Gross profit is the main income of the enterprise, from which expenses have not been calculated. All kinds of payments will be planned only from this profit. Simply put, this is an indicator that shows how income exceeds expenses.

Gross profit is obtained from the sales of all types of services and goods presented. It demonstrates an indicator of the efficient operation of production. This type of profit shows income on which operations were not carried out to make payments for planned payments.

What is gross profit?

Gross profit is the difference between income and cost. Taxes are not deducted from these funds. Cost means:

- costs of producing the product: costs of materials, equipment maintenance;

- expenses for purchasing a finished product at the purchase price;

- payment for electricity;

- salary payments.

How is net profit distributed among LLC participants ?

All these indicators constitute technical costs.

IMPORTANT! VP is calculated for a specific period. The time period depends on the company. The resulting figure is indicated in the balance sheet.

Net sales formula

Therefore, as shown above, to calculate net sales, you must follow the net sales formula:

- Net Sales = Gross Sales - Returns and Discounts - Sales Discount.

Now there are expenses that are not directly related to the production activities of the business. This is called indirect costs. Thus, while preparing the income statement, all such expenses are transferred to the debit side of the statement, whereas revenue or profit other than sales of the company is transferred to the credit side of the income statement.

If the credit side of the income statement exceeds the debit side, the difference is the net income of the business. If the debit portion of the income statement exceeds the debit side, you will receive a net loss instead.

- Net profit = Gross profit + Other income - Indirect expenses.

The net profit calculated in this way is transferred to the balance sheet, which is a capital account.

What influences VP?

Gross profit changes under the influence of external circumstances, such as:

- cost of transportation services,

- natural, environmental factors,

- socio-economic environment in which the enterprise operates,

- costs of production resources,

- foreign economic contacts.

What affects the amount of retained earnings (uncovered loss) ?

VP is also influenced by internal factors:

- income from product sales,

- other sources of income: investments, provision of services,

- cost of goods,

- demand for manufactured products, sales figures,

- cost of manufactured goods.

Gross profit is also affected by negative factors possible during the operation of the enterprise:

- overestimated or underestimated cost of products sold;

- low quality of goods;

- disciplinary violations by the company’s employees leading to losses;

- fines and sanctions.

The listed factors can affect the gross profit directly and indirectly. Factors that affect sales income have an indirect influence.

Results

Gross profit represents the excess of revenue from sales and provision of services over their cost.

Otherwise, the indicator indicates that the product is not profitable. Information on the amount of gross profit/loss is presented in line 2100 of the financial result report and is calculated as the difference between lines 2110 and 2120. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Gross profit composition

The VP may include the following financial resources:

- profit from sales of enterprise products and services;

- funds received from rural and logging farms;

- income from the sale of company property: equipment and other objects;

- amounts received from transactions not included in the main list of company activities. For example, a store sells goods. This is his main activity. However, the funds are spent on investments, the income from which is classified as non-operating profit;

- amounts received from the sale of shares.

The vast majority of EP, according to statistics, consists of income received from core activities.

Sales returns and allowances

Sales return refers to the sales value of items returned by your customers. And allowances are subsidies that you give to customers due to a product defect or for some other reason. The amount of sales returns and rebates can either be deducted directly from sales or shown separately. However, it is wise to show it separately as it clearly represents the different components.

Sales discounts, also called payment discounts, refer to the amount of discounts customers receive in lieu of paying on time.

Formula for calculating gross profit

Gross profit is calculated using the formula:

VP = D - (S+W)

The formula includes the following indicators:

- VP – gross profit;

- D – quantity of products sold;

- C – cost of production of goods;

- C – costs of production processes.

VP indicators can be calculated after the product has been produced and sold.

ATTENTION! Typically, gross profit is calculated once a year.

Example

The company produces electric kettles. Production costs are 20,000 rubles, expenses are 10,000 rubles. 500 teapots were sold per day at a cost of 1000 rubles.

Calculations are carried out as follows: revenue per day is calculated. That is, the number of teapots sold is multiplied by their cost. We will receive 500,000 rubles. From this result you need to subtract all costs, which in total amount to 30,000 rubles. From 500,000, 30,000 rubles are deducted. Gross profit will be 470,000 rubles.

Calculation features

The calculation of VP differs in a number of nuances, determined by the type of activity of the enterprise:

- If a company specializes in selling products, it is required to deduct all expenses from revenue, including discounts on goods and returns. The cost of production is subtracted from the amount received. The result of the calculations is the gross profit;

- If an organization specializes in providing services, calculations are usually carried out according to a simplified scheme. Their revenues are deducted from discounts and other expenses. The resulting net profit is also gross profit.

The main stages of the calculation are standard.

Why is gross cost calculation necessary?

Gross profit does not reflect the actual income of a business. This figure includes many unnecessary expenses: advertising, salaries, rent. VP is required for other purposes. This is a narrow, not a general tool. It is used to analyze the production resources of an enterprise. Correctly calculated indicators ensure the achievement of the following goals:

- analysis of the difference between the cost of a product and the income from its sale;

- determining the optimal cost for a product or service;

- competent measures for planning the company’s activities;

- identifying problems and weaknesses of the enterprise.

Based on the analysis of annual VP indicators, it is possible to track the economic growth of the enterprise and the results of optimizing activities.

Gross output in balance sheet and accounting

Since the main share in VP is allocated to finished products (GP), let us recall the features of the formation of this indicator in the company’s accounting.

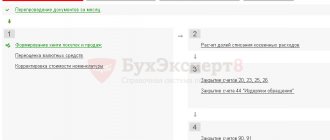

Information about the GP is combined on account 43 - the debit reflects the receipt of finished products at the warehouse, and the credit reflects the write-off of their cost.

The accountant operates with the following records:

| Operation | D/t | K/t |

| Accumulated costs for the production of GP | 20,23,26 | 02,10,16,23,26,29 60,69,70,71,76,79 |

| Semi-finished products were transferred to production | 20 | 21 |

| Produced by GP and credited to the warehouse at actual cost | 40,43 | 20,23,26,29 |

| The shipped GP, if payment for it has not yet been received, is taken into account on the account. 45 | 45 | 43 |

| GP and semi-finished products are sent for sale | 90/2 | 43, 21 |

| Revenue from sales of products is taken into account | 62 | 90/1 |

To form the VP indicator, you should take into account the indicators on accounts 21, 40, 43.45. Data on the volume of work in progress is recorded in the debit of the account. 20, the difference between its debit balances at the beginning and end of the period forms the value of the “work in progress”, and the difference between the turnover in the account. 21 forms the volume of semi-finished products for calculating VP.

How to increase gross profit?

Gross profit is a dynamic indicator. It constantly changes depending on the company's activities. The following activities help increase VP:

- use of LIFO technique in inventory analysis;

- tax reduction with the help of benefits that the enterprise is entitled to;

- regular write-off of bad debts from the balance sheet;

- optimization of production processes aimed at reducing costs;

- competent pricing policy that takes into account the demand for products and the general market situation;

- improving the quality of equipment to speed up the release of goods and improve their quality. Restoration or acquisition of equipment can be carried out at the expense of shareholder dividends;

- creation of reasonable standards to ensure control over intangible assets.

IMPORTANT! Gross profit is an indicator on the basis of which planning of an enterprise’s activities in the production sector can be carried out.

So. Gross profit is the amount obtained after deducting costs and production costs. Determined by formula. The nuances of the calculation depend on the type of activity of the enterprise. The VP indicator is important for assessing the company's production resources. Is the basis for reasonable pricing. Gross profit is reflected in the financial statements using the appropriate entries established by the Order of the Ministry of Finance.

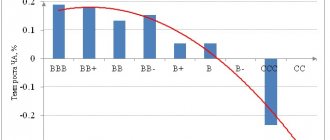

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Positive factor

If the indicator decreases

Negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- TOTAL for section III 1300 Definition of TOTAL for section III 1300 is the sum of indicators for lines with codes 1310 - 1370 and reflects the total amount of the organization’s own capital: 1310 “Authorized capital ...

- BALANCE 1600 Definition BALANCE 1600 is the sum of indicators on lines 1100 and 1200, that is, the sum of non-current and current assets. These are all the assets that a company uses...

- Deferred tax assets 1180 Definition Deferred tax assets 1180 are an asset that will reduce income taxes in future periods, thereby increasing after-tax profits. The presence of such an asset...

- Retained earnings (uncovered loss) 1370 Definition Retained earnings (uncovered loss) 1370 is the amount of retained earnings or uncovered loss of an organization. It is equal to the amount of net profit (net loss) of the reporting period, i.e....

- Deferred tax liability 1420 Definition Deferred tax liability 1420 is a liability in the form of a portion of deferred income taxes that will result in an increase in income taxes in one or...

- BALANCE 1700 Definition BALANCE 1700 is the total value of the organization's liabilities. This is the sum of the indicators on lines 1300, 1400, 1500, that is, equity capital, long-term liabilities and short-term...

- Balance sheet equality Definition Balance sheet equality (basic accounting equation) is a mandatory coincidence of balance sheet assets (line 1600) and balance sheet liabilities (line 1700). In other words, there should always be a check...

- Other liabilities 1450 Definition Other liabilities 1450 are other liabilities of the organization, the maturity of which exceeds 12 months, which are not included in other groups of the 4th section of the balance sheet. Their presence...

- Revaluation of non-current assets 1340 Definition Revaluation of non-current assets 1340 is the added value of non-current assets discovered by revaluation. In fact, this is a re-determination of the value of non-current assets, which, if this ...

- Estimated liabilities 1430 Definition Estimated liabilities 1430 are estimated liabilities, the expected fulfillment period of which exceeds 12 months. Despite not the simplest definition, in fact, estimated liabilities are...

Which business has the highest profit?

Now you know how to calculate gross profit. But which companies have the highest revenue?

Companies with the highest profits tend to be service-oriented. This is because they have no costs associated with producing the product.

Why do some businesses produce products when clearly service-oriented businesses make more profits? If the business is large, then this may be due to volume. A larger business can move more and make more profits.

Balance sheet

This is a way of grouping and structuring the capital of the economy and the sources of its receipt. The balance sheet indicator reflects the economic position of the company for a certain period.

The main purpose of the balance sheet is reporting for the owner of the company . The balance sheet includes information: about material assets, the amount of depreciation reserves, the state of accounts, and investments being poured in.

Consists of two parts: an asset and a liability. Asset – resources of the enterprise, liability – sources of their receipt. Ultimately, assets and liabilities must be equal to each other.

Gross revenue is an integral criterion and assessment of the success of a company or enterprise. This parameter clearly demonstrates the economic situation. But the main thing is to know how to use it correctly and apply it in accounting.

Necessary explosives - what is it?

Required gross revenue – economically justified financial resources required by a company or organization to conduct business activities during a certain regulatory period.

Reference! Regulates the standards for the required gross revenue “Order of the Federal Tariff Service of the Russian Federation dated March 30, 2012 No. 228-E “on the approval of guidelines for regulating tariffs using the method of return on invested capital.”

When calculating tariffs using the return on investment capital method, gross revenue is taken into account at the time of setting tariffs according to the following template: Calculation of the required gross revenue for a long period is carried out on the basis of long-term regulatory parameters:

- start-up operating costs;

- cost efficiency index for operations;

- the amount of capital investment;

- working capital (net);

- normalized return on investment in capital;

- terms of return of investments in capital;

- ratio of controllable operating expenses by assets;

- technological resource consumption standard;

- an indicator of the quality and reliability of the goods and services offered.

Postings in accounting

Postings are special correspondence of accounts intended for a more detailed reflection of transactions in accounting registers. Every accountant should be able to quickly compile records of various transactions.

Kinds

Wiring can be simple or complex . The differences are that simple ones use two related accounts, while complex ones use more than two accounts. Compiled documents are distributed among accounting registers.

Compilation

When drawing up postings, the following aspects are taken into account:

- on passive accounts the balance can only be a credit, while on active accounts there can only be a debit balance;

- increase in active accounts - by debit, passive - by credit;

- active-passive accounts are reflected in two states at once (balance sheet asset and liability);

- When filling out the balance sheet, lines with active balances are displayed on the left side, and passive balances on the right.

To make transactions, follow the following diagram:

- determine which structures and accounts are included in the transaction being completed (economic aspect only);

- determine the type of posting accounts (active or passive, credit or debit). Consider the initial parameters of the operation and the necessary factors.