses (not documented, excess daily allowance) | |

| Income in kind |

IMPORTANT! The dates on lines 110 and 120 will never coincide: these are completely different report fields in their meaning. Even if your organization pays tax to the budget on the day this tax is withheld, you will still indicate in column 120 the day prescribed by legislators. Tax inspectors will see the date of your actual transfer of funds in the budget settlement card and only then compare it with the due dates indicated in your report.

Of course, when filling out column 110, various nuances may arise. Let's look at frequently occurring issues in more detail.

Title page

On the title page, the tax agent fills in all the details, except for the section “To be filled out by a tax authority employee”

.

When filling out the “Adjustment number”

in the primary calculation, “0” is automatically entered; in the updated calculation for the corresponding period, it is necessary to indicate the adjustment number (for example, “1”, “2”, etc.).

Field "Representation period (code)"

filled out in accordance with the codes given in the directory. For example, when submitting a report for the first quarter, the code “21” is indicated, for the six months – “31”, etc.

In the “Tax period (year)”

The year for the tax period for which the calculation is submitted is automatically indicated.

When filling out the field “Submitted to the tax authority (code)”

The code of the tax authority to which the calculation is submitted is reflected. It is selected from the directory. By default, the field is automatically filled with the code that was specified when the client registered in the system.

In the field “At location (accounting) (code)”

the code for the place where the calculation is submitted by the tax agent is selected from the corresponding directory. Thus, agents who are organizations choose code “212”, the largest taxpayers - “213”, individual entrepreneurs - “120”, etc.

When filling out the “Tax Agent”

The short name of the organization is reflected in accordance with the constituent documents, and if there is none, the full name. Entrepreneurs, lawyers, notaries indicate their full (without abbreviations) last name, first name, patronymic (if any).

In the “OKTMO code”

indicated by OKTMO of the municipality. This code is selected from the corresponding classifier. You can find out your OKTMO code using the electronic services of the Federal Tax Service “Find out OK” (https://nalog.ru, section “All services”).

Attention! Calculation of 6-NDFL is completed separately for each OKTMO.

When filling out the “Contact phone number”

The telephone number of the tax agent specified during registration is automatically reflected.

When filling out the indicator “On ____ pages”

The number of pages on which the calculation is compiled is indicated. The field value is filled in automatically and recalculated when the composition of the calculation changes (adding/deleting sections).

When filling out the indicator “with the attachment of supporting documents or their copies on ___ sheets”

the number of sheets of supporting documents and (or) their copies (if any) is reflected, for example, the original (or a certified copy) of a power of attorney confirming the authority of a representative of a tax agent (if the calculation is submitted by a representative of a tax agent).

In the section of the title page “I confirm the accuracy and completeness of the information:”

indicated:

1 - if the document is presented by a tax agent,

2 - if the document is submitted by a representative of the tax agent. In this case, the name of the representative and the document confirming his authority are indicated.

Also on the title page, in the field “I confirm the accuracy and completeness of the information”

The date is automatically indicated.

Reflection in 6-NDFL of data on wages issued before the end of the month

Sometimes there are situations when an employer pays income to an employee before the end of the pay period (month worked), for example, when the salary payment deadline falls on a weekend. At the moment, the Labor Code states that in this case, wages must be paid on the eve of the day off.

Representatives of the Federal Tax Service gave ambiguous explanations regarding the reflection of a similar situation in the 6-NDFL report. First, a letter dated 03/24/2016 No. BS-4-11/5106 was issued, which recommended one procedure for filling out the calculation, and later a letter dated 04/29/2016 No. BS-4-11/7893 was issued, from which a different procedure follows.

Let's look at both of these options using a specific example.

Example

In connection with the upcoming May holidays, Trikotazh LLC paid wages to seamstresses and cutters on April 26. How to fill the lines in this case?

According to the Federal Tax Service letter No. BS-4-11/5106 dated March 26, 2016, this should be done this way:

- line 100: 04/30/20XX

- line 110: 04/26/20XX

- line 120: 04/29/20XX

In the second letter, which appeared on 04/29/2016 (No. BS-4-11/7893), the position changes, approaching the general principles of calculating income tax, and filling out the report lines will depend on the date of payment of the next income. Let's assume that the next day of receipt of income was the advance for May, and it was paid on May 15. That is, if you follow the recommendations of the April letter, the tax withholding date for April will be the day of payment of the advance for May:

- line 100: 04/30/20XX

- line 110: 05.15.20ХХ

- line 120: 05/16/20XX

IMPORTANT! Remember that the advance payment itself is not income from the point of view of calculating personal income tax, and you should not create a separate block of columns 100–120 for this payment.

Thus, when withholding and remitting tax in such a situation, it is necessary to be guided by later clarifications.

Read more about the letter here: “New clarifications from the Federal Tax Service on the reflection in 6-NDFL of wages issued before the end of the month .

Key Notes

Design details

The form for calculating the amounts that were determined by the tax agent has already been approved by the Federal Tax Service. According to it, the procedure for filling out the form is also precisely spelled out so that any company that is a tax agent can correctly draw up 6-NDFL.

If the payment transfer date and the accrual period differ, the information will be filled out in two stages. In the first section, data on the actual transfer is filled in, and in the second - for the next reporting period.

Reflection of salary payments next month in 6-NDFL

In practice, situations are more common when wages for the previous month are paid in the next month. Questions about filling out arise when these are months of different reporting periods. For example, how to arrange payment of wages for September on October 3?

According to the explanations of the Federal Tax Service dated 02/25/2016 No. BS-4-11/ [email protected] and the letter of the Federal Tax Service dated 03/18/2016 No. BS-4-11/4538, it should look like this:

- line 100: 09.30.20XX

- line 110: 03.10.20ХХ

- line 120: 04.10.20ХХ

Moreover, this operation should already be reflected in the report for the year, that is, in the period when the personal income tax withholding procedure for September was completed.

How is the amount of income actually received shown?

The amount of income actually received on the date indicated in line 100 is given in line 130 as a single amount, if there are no grounds for dividing income into different sheets (due to different tax rates) or lines (due to the need to separate according to the timing of tax payment) report. Its value is the value before tax is withheld from it, i.e. it includes the amount of tax accrued on this income (clause 4.2 of Appendix 2 to Order No. ММВ-7-11 / [email protected] ).

If the same date of actual receipt is present for income taxed at the same rate, but having different tax payment deadlines, then these incomes are entered into Form 6-NDFL in different lines with number 100 (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-4-11 /8312).

Results

Filling out line 110 of tax document 6-NDFL will not cause difficulties for an accountant if you prepare in advance and study the regulatory framework for generating the report.

Having the correct tax register, where all the necessary information will be reflected, will reduce the time for preparing the report to a minimum. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Priority and latest changes

| Title page | Consists of basic information and deadlines for submitting the form. |

| First section | Contains stacked indicators. An advance is indicated here, the amount of which is predetermined in 6 personal income taxes for both residents of the Russian Federation and foreigners living in the country for less than six months. |

| Second section | Implies information on income received by individuals, according to 2-NDFL. |

There are two main differences that must always be remembered: the second form is filled in with personalized data, taking into account each employee individually, the sixth form is filled in with consolidated values for all employees.

| Income type | How to determine the date of actual receipt |

| Salary | The last day of the month when funds were transferred. For example, if the money is transferred on the fifteenth of April, then the date is considered to be the thirtieth of April. |

| Cash (salary not included) | The day the funds are received or received into the account. |

| Business trips | The last day of the month when the employee approved the amount of expenses. For example, if confirmation is provided on December seventh, then the date of receipt is December thirty-first. |

| Receipts transferred in any form other than cash | The day on which the income was transferred. |

| Profit received from the purchase of securities, goods and services | The immediate day of the transaction. |

| Profit from loans with a rate lower than that established by refinancing | The last day of each month while the money was set aside. |

6-NDFL on paper

is submitted only in cases where the local Federal Tax Service accepts reports in this form.

Read in this article how to reflect the tax deduction in 6-NDFL.