The employee was paid income (compensated for travel expenses), confirmed only by indirect documents. According to officials, this income should be included in the personal income tax tax base. The arbitrators have a different opinion. The organization decided not to calculate or withhold tax. What threatens the organization and the employee if tax inspectors reveal this fact?

Individuals are recognized as payers of personal income tax (clause 1 of article 207 of the Tax Code of the Russian Federation). Russian organizations from which or as a result of relations with which the taxpayer received income are required to calculate and withhold personal income tax from the taxpayer’s wages and pay tax to the budget (clause 1 of Article 226 of the Tax Code of the Russian Federation). That is, organizations are tax agents for this tax (Article 24 of the Tax Code of the Russian Federation). Payment of personal income tax at the expense of tax agents is not allowed (clause 9 of article 226 of the Tax Code of the Russian Federation).

For reference

The specified wording of paragraph 9 of Art. 226 of the Tax Code of the Russian Federation is valid until December 31, 2019. From 2021, this rule has been supplemented by an exception: payment of tax at the expense of tax agents is not allowed, except in cases of additional assessment (collection) of tax based on the results of a tax audit in accordance with this code in case of unlawful non-withholding (incomplete withholding of personal income tax from wages) of tax by the tax authorities agent (as amended by Federal Law No. 325-FZ dated September 29, 2019).

Until 2021 and starting from 01/01/2020, for employers who did not withhold personal income tax in cases provided for by law (and who did not report this fact to the tax office), the consequences will be different.

Who must fulfill the obligation to pay tax?

The obligation to transfer personal income tax to the budget arises when there is an object of taxation.

In this case, the following categories of its payers can be distinguished:

- Individuals as independent payers of personal income tax on the amount of income received.

- Organizations and individual entrepreneurs - as a tax agent when withholding tax on income paid to employees.

If the organization has separate divisions, you must adhere to the procedure for paying personal income tax for branches, which is described in the material “If the personal income tax for a division went to the head office address, there will be no sanctions.”

Distinctions of a good accountant

For those who do not know accounting November 17, 2021 18721 60 9

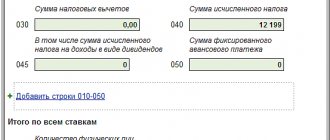

Also note: the amounts of calculated (line 040) and withheld (line 070) personal income tax may not match. There will be inequality if income from the March salary has already been recognized, personal income tax has been calculated on it, but the actual payment has not yet been made - it will only occur in April 2021.

How to calculate the 6-personal income tax for the 1st quarter of 2021 to reflect the salary for March, which was paid to employees in April 2021? Should this payment be shown in sections 1 and 2? Is there any official clarification from the Federal Tax Service on this matter? You will find answers to these and other questions, as well as an example of reflecting the March salary in 6-NDFL in this article.

What violations occur in the field of personal income tax

Liability for personal income tax arises in the following cases:

- If the taxpayer or tax agent has not paid the tax or paid it, but not in full (more about this in the material “The Ministry of Finance does not support the proposal to increase the fine for tax agents to 200% of the unpaid amounts” ).

- If the payer (agent) did not report on the forms established for personal income tax or made errors in them. Details are in the publications:

- “Fines for 6-NDFL: rules for imposition”;

- “A fine will be imposed for any errors in 2-NDFL.”

How not to miss anything

We publish a link to the article as soon as it is published. We will separately let you know about important changes in laws. We joke, but not too funny.

We send articles a couple of times a week, as well as a news digest and greetings from Modulbank. By subscribing, you agree to the privacy policy.

And if you don’t want to subscribe by email and make friends on social networks, well! You can type our address manually in your browser, just like in 2000.

Read to the end

To read this article further, and then receive materials about business every day, leave your email JSC CB "Modulbank" License of the Central Bank of the Russian Federation No. 1927 dated March 16, 2016.

When does liability arise for non-payment of tax?

An employer who, acting as a tax agent, is obliged to withhold personal income tax on income paid to an employee may also be found guilty of non-payment of tax. At the same time, he can commit this evasion in different ways, on which the number of sanctions applicable in each specific situation depends. More information about such violations can be found in the article “What liability is provided for non-payment of personal income tax?”

We also advise you to pay attention to the article, which deals with whether liability arises if the payer paid the tax the next day after the deadline for payment - “Follow the deadline for paying personal income tax to the budget.”

There are situations when the tax agent failed to pay the tax, but the tax authority did not detect this offense. In this situation, the question may arise: within what time do controllers have the opportunity to bring the violator to justice? You will learn the answer from the article “The Federal Tax Service explained how to calculate the tax limitation period for personal income tax agents.”

The period specified in this article takes into account the method of receiving income - cash, non-cash, in kind or in the form of material benefits.

Some unscrupulous payers try to save on taxes to minimize their costs. Most often this is connected specifically with salary taxes, since this is the main large-scale expense item for most organizations. In order to hide the employee’s real income from controllers, the employer can resort to the payment of wages in envelopes, thereby reducing the tax base for calculating personal income tax and insurance contributions.

When an employer may face criminal liability for an envelope salary (non-payment of personal income tax on the amounts of paid salary income), find out from our material.

An employee who receives a salary in an envelope may also be liable for personal income tax (if he is aware that the employer does not withhold or pay tax deductions from his salary).

When receiving income from which personal income tax has not been withheld, the employee must independently fill out a declaration, submit it to the tax authority (by April 30 of the following year) and pay the tax. If he does not do this, the tax authority may collect personal income tax and penalties from him. For failure to submit a return, an employee may be subject to a fine of 5% of the unpaid tax amount for each full or partial month from the day on which it was due. Failure to pay personal income tax on a large scale may also result in criminal penalties.

Having committed an offense related to non-payment of personal income tax, the payer, in addition to the unpaid amount and fine, must transfer the amount of the penalty to the budget of the Russian Federation. However, its calculation has some peculiarities. In this case, it is necessary to determine:

- There are circumstances when a penalty cannot be assessed.

- Can the Federal Tax Service independently calculate the amount of penalties.

The emphasis on these issues is made in the material “What threatens a personal income tax agent who fails to withhold tax?”

Find out how to calculate penalties from the material “Penies have been increased, but not for everyone.”

It is very important, when paying the penalty accrued for non-payment of tax, not to make a mistake in the details, because the BCC, depending on the category of the payer and the type of income received, changes.

The details for paying penalties for personal income tax in 2019–2020 remained unchanged and are presented in the material “KBK for transferring penalties for personal income tax in 2019–2020.”

As for the fine, our material “What is the liability for non-payment of personal income tax?” will help you correctly calculate its amount.

If the underpayment is found next year

The company would be out of luck if it noticed an underpayment the following year. For example, the error was in 2021, but it was found after April 1, 2021. In this case, the company will have to pay a fine - 20% of the amount of the underpayment - and the employee himself will pay the tax.

In June 2021, the accountant quit, and the owner of the company paid the salary himself. He forgot to withhold personal income tax from Anatoly’s salary.

The salary is 50,000 rubles, which means that 6,500 were not paid into the budget. This is 13% of fifty thousand rubles.

After April 1, 2021, the tax office sent a fine of 1,300 rubles. But Anatoly himself will pay the tax for himself.

The procedure is as follows:

- make sure the fine is correct;

- pay fines and penalties;

- submit certificate 2-NDFL.

Make sure the penalty is correct. Sometimes a company pays personal income tax on time and in full, but still receives a fine. To prevent this from happening, you need to order a reconciliation report or statement of settlements with the budget. It can be done:

- at the tax office at the place of business registration;

- through your personal account on the tax website. There you need to find the section “Reconciliations with the budget” → “Submit an application to initiate the procedure...”.

Pay fines and penalties. If you really haven’t paid your personal income tax and you receive a fine, you need to pay it.

Letter dated August 4, 2015 No. ED-4-2/13600

Resolution of the Plenum of the Arbitration Court 57 of July 30, 2013

The tax office may ask you to pay not only a fine, but also penalties. But here everything is ambiguous. According to the letter, a tax penalty for personal income tax is charged if the company withheld but did not remit the tax. That is, she deducted tax from her salary, but did not send it to the tax office, but kept it for herself. The arbitration court believes that penalties should be accrued in any case.

If the tax office charges penalties, but the company does not want to pay them, you will have to go to court and prove the case there. But it is difficult to predict the exact outcome of the case.

Submit tax certificate 2-NDFL. The certificate must indicate sign “2” for employees who had a tax error.

Is it possible to reduce the tax agent's guilt?

Legislation in the field of rights - civil, criminal, administrative, etc. - provides for such conditions that make it possible to reduce a person’s responsibility for an offense committed, while the Tax Code of the Russian Federation also provides for this possibility. How to justify reducing the employer’s guilt is described in the material “Financial difficulties of a tax agent - organizations can mitigate liability.”

Let's consider another situation in which the question may arise: will liability be mitigated or not?

The organization fulfills all its duties as a tax agent, submits 2-personal income tax information in a timely manner, pays tax regularly, and all previous tax audit results were positive. But at some point she missed the deadline for remitting the tax. Will such a good reputation help mitigate taxpayer liability? You will find the answer to this question here .

And about what factors make it possible to mitigate the payer’s liability, read the material “Art. 123 of the Tax Code of the Russian Federation: questions and answers.”

If personal income tax was not withheld and all income was paid without withholding

And upon final payment for the month, 16,950 rubles are credited. (30,000 rubles - 13,050 rubles), of which personal income tax is withheld in the amount of 3,900 rubles. (RUB 30,000 x 13%). On the last day of the month, a posting is made to the debit of account 70 and the credit of the subaccount “Calculations for personal income tax” of account 68 “Calculations with the budget for taxes and fees”. The employee receives 13,050 rubles. (RUB 16,950 - RUB 3,900).

When an organization has cash revenue, it can be used to pay salaries, without necessarily withdrawing money from a bank account. Then the organization must pay the personal income tax withheld from wages for the second half of the month to the budget no later than the day following the day cash is issued to employees.

Income is not just money. Income can also be property. For example, which the employer transferred as salary. And also accepted gifts - fortunately, not all, but only some. We are talking about income in kind here. There is also a completely intangible type of income. This is when a person saved on something.

What is this income? Most often - salary. It's not limited to that. Income is a very broad concept. There is no exact list of situations when a person is considered to have received income. In fact, everything can be recognized as such, due to which the personal budget is replenished.

When there is no liability to pay personal income tax

There are cases in which at first glance it may seem that a violation has been committed, but in fact the taxpayer is not at fault. For example:

- The individual paid the tax before the obligation to transfer personal income tax to the budget occurred, i.e. he has not yet received income. You will find justification for the fact that in such circumstances there will be no offense in the material “If personal income tax is transferred ahead of schedule, a fine under Art. 123 of the Tax Code of the Russian Federation will not exist.”

- The tax agent transferred personal income tax to the budget, but has not yet paid the income to the employees. Read about this situation in the article “Is it legal to hold a tax agent accountable for early transfer of personal income tax to the budget?” .

- Transfer of tax for the branch to the tax authority at the place of registration of the parent organization. Often, having noticed such an error, the tax authority tries to attract the taxpayer. You will find arguments that will help you avoid liability, as well as decisions of arbitration practice and letters from regulatory authorities in the publications:

- “There is no fine for erroneous transfer of personal income tax at the location of the head office”;

- “Ministry of Finance of Russia: if personal income tax for a division is transferred to the location of the head office, there will be no fine.”

- The tax authority found the individual guilty of non-payment of tax when he made any major acquisition, believing that the reason for such a purchase was the receipt of hidden income. Thus, based on the expenses incurred by the individual, the amount of the fine is calculated. Why such actions of tax officials are illegal can be found out from the materials:

- “Taxpayers do not have the right to charge additional personal income tax based on the taxpayer’s expenses”;

- “The Federal Tax Service warned the inspectorates against additionally assessing personal income tax on taxpayers’ expenses.”

- “Personal income tax reporting during reorganization - what will change in 2018?”;

- “The tax on lottery winnings will be levied in a new way.”

To avoid being fined, taxpayers and personal income tax agents must constantly monitor changes in legislation on this issue. The materials on our website will help you with this:

The considered cases of prosecution for non-payment of personal income tax will allow you to navigate how to behave correctly in such circumstances in practice. “Fine (NDFL)” will always help you avoid getting into unpleasant situations or get out of them with minimal financial losses .

The employee continues to work

The salary was paid, but personal income tax was forgotten. But the employee continues to work on staff. In this case, you will have to recalculate personal income tax and deduct it from the employee’s future income: wages, sick leave, vacation pay. That is, he will receive less money than he expected.

By law, personal income tax can only be withheld in the current tax period. For example, for 2021 - until April 1, 2021. After this date you will have to pay a fine.

Here is the procedure step by step:

- Recalculate the personal income tax for the employee for the quarter and understand how much you need to pay extra.

- Warn the employee that he will receive less money because he received more by mistake last time.

- Transfer the missing tax amount by the end of the quarter.

- Correct form 6-NDFL for the quarter in which there was an error.

- Correct the 2-NDFL certificate for the employee by the end of the year.

In the corrective report on Form 6-NDFL, you must indicate the adjustment number and the correct amounts:

- if you are correcting a mistake for the first time, it will be about;

- the second is “002” and so on.

You can report on Form 6-NDFL in different ways: for a quarter, six months, nine months or a year. If a company submits Form 6-NDFL quarterly and discovers an error for the first quarter at the end of the year, all forms will have to be corrected.

certificate number (field “N___”) - certificate number with an error;

certificate date (field “from __.__.____”) - date of the corrective certificate. This is the date when you draw up a new certificate;

correction number—correction number. If you are correcting for the first time, write 01.

Calculation of taxes by tax agents in the Tax Code

If personal income tax was calculated incorrectly or was not paid for several months, it will not be possible to correct the error in one go. By law, you cannot take more than half of an employee’s salary or vacation pay for taxes. Therefore, you will have to draw up several corrective certificates 2-NDFL and 6-NDFL.

Tax agents in the Tax Code

Features of tax calculation by tax agents in the Tax Code

It happens that a company finds an error in personal income tax when an employee quits. In this case, it will not be possible to deduct tax from the employee’s salary, and the tax office must be notified about this before March 1 of the next year.

In 2021, the company incorrectly paid personal income tax to Anatoly. But the mistake was discovered when Anatoly left to work elsewhere. This means that you must notify the tax authorities about the error before March 1, 2019.

The plan is:

- Inform the tax office in writing that it will not be possible to withhold tax from your salary. To do this, you need to fill out a 2-NDFL certificate with the sign “2” and send it to the tax office.

Sign “1” is indicated in the certificates of employees for whom the company paid personal income tax. Sign “2” - for employees from whose income it was not possible to withhold personal income tax.

- At the end of the year, submit 2-NDFL tax certificates for all employees with attribute “1” and 6-NDFL declaration for the year before April 2 of the next year.

The tax office will notify the employee that he must pay personal income tax himself. He will receive a letter by email; the company does not need to control this.

If the company corrects the error with personal income tax before March 1 of the next year and sends corrected tax documents, there will be no fine or other penalties.

No more payments expected

You need to act differently if during the remaining tax period the payment of income to the employee in cash was no longer made.

Example 2.

On November 15, 2021, employee I. D. Romanova was paid upon dismissal (wages for days worked amounted to RUB 20,500.00 and vacation compensation amounted to RUB 12,650.00). The accountant calculated the amount of personal income tax to be withheld and transferred to the budget in the total amount of 2665.00 rubles. The amount paid to the employee was RUB 30,485.00.

The accountant made a mistake - the amount of personal income tax was withheld only from the salary of I.D. Romanova, and personal income tax was not withheld from the amount of compensation for vacations not taken and was not transferred to the budget.

Types of errors in the 2-NDFL certificate

The first option is being late.

If the first of April has passed and you have not submitted certificates to the tax office (they are accepted by the Federal Tax Service according to the attached register), prepare to pay a fine.

If your certificates do not pass the entrance control for any reason (whether in paper or electronic form you report to the tax office) and there is no time left to correct the documents on time, then these 2-NDFL certificates will also be considered not provided.

During incoming control, the completion of all required fields of the document is checked.

Example: a street is missing from the address - the certificate will definitely not be accepted, however, if the employee’s TIN is missing, then this will not be a violation during entry control.

Based on the results of the inspection, a protocol is issued or sent through the electronic document management operator, indicating the not accepted certificates and errors found in them.

You can calculate the total amount of the fine for the first version of violations as follows: (“Number of certificates not submitted” + “Number of not accepted”) * 200 rubles for each form.

The second option is, in fact, errors.

For example:

- There is a TIN, but for another person;

- A letter is missing from the surname;

- The street was renamed last year;

- Errors in rounding of income received, etc.

The 2-NDFL certificates accepted from you (entrepreneurs) are then subjected to a second (office) inspection. Tax inspectors check documents against databases to identify all inaccuracies and violations. Previously, it was enough to simply submit corrected documents. Since 2021, an accountant’s mistake began to cost 500 rubles for each certificate.

Example: The program has incorrect rounding configured. You have twenty-five employees. The fine will be twelve thousand five hundred rubles (25*500).

Actions of an employee in the event of violations of the employer’s obligations

If an employee discovers that an enterprise withholds personal income tax from his wages, but does not transfer the tax to the appropriate budget, he has the right to submit a written appeal to the Labor Inspectorate, the prosecutor's office or the tax authority to which the employer is attached.

When submitting an application, the employee must attach documents confirming the deduction of personal income tax. The evidence is an employment agreement indicating the employee’s salary (without deduction of tax), pay slips and sheets, statements from the employee’s personal account about the receipt of money on the salary card.

Recalculation of taxes when acquiring Russian resident status

An excessively withheld amount of personal income tax also arises in the event of a change in the status of the taxpayer from a non-resident to a resident of the Russian Federation. A non-resident paid personal income tax at a rate of 30%. After an individual is recognized as a tax resident of the Russian Federation, the specified income in accordance with paragraph 1 of Article 224 of the Tax Code of the Russian Federation is subject to taxation at a rate of 13%.

Until 2011, such overpayments were subject to refund. Legislative changes have confused users. The prohibition on the return of overpayment of personal income tax that arose in connection with a change in the taxpayer’s status does not mean that it is not necessary to recalculate the tax at a rate of 13% and take into account the overpayment in the next assessments.

Letters from the Ministry of Finance of Russia dated 08/12/2011 No. 03-04-08/4-146 and the Federal Tax Service of Russia dated 06/09/2011 No. ED-4-3/9150 indicate that the tax agent calculates, withholds and pays personal income tax amounts to the budget system of the Russian Federation with taking into account the tax status of the taxpayer determined on each date of payment of income. Having determined at a certain date the change in the status of a non-resident to the status of a resident, when calculating personal income tax, it takes into account the amounts that were previously accrued at a rate of 30%.

Users of 1C:Enterprise 8 programs do not need to do anything in this case. It is enough to indicate only the change in taxpayer status and the recalculation will be made automatically when calculating personal income tax.

Letter of the Ministry of Finance of Russia dated November 22, 2010 No. 03-04-06/6-273 indicates two cases in which tax refunds can only be made to the Federal Tax Service: change of Russian resident status, property deduction.

If an employee applies to an employer for a property tax deduction not from the first month of the tax period, the deduction is provided starting from the month of application.

A refund of over-withheld tax can be made by the tax authority when the taxpayer submits a tax return to the inspectorate based on the results of the tax period.

The Ministry of Finance repeatedly indicates in its letters that those amounts of tax that were withheld in accordance with the established procedure before receiving the taxpayer’s application for a property tax deduction and the corresponding confirmation from the tax authority are not “excessively withheld.”

However, representatives of the Federal Tax Service of Russia in a letter dated 06/09/2011 No. ED-4-3/9150 indicate that the refund of over-withheld tax when changing the status of a resident of the Russian Federation can be carried out by the tax agent-employer during this tax period.

In a letter from the Ministry of Finance of Russia dated September 28, 2011 N 03-04-06/6-242, Deputy Director of the Department of Tax and Customs Tariff Policy S.V. Razgulin replies that the above letter from the Federal Tax Service is a request to the Ministry of Finance of Russia, to which there were appropriate explanations were given. And the letter of the Ministry of Finance dated August 12, 2011 No. 03-04-08/4-146, which was issued in response to a request from the Federal Tax Service, clearly indicates that in accordance with paragraph 1.1 of Article 231 of the Tax Code of the Russian Federation, the provisions of which came into force on January 1, 2011. , the refund of the amount of personal income tax to the taxpayer in accordance with the status of a resident of the Russian Federation acquired by him is carried out by the tax authority with which he was registered at the place of residence (place of stay). The refund is made when the taxpayer submits a tax return at the end of the specified tax period, as well as documents confirming the status of a tax resident of the Russian Federation in this tax period, in the manner established by Article 78 of the Tax Code of the Russian Federation.

Thus, if an employee of an organization acquires the status of a tax resident of the Russian Federation, the tax amount is refunded based on the results of the tax period by the tax authority.

Users of the 1C:Enterprise 8 programs only need to indicate the date of change of taxpayer status and the recalculation will be made automatically when calculating personal income tax.

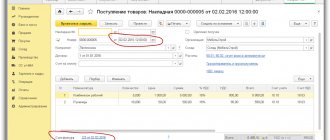

In the payment for personal income tax withheld less than the personal income tax calculated.

IGood afternoon. ZUP 2.5.123.1. For one employee, this is the situation: they made an accrual of salary for September, calculated by personal income tax, for example, 3000. They made a salary payment, withheld by personal income tax, for example, 2500. With the next payment (advance), the program tops off the withheld personal income tax of 500 rubles. Please tell me why the entire personal income tax is not withheld when paying salary?

ps Since September, the employee’s salary has increased (maybe this is the case)?

Get your work in order using the 1C configuration “IT Department Management 8”

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

Encyclopedia of solutions

Thus, tax accounting registers for personal income tax must be maintained in relation to each taxpayer to whom the tax agent pays income. In addition, the developed form of the tax accounting register should be approved in the accounting policy of the organization.

In a letter dated 02/14/2012 N 03-04-06/6-37, the Ministry of Finance of Russia clarified that if wages to employees of an organization are paid by crediting funds to their card accounts, the date of payment of income indicated in tax accounting registers is the date of transfer of funds funds to taxpayers' card accounts.

- What is personal income tax calculated and withheld

- If you transferred personal income tax more than necessary for the month 2021 || If personal income tax is transferred more than accrued

In the payment for personal income tax withheld less than the personal income tax calculated.

IGood afternoon. ZUP 2.5.123.1. For one employee, this is the situation: they made an accrual of salary for September, calculated by personal income tax, for example, 3000. They made a salary payment, withheld by personal income tax, for example, 2500. With the next payment (advance), the program tops off the withheld personal income tax of 500 rubles. Please tell me why the entire personal income tax is not withheld when paying salary?

ps Since September, the employee’s salary has increased (maybe this is the case)?

Get your work in order using the 1C configuration “IT Department Management 8”

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The topic has not been updated for a long time and has been marked as archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

How to obtain information regarding the transfer of the deducted tax amount to the budget

To obtain information regarding the transfer of the deducted tax amount to the budget, you can use one of two methods:

- write an application addressed to the manager about the need to obtain a certificate of form 2-NDFL, which contains all the necessary data. In some cases, employers who deliberately fail to fulfill the employer's obligation falsify such certificates;

- Log in to your personal account on the official website of the Federal Tax Service.

You can also obtain the necessary data when submitting a declaration form 3-NDFL to obtain a tax deduction.

Tax obligations of employers

According to the Tax Code, employers are tax agents for their officially employed employees. The only exceptions are situations when an individual is considered an employer without registering as an individual entrepreneur.

The employer's responsibilities include:

- Calculation of the amount of income tax on employee salaries.

- Subtraction of the mandatory payment, that is, payment of the employee’s labor income taking into account the calculated tax.

- Transfer of income tax to the appropriate budget.

According to the norms of Russian legislation, an employee who has a tax agent (for official employees, this is considered an employer) is considered to have fulfilled his tax obligation in absentia within the framework of the relevant Code at the time the tax is deducted. If the enterprise has not transferred the specified amount to the budget, only the organization itself, and not the employee, is responsible for this.