Key components of the tariff system of remuneration

The tariff system is the most common payment model. She shares this:

- Time-based tariff system - the actual time worked by a person is taken into account.

- Piece-rate tariff system - it takes into account how much the employee produced (provided services).

The elements of this system include tariff indicators:

- Grid;

- Discharges;

- Odds;

- Rates;

- TKS.

The tariff schedule is a scale that connects categories with coefficients. For example, for state employees, tariffs for 18 categories are applied. The size of the tariff and earnings is influenced by the qualifications and complexity of the work. The calculation base is considered to be the first category rate. It sets the salary for the reporting period.

ETKS - unified tariff and qualification list and EKS - unified directory of administration positions were created for tariff classification and rank division of personnel. They describe what education and experience an employee should have, his knowledge, skills, and nature of work. Today, employers can use professional standards that meet the requirements of the labor market.

Tariff schedule and tariff category

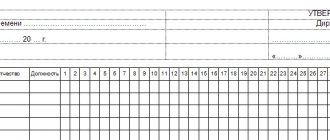

The tariff schedule represents the ratio of tariff rates in accordance with the category. Designed in the form of a table for entering data. For different categories of work, tariff scales with different numbers of categories are provided.

Enterprises, as a rule, use a six-digit grid, where the first digit is the lowest and the sixth is the highest.

An enterprise, in accordance with its internal situation, can change the tariff scale towards increasing or decreasing its range. The instrument in question is used not only in relation to blue-collar professions. The tariff schedule is typical for calculating wages of public sector workers.

The tariff category shows the level of qualifications and skills of the employee and characterizes the complexity of the work he performs. The composition and size of an employee’s salary largely depends on the tariff category.

How are tariffs set for paying employees?

Personnel performing basic operations are assigned category I. It increases with the growth of the worker’s professionalism.

The tariff rate is fixed by local acts of the organization, regulations, agreements, and collective agreements. The established payment system for work must fully comply with the Labor Code of the Russian Federation, and the established rates must comply with the norms of ETKS, EKS, professional standards, and also not contradict state guarantees.

According to Rostrud Letter No. 1111-6-1 dated April 27, 2011, official bodies recommend establishing equal salaries for positions of the same name in the state.

Work of equal value must be paid equally (Article 22 of the Labor Code of the Russian Federation). Other payments in excess of the tariff: allowances, incentives and others may vary for employees depending on the following points (Article 132 of the Labor Code of the Russian Federation):

- Qualifications;

- Difficulties of activity;

- Amount of labor costs;

- Quality of work.

Employee earnings also increase by the coefficients indicated in the table.

| District groups | coefficient |

| Far North: North-eastern districts Siberia (northern regions) European part (northern regions) | 1,6-2,0 1,4-1,8 1,4-1,5 |

| Areas equated to the regions of the Far North: Far East | 1,4-1,6 1,3-1,4 |

| South of the Far East and Eastern Siberia | 1,2-1,3 |

| European North (except the Far North) | 1,15-1,2 |

| Ural, south Western Siberia | 1,15 |

These coefficients are determined by government bodies by industry and separate areas of organizations.

Example #1. Payroll calculation according to the tariff system of remuneration

Accounting employee M.P. Chernygova earnings are calculated based on the daily tariff rate: 1,200 rubles/day. In addition, she is entitled to a bonus of 2,500 rubles per month. It operates in the Far East with a multiplying factor of 1.5. In August 2021, she worked 18 days out of 22 as scheduled, and was on sick leave for 4 days, the amount of which amounted to 4,054 rubles.

The employee’s earnings for August are equal to: ((1,200*18)+(2,500/22*18))*1.5+4,054=(21,600+2,045.45)*1.5+4,054= 39,522 ,18 rub.

Peculiarities

Sometimes an employee cannot work the quota established at the enterprise for good reasons.

Then the hourly rate should be calculated as follows: the rate during the accounting period should be reduced by the number of days that the employee was absent.

Example:

Kovaleva A.M. works as an operator in the company. Her work schedule is variable, her salary is 20,000 rubles, the monthly norm is 158 hours. In March 2016, Kovaleva did not work 18 hours of normal work because she was on sick leave.

When calculating the hourly rate, the rate should be reduced by 18 hours:

20,000 rubles: 140 hours (158-18) = 142.85 rubles/hour.

Calculating the hourly rate is necessary for many calculations. More and more organizations are leaning in favor of the second method of calculation. This is necessarily reflected in local regulations.

Didn't find the answer to your question? Call the hotline numbers. 24 hours free!

Time-based wage system

Earnings depend on the skill of the employee and the time he works. The system is implemented when labor is not standardized and it is difficult to take into account the number of actions performed by a person. Often time-based payments are used to pay administrative and management personnel (AUP), support and service personnel and part-time workers.

Earnings for simple time work are calculated by multiplying the rate by the time spent on work. If not the entire calculation period has been worked out, the interval actually worked is taken into account.

Salary = Hourly rate x Hours worked

In a similar way, you can calculate wages by day.

The bonus form, in addition to the time spent on work, implies taking into account the quality and quantity of duties performed. Based on this, the employee is entitled to a bonus: a fixed amount or a percentage of the base in accordance with the collective agreement, regulations and order.

Salary = Hourly rate x Hours worked + Bonus

Salary (option No. 2) = (Hourly rate x Volume of hours worked) * Bonus percentage

If the results of work are unsatisfactory, the employer has the right not to issue bonuses to the employee.

Example #2. Payroll calculation according to the temporary wage system

Employee of Mayak LLC, painter N.N. Vasiliev. The tariff rate assigned is 155 rubles/hour. In July of this year, he worked 176 hours (22 days * 8 hours). The organization provides bonuses for employees of this position in the amount of 3,500 rubles. monthly.

Vasiliev’s earnings for July 2021 will be: 155*176+3,500 = 30,780 rubles.

What is the tariff rate

People cannot receive the same compensation for their work. The amount to be paid as salary depends on:

- qualification level of personnel;

- difficulties of the labor functions assigned to the employee;

- quantitative characteristics of work;

- conditions of employment;

- time allocated for completing work, etc.

Differentiation of wages according to the degree of expression of these points is carried out within the framework of the tariff system of labor remuneration. Its key element is the tariff rate as the main component of wages.

Tariff rate is a documented amount of financial remuneration for achieving a labor standard of varying degrees of difficulty by an employee of a certain qualification for a given unit of time. This is the “backbone”, the minimum component of the payment for labor, on the basis of which the amount received by employees “in hand” is based.

REFERENCE! An employee cannot receive an amount less than the tariff rate under any circumstances if all functional duties are performed in full - this is the minimum guaranteed by law.

Not part of the tariff rate:

- compensation;

- incentive payments;

- social charges.

Question: The organization is planning organizational changes (personnel changes, staff reductions, changes in wage conditions, etc.). In what cases will it be necessary to make changes to the staffing table and how often do they need to be made? Is it enough to reflect only the tariff rate (salary) in the employment contract, and stipulate incentive payments in the collective agreement? View answer

Estimated time of tariff rate

The time period for which the tariff rate is calculated can be any period convenient for the employer:

- hour;

- day;

- month.

hourly tariff rates if the enterprise operates a shift schedule, which stipulates the mode of summarized recording of working hours, as well as when hourly employees work.

Daily tariff rates are applied when work has the status of a daily wage, while the number of working hours in each such day is the same, but differs from the usual norm established by the Labor Code of the Russian Federation.

Monthly tariff rates are valid subject to constant observance of normal working hours: a stable schedule, fixed days off. In such conditions, the employee will “close” the month regardless of how many hours he actually worked: having worked the monthly norm, he earns his salary.

How to indicate salary and tariff rate in an employment contract ?

Piece rate form of remuneration

With this form of payment to staff depends on the final result of work, taking into account the quality of services provided or finished products. Such a system gives a person an incentive to increase productivity and ensure good quality of his work.

The amount of earnings is determined at piece rates per unit of production or operation. The transaction is practiced by organizations that can clearly record the quality and volume of goods produced or actions performed.

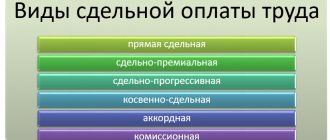

An organization can make payments for work results individually or collectively, for example, for a team of employees. Depending on the method of calculating wages, the transaction is divided into several types:

- Direct - at fixed prices;

- Premium - bonuses are applied for processing and on other grounds;

- Progressive - prices increase when production exceeds the norm;

- Indirect - earnings directly depend on the result of labor;

- Accord - a deadline and payment are established for the entire volume of work.

Tariffing procedure

Tariffication occurs by comparing the work performed at the enterprise with the list and examples of work contained in a single directory. For pricing purposes, an enterprise can develop and introduce internal lists of work, and use them along with the main ones.

Depending on the rank, the salary of an employee of an enterprise varies. To transfer an employee from rank to rank, in accordance with the internal regulations of the organization, a qualification commission is formed and convened, and its chairman is elected.

The employee, in the presence of members of the commission, passes a qualification exam, which includes testing theoretical knowledge and, in some cases, practical skills. If the exam is passed successfully, the employee receives a certain rank or moves from one to another, which is recorded in his work book. To rate the salaries of managers, as well as employees and specialists, a single directory of the specified positions is used.

Recommendations for improving the tariff system

This form is based on clear rates and takes into account ongoing circumstances. It is ideal for remuneration according to plan: for completing a specific amount of work.

It has some disadvantages. Employees who constantly receive official salaries do not strive to increase the intensity and efficiency of their work, or to make the production process more optimal and rational.

Additional financial compensation for employees is simply necessary. This will stimulate initiative and a creative approach to fulfilling your duties.

By paying raises and bonuses to employees who show the best results, the manager ultimately wins. Production begins to actively develop.

Compliance with several simple rules will have a positive impact on the economy of the organization, in terms of wages at the tariff:

- Arouse workers' interest in the wage system;

- Payment for identical work is equivalent;

- Divide rates not only depending on the skill of the staff, but also on the results, complexity, and intensity of the activity;

- Create interest in replenishing the workforce;

- Provide bonuses and salary increases to highly qualified specialists who show significant results for production;

- Raise prices for work performed above standards.

Average salary calculation

To calculate the average salary, you need:

- The amount of wages accrued for 12 months. If the employee worked less, all days worked are taken into account;

- Working hours according to the calendar. To calculate it, add up all calendar days in a year and divide by 12. The result is the average number of days in a month.

Formula for calculating average salary:

Average salary = Payments for the period / Time worked

Formula for calculating average monthly salary:

Salary = Salary per year / Days on average

- Days on average - averaging the number of days in a month.

Formula for calculating average daily wage:

Average daily salary = (Basic salary + Additional) / (12 × 29,3)

- Basic salary - the amount of basic salary for 12 months. Includes payment based on official salary, tariff or piecework.

- 29.3 is the average number of days in a month established by law.

- Additionally - additional payments for 12 months. The additional salary fund includes additional payments, allowances, bonuses, remunerations, coefficients, night and overtime.

When an employee resigns, compensation for unused vacation is added to the salary. In this case, the average monthly salary is adjusted to the actual time worked and earnings per day are calculated. The number of days of remaining vacation is multiplied by the average daily wage.

Tariffs in the budget

The wage system in the budget is established by a collective agreement, agreements, and other local acts. They must comply with the laws of the Russian Federation.

Payment in the budget until December 2008 was carried out according to the Unified Tariff Schedule. She acted on the basis of Resolution No. 785 of October 14, 1992.

| Pay grades | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Tariff coefficients | 1,00 | 1,36 | 1,59 | 1,73 | 1,82 | 2,00 | 2,27 | 2,54 | 2,91 |

continuation:

| Pay grades | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| Tariff coefficients | 3,27 | 3,68 | 4,18 | 4,73 | 5,32 | 6,00 | 6,68 | 7,41 | 8,23 |

Each employee, according to the UTS, has his own pay ratio.

The salary (tariff) of the first category must be equal to or exceed the minimum wage (see → table of minimum wages by year). The maximum size of this indicator is unlimited and depends solely on the employer’s finances.

The rates for personnel of the highest ranks are equal to the product of the level 1 rate and the skill coefficient.

Now work is paid in a new way (NSOT), this is enshrined in Resolution No. 583 of 08/05/2008. The principle of payment to public sector employees is based on data from the ETKS and EKS, state guarantees, lists of additional payments and incentives.

The size of the rates is determined in a new way by the manager, taking into account the skill of the employee, the complexity and significance of his work. The amount of earnings excluding additional payments under the NSOT should not be lower than the indicators established in the UTS for similar work.

According to the recommendations of the Russian Federation Commission dated December 25, 2015, employees of identical professional levels and positions should earn the same.

Calculation of average monthly salary

The amount of an employee’s average monthly salary is needed for basic payroll operations:

- vacation pay and compensation for unused vacation if an employee resigns;

- payments, while maintaining the average monthly salary at the main place of work;

- remuneration during downtime due to the fault of the employer or due to natural disasters and other force majeure;

- severance and other benefits, termination of an employment contract, staff reduction;

- disability benefits;

- payment for working hours on business trips.

The average monthly salary is calculated if the employee requests income certificates and other data.

The list does not include some types of social benefits and compensation:

- one-time financial assistance (for vacation, for treatment);

- compensation for travel, housing and communal services, food;

- benefits for temporary disability and maternity;

- monthly benefits for caring for a child under 1.5 or 3 years old;

- funeral allowance and some others.

The last 3 types of payments are made from the Social Insurance Fund. To compensate them, the employer submits special petitions.

When calculating average monthly earnings for the past year, the above social payments and compensations are subtracted from the amount of accruals. The resulting amount is divided by the number of calendar months worked. A calendar month is understood as a fully worked period from the 1st to the 30th (31st), and in February - to the 28th (29th).

Important!

Salary calculation is regulated by Article 139 of the Labor Code and the Regulations of the Government of the Russian Federation of 2007 (as amended from time to time).

Additional payments in the tariff system

Additional payments are used to compensate the employee for any losses in salary caused by reasons beyond his control. Bonuses encourage workers to improve their professional qualities and skills.

Some above-tariff payments are fixed in the internal documents of the organization, while others are mandatory and guaranteed by law. For example, payments for an academic degree, northern payments, for movement along a mine shaft, etc. Additional payments can be established by agreement of the parties and enshrined in the employment agreement.

Additional payments can be divided as follows:

| Payment groups | Special nature of the work | Special working conditions |

| Types of surcharges and allowances | Weekends and holidays | Dangerous and harmful conditions |

| Shift work | Intensity of work on the conveyor | |

| Overtime work | Combination of professions, substitution | |

| Dividing a work shift into parts | Night work |

According to Art. 191 of the Labor Code of the Russian Federation, the employer has the right to independently establish the types of incentives for employees for the successes they have achieved. Additional payments are fixed in the collective agreement, charter, and regulations on discipline. Allowances for work are stimulating and depend on the business qualities of a particular employee.

How to calculate personal income tax

Personal income tax (NDFL) is 13% of accrued wages and will be calculated using the formula:

(Salary per month) * 13% / 100

Example 5

Let’s assume that a worker planting trees received 27,500 rubles in accordance with the piece-rate progressive wage system. Personal income tax will be:

27500 * 0.13 = 3575 rubles

The employee received:

27500 – 3575 = 23925 rubles

There is a system of tax deductions from the personal income tax base, which includes standard, social, property, professional and other deductions.

Let's look at the example of the most common standard deduction for a child (children). The deduction is provided in the amount of 1,400 rubles for the first child, a similar amount for the second child, 3,000 rubles for the third child and a similar amount for the fourth child. The deduction occurs from the tax base (i.e. from accrued wages) until the accrued amount of wages from the beginning of the year does not exceed 280 thousand rubles. The calculation is made using the following formula: (Monthly salary – Tax deduction) *13% / 100

Example 6

Let's assume that the employee's income is fixed and amounts to 27,500 rubles. per month. The employee has three minor children. For the first two, the amount of tax deduction will be 1400 * 2 = 2800 rubles, for the third 3000. Total 5800 rubles. will be deducted from RUB 27,500. for 11 months inclusive. The tax base will be 21,700 rubles. In the 12th month, wages, cumulatively summed up from the beginning of the year, will exceed 280 thousand rubles, after which the employee will lose the right to apply a tax deduction. Let's do the math:

(27500 – 5800) * 0.13 = 2821 rub.

The employee will receive:

27500 – 2821 = 24679 rubles.

Results

Salary is the minimum fixed amount of wages for a fully worked calendar month, excluding additional incentive or compensation payments.

To calculate salary based on salary, it is necessary to adjust the salary amount by the number of days worked in the billing month. Additional payments are added to the calculated amount if the employee has the right to receive them in accordance with the employment contract or other internal regulations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.