For most employees, the duration of annual basic leave is 28 calendar days, for minor workers – 31 days, for disabled workers – at least 30. Moreover, at least one part of the leave must be at least 14 calendar days. The remaining days can be divided into any parts (Articles 123, 125 of the Labor Code of the Russian Federation). But such “fragmentation” requires agreement between the employee and the employer; the intention to divide the vacation must be recorded in the schedule. The document is mandatory for the employer (Part 2 of Article 123 of the Labor Code of the Russian Federation).

All organizations are required to draw up a vacation schedule, regardless of the number of staff. Only individual entrepreneurs can avoid doing this, but it is better for them to draw up such a document in order to avoid disagreements with employees (Article 305 of the Labor Code of the Russian Federation).

The schedule is drawn up once a year. For 2021, the vacation plan had to be approved no later than 14 calendar days before the new calendar year, that is, December 17, 2021, since the deadline falls on a weekend (Article 123 of the Labor Code of the Russian Federation). Employees must be familiarized with the approved schedule against signature.

note

It is possible to take into account insurance premiums from vacation pay for tax purposes in full, even when the vacation income itself does not reduce, and it must be distributed among quarters if the vacation is “transitionable” (clause 1 of Article 264 of the Tax Code of the Russian Federation).

Labor legislation does not regulate what to do if employees were hired after the schedule had already been approved. It follows from the norms of the Labor Code that the right to go on vacation for the first time at a new job arises for a specialist after six months of continuous service. Newly hired employees can go on vacation earlier, but only with the permission of the manager (Article 122 of the Labor Code of the Russian Federation).

Common types of leave and the current legislative framework

The following types of annual leave are distinguished:

- standard - 28 days (Article 115);

- extended - depend on age, position, specifics of work (for example, this category of vacationers includes military personnel, teachers, etc.);

- additional - in the presence of dangerous, harmful working conditions, etc. (Art. 116).

Vacation can be divided (Labor Code, RF, Art. 125), and in some situations, postponed or extended (Labor Code of the Russian Federation, Art. 124). The next paid leave, which falls on different months or reporting periods, is called rolling (hereinafter referred to as PO). Calculation, features of payment of software, calculation of personal income tax, insurance premiums on it, as well as the application of preferential deductions are carried out in accordance with the generally accepted rules of the Labor Code of the Russian Federation. Read also the article: → “The procedure for dividing vacation into parts, calculating payments.”

Insurance premiums for compensation upon dismissal - how to calculate

Is compensation for unused vacation subject to contributions? Regarding insurance premiums, the answer is given in paragraph. 6 subp. 2 clause 1 stat. 422 of the Tax Code, which states that such payments are subject to taxation in terms of contributions from compulsory social, medical, and pension insurance. The same situation applies to injuries - in accordance with paragraph. 6 subp. 2 clause 1 stat. 20.2 of Law No. 125-FZ, compensation amounts paid upon dismissal of personnel are subject to taxation in terms of NS and PZ (accidents and occupational diseases).

Some principles for accounting for rolling leave

Calculated insurance premiums (or premiums), as well as taxes and other fees, are included in expenses for the period in which they were credited. FSSO, PFR, FFOMS contributions are calculated and paid for the software. Insurance fees are most often not distributed between months. For example, if an employee went on vacation in June and returned in July 2017, then insurance payments for vacation pay are taken into account in June 2021. Expenses are fully reflected in the declaration for the second quarter of 2017.

However, if, for example, the vacation began in December of one year and ended in the month of another year, accounting is kept differently. Vacation money is an expense included in wages. These software amounts are distributed in proportion to vacation days. They need to be included as expenses every month.

When calculating the single tax, expenses take into account: the software itself minus personal income tax (on the date this amount is issued to the vacationer), the insurance fee for the software (on the day of deduction to the funds).

Under the simplified tax system (Income), the single tax is reduced by the amount of insurance premiums in the period when they were transferred to the fund. However, there is a limit of no more than 50%. Vacation pay themselves do not affect the single tax, because no expenses are taken into account under such a taxation object.

Under the simplified tax system (income - expenses), the obligated person has the right to reduce his income by the amount of expenses for wages. Vacation pay (and in relation to software) is considered an expense at the time of issue. As for insurance premiums, they also reduce the tax base when paying a single tax on the date of payment.

Benefits in the form of deductions applied during rolling leave

The software is subject to standard tax deductions for the vacationer and his children (Tax Code of the Russian Federation, Article 216). The only caveat is that this benefit applies only for one month, and not for both (that is, even when the vacation begins in one month and ends in another). This means that the deductions due to the vacationer are not distributed between months, but are recognized in the generally accepted manner for the current month. It is noteworthy that such benefits can be used both in vacation pay and wages.

| Deduction option | Conditions for providing benefits in the form of a deduction | Base |

| On your children | For each minor child, until the end of the year in which he turns 18; for full-time students up to 24 years of age | Tax Code of the Russian Federation, art. 218, clause 1, sub. 4; Letters of the Ministry of Finance No. 03-04-05/53291 dated October 22, 2014 and No. 03-04-05/8-1251 dated November 6, 2012 |

| To myself | The benefit is provided to participants and victims of the Chernobyl Nuclear Power Plant, participants and disabled people of the Second World War, former prisoners of concentration camps, heroes of the USSR and the Russian Federation, disabled people from childhood and groups 1 and 2, as well as other categories of persons specified in the Tax Code of the Russian Federation | Tax Code of the Russian Federation, art. 218 |

The legislation provides the opportunity for the hotel category of vacationers to receive a double deduction for their children (single parent, guardian, adoptive parent, etc.).

To exercise his right to a benefit, an employee must contact the employer (tax agent) with an application for the provision of this type of benefit and attach to it proper documentary evidence of the right to a deduction, such as: a copy of the certificate of a WWII veteran, a participant in the liquidation of the consequences of the Chernobyl nuclear power plant, etc.

Vacation pay - payment for work?

On the one hand, the amounts of accrued vacation pay are included in the wage system, are guaranteed by an employment contract, and from these positions can be classified as wages. This opinion is shared by some arbitration judges (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated December 29, 2009 in case No. A46-11967/2009, the Federal Antimonopoly Service of the Ural District dated August 5, 2010 No. Ф09-9955/09-С3 and the Federal Antimonopoly Service of the Northwestern District dated September 30. 2010 in case No. A56-41465/2009). And if vacation pay is wages, then it is quite acceptable to apply the norm of paragraph 2 of Art. 223 of the Tax Code: the date of actual receipt of income by the taxpayer is the last day of the month for which the income was accrued to him.

The procedure for calculating the amount due and issuing money to the vacationer

Calculation of annual paid leave (and rolling over) is carried out taking into account the requirements of Government Decree of the Russian Federation No. 922 dated December 24, 2007. Vacation payment is made in advance. Regardless of when the period begins and ends, the employer must pay the amount due to the employee three days before the start of the vacation (Labor Code of the Russian Federation, Article 136, Part 9). In the month when the money was issued, personal income tax is calculated from it.

Calculation is made according to the formula: PO = GD / 12 (months) / 29.4 (days) * BH, where PO is rolling leave, GD is annual income, BH is the number of days of vacation. The billing period is the previous 12 calendar months (Government Decree No. 922 12/24/2007, clause 4). Calendar month is the period from the first to the last day of the month.

For example, a citizen of the Russian Federation has worked for 2 years and goes on another paid leave from August 21, 2021 for 14 calendar days. The vacation is rolling: it starts in August and ends in September. The employer is obliged to calculate and pay the amount due 3 days before 08/21/2017 (before the start of the program). The employee did not have sick leaves, swearing. assistance, bonuses and allowances were not accrued; the billing period was fully exhausted.

| Data for calculation | Sequential software counting | Calculation results |

| Salary 23,000 rub. for the previous 12 months; number of vacation days - 14; multiplier of the average number of days worked - 29.4 | Annual income: 23,000 * 12 = 276,000 rubles; PO without calculating personal income tax according to the formula GD/ 12/29.4* BH: 276,000/12/29.4 * 14 = 10,952 rubles; Personal income tax on vacation pay, formula - PO * 13%: 10952 * 13 / 100 = 1,424 rubles; Amount of software to be paid minus personal income tax (13%): 10952 - 1424 = 9,528 rubles. | Annual income - 276 rubles; Software - 10,962 rubles; Personal income tax - 1424 rubles. Payable - RUB 9,528. |

Based on the calculation results, the software is issued (9,528 rubles) three days before 08/21/2017, and the tax on personal income is transferred no later than 08/31/2017.

Days not worked

If the entire billing period consists of excluded days, the preceding 12 months in which the employee had days worked are taken as the billing period. For a specialist who did not have any days worked in previous periods, the calculation period will be from the 1st day of the month of the start of the vacation to the date preceding the first day of the start of the vacation. For example, if a salaried employee did not have actual accrued wages or days worked for the billing period and before the start of the period (for example, she was on maternity leave), but had wages in the month she went on vacation (she returned from vacation this month and worked several days), then the average salary for vacation pay is calculated by dividing the wages accrued for days worked in a month by the estimated number of calendar days in that month. If, before the day she went on vacation, the employee had no payments included in the calculation of average earnings or days worked, the average daily earnings are calculated by dividing the tariff rate established for her by 29.3.

note

Vacations that are not used for several years do not “burn out” in any case, although not providing them is a violation of the law. And since the employer is still obliged to give a person a rest, vacation pay for “accumulated” vacations is taken into account in full in tax expenses.

The calculation of vacation pay and the procedure for its payment is affected by whether holidays fall on holidays. Difficulties may arise if the holiday starts at the end of December or immediately after the New Year holidays, or during public holidays in February or March. There are many non-working holidays in Russia in January. There are eight of them in total: New Year holidays and Christmas. If these days fall on vacation, they are not considered rest days and do not need to be paid for.

At the same time, the amount of vacation pay for the employee will not be less, since non-working holidays are not taken into account when calculating days of rest. In the application, the employee will indicate the number of vacation days for which he will be paid. In this case, the rest time must be increased by eight days. New Year's holidays and Christmas are non-paid days. The same should be done when calculating vacation pay that falls on February, March 8, or May holidays.

Standard 6-NDFL and display of software in it

6-NDFL is a model standard approved by Order of the Federal Tax Service N MMV-7-11/ [email protected] dated 10/14/2015. Valid from 2021, applied by all tax agents every quarter. The current form 6-NDFL consists of 2 sections. The first includes the latest income and personal income tax data for the organization as a whole. The second section contains detailed information on each individual transaction that appears when withholding income tax.

Carrying holiday pay is displayed in accordance with uniform rules, i.e. depending on the date of their payment and taking into account the deadline for payment of personal income tax. The deadline for making tax payments is the last day of the month. Therefore, in the appropriate column 6-NDFL, the date of the last working day of the month in which vacation pay was paid is entered. If the deadline falls on a weekend, then the first working day of the next month is entered in the form.

An example of reflecting rolling leave in 6-NDFL

Example 1. Deadline for transferring personal income tax from the rolling leave of employee P.N. Leonidova.

Vacation P.N. Leonidova lasts from 07/11/2017 to 08/3/2017. It starts in July and ends in August, which means it is a rolling vacation. The organization paid its employee the money for the software on time - 07/10/2017 (no later than 3 days before the start of the vacation period).

Tax deductions depend on the actual date of payment of money, i.e. taking into account the date 07/10/2017. From the above it follows that the deadline for transferring personal income tax from employee P.N. Leonidov’s vacation pay in this case will be on the deadline of July - 07/31/2017, Monday, working day.

Example 2. Calculation of income tax for individuals with two employees and display of the appropriate amounts in 6-NDFL

The accounting department of Vasilek LLC paid vacation money to its employees I.A. Romashova (06/14/2017 - 23,000 rubles) and T.P. Lorina (06/30/2017 - 13,000 rubles) in June 2021. The tax calculation for the income of individuals (13% rate) is as follows:

- From vacation pay of employee I.A. Romashova: 23,000 * 13% = 2,990 rubles;

- From the vacation pay of employee T.P. Lorina: 13,000 * 13% = 1,690 rubles.

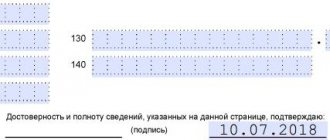

The tax was transferred in a single payment for both employees on June 30, 2017. Vacationers received money in their hands minus personal income tax. Standard 6-NDFL (six-year period) is filled out like this. The first section: information about vacations is entered in columns 020, 040, 070. In the second section, columns 100-140 are filled in:

- 100 14.06.17 130 23000;

- 110 14.06.17 140 2990;

- 120 30.06.17

- 100 30.06.17 130 13000;

- 110 30.06.17 140 1690;

- 120 30.06.17.