Net profit is an important element in analyzing the efficiency of an enterprise. This is the balance of gross profit after taxes. Simply put, these are the funds that remain at the free disposal of the organization .

Using these finances, the company forms reserve capital, increases working capital, buys new equipment, and acquires shares of other companies. Part is spent on employee incentives: bonuses, corporate events, travel vouchers, gifts, assistance in purchasing housing or treatment.

The size of the indicator depends on several factors:

- revenue amount;

- production cost;

- amount of taxes;

- volume of other income and expenses.

Negative profits are called net losses. Many enterprises turn out to be unprofitable, despite successful activities during the year. Conversely, a small company without a huge turnover and a wide range of products can bring in colossal amounts.

Net profit indicator: who, where and why calculates it

Net profit and commercial activity are inextricably linked concepts.

For the sake of profit, new production facilities are created, material and labor resources are intensively used, and effective ways are sought to increase the profitability of commercial activities. Net profit is one of the important final performance indicators of any company. Not only the management and owners of companies are interested in obtaining net profit. Good net profit indicators attract new investors, contribute to making positive decisions on issuing loans to the company, as well as strengthening the company’s authority in market conditions.

It is net profit that allows firms to develop their material base, invest in expanding production, improving technology and mastering advanced techniques and methods of work. All this leads to the company entering new markets, expanding sales volumes and, as a result, an increase in net profit.

Find out how to analyze net profit from the article “Procedure for analyzing net profit of an enterprise.”

Many financial indicators take part in calculating net profit, and the formula for calculating it is not as simple as it seems at first glance. In the accounting records of any company, net profit is reflected in line 2400 of the financial results statement (OFR), and all indicators in column 2 of this report are involved in determining net profit .

Learn about the structure and purpose of the ODF from this publication.

A detailed algorithm for calculating net profit is given in the next section.

Revenue for a certain period

The main indicator of net profit is revenue for a certain period. It consists of the money that your company receives for the sale of goods or services, investment and financial activities.

To analyze this indicator, you should choose the right period - if it comes to production, especially mass production, then it is reasonable to analyze revenue for a whole year or quarter.

As for more “dynamic” areas of business, such as sales or the provision of services, it makes sense to pay attention to revenue for the week, month or certain seasons when a particular product or service is in high demand.

How can you influence your revenue? If demand exceeds supply, revenue increases by increasing production. In the opposite situation, you need to create advantages for your products and services over competitors.

If your company is engaged in retail trade, then in order to increase revenue it is necessary to increase the attractiveness for consumers not only of the goods themselves, but also of the store in which they are sold.

The impact of the company's main performance indicators on net profit

Net profit is a multi-component indicator - this can be seen from the composition of its calculation formula. Moreover, each parameter involved in the calculation is also complex. For example, a company's revenue may be divided into different lines of business or geographic segments, but its entire volume must be reflected in the formula for calculating net profit.

For information on how revenue and gross income of a company are related, see the article “How to correctly calculate gross income?” .

An indicator such as cost may have a different structure in certain companies and have a different impact on net profit. Thus, you should not expect a large net profit if amounts equal to or exceeding the amount of revenue received are spent on the products manufactured by the company (this is possible in case of material-intensive or labor-intensive production or the use of outdated technologies).

The impact on net profit of selling and administrative expenses is obvious: they reduce it. The magnitude of such a reduction directly depends on the ability of the company’s management to rationally approach the structure and volume of this type of costs.

However, even with zero or negative sales profit, which is influenced by the indicators listed above, it is possible to obtain a net profit . This is due to the fact that, in addition to profits from its core activities, the company can earn additional income. This will be discussed in the next section.

The procedure for calculating the rate of return

The rate of profit (Np) is the ratio of profit (P) for a certain period to the advanced funds (AS).

Advanced funds consist of the costs of production of goods and wages for the reporting period.

The result of the ratio should be multiplied by 100%:

Np=(P/AS)x100%

Depending on the field of activity of the enterprise, the profit rate can range from 15 to 50%. With such values, the company has opportunities for growth, and its activities pay for themselves. If the rate of return is less than 15%, the enterprise has problems and its future is unstable, and if it is more than 100%, then you receive excess profits.

When calculating this indicator, it is necessary to carefully select the reporting period - in a number of industries, advanced funds have a turnover of more than one year, therefore, calculating the rate of profit in a shorter period of time can lead to false results.

The role of other income and expenses in the formation of net profit

Often, the company's core activities do not bring it the desired net profit. This happens especially often at the initial stage of a company’s formation. In this case, the additional income received by the company can be of great help.

For example, you can make a profit from participating in other companies or successfully invest free funds in securities. The income received will help increase net profit. Even a regular agreement with a bank on using the balance of money in the company’s current accounts for a certain percentage will allow the company to receive additional income, which will certainly affect its net profit.

But if a company uses borrowed funds in its work, the interest accrued for using the loan can significantly reduce the net profit - one should not forget about the impact of the fact of borrowing on net profit. The amount of interest on borrowed obligations (even calculated at the market rate) can seriously reduce net income, and in certain cases lead to losses and bankruptcy.

Whether the company's debts can be collected from the chief accountant in the event of bankruptcy, find out by following the link.

A variety of income and expenses not related to the company's core activities have a significant impact on net profit. For example, renting out unused space or equipment can bring good additional income and have a positive impact on your net profit. Net profit will increase if the company's assets that are not used in its activities are sold.

At the same time, we should not forget about the need for constant monitoring of the composition and amount of other expenses - as they increase, net profit decreases. For example, net income may decrease as a result of excessive spending on charity and other similar situations.

We will tell you in this material how to reflect charity expenses in accounting.

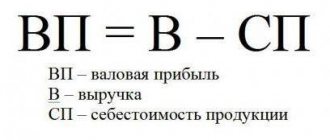

Product cost

Cost refers to the cost of resources, human labor and equipment spent on the production of a particular product or service.

It also includes the costs of storing manufactured goods and transporting them.

Reducing costs is one of the main ways to increase profits.

But in the pursuit of excess profits by reducing costs, one should be careful and ensure that the quality of what is produced remains at the same level; low-quality products are less competitive.

The net profit of an enterprise is an indicator calculated in different ways

Net profit, the calculation formula for which was described in the previous sections, can be determined in another way. For example:

Page 2400 = page 2300 – page 2410

Net profit, the calculation formula for which is given above , is equal to profit before tax minus income tax.

This algorithm for calculating net profit is simplified and can be used, for example, by small enterprises that have the right not to apply PBU 18/02 “Accounting for income tax calculations.”

IMPORTANT! The criteria for small enterprises are given in Federal Law No. 209-FZ dated July 24, 2007 “On the development of small and medium-sized enterprises in the Russian Federation.”

For more information on the criteria for small businesses, see this article.

Information about deferred tax assets and liabilities is generated in accounting and is required to reflect differences arising between tax and accounting accounting.

Ways to enlarge

Net profit is an important economic indicator that clearly demonstrates the level of profitability of an enterprise. An increase in profits during the reporting period indicates high demand for products in the market. Many large companies work with special agencies that develop various strategies aimed at increasing income. But small manufacturing enterprises do not have the required amount of financial resources that could be used to cooperate with such agencies. Based on this, the relevance of the question of ways to increase profits increases.

First, it is necessary to conduct an internal analysis of the production process, after which the work of the marketing department is assessed. Then you need to develop a strategy that will help reduce production costs and increase the volume of products sold. Carrying out such preventive measures is practiced by all entrepreneurs. However, many owners of private organizations do not pay attention to invisible factors that influence the amount of income.

You can increase the profitability of an enterprise by reducing staff and lowering employee wages. In addition, it is necessary to optimize inventory and increase margins. By improving the quality of goods and reducing production costs, the production capacity of the enterprise can be increased, and this, in turn, will have a positive impact on profit margins.

To increase the amount of profit received, it is necessary to increase labor productivity and introduce new technological processes. Also, in addition to all of the above, the management of the enterprise must take measures to develop new markets and expand the distribution network.

Results

Net profit is a complex indicator that includes all types of income received by the company, taking into account expenses incurred. If the company's costs exceed the total of sales revenue and additional other income, then we can talk about the absence of net profit and the company's activities are unprofitable.

Net profit allows merchants to expand their business, master new technologies and markets, which, in turn, has a positive effect on the increase in net profit.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Definition

Net profit (loss) 2400 is the net profit (loss) of the organization, i.e. retained earnings (uncovered loss) of the reporting period

Net profit (loss) is the result of the organization’s activities as a whole, after taxation and various adjustments.

If the indicator is positive, then the net financial result is net profit; if negative, then the net loss is net loss.

Net profit (loss) of the reporting period is one of the absolute economic indicators of the enterprise’s activity, used in the service to characterize the scale of the enterprise’s activities and the achieved work results.