In what cases is a zero income tax return submitted?

The obligation to submit a “profitable” declaration does not depend on the presence or absence of profit or the amount of tax payable in a particular period (clause 1 of Article 289 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 02/03/2015 No. 03-02-07/1/4179, clause 7 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71).

Therefore, a taxpayer using the OSN must submit a declaration, including when the profit is 0 and there is nothing to pay tax on.

IMPORTANT! We submit the declaration for 2021 using a new form. Comments and a sample from ConsultantPlus will help you fill it out. Trial access to the legal system is free.

A zero result can occur in 2 cases:

- if the activity is not carried out, and therefore there are no income or expenses;

- if the activity is carried out, but income is equal to expenses and the tax base results in the corresponding 0.

The declaration drawn up in the first situation will be zero. In the second situation, there is data to fill in, and the zero tax value is just the result of arithmetic operations with the available data.

ConsultantPlus experts explained in what cases to submit a zero income tax return. Get trial access to the system and move on to the Ready-made solution.

The deadline for submitting zero declarations is the usual for profit: before the 28th day of the month following the reporting period, or until March 28 for submitting the annual form.

In 2021, March 28 is a day off, so you need to report by March 29, 2021.

Read more about deadlines in the article “What are the deadlines for filing income tax returns?” .

Sample filling

When creating a report on a computer, you must select the Courier New font with a size of 16-18. If there are typos or corrections, tax officials have every reason not to accept the document.

Compound

The zero declaration includes:

- title page;

- subsection of the first section;

- second sheet;

- appendices 1 and 2 to the second page.

Composition of the declaration for NPOs:

- title page;

- second sheet;

- application (filled out only if there are profits and expenses);

- sheet 07 (if there was a receipt of funds for targeted costs, and so on).

In a simplified version, reporting is provided:

- companies that had no financial transactions for the entire reporting period (it does not matter by cash or account);

- companies that do not have a taxable object.

Tax period code

If companies make advance payments monthly, you will need to indicate the following codes:

- for the 1st quarter – “21”;

- for 6 months – “31”;

- simultaneously for 3 quarters – “33”;

- for the annual reporting period – “34”.

In a situation where an enterprise provides reporting on advance payments on a monthly basis, the document indicates a code from “35” to “46” (based on the principle of 35 - January, 36 - February, and so on).

Code number 46 is indicated exclusively in the annual report for the last period before the future reorganization.

Section 1

This section contains information regarding the amount of calculated tax for a particular tax or reporting period. Subsection 1.1 includes advance payments and amounts to be credited to the budget.

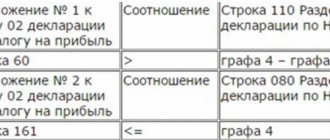

The order of filling out the lines is presented in the table.

| Line numbering | What to indicate |

| 040 | An amount that must be transferred to the budget. When specifying data, you need to pay attention to the information from lines 220 and 250. The field must be filled in provided that the size of line 190 exceeds the total amount of lines 220 and 250. |

| 050 | The amount that was overpaid to the budget. Indicated only if the size of column 190 is less than the total amount of lines 220 and 250. |

| 070 | The amount of money that must be additionally charged to the budget. The field is filled in provided that the sum of column 220 exceeds the total number of 230 and 260. |

| 080 | The amount of money that was overpaid to the budget. The field is filled in provided that the sum of column 220 is less than the total number of 230 and 260. |

Taxpayers who make advance payments must also indicate subsection 1.2 from the first section.

Other sheets

The second sheet of the declaration displays the tax calculation. It must contain the following information.

| Line numbering | What needs to be indicated |

| 010 | Income received from sales |

| 020 | Revenues not dependent on sales |

| 030 | Costs that reduce profits |

| 040 | Costs not dependent on sales |

| 050 | Costs that are not taken into account when taxing profits |

| 060 | Total income |

| 070 | Income eliminated from profit itself |

| 080-140 | The fields are filled in by various companies if there is a specific work activity |

| 140-170 | Percentage tax rate |

| 190 | Tax value, which is determined as the product of income and rate |

| 200 | The amount of money that will be transferred to the budget |

| 210 | Advance payments |

Based on this, the application (for the second sheet) indicates profit from sales and other types of income that are taken into account when determining the amount of tax.

For the second appendix of the second sheet, you need to indicate the expenses that are taken into account when calculating the tax amount.

| Line numbering | What to indicate |

| 010 | All costs associated with sales |

| 040 | Indirect costs used on the accrual basis |

| The remaining fields are filled in by those companies that have specific labor activities |

Depending on the type of work activity, additional sheets may be needed.

Documents for download (free)

- Sample of filling out a zero VAT return

What is the composition of a zero income tax return?

The zero declaration is formed on the current report form as part of the sheets required for submission (clause 1.1 of the procedure for filling out the income tax declaration, approved by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] ):

- title, filled out in the general manner;

- section 1 (subsection 1.1 or 1.2), in which, in addition to the INN and KPP, only OKATO and KBK codes are indicated, and dashes are placed in the fields of numerical indicators;

- sheet 02 and appendices 1 and 2 to it - they will also have dashes.

Read about the declaration form and the principles for filling it out here.

A ready-made solution from ConsultantPlus will help you check whether you filled out your zero income tax return correctly. If you don't already have access to the system, get a free trial online.

General requirements

The current legislation establishes clear requirements for filling out the declaration, namely:

- price values must be indicated exclusively in rubles, while prices up to 50 kopecks are not taken into account, and above must be rounded up to the nearest ruble;

- All pages must have continuous numbering, counting from the title page;

- Page numbering is carried out in special fields according to the principle: the first page is “001”, the second is “002” and so on;

- The presence of blots and errors is strictly prohibited; it is not allowed to use a proofreader;

- It is prohibited to make double-sided printing;

- information must be entered in ink: blue, black or purple;

- each information has its own corresponding field;

- all information in text form must be indicated in block letters (exclusively in capital letters);

- if there is no information to indicate in any field, you need to put a dash.

Who does not need to submit a zero income tax return?

Firstly, those who are exempt from paying this tax do not submit a zero income tax return. For example, organizations using the simplified tax system.

You can also avoid submitting the “zero” test if you replace it with a single (simplified) declaration. But in this case, in addition to the absence of a taxable object, you should not have any movement of money through accounts or the cash register. The form of a single declaration was approved by order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n. Please also keep in mind that it is due no later than the 20th day of the month following the expired quarter, half-year, 9 months, calendar year (paragraph 4, paragraph 2, article 80 of the Tax Code of the Russian Federation). That is, for 2020 it is 01/20/2021, which is much earlier than the deadline for filing a zero profit statement.

Read more about the single simplified declaration in this article.

Possibility of another report

Companies that do not carry out their labor activities have legal grounds to provide a EUD (single simplified declaration) instead of “zero” income.

To do this, in the process of filling out the declaration, you must indicate: in the first field - the tax on the company’s income is indicated, in the second - code “25”, in fields 3-4 the period when the EUD was provided is indicated.

One of the disadvantages of a single simplified declaration is that the deadline for submitting the report is earlier than is possible in the standard form (the document must be submitted before the 20th). However, in practice this rarely plays a significant role.

More information on the declaration is in this video.

What is the liability for failure to submit a zero declaration?

Since submitting a zero income tax return is the responsibility of the taxpayer, failure to submit or late return may result in a fine under Art. 119 of the Tax Code of the Russian Federation. Its amount is determined as a percentage of the amount of tax not paid on the basis of a failed/late declaration.

In this case, the tax amount is 0, so they can collect a fine from you only in the minimum amount - 1000 rubles. But only for the annual declaration. For declarations based on the results of reporting periods, you will be fined no more than 200 rubles. - according to Art. 126 of the Tax Code of the Russian Federation.

Read more about liability for failure to file tax reports in this article.

How to submit

You can submit a declaration to the tax authority:

- in person;

- with the help of a legal representative (a notarized power of attorney is required);

- using Russian Post, in this case a registered letter with an inventory is sent;

- in electronic form (with an electronic digital signature).

When submitting a declaration by mail, the day of its submission to the tax office is usually considered the date of dispatch. This also applies to the case of an electronic digital signature.

Results

The absence of data to be included in the declaration or receipt of a zero tax amount for payment does not exempt the income tax payer from filing a declaration. If there is no data on income and expenses to fill out sections of the declaration, it is considered zero. Its presentation is carried out within the usual time frame for profit reporting. Responsibility for failure to submit a zero declaration is minimal: a fine of 1000 rubles. for the annual declaration and 200 rubles. for declarations of reporting periods.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- Order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

RSV and 4-FSS, if there are no employees

Calculation of insurance contributions to the tax and 4-FSS to the social insurance fund is submitted by individual entrepreneurs with employees and all LLCs.

If an individual entrepreneur does not have employees during the year, there is no need to submit RSV and 4-FSS.

LLCs always report. If the organization has no employees, submit zero reports, but this may lead to claims from the state.

The fact is that an LLC is a separate organization in whose interests the director acts. Often in small companies the work of the director is performed by the founder himself. He does not pay himself a salary and receives income in the form of dividends. But according to labor law, a director is an employee like everyone else, so he is entitled to a salary.

Inspectors are especially suspicious of companies that receive income but pay zero money for employees. They may require clarification, charge additional fees and fine you.

We wrote more about the director of an LLC in the article “Even if the director is the founder of the LLC, he is entitled to a salary.”

Consequences of failure to meet deadlines

The law provides for penalties for violating reporting deadlines. The amount withheld depends on the frequency of filing documents:

- for a month, quarter or other reporting period – 200 rubles;

- per year – 1000 rub.

However, exceptions are provided for companies in such cases as a short period of delay, difficult financial situation, etc. Note that you will not find a complete list of mitigating circumstances anywhere. This issue is left to practice (also see paragraph 1 of Article 112 of the Tax Code of the Russian Federation and the resolution of the Supreme Arbitration Court of the Russian Federation).

To reduce the amount of the fine, it is necessary to write a letter along with zero income tax reporting with a corresponding request, indicating the reason and a link to the article of the law.

Attention! If the inspector issues a fine of 1000 rubles. for late submission of a declaration for the reporting period, write a complaint to the Federal Tax Service of your region. Such actions are illegal!

Violation of reporting deadlines may result in temporary blocking of an organization's bank accounts (Article 76 of the Tax Code of the Russian Federation). This measure is provided for organizations that have delayed sending their year-end declaration for more than 10 working days.

Deadlines and penalties

The declaration at the end of the calendar year (final) must be submitted by March 28 of the following year inclusive.

All calculations for advance payments must be submitted to the Federal Tax Service by the 28th of the month. which occurs immediately after the end of the reporting period. Based on this information, the declaration for the first 3 months must be submitted before April 28 (inclusive), for the second reporting quarter - no later than July 28, and for the next - no later than October 28.

In a situation where the company makes advance payments monthly, all calculations must be provided by the 28th of the reporting month. For example, May must be submitted by June 28.

If the period for submitting a document to the tax authority falls on a weekend or holiday, the date is considered to be the next working day.

According to Article 119 of the Tax Code of the Russian Federation, an administrative fine of 1,000 rubles is provided for late filing of a declaration based on the results of the calendar year.

According to Article 126 of the Tax Code and the Letter of the Federal Tax Service dated September 30, 2013, for late filing of a declaration at the end of the reporting period, an administrative fine of 200 rubles is provided.

If the deadline for filing a zero return at the end of the calendar year is violated, in addition to a fine, the tax authority has the right to block current accounts until the circumstances are clarified (according to Article 76 of the Tax Code of the Russian Federation).

The procedure for filing a single (simplified) declaration

All tax returns are completed in machine-readable forms, so you need to be especially careful when filing them in handwritten form. The template for the Unified (simplified) declaration in different formats (TIF, PDF, MS-Excel) can be downloaded here.

The general requirements for filling out the single declaration form by hand are standard:

- fill in the text with a black or blue pen;

- in capital letters;

- letters and numbers are entered one at a time into each cell, without “jumping out” beyond its limits;

- data is written legibly;

- when correcting errors, we cross out the incorrect values, new data must be endorsed and dated for correction;

- It is prohibited to use proofreaders or erase errors.

Filling out such a declaration will definitely not be difficult for an individual entrepreneur - a minimum of data and only one page.

The tax (reporting) period in a single simplified declaration is indicated in column 3

Basic data that must be included in a single (simplified) declaration:

- In the first upper field on each page (No. 1–2) the entrepreneur’s TIN is placed, in the checkpoint line there are dashes (empty);

- type of document - put 1, number 3 is put only if this is not the first declaration submitted during this period. For each adjustment, a number is indicated through a fraction, for example: 3/1 - the first updated declaration, 3/2 - the second, etc.;

- reporting year - 2021 (or the one for which the report is submitted);

- name of the tax authority - we write in full the name of the Federal Tax Service where the individual entrepreneur is registered, next to it is the code of this inspection;

- The full name of the entrepreneur is indicated as written in the passport;

- object code - filled in according to OKTMO (All-Russian Classifier of Territories of Municipal Entities), you can clarify its number on the portal of the Federal Tax Service of the Russian Federation or by clicking on the link. If the municipality code consists of 10 (or less) characters, zeros (00) are placed in empty cells;

- OKVED - indicates the main type of activity of the individual entrepreneur;

- We list the types of taxes for which a declaration is submitted. In this case, the names are written correctly and in full, for example: Value added tax (without abbreviation - VAT);

- chapter number - put the number of the tax for which the declaration is submitted (for VAT, for example, No. 21);

- UTII reporting periods - in column No. 3 we put the number “3” (number of months), the number in column No. 4 “quarter number” is determined by the calendar quarter (January - March - 01 (first quarter), etc.);

- according to the annual reports of the simplified tax system or personal income tax, we put “0” in column No. 3, and do not fill in “quarter number”;

- indicate the IP telephone number;

- number of pages - 1;

- number of sheets of supporting documents - 0 (if there is something to provide, we count it);

- We endorse the first page of the declaration with a handwritten signature.

The second page of the single (simplified) declaration is not filled out or endorsed by individual entrepreneurs; it is intended only for individuals.

You will have to report to OSNO on a zero VAT return 4 times a year, unless the obligation to pay value added tax is removed or you do not go to the simplified tax system.

SZV-M without employees

SZV-M is a monthly report to the pension fund, which contains a list of all your employees.

If you are an individual entrepreneur without employees, you do not need to take the SZV-M.

But an LLC has at least one employee - a director, and he must be shown in SZV-M.

There is no consensus on whether it is necessary to submit SZV-M to a director who is the only founder with whom an agreement has not been drawn up. The Pension Fund itself issued two letters with opposing positions. According to the letter dated May 6, 2021, the SZV-M must be taken in any case, but in the letter dated July 27, 2021, the Pension Fund says that there is no such obligation.

We recommend employing the director at least part-time and submitting SZV-M and other reports for him as for a regular employee. If an employment contract has not been drawn up with the director, regulatory authorities may have questions. Read more about this in the article.

If you still do not want to employ the founder, ask your Pension Fund a question whether it is necessary to show the director without an employment contract to SZV-M - different departments may have different opinions.

If an organization has suspended its business, does not receive income, and has no hired employees, there is no need to submit the SZV-M. The Pension Fund provides such explanations on its website.

Zero accounting for LLC

Every year, all LLCs submit financial statements, which reflect the annual results of activities - money in accounts, property, debts, profits or losses.

Accounting is never zero, even if you did not run a business. Each organization has an authorized capital, the amount of which you determine when registering a business and deposit it into a bank account. It must be reflected in the accounting reports.

An article about how to do accounting yourself - “Accounting without an accountant: what you need to know for an LLC.”

In Elba there is a special tariff for LLCs that submit zero reports. Read about the details on the special page.

How to pass zero in 2021

A zero income tax return in 2021 is submitted on the same form as a regular return. It was approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] and has not changed for the last couple of years.

Many categories of organizations are required to submit a profit declaration, which includes non-profit enterprises, budgetary organizations, foreigners with representative offices in the Russian Federation, and commercial firms using OSNO. The composition of profit reporting may vary depending on the category of taxpayer. In this article we will provide a sample of a zero income tax return used by commercial enterprises in the Russian Federation.

The rules for submitting a zero corporate income tax return do not differ from submitting a non-zero version of reporting. Depending on the method of calculating income tax, the declaration should be submitted to the tax office at the place of registration of the enterprise quarterly or monthly, no later than the 28th day of the month following the reporting month. The annual declaration is submitted by March 28 of the following year.