A plastic snow shovel is broken: what to do?

A plastic snow shovel is a reliable snow removal tool that almost everyone has. However, it requires remarkable strength and a certain dexterity.

Today, varieties of snow removal equipment are becoming more common. It may vary in appearance, cost, design and functionality. If you decide to purchase such a device, read it first here.

In it you will find a lot of useful and interesting information about modern snow removal equipment. If you don’t want to bother and decide to buy a new similar shovel, then you must fulfill a number of conditions.

They will allow you to choose the most suitable shovel option and help extend its service life.

Reasons and grounds for writing off material assets

In the second case, writing off valuables requires an individual approach, and in each case, writing off is carried out on commission.

There are several options for snow shovels. They have different characteristics and the choice should be made carefully. Below are snow shovels made from different materials and their most important qualities: Wood.

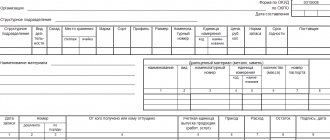

Methods for writing off material assets should be reflected in the accounting policies of the enterprise. Detailed write-off processes (templates for documents for write-off, regulations for their execution and reflection on accounting accounts, other aspects) are prescribed in the internal regulations of the enterprise (Regulations on accounting and write-off of valuables, orders, instructions, instructions).

Thus, even before the start of writing off assets, the enterprise needs to regulate this process (develop internal regulations and instructions) and consolidate important accounting aspects in the accounting policy.

Writing off valuables during the production process is a natural process. It is impossible to make a product without using up certain materials. It does not matter what type of final product is manufactured - write-off of raw materials is inevitable.

Useful: how to write off inventory items for production or sale

Accounting and tax accounting for the write-off of inventory items (material assets) depends on the type of these assets and the grounds for their write-off (disposal).

Inventories include inventories (MPI), as well as finished products (clause 2 of the Accounting Regulations “Accounting for inventories” PBU 5/01, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n (hereinafter referred to as PBU 5/01), clause 3.15 of the Guidelines for the inventory of property and financial obligations, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49). Read more in ConsultantPlus

Describe the defects of plastic products

If the content is low, the filler does not have the proper reinforcing effect; if it is in excess, it is not completely wetted by the polymer; increased water absorption is the result of an excess amount of hygroscopic fillers. Molding defects arise due to deficiencies in the design of the mold and molding machines, incorrect selection or violation of the plastic processing regime.

Particularly important is compliance with the temperature regime and duration of the molding operation.

With deviations from the optimal molding temperature, uneven heating of molds, rapid or slow cooling, destructive processes can occur, significant internal stresses may arise, causing deformation of products, appearance of defects in appearance, and also reducing mechanical strength. The most common molding defects include the following: warping - distortion of the shape of products,

We recommend reading: Who can file a missing persons report?

REPORT ABOUT THE SHOVEL.

naval humor.

During testing, the shovel broke.16. The broken shovel was not included in the write-off act.17. The shovel is not excluded from the fire board inventory.18.

There is no administrative conclusion about the cause of the shovel failure.19.

There is no order to punish the person responsible for breaking the shovel.20. Even before the breakdown, the shovel exceeded the weight standard by 11 kg.

250 gr.21. The shovel was not assigned to a specific sailor of the combat fire crew.22. During operation, the shovel was repeatedly used for purposes other than its intended (firefighting) purpose. The investigation established: in winter conditions, the boatswain, Petty Officer 1st Class, V.D. Chuvilin was using it to clear the snow on the deck. At the same time, she beat the boatswain, Petty Officer, 1st Class, V. Chuvilin.

D. And on March 8, a fire shovel was used at a demonstration to carry a portrait of a female historical figure on its tray. Conclusion.

Due to the final breakdown of the shovel - factory No. 15256 (ship No. 5) - it is impossible to recognize its further use for combat and firefighting needs.

gold4

April 9th, 2012, 12:06 pm How to write off property (1)? Have you ever had to write off property in an enterprise or organization?

Poring over the act, coming up with a reason for the write-off? (We know that sometimes what was written off wandered to someone’s dacha). Or maybe this problem is facing you today? Then below, an excerpt from the story by the Soviet writer Viktor Konetsky “How I am” will help commanded a ship for the first time.” The excerpt shows a document that, according to the author of the story, he happened to see during his service in the Navy - in the form of a Report, but in fact an Act for the decommissioning of the most primitive shovel located on a fire shield .

Instructions on the procedure for writing off equipment, inventory and other property that have become unusable and are included in fixed assets (funds) in institutions, organizations and enterprises of the system of the USSR Ministry of Education (in fact not applied)

on the procedure for writing off equipment, inventory and other property that has become unusable and included in fixed assets (funds) in institutions, organizations and enterprises of the system of the Ministry of Education of the USSR ___________________________________________________________ Actually not applied.

I think this passage will inspire anyone to come up with an adequate reason to justify the write-off of any property. So, the passage: “Secret. To the commander of “SS-4138” Lieutenant Konetsky V.V. Captain-Lieutenant Dudarkin-Krylov N.D. RAPORT I hereby bring to your attention regarding fire shovel No. 5. Equipment, inventory and other property listed as part of fixed assets and have completely lost their educational and production value due to wear and tear, after working out the established service life, dilapidated and unusable condition, as well as destroyed

Write-off of business equipment

In the construction field of human activity, a galvanized bucket is simply necessary. Here it is used for transferring and preparing enamels, varnishes, adhesives, finishing solutions and for delivering water.

For ease of transportation, it is equipped with a metal shackle that can withstand weight up to 15 kg, and has a durable body that does not change shape.

The increased strength and long service life of this utensil is achieved due to the fact that thin sheet metal is used for its manufacture, protected from rust and from the effects of various chemical compounds by a special coating, which distinguishes a galvanized bucket from its functional analogues produced by industry. If we compare them with plastic buckets, the disadvantage of greater weight is more than offset by the fact that they can store a wide range of chemically active substances (solvents, etc.) that do not come into contact with the protected metal, but can change not only the properties , but also the structure of polymers.

Cause of snow shovel damage

A block will be needed to install the manufactured bucket to the junction with the handle - again using self-tapping screws. To make the snow slide better over the shovel and prevent it from sticking, after making the product, you should treat it with sandpaper.

Making a scraper Such a cunning mechanism as a scraper will make it easy to move a large amount of snow.

Of course, with its help you will not clear a narrow path. But a scraper is quite capable of improving the appearance of a large area! To make it, a sheet of plywood, in the same way as in the previous version, is covered with a metal edging at the bottom. This ensures better sliding of the bucket on snow and a longer service life of the product.

The surface size of a plywood sheet can be quite large.

The main condition is to be able to then move the volume of snow that the manufactured scraper will take on. The handle of the device can be made of bars of suitable length or be ready-made metal.

Can bailiffs seize a house for debts from another bank if it is mortgaged?

The value of the instrument is transferred monthly until it is completely written off. The amount of annual deductions is determined by the product of the cost of the instrument and the annual depreciation rate. The amount included in the monthly cost is calculated by dividing the annual depreciation amount by 12 - the number of months.

This group of industrial goods includes household supplies and equipment with a useful life of up to 12 months, regardless of cost.

The service life can be calculated in units of time, as well as other units of measurement - kilometers, meters, etc. based on the functional purpose of the product.

Reasons for writing off a galvanized bucket

Appears during breaks in pouring metals.

Chill (a defect in cast iron cookware) is the formation of free cementite in the surface layer in the form of a light crust.

Mechanical damage - dents, nicks, damage to the integrity of the casting (formed when the mold is knocked out). Defects of stamping are observed in all types of steel utensils, utensils made of copper alloys, and sheet aluminum: Fractures - rupture of metals during deformation.

Nicks are the introduction into the surface of a product of pieces of metal that have fallen into the stamp. Dents are local deformation of goods due to mechanical stress. Corrugations are wavy folds on the surface of a product. Burrs are sharp, uneven edges of products. Drawing is the spiral-shaped and concentric marks of a press when processed on pressing machines.

Side waviness is the deviation of the edge of the pan from the specified shape.

Thickening or thinning is observed in individual parts of goods. Defects of the protective and decorative coating include:

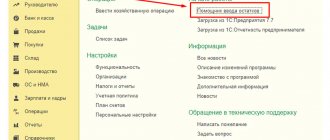

Enter the site

How would everything be interchangeable and in case of breakdown/wear you can buy a separate part to replace it - when replacing it in the future, then we immediately write it off as a cost? — Do I need to do a completion certificate?

I want to draw the moderator's attention to this message because:

A notification is being sent.

[e-mail hidden] Minsk Posted by 262 Reputation: December 4, 2013, 5:01 pm Finski, the cost of transferring inventory into operation is debited from account 10.9. Is the quantity written off at the time of knockout due to a breakdown, for example?

no further suitability. I would not complete the mop, but would write everything off separately, because...

If, for example, a pen or holder breaks, you simply write it off and buy new ones.

And so, complete the mop (a complete set certificate is needed), and then when

Conditions for classifying an instrument as a fixed asset

The secret of a true master is not only in the perfectly trained ability to perform his work, but also in the tool with which this work is performed.

Raw materials and materials are written off at the enterprise according to reporting periods (daily, ten-day, monthly, quarterly).

If materials were received as surplus or during disassembly, repair, or disposal of other property, take them into account at the estimated cost.

Working tank for mastic 6 10 0–70 0–14 Scoop for mastic 6 10 0-50 0–10 Steel brush 24 20 0-53 0–05 Metal square 60 20 1-72 0–07 Workbench 48 20 7-50 0 -38 Total – – – 3-85 Painters – – – – Scissors 20 30 1-00 0-18 Steel spatula 18 100 0-34 0–23 Wooden spatula 3 100 0-15 0-60 Ruler 6 20 0-30 0 –12 Compass 36 10 1-00 0-03 Wooden square 24 10 0-30 0–03 Plumb line 24 40 0-60 0–12 Block 12 10 0–30 0-03 Spray gun 84 10 27-90 0-40 Gun 84 10 20-50 0-29 Flying brush 12 50 2–53 1-27 Hand brush 6 100 0-95 1–80 Stencil brush 6 100 0-36 0-72 Flute brush 12 100 0-95 0-95 End brush 30 3 48-07 – Electric glue cooker.

- This is stated in paragraph 102 of the Instructions to the Unified Chart of Accounts No. 157n.