Report submission deadlines

The reporting period is a month or a quarter, depending on how often the legal entity transfers advances to the budget. The document is submitted on a cumulative basis from the beginning of the year. In addition, a completed tax return form for the organization's profits must be submitted for the year.

The last day of submission is the 28th day of the month following the reporting period. If this day falls on a weekend, the deadline is moved forward.

Composition of an organization's profit tax return

The declaration form was approved by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] It consists of several sheets, among which are mandatory for everyone:

- title or 01;

- subsection 1.1 of Section 1;

- “Tax calculation” or 02;

- appendices 1 and 2 to the “Tax calculation” sheet.

The remaining sheets are filled out provided that the company has data for them:

- subsections 1.2 and 1.3 of Section 1;

- appendices 3, 4 and 5 to the sheet “Tax calculation”;

- sheets 03, 04, 05, 06, 07, 08, 09;

- appendices 1 and 2 to the declaration.

Note!

Appendix 4, regardless of the availability of data, is added only to the annual report and the report for the 1st quarter.

How to fill out a tax return for an organization's profits?

Title page

. Includes information about the enterprise.

Section 1

. This indicates the amount of tax that the company undertakes to transfer to the budget. Subsection 1.1 records the amount of tax for the reporting period.

Sheet 02

. On this sheet you should indicate expenses and income for the reporting period, the tax base and, ultimately, the amount of tax. Line 110 shows losses from previous periods transferred to the current period.

Appendix 1 to sheet 02

. Filled out to show the company's income. The peculiarity is that it is necessary to display income received in any way, and not just from the sale of goods and services.

Appendix 2 to sheet 02

. Filled out to demonstrate all expenses of a legal entity: direct, indirect and non-operating.

How to send, in what form?

The declaration is submitted electronically or in paper form. The paper format is allowed only for small enterprises, the average number of employees in which does not exceed 100 people (according to Article 80 of the Tax Code of the Russian Federation).

The most convenient way to fill out a report is via the Internet using specialized online services.

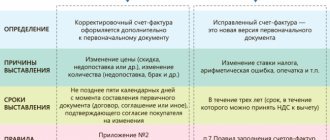

Updated declaration

If an error is discovered when calculating income tax after sending the declaration, you need to submit an updated declaration with the correct amount. If the amount of tax paid was less than required, then you must pay additionally, taking into account the penalty.

Responsibility for late submission

The standard fine for late submission of a report is 5% of the tax amount, but not less than 1000 rubles. and no more than 30% of the amount. The fine is charged for each month of delay.

An official of an enterprise who is late may be punished with an administrative fine in the amount of 500 rubles.

QUICKLY AND EFFICIENTLY

Sending invoices to your clients' e-mail. The invoice status will always tell you whether it is paid or overdue. A short introductory text about the invoice for payment. Invoicing with logo, seal and signature. Sending invoices to your clients' emails. The invoice status will always tell you whether it is paid or overdue.

- Convenient online invoicing

- Instantly send invoices by e-mail to your buyer

- Debt control for each customer

Sample of filling out an organization's profit declaration

Download the already completed corporate income tax return for free to have the correct example before your eyes.

Corporate income tax return form

Download a blank income tax return form in your preferred Word or Excel format.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Form KND 1151006 “Tax return for corporate income tax”

General requirements

The declaration is drawn up on a cumulative basis from the beginning of the year.

All values of the Declaration’s cost indicators are indicated in full rubles (except for the values indicated in Appendix No. 2 to the Declaration). When indicating the values of cost indicators in full rubles, values of indicators less than 50 kopecks are discarded, and 50 kopecks or more are rounded to the full ruble. The pages of the declaration have continuous numbering, starting with the Title Page (Sheet 01), regardless of the presence (absence) and number of sections, sheets and appendices to be filled out. The serial number of the page is written in the field specified for numbering from left to right, starting from the first (left) space, for example, for the first page - “001”, for the twelfth - “012”.

Errors may not be corrected by correction or other similar means.

Double-sided printing of the declaration on paper and fastening of declaration sheets, which leads to damage to the paper, is not allowed.

When filling out the declaration, black, purple or blue ink is used.

Each declaration indicator corresponds to one field, consisting of a certain number of acquaintances. Each field contains only one indicator.

The exception is for indicators whose value is a date or a decimal fraction. To indicate the date, three fields are used in order: day (field of two characters), month (field of two characters) and year (field of four characters), separated by the sign “.” ("dot"). For decimal fractions, two fields are used, separated by a period. The first field corresponds to the integer part of the decimal fraction, the second - to the fractional part of the decimal fraction.

Filling out the declaration fields with the values of text, numeric, and code indicators is carried out from left to right, starting from the first (left) familiarity.

For negative numbers, the “-” (“minus”) sign is indicated in the first familiarity on the left.

When filling out declaration fields using software, the values of numerical indicators are aligned to the right (last) space. In this case, in negative numbers the “-” (“minus”) sign is indicated in the familiar place before the numerical value of the indicator.

Filling out the text fields of the declaration form is carried out in capital printed characters.

If any indicator is missing, a dash is placed in all familiar places in the corresponding field. The dash is a straight line drawn in the middle of the familiarity along the entire length of the field.

If to indicate any indicator it is not necessary to fill out all the spaces in the corresponding field, then a dash is placed in the unfilled spaces on the right side of the field. For example, at the top of each page of the Declaration, the taxpayer identification number (hereinafter referred to as the TIN) and the organization’s checkpoint are indicated in the manner specified in Section III “Procedure for filling out the Title Page (Sheet 01) of the Declaration.” When specifying a ten-digit TIN of an organization in a field of twelve acquaintances, the indicator is filled in from left to right, starting from the first acquaintance, in the last two acquaintances a dash is placed: “TIN 5024002119—“.

Fractional numeric indicators are filled in similarly to the rules for filling in integer numeric indicators. If there are more acquaintances for indicating the fractional part than numbers, then a dash is placed in the empty acquaintances of the corresponding field. For example, the share of the tax base attributable to a separate division is 56.234 percent. The specified indicator must be filled in according to the format: 3 spaces for the integer part and 11 spaces for the fractional part. Therefore, in the Declaration it should look like this: 56-.234———. The income tax rate in the Declaration is filled in according to the format: 2 places for the whole part and 2 places for the fractional part and, accordingly, at rates of 2% and 13.5% they are indicated as: 2-.- and 13.5-.

When preparing the Declaration using software when printing on a printer, it is allowed that there is no framing of the acquaintances and dashes for blank acquaintances. The location and size of the attribute values should not change. Signs are printed in Courier New font with a height of 16 - 18 points.

The declaration may be submitted by the taxpayer to the tax authority personally or through his representative, sent by mail with a list of attachments, or transmitted electronically with an enhanced qualified electronic signature via telecommunication channels in accordance with Article 80 of the Code.

The declaration is submitted via telecommunication channels in electronic form in established formats in accordance with the Procedure for submitting a tax return electronically via telecommunication channels, approved by order of the Ministry of the Russian Federation for Taxes and Duties dated April 2, 2002 No. BG-3-32/169 (registered by the Ministry of Justice of the Russian Federation on May 16, 2002, registration number 3437.

When sending the Declaration by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. When transmitting the Declaration via telecommunication channels, the day of its submission is considered the date of its dispatch. Upon receipt of the Declaration via telecommunication channels, the tax authority is obliged to provide the taxpayer with a receipt of its receipt in electronic form.

Tax agents fill out and submit Calculations taking into account the general requirements provided for in Section II of this Procedure.

The successor organization submits to the tax authority at its location (at the place of registration as the largest taxpayer) Declarations (including Declarations for separate divisions) for the last tax period and updated Declarations for the reorganized organization (in the form of merger with another legal entity, merger of several legal entities persons, division of a legal entity, transformation of one legal entity into another) indicating in the Title Page (Sheet 01) according to the details “at the location (accounting) (code)” the code “215” or “216”, and in the upper part - TIN and KPP of the successor organization. The “organization/separate division” detail indicates the name of the reorganized organization or a separate division of the reorganized organization.

The details “TIN/KPP of the reorganized organization (separate division)” indicate, respectively, the TIN and KPP that were assigned to the organization before the reorganization by the tax authority at its location (for taxpayers classified as the largest - by the tax authority at the place of registration as largest taxpayer) or at the location of separate divisions of the reorganized organization.

Codes of forms of reorganization and liquidation are given in Appendix No. 1 to this Procedure.

If the Declaration submitted to the tax authority is not a Declaration for a reorganized organization, then dashes are indicated for the details “TIN/KPP of the reorganized organization (separate division).”

If an organization makes a decision to terminate the activities (closing) of its separate division (hereinafter referred to as a closed separate division), updated Declarations for the specified separate division, as well as Declarations for subsequent (after closure) reporting periods and the current tax period, are submitted to the tax authority at the location organization, and for an organization classified as the largest taxpayer - to the tax authority at the place of its registration as the largest taxpayer.

In this case, in the Title Sheet (Sheet 01), according to the details “at the location (accounting) (code)”, the code “223” is indicated, and in its upper part the checkpoint is indicated, which was assigned to the organization by the tax authority at the location of the closed separate division.

The procedure for filling out the Title Page (Sheet 01) of the Declaration

The title page (Sheet 01) of the Declaration is filled out by the taxpayer, except for the section “To be filled out by a tax authority employee.”

The title page (Sheet 01) of the Declaration is filled out by the tax agent in the manner prescribed by this section (taking into account the provisions of paragraph 1.7 of Section I of this Procedure).

When filling out the Title Page (Sheet 01), you must indicate:

1) TIN and KPP, which is assigned to the organization by the tax authority to which the Declaration is submitted (the specifics of indicating the TIN and KPP for reorganized organizations, as well as the features of indicating the KPP in Declarations for separate divisions of the largest taxpayer, for closed separate divisions are set out, respectively, in paragraphs 1.4 Section I, paragraphs 2.7 and 2.8 Section II of this Procedure). In the Declaration for a consolidated group of taxpayers, in the Title Page (Sheet 01) and on each subsequent page of the Declaration, the TIN and KPP assigned to the organization as the responsible member of this group are indicated (in its absence, the KPP assigned to the responsible member of the group by the tax authority to which it is submitted is indicated declaration).

The TIN and KPP of the organization at its location, the location of a separate division, at the place of registration as the largest taxpayer are indicated in accordance with the document confirming the registration of the organization with the tax authority on the appropriate basis.

2) correction number.

When submitting the initial Declaration to the tax authority, “0—” is entered according to the details “Adjustment number”; when submitting an updated Declaration, the correction number is indicated (for example, “1—“, “2—” and so on). At the same time, in the updated Declarations, when recalculating the tax base and the amount of income tax, the results of tax audits conducted by the tax authority for the tax period for which the tax base and the amount of tax are recalculated are not taken into account.

If a tax agent discovers in the Calculation submitted to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an understatement or overstatement of the amount of corporate income tax to be transferred, the tax agent is obliged to make the necessary changes and submit an updated Calculation to the tax authority.

The updated Calculation must contain data only in relation to those taxpayers in respect of whom facts of non-reflection or incomplete reflection of information, as well as errors leading to an understatement of the amount of income tax, were discovered. To reflect the information adjustment number for specific taxpayers, use the “Type” attribute in Section B of Sheet 03 of the Calculation. In this case, in the Title Page (Sheet 01) of the updated Calculation according to the details “at the location (accounting) (code)” the code “231” is indicated.

When submitting updated Declarations, they do not include previously submitted Information on the income of an individual paid to him by a tax agent from transactions with securities, transactions with derivative financial instruments, as well as when making payments on securities of Russian issuers (Appendix No. 2 to the Declaration ), unless changes are made to this Information.

The submission by the tax agent of updated Information on the income of an individual paid to him by the tax agent is carried out taking into account the provisions set out in Section XVIII of this Procedure;

3) tax (reporting) period for which the Declaration was submitted.

The codes defining tax (reporting) periods are given in Appendix No. 1 to this Procedure.

In the Declarations for the consolidated group of taxpayers, codes from “13” to “16” are indicated, and when making advance payments monthly based on the actual profit received, codes from “57” to “68”;

4) code of the tax authority to which the Declaration is submitted, code for submitting the Declaration at the location (registration).

The codes for submitting the Declaration to the tax authority at the location (registration) are given in Appendix No. 1 to this Procedure;

5) the full name of the organization (separate division), corresponding to the name specified in its (his) constituent documents (if there is a Latin transcription in the name, this is indicated);

6) code of the type of economic activity of the taxpayer according to the All-Russian Classifier of Types of Economic Activities (OKVED); taxpayer contact phone number;

7) the number of pages on which the Declaration is drawn up;

the number of sheets of supporting documents or their copies, including documents or their copies confirming the authority of the taxpayer’s representative (in the case of the submission of the Declaration by the taxpayer’s representative), attached to the Declaration.

the number of sheets of supporting documents or their copies, including documents or their copies confirming the authority of the taxpayer’s representative (in the case of the submission of the Declaration by the taxpayer’s representative), attached to the Declaration.

In the section of the Title Page “I confirm the accuracy and completeness of the information specified in this Declaration” the following is indicated:

- 1) if the accuracy and completeness of the information is confirmed in the Declaration, the head of the taxpayer organization (responsible participant in the consolidated group of taxpayers) enters “1”; if the accuracy and completeness of the information is confirmed by the taxpayer’s representative, “2” is entered;

- 2) when submitting the Declaration by a taxpayer (responsible participant of a consolidated group of taxpayers), in the line “last name, first name, patronymic in full”, the surname, first name, patronymic (hereinafter the patronymic is indicated if available) of the head of the organization in full is indicated line by line. The personal signature of the head of the organization and the date of signing are affixed;

- 3) when submitting the Declaration by a taxpayer’s representative - an individual, in the line “last name, first name, patronymic in full”, the full surname, first name, patronymic (patronymic, if any) of the taxpayer’s representative is indicated line by line. The personal signature of the taxpayer’s representative is affixed, the date of signing, and the type of document confirming the authority of the taxpayer’s representative is also indicated;

- 4) when submitting the Declaration by a representative of a taxpayer - a legal entity, in the line “last name, first name, patronymic in full”, the full surname, first name, patronymic (patronymic if available) of an individual authorized in accordance with the document confirming the powers of the representative of the taxpayer - legal entity is indicated line by line, certify the accuracy and completeness of the information specified in the Declaration. In the line “name of the organization - representative of the taxpayer, tax agent” the name of the legal entity - representative of the taxpayer is indicated. The signature of the person whose information is indicated in the line “last name, first name, patronymic in full” and the date of signing is affixed; 5) in the line “Name of the document confirming the authority of the taxpayer’s representative” the type of document confirming the authority of the taxpayer’s representative and its details are indicated;

- 6) when submitting the Calculation to the tax authority by the tax agent, this detail of the Title Page is filled in in a similar manner.

The section “To be completed by a tax authority employee” contains information about the submission of the Declaration (the code for the method of submitting the Declaration is indicated in accordance with Appendix No. 1 to this Procedure); number of pages of the Declaration; the number of sheets of supporting documents or their copies attached to the Declaration; date of presentation; number under which the Declaration is registered; surname and initials of the name and patronymic (if any) of the tax authority employee who accepted the Declaration; his signature).

The procedure for filling out Section 1 “The amount of tax payable to the budget, according to the taxpayer (tax agent)” of the Declaration

Section 1 of the Declaration contains information about the amount of tax payable to the budget, according to the taxpayer (tax agent).

At the same time, in the Declaration submitted by an organization that does not pay income tax at the location of its separate divisions, in Section 1 the indicators are given for the organization as a whole.

For an organization that includes separate divisions, in the Declaration submitted to the tax authority at the place of registration of the organization itself, in subsections 1.1 and 1.2 of Section 1, payments to the budget of a constituent entity of the Russian Federation are indicated in amounts related to the organization without taking into account payments included in its composition separate divisions.

In the Declaration submitted to the tax authority at the location of the separate division (responsible separate division), in subsections 1.1 and 1.2 of Section 1, payments to the budget of the constituent entity of the Russian Federation are indicated in amounts related to this separate division (group of separate divisions).

- Budget classification codes are indicated in accordance with the budget legislation of the Russian Federation.

- In the details “Code according to OKCode according to OKCode according to OK12445698—“.

- In the Declaration for a consolidated group of taxpayers in subsections 1.1 and 1.2 of Section 1, payments to the budget of a constituent entity of the Russian Federation are indicated in amounts related to participants in the consolidated group of taxpayers, separate divisions, responsible separate divisions located on the territory of one constituent entity of the Russian Federation, and reflected in Appendix N 6 to Sheet 02 with the corresponding OKTMO code.

- The number of pages of subsections 1.1 and 1.2 of Section 1 must be no less than the number of Appendices No. 6 to Sheet 02 and depends on the number of constituent entities of the Russian Federation in whose territory the participants of the consolidated group of taxpayers and their separate divisions are located.

- When the successor organization submits to the tax authority the Declaration for the last tax period and the updated Declarations for the reorganized organization, Section 1 indicates the OKTMO code of the municipal entity on the territory of which the reorganized organization or its separate divisions were located.

- Section 1 of the Declaration for a closed separate subdivision indicates the OKTMO code of the municipality on whose territory the closed separate subdivision was located.

- If an organization or its separate division changes its location and pays tax (advance payments) during the reporting (tax) period to the budgets of different constituent entities of the Russian Federation, the taxpayer has the right, as part of the updated Declaration, to submit the corresponding number of pages of subsections 1.1 and 1.2 of Section 1. For example, if the location of the taxpayer changes on August 1, in the updated tax return for the half-year, the amount of additional payment (reduction) of the advance payment for the half-year and the monthly advance payment for the payment deadline “no later than July 28” are indicated in subsections 1.1 and 1.2 of Section 1 with the OKTMO code for the old place location of the taxpayer. On a separate page of subsection 1.2 of Section 1 with the new OKTMO code, the amounts of monthly advance payments are given with the payment deadline “no later than August 28” and “no later than September 28”.

4.2. Subsection 1.1 of Section 1 indicates the amounts of advance payments and taxes payable to budgets of all levels based on the results of the reporting (tax) period.

- Line 040 indicates the amount of tax to be paid additionally to the federal budget, which is transferred from line 270 of Sheet 02.

- Line 050 indicates the amount of tax to be reduced to the federal budget, which is transferred from line 280 of Sheet 02.

- Line 070 indicates the amount of tax to be paid additionally to the budget of the constituent entity of the Russian Federation, which is transferred from line 271 of Sheet 02.

- Line 080 indicates the amount of tax to be reduced to the budget of the constituent entity of the Russian Federation, which is transferred from line 281 of Sheet 02.

- Agricultural producers fill out lines 040, 050, 070, 080 of subsection 1.1 of Section 1 based on the corresponding indicators of lines 270, 271, 280, 281 of Sheet 02 with code “1” according to the detail “Taxpayer attribute (code)”. If organizations have separate divisions - based on the indicators of lines 100 or 110 of Appendix No. 5 to Sheet 02 with code “1” according to the detail “Taxpayer Attribute (code)”.

- Residents (participants) of special (free) economic zones fill out lines 040, 050, 070, 080 of subsection 1.1 of Section 1 by summing the indicators of lines 270, 271, 280, 281 of Sheet 02 with code “3” according to the detail “Taxpayer attribute (code)” and the same lines of Sheet 02 with code “1” according to the detail “Taxpayer Attribute (code)”. If one Sheet 02 on line 270 indicates the amount of tax to be paid additionally, and the other on line 280 indicates the amount of tax to be reduced, then the difference between these indicators taken in absolute values is determined. If the amount of tax to be paid additionally exceeded the amount of tax to be reduced, then the amount of the difference is indicated on line 040 of subsection 1.1 of Section 1. Line 050 of subsection 1.1 of Section 1 is filled in if the amount of tax to be reduced was higher than the amount of tax to be paid additionally. The indicator for lines 070 or 080 is determined in the same way.

- Organizations listed in paragraph 1 of Article 275.2 of the Code, the amount of tax to be paid additionally or reduced to the federal budget for lines 040 or 050 of subsection 1.1 of Section 1 is determined by summing the indicators of lines 270 and 280 of Sheet 02 with code “1” and codes “4” according to details “Taxpayer identification (code)”.

- Organizations that are controlling persons of controlled foreign companies fill out a separate subsection 1.1 of Section 1 of the Declaration regarding tax on income in the form of profits of controlled foreign companies. The amount of tax to be paid additionally to the federal budget for line 040 of subsection 1.1 of Section 1, calculated on income in the form of profits of controlled foreign companies, is determined by summing the indicators of lines 210 of Section B1 and lines 250 of Section B2 of Sheets 09 of the Declaration.

- Organizations that have separate divisions, the amounts of advance payments and taxes to be paid additionally or reduced to the budgets of the constituent entities of the Russian Federation at the location of these separate divisions (responsible separate divisions) and their location indicate in Appendix No. 5 to Sheet 02 and the data of lines 100 (to surcharge) and 110 (to be reduced) of these applications are reflected, respectively, on lines 070 and 080 of subsection 1.1 of Section 1.

- The Declaration for a consolidated group of taxpayers on lines 070 and 080 of subsection 1.1 of Section 1 indicates the amounts of advance payments and income tax to be additionally paid or reduced to the budgets of the relevant constituent entities of the Russian Federation, given in Appendix No. 6 to Sheet 02 on lines 100 (to an additional payment) and 110 (to decrease).

4.3. Subsection 1.2 of Section 1 of the Declaration is filled out only by those taxpayers who calculate monthly advance tax payments in accordance with paragraphs two through five of paragraph 2 of Article 286 of the Code.

If the amount of monthly advance payments for the 1st quarter of the next tax period differs from the amount of monthly advance payments for the 4th quarter of the current tax period (in particular, in connection with the closure of separate divisions, reorganization of the organization, entry of the organization into the consolidated group of taxpayers) in the Declaration for nine months two pages of subsection 1.2 of Section 1 are included with codes “21” (first quarter) and “24” (fourth quarter) according to the details “Quarter for which monthly advance payments are calculated (code)”.

Subsection 1.2 of Section 1 of the Declaration (indicating the details “Quarter for which monthly advance payments are calculated (code)” code “21” (first quarter) is also filled in by taxpayers who pay advance payments monthly based on the actual profit received, when transferring them from the beginning of the next tax period on the general procedure for paying tax in accordance with paragraphs two - five of paragraph 2 of Article 286 of the Code.

Lines 120, 130, 140 reflect the amounts of monthly advance payments payable to the federal budget, and are determined as one third of the amount indicated on lines 300 or 330 of Sheet 02. Monthly advance payments payable during the reporting period are paid on time not later than the 28th day of each month of this reporting period. Accordingly, the first, second and third payment deadlines are the last day of each of the three payment deadlines for monthly advance payments falling in the quarter following the reporting period or in the 1st quarter of the next tax period.

Lines 220, 230, 240 reflect the amounts of monthly advance payments payable to the budget of the constituent entity of the Russian Federation, and are determined as one third of the amount indicated on lines 310 or 340 of Sheet 02.

An organization that includes separate divisions, when submitting the Declaration, including at the location of these separate divisions (responsible separate divisions), the amount of monthly advance payments payable to the budget of the constituent entity of the Russian Federation is indicated accordingly on lines 220 - 240 and the amount they must correspond to lines 120 or 121 of Appendix No. 5 to Sheet 02.

When submitting the Declaration by the responsible participant of the consolidated group of taxpayers on lines 220 - 240 of subsection 1.2 of Section 1, the amounts of monthly advance payments to be paid to the budgets of the constituent entities of the Russian Federation are indicated, given in the relevant Appendix No. 6 to Sheet 02 on lines 120 or 121.

Agricultural producers indicators on lines 120, 130, 140 and 220, 230, 240 of subsection 1.2 of Section 1 are determined as one third of the amounts indicated respectively on lines 300, 310 or 330 and 340 of Sheet 02 (with code “1” for the attribute “Taxpayer Attribute ( code)"). If organizations have separate divisions, the amounts of monthly advance payments payable to the budgets of the constituent entities of the Russian Federation are indicated on lines 220 - 240, and their amount must correspond to lines 120 or 121 of Appendix No. 5 to Sheet 02 with code “1” according to the attribute “Attribute taxpayer (code)".

Residents (participants) of special (free) economic zones, the indicators on lines 120, 130, 140 and 220, 230, 240 of subsection 1.2 of Section 1 are determined as one third of the amounts calculated by summing the indicators on lines 300, 310 or 330 and 340 of Sheet 02 with code “3” according to the detail “Taxpayer Identifier (code)” with the corresponding lines of Sheet 02 with code “1” according to the detail “Taxpayer Identifier (code)”.

Organizations listed in paragraph 1 of Article 275.2 of the Code, monthly advance payments payable to the federal budget (lines 120, 130, 140 of subsection 1.2 of Section 1) are determined as one third of the amounts calculated by summing the indicators on lines 300 or 330 of Sheets 02 s code “1” and codes “4” for the details “Taxpayer Identification (code)”.

Subsection 1.3 of Section 1 is intended to indicate the amounts of tax to be credited to the federal budget in the last quarter (month) of the reporting (tax) period for certain types of income specified in Sheets 03, 04 of the Declaration.

In subsection 1.3 of Section 1 with payment type code “1”, line 010 reflects the amount of tax on income in the form of dividends (income from equity participation in other organizations created on the territory of the Russian Federation).

The “Payment Deadline” detail specifies the deadline for payment to the federal budget of the tax withheld by the tax agent when paying income. When paying dividends partially (in several stages), the amount of tax payable within the specified time frame is reflected on separate lines 040. The sum of the indicators of these lines must correspond to the sum of the indicators of lines 120 of Section A of Sheets 03 of the Declaration.

Organizations that compose Sections A of Sheet 03 of the Declaration indicating code “2” for the requisite “Category of tax agent”, with the simultaneous payment of income on securities of several issuers, the indicators of lines 120 of Sections A of Sheet 03 are summed up and indicate the total amount of tax on one line 040.

If the number of dividend payment deadlines exceeds the number of corresponding lines of subsection 1.3 of Section 1 of the Declaration, then the tax agent submits the required number of pages of subsection 1.3 of Section 1.

In subsection 1.3 with payment type code “2”, line 010 reflects the amount of tax on income in the form of interest on state and municipal securities, in the form of interest on municipal securities issued for a period of at least three years before January 1, 2007, and also on income in the form of interest on mortgage-backed bonds issued before January 1, 2007, and income of the founders of trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before January 1, 2007, withheld by the tax agent (source income payments). The indicated income is reflected in Section B of Sheet 03 of the Declaration with income type codes “1” and “2”.

Line 040 reflects the amount of tax when interest is paid in installments. The amount of tax indicated in these lines must correspond to the indicator in line 050 of Section B of Sheet 03 of the Declaration.

The “Payment Deadline” detail indicates the last day of the deadline for paying the tax to the federal budget withheld by the tax agent when paying income - no later than the day following the day the income was paid.

If the tax agent has the obligation to pay withheld tax on two types of income named in Section B of Sheet 03, the corresponding number of pages of subsection 1.3 of Section 1 is presented as part of the Declaration (Calculation).

In subsection 1.3 with payment type code “3”, line 010 reflects the amount of tax independently paid by the organization on income in the form of interest received (accrued) on government securities of member states of the Union State, government securities of constituent entities of the Russian Federation and municipal securities , in the form of interest on securities named in subparagraph 2 of paragraph 4 of Article 284 of the Code. The indicated income is reflected in Sheet 04 of the Declaration with income type codes “1” and “2”.

The “Payment Deadline” requisite indicates the last day of the deadline for payment of income tax on government securities of the member states of the Union State, government securities of the constituent entities of the Russian Federation and municipal securities, the circulation of which provides for the recognition of income received by the seller in the form of interest, the amounts of accumulated interest income (accumulated coupon income), calculated at rates in accordance with paragraph 4 of Article 284 of the Code for the recipient of income.

The sum of the indicators of lines 040 must correspond to the sum of the indicators of lines 080 of Sheet 04 of the Declaration with codes of the type of income “1” and “2”.

In subsection 1.3 with payment type code “4”, line 010 reflects income tax on income in the form of dividends (income from equity participation in foreign organizations).

The “Payment due date” details indicate

why is a cube more convenient?

Convenient online invoicing

Instantly send invoices by e-mail to your buyer

Debt control for each customer

Management reporting

Organized storage of all your documents

20% discount on accounting services from your accountant

Have you changed your mind about downloading document templates online?

With the KUB service you can save 29 minutes on issuing documents without a single error, and that’s not all. Get KUB - an online service for automating invoicing and other documents.

Start using the CUBE right now 14 days FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

Results

Before preparing reports, always make sure that the form you are going to fill out is up to date. Always submit the clarification in the form that was in effect during the period being clarified. You can always find the latest reporting forms and samples for filling them out on our website.

Sources:

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- Order of the Federal Tax Service dated September 11, 2020 No. ED-7-3/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.