The Russian tax system provides for several regimes. There are certain restrictions on their use, but most organizations and entrepreneurs still have the opportunity to choose. These modes can be changed periodically. For example, a company has the right to switch from the main system to a simplified one or vice versa from the beginning of the next calendar year. Therefore, it is not always possible to know for sure which regime your counterparty applies. Let's consider how to find out the taxation system using the TIN, if such information is necessary.

Free tax consultation

Content of the letter

A request to the tax service can be made in any form.

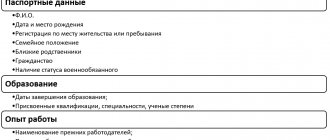

There is a list of certain details:

- Full name of the organization (full name of the individual).

- TIN (for organizations).

- Signature of the head of the organization (individual).

- Seal of the organization.

In your request you can specify:

- Method of receiving the statement (in person/by mail). If the method of receipt is not specified, the completed document is sent by registered mail.

- The date on which the certificate must be issued. If there is no date, then the document is drawn up at the time of registration of the petition.

Read about how to make a request to the tax office for the provision of information here, and from this article you will learn about the specifics of filing a request to the Federal Tax Service about the absence of debt.

General features of special tax regimes

Existing types of special tax regimes, with a large number of fundamental differences among themselves, also have a number of common features. At the same time, they are divided into the following groups in relation to:

- Regarding the scale of activity of persons applying these regimes: Unified Agricultural Tax, simplified tax system, UTII and PSN are intended for small enterprises, and PSA can only be used by full-fledged taxpayers.

- To the circle of taxpayers. Unified agricultural tax, simplified tax system and UTII are available to both organizations and individual entrepreneurs. PSA can only be used by organizations, and PSN can only be used by individual entrepreneurs.

- Object of application. Unified agricultural tax, UTII, PSA and PSN are possible only for certain types of activities, and simplified taxation for the majority (with some exceptions).

- A set of taxes, instead of which a special tax is charged. For Unified Agricultural Tax, simplified tax system, UTII and PSN, it replaces income tax (for individual entrepreneurs - personal income tax), property (except for tax calculated from the cadastral value) and VAT. For PSA there is no special tax as such, but a system of benefits for most existing taxes is applied, allowing for the complete abolition of some of them.

- Compatibility with each other and OSNO. The PSA is not compatible with any of the modes. OSNO, Unified Agricultural Tax and the simplified tax system cannot be combined with each other, but can be used together with UTII or PSN. At the same time, UTII and PSN are also compatible.

Read more about the possibility of combining modes in the following articles:

- “What are the features of combining OSNO and simplified tax system?”;

- “Distribution of expenses when combining UTII and simplified tax system.”

Submission methods

A request to the tax service can be submitted in person or by an authorized person directly at the taxpayer’s place of registration, by mail or electronically.

If you submit the application in person, it is advisable to have two copies - one for the Federal Tax Service, the second - with the registration date, for the taxpayer .

When filing an application electronically (via telecommunication channels), the taxpayer is sent two electronic documents:

- Confirmation by the tax authority of the date of receipt of the request.

- Receipt of acceptance of the application for consideration.

Differences in taxation under special regimes

Special tax regimes differ significantly in terms of the tax bases to which the special tax rate applies. The base can be:

- A variable depending on the actual volume of income (or other object of taxation under a PSA) - for the Unified Agricultural Tax, the simplified tax system, the PSA. At the same time, for the simplified tax system there are 2 bases with different rates: “income minus expenses” with a basic rate of 15% and “income” with a basic rate of 6%.

- Constant (provided that the initial parameters on which its value is set remain unchanged) regardless of the volume of revenue - for UTII and PSN.

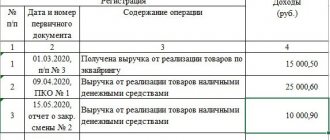

A set of indicators characterizing the main features of taxation under each of the special regimes is given in Table 2.

table 2

Read more about the most commonly used systems in the material “Types of taxation systems: simplified tax system, UTII or OSNO” .

Ways to pick up a completed certificate

The completed document can be obtained:

- Personally .

Upon issuance, the inspector will check the availability of identification documents of the taxpayer or authorized person. One copy of the certificate is issued to the recipient, the second remains with the tax authorities. It bears a mark of issue, date, surname, first name, patronymic and signature of the recipient. If the taxpayer has not received the certificate in person within five working days, the Federal Tax Service sends the document by mail to the address specified in the request. - By mail . In the case where the applicant in the request indicated the method of receipt “by mail”.

- Electronic . When sending a request via telecommunication channels.

We recommend that you look at our other articles on how to write a letter requesting the provision of documents, the status of settlements and to obtain a reconciliation report with a counterparty (in the Social Insurance Fund), for reconciliation with the tax office, checking sick leave, to the bank for the provision of information, and also how to write document in English.

A certificate on the status of settlements with the budget for taxes, penalties and fines was developed in order to improve the quality of performance of government functions, create comfortable conditions for tax payers, determine the timing and sequence of actions of the Federal Tax Service, its territorial bodies and officials.

What modes are special?

There have been no changes to the list of special tax regimes in 2021. It is fully given in paragraph 2 of Art. 18 Tax Code of the Russian Federation. These are the systems:

- for agricultural producers (UES);

- simplified (USN);

- imputed tax (UTII);

- production sharing agreements (PSAs);

- patent (PSN).

ATTENTION! UTII has been abolished throughout the Russian Federation since 2021. A number of entities have already abandoned the special regime. See here for details.

Despite the fact that since the beginning of 2015, each of these systems has been affected by a number of innovations introduced into the Tax Code of the Russian Federation, their fundamental provisions remain the same. The main change in relation to the special tax regimes of the simplified tax system and UTII was the introduction of the obligation to pay property tax on objects whose value is determined as cadastral.

The characteristics and conditions for using special modes are different. Therefore, when choosing, you should take into account a number of conditions: what types of activities the regime is intended for, what taxes it exempts from compared to the general taxation system, what restrictions are set for transition and application, how many times a year you need to submit reports, etc.. As an individual entrepreneur assess all these factors and choose the right special mode, ConsultantPlus experts explained in detail. If you don't already have access to the legal system, get a temporary demo access for free.

Why do you need a certificate?

In most cases, business partners require confirmation of the chosen taxation system in order to correctly calculate and pay fiscal VAT payments. Let us remind you that for violation of the rules, significant fines and liability are provided, including the seizure of accounts and the freezing of activities for up to 90 calendar days.

If the company has received documents from a partner that contain o, then it should request appropriate confirmation that the entity has the right not to allocate value added tax. Your company may receive a similar request. In this case, you will have to prepare a response sample: a certificate about the taxation system.

Accounting and reporting for UTII

UTII is one of those taxes that predetermine the need for businesses to keep fairly detailed records and also submit reports to the Federal Tax Service. Thus, single tax payers must record indicators relating to fees, which are calculated due to the enterprise having the status of a tax agent, as well as other payments provided for by the legislation of the Russian Federation. The UTII payer is obliged to comply with the established procedure for carrying out cash transactions. Another obligation established for payers is the provision of financial statements to the Federal Tax Service. Individual entrepreneurs are exempt from fulfilling this obligation.

Single tax on imputed income in 2021

UTII is one of the most popular special tax regimes in Russia. It, like the simplified tax system, exempts you from paying several types of taxes at once. The tax base here is not the profit received, but the amount of expected income for your type of activity. Despite a lot of rumors about the abolition of this tax regime, the President of the Russian Federation signed a decree extending the validity of UTII until 2021, so this special regime will not go anywhere in the coming years.

The imputation is approved by the regions; it has several characteristic features:

- the amount of tax does not depend on the results of economic activity;

- the amount of tax is determined using coefficients that depend on the area of the sales floor (for trade), the number of employees (for services), and the number of vehicles (for transport services).

Individual entrepreneurs and companies cannot apply UTII if:

- the number of employees during the reporting period is more than 100;

- the company is a large taxpayer;

- in the authorized capital of the organization the share of other companies is more than 25%;

- An individual entrepreneur or company is engaged in a type of activity not provided for in Art. 26.3 Tax Code of the Russian Federation;

- if the organization is engaged in public catering in hospitals, schools and other institutions in which this service is mandatory;

- the company leases premises or land plots at gas stations, and also leases land for placing retail facilities on it;

- the region does not provide for the payment of UTII.

Results

Information about the status of business partners is in the public domain and is provided upon a formal request from a person interested in the information. You can resolve the issue quickly and free of charge through the taxpayer’s personal account. To obtain the necessary information, it is enough to know the TIN of the counterparty.

Other methods of obtaining information from a single database involve a more complex algorithm of actions. The State Services website provides paid services, for which regulatory authorities allocate more time than when contacting them directly. When visiting the inspection in person, additional papers will be required, and determining the tax status based on the reports is impossible without the appropriate skills and knowledge.

Characteristics and comparative analysis of types of special modes

The Tax Code of the Russian Federation has five special regimes that payers can use if they have grounds for doing so. Each of the systems has both its advantages and disadvantages, so we will conduct a comparative analysis of each of the popular types.

Taxation system for agricultural producers

This tax regime is available only to those enterprises and individual entrepreneurs whose activities are related to agriculture. Moreover, income from this activity must cover at least 70% of the total total income received.

Activities that fall under the Unified Agricultural Tax:

- crop production;

- livestock farming;

- breeding and growing fish;

- forestry, etc.

To have the right to apply this tax system, entrepreneurs must produce such products, and not engage in their further sale or processing.

The transition to the Unified Agricultural Tax regime is carried out voluntarily and subject to the necessary conditions for this, by submitting a special application to the tax office.

This system is in many ways similar to the simplified tax system, with the only difference being that it is used for agricultural enterprises. The single tax replaces the profit tax for LLCs, and the income tax for individual entrepreneurs, and also for both of them – property tax and VAT (except for customs). At the same time, personal income tax will continue to be paid for its employees - both individual entrepreneurs and enterprises.

The tax rate is 6%, and the base is profit - income received minus all documented expenses. In this case, it is possible to reduce the amount of income by subtracting losses from previous periods.

Simplified taxation system

This system is available for both individual entrepreneurs and legal entities. To switch to it, you need to submit a special application to the tax office. This can be done only within three days after registration of a newly created economic entity or from October 1 to November 30.

For LLCs, the single tax replaces:

- income tax;

- property tax.

Individual entrepreneurs will not pay taxes such as:

- personal income tax;

- property tax.

Also, all taxpayers are exempt from paying VAT (except for customs). At the same time, the obligation to pay insurance contributions to the pension fund remains with both the LLC and the individual entrepreneur.

The single tax can be calculated in two ways:

- from the income received - in the amount of up to 15% (a specific figure may be established by regional legislative acts);

- from the profit received (income minus expenses) – 6% of the amount.

The simplified tax system is not available for all types of activities: banking, insurance, investment sectors, production of excisable goods and transactions with securities are not covered by this system. For individual entrepreneurs there is also a limit on the number of employees - there should not be more than 100. The list of restrictions for organizations is much wider:

- sales income for 9 months of last year should not exceed 45 million rubles;

- the value of the property cannot exceed 100 million rubles;

- there should be no branches or representative offices;

- the share in the authorized capital of legal entities cannot be more than a quarter.

If during the reporting period the value of property that was sold exceeds 60 million rubles, then both organizations and individual entrepreneurs will have to return to the general regime.

Unified tax on imputed income (UTII)

The use of the UTII regime is also available for both individual entrepreneurs and organizations, and since 2013 it has been a completely voluntary decision of the payer. Its essence is that the taxpayer pays one tax in the amount of 15% of the tax base instead of several different ones.

The peculiarity of the regime is that the tax base does not depend on the actual result of the activity.

The amount of income or profit does not matter, since the tax is paid on imputed income.

Imputed income is an amount of money that is set at a fixed value and is considered the average indicator of profitability of a particular type of activity.

UTII can be combined with other regimes, since this system is applied only to a legally established list of activities:

- transport transportation (both passengers and cargo), as well as servicing various types of vehicles;

- retail;

- catering industry;

- provision of veterinary services, etc.

Each region of the Russian Federation has its own list of specific types of activities that fall under this regime. There are also restrictions on the scale of operation of the enterprise, that is, according to such criteria as:

- number of personnel (no more than 100);

- share of other legal entities in the authorized capital (less than 25%);

- production area (depending on the type of activity).

Also, an LLC or individual entrepreneur should not be a large taxpayer. If all indicators remain unchanged, then the declaration is drawn up only once and then duplicated every three months.

With UTII it is not possible to submit zero declarations and not pay tax if there is no activity. The taxpayer is obliged to either make all contributions on time or switch to another tax regime.

Taxation system for the implementation of production sharing agreements

This regime is used to regulate the relations of the parties to a production sharing agreement and replaces part of the taxes required for payment. The parties to the agreement are:

- An investor is an entrepreneur who pays a certain amount of money to obtain the right to search for and extract minerals in the territory specified in the agreement.

- The state represented by the local executive body, which grants the investor the right to use the subsoil.

In accordance with the terms of this system, in the case of production of valuable products, it will be divided between the investor and the state. This division will replace part of the taxes and fees established by law. At the same time, he must pay taxes such as:

- VAT;

- insurance premiums;

- income tax;

- excise tax;

- state duty;

- mineral extraction tax;

- payments for the use of natural resources;

- land tax;

- payment for having a negative impact on the environment.

Almost all of these taxes will be reimbursed to the investor in the future. The division of manufactured products can be carried out using two options:

- 75% and 25% (between the investor and the state, respectively) – the basic option;

- 68% and 32%.

The profit before tax formula is everything you need to know about calculating the final result of a company’s activities.

The latter option is rarely used, only in exceptional cases, and may depend on the feasibility study of the project or the cost assessment of the subsoil.

Find out what a business plan consists of.

How to open a bookmaker's office?An example of a hookah bar business plan: read here.

Patent tax system

This tax regime is available only to individual entrepreneurs and is aimed at stimulating the development of small businesses. It can be used by individual entrepreneurs who are engaged in a limited list of activities, for example:

- provision of hairdressing services;

- shoe repair work;

- tailoring;

- cosmetic services;

- individual educational services (tutoring or course management);

- design services;

- furniture repair, etc.

An entrepreneur engaged in one of these types of activities may apply the patent system if the following conditions are met:

- it has no more than 15 employees;

- its revenue for the year is less than 64.02 million rubles.

The work is carried out on the basis of the received patent - it is valid for one year and only in the territory of the constituent entity of the Russian Federation where it was issued. The tax is set at 6% of potential income.

The latter value is prescribed in local regulations and can range from 100,000 rubles. up to 1 million rubles Also, depending on various factors, it can be adjusted using special coefficients.

At the end of the year or before the end of the patent's validity period, it must be renewed - without fulfilling this condition, the entrepreneur will not be able to further work on this system.

Also about special tax regimes, watch this video:

Comparison of tax principles

The application of a special regime should be based on the following principles:

- Simplification of the taxation procedure - many taxes existing under the general regime are replaced by one. This makes the procedure for calculating and paying them more convenient and simpler.

- Tax favoring – a special regime must have more lenient and favorable conditions for the payer, otherwise its use will be meaningless.

- Voluntariness – the entrepreneur himself decides whether to remain in the general taxation regime or switch to a special one.

- Selectivity - legislation establishes restrictions on the type of activity and scale of the taxpayer, who has the opportunity to switch to a special regime.

- Coexistence - all regimes provide for the application of both a single tax and other mandatory contributions (for example, insurance).

- Substitution - a single tax of each special regime replaces several others from the general system.

- Taking into account the peculiarities of the economic conditions of each subject - this principle is implemented by introducing various adjustment coefficients.

The use of special regimes is aimed at helping start-up entrepreneurs and small organizations withstand the existing competition in the market and be able to continue their activities.

The conditions of special regimes help reduce the tax burden and significantly simplify the maintenance of reporting documentation for taxpayers.

How to find out what taxation system an LLC or individual entrepreneur is on?

You can find out the necessary information about the nature of the taxes paid from the papers that are drawn up when registering the entity. If they apply special tax regimes, then the documentation package must contain a notice of a change in the tax system chosen at the stage of opening a business.

Its manager can find out information about his company by directly contacting the inspection department. Information can be provided documented if there is a corresponding written request from the interested party. It is worth noting that such a procedure can be initiated and implemented by the head of the company who has the authority to take such actions. If he cannot independently resolve such issues, then he has the right to issue a power of attorney to the person who will deal with this issue.

To quickly obtain information about the applicable regime, you can use the functionality of the taxpayer’s personal account. To do this, you must first register in the service and fill out a corresponding request, an electronic response to which will be received the next day.

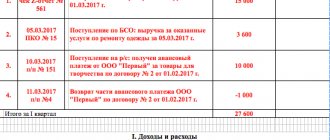

An example of calculating the total tax burden

The individual entrepreneur provides household services in Moscow - repairs clothes, shoes, metal products and makes keys. Its annual revenue is 2,500 thousand rubles (including VAT - 416.67 thousand rubles), expenses - 1,400 thousand rubles (including VAT - 150 thousand rubles), of which taken into account when STS - 1,300 thousand rubles. He has one employee with a salary of 40 thousand rubles per month.

Let's look at 5 tax regimes and determine which one will be more profitable.

Option 1. General taxation system

On OSNO, income and expenses to determine the tax base for personal income tax are taken without VAT. The tax base will be 2,083,333 - 1,250,000 = 833,333 rubles, and the tax amount of 13% of it will be 108,333 rubles. VAT payable will be 266,667 rubles = 416,667 - 150,000.

Let's determine the amount of insurance premiums.

Insurance premiums for an employee will be 12 × (12,392 × 30.2% + (40,000 - 12,392) × 15.2%) = 95,265.60 rubles per year, where:

- 12 - number of months;

- 12,392 - minimum wage for 2021;

- 30.2% - total contribution rate (including injuries);

- 15.2% - the aggregate reduced rate of contributions for payments above the minimum wage.

“For itself,” the individual entrepreneur will pay contributions in a fixed amount - 40,874 rubles, as well as a “variable” part to the Pension Fund - 1% × (833,333 - 300,000) = 5,333.33 rubles.

The amount of contributions for the employee and fixed contributions of the individual entrepreneur “for himself” will be the same in all options.

Option 2. OSNO with VAT exemption under Art. 145 Tax Code of the Russian Federation

VAT is not allocated from income, and expenses are taken into account for taxation in amounts that include VAT. Thus, the tax base for personal income tax will be 2,500,000 - 1,400,000 = 1,100,000 rubles. And the tax itself is 13% of it - 143,000 rubles. In this case, VAT payable will be zero. The “variable” part of the contributions will be 1% × (1,100,000 - 300,000) = 8,000 rubles.

Option 3. STS “income”

Expenses for tax purposes are not taken into account, therefore the tax base is equal to the amount of income - 2,500,000 rubles, and the calculated tax amount is equal to 6% of it - 150,000 rubles.

The “variable” part of the contributions will be 1% × (2,500,000 - 300,000) = 22,000 rubles. At the same time, the tax calculated when applying the simplified tax system can be reduced by the amount of insurance premiums, but only by 50%. As a result, the amount of contributions “to be counted” will be 75,000 rubles.

Option 4. Simplified tax system “income minus expenses”

The tax base under the simplified tax system in this option will be 2,500,000 - 1,300,000 = 1,200,000 rubles, and the tax amount of 15% of it will be 180,000 rubles. This is more than the minimum tax (1% of revenue, i.e. 25,000 rubles), so the tax must be paid in the calculated amount.

The “variable” part of the contributions will be 1% x ((2,500,000 - 1,300,000) - 300,000) = 9,000 rubles, and the total tax burden for this option is 325,139.60 rubles.

This position has been adhered to by the courts for quite some time (clause 27 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 3 (2017), approved by the Presidium of the Supreme Court of the Russian Federation on July 12, 2017, determination of the Constitutional Court of the Russian Federation dated January 30, 2020 No. 10-O). Now the Federal Tax Service has also accepted this position (letter of the Federal Tax Service dated September 1, 2020 No. BS-4-11/14090).

Option 5. Patent

The base for calculating tax is the sum of the potential annual income for each type of activity. In this case, there are three of them, for each of them this amount is 660,000 rubles. This means that the tax will be 6% × (660,000 × 3) = 118,000 rubles. You cannot take into account expenses, but from 2021 you can reduce the tax on the amount of insurance premiums for yourself and your employees.

The “variable” part of the contributions will be 1% × (2,500,000 - 300,000) = 22,000 rubles.

The tax can only be reduced by 50%. Therefore, you need to pay for the patent in the amount of 59,400 rubles.

The concept of “special tax regime” according to the Tax Code of the Russian Federation

The concept of “Special tax regime” implies a special procedure for determining and collecting taxes, as well as exemption from their payment, subject to certain conditions.

The purpose of its introduction is to provide budding entrepreneurs with the opportunity to work in more favorable conditions.

What does the transition involve?

The criteria by which the possibility of switching to one of the special systems is determined may be:

- the type of activity the enterprise is engaged in;

- number of company employees;

- the amount of income received;

- type of ownership.

Requirements for financial statements: read here.

Beauty salon from scratch: business plan step by step.Business ideas: how a woman can start a business.

The use of special modes has the following positive aspects:

- many priority areas of entrepreneurship experience a lower tax burden;

- special tax payment conditions stimulate the development of small businesses;

- the level of shadow turnover decreases;

- in areas where special regimes are used, tax collection increases.

What all existing special tax regimes have in common is that they replace the many levies of the general system by introducing one single tax.

The specific rate, tax base and features of its calculation depend on the specific type of special regime.

Legislative nuances

Legislative acts stipulate that responsibility for verifying the accuracy of information about the tax regime applied by the partner rests with the recipient of services or goods.

If the contractor accidentally or intentionally provided false information, the customer is not released from liability resulting from the irrelevant data. Fines, sanctions and penalties will be assessed to the recipient of services, so it is he who needs to initiate a check of the counterparty’s status.

Example

The company entered into agreements with several counterparties. Its management was not informed of their tax status. As a result, at the end of the annual period, an excess of the regulated amount of tax deductions of 300,000 rubles was recorded. The fact of violation was revealed during an inspection by a regulatory authority, as a result of which sanctions were applied to the company in the amount of underestimated tax liabilities of 3,000,000 rubles. Additionally, 20 percent of the total amount of the underpayment was charged, which corresponds to 60,000 rubles and a penalty for late payment of taxes. Lack of awareness led to financial losses.

How to prepare

Taxpayers who have switched to simplified tax regimes confirm their status with an official notification from the Federal Tax Service or provide a special form No. 26.2-7. Consequently, it is enough for “simplified” clients to send a copy of the Federal Tax Service’s notification about the transition to a preferential regime to the business partner. Or request a special information letter from the inspection.

For subjects using the general regime (OSNO), a similar form is not provided. To confirm the selected mode, you will have to notify your partner by letter, drawn up in any form.

How to find out the taxation system by TIN

To find out about the nature of your partner’s tax payments, you can use the capabilities of the World Wide Web. The procedure can be implemented through the service of the inspecting body. To do this you need:

- go to his website;

- log in;

- go to the appropriate section of the service;

- submit a request for an extract, indicating the TIN;

- enter captcha;

- complete the request by clicking on the appropriate button, confirming that the form is completely filled out.

Within one day, information from an open database will be provided in the form of an electronic document in PDF format, certified by an electronic digital signature. You can download it for five days, after which the document becomes unavailable.

An alternative option for obtaining information about a counterparty is to create a request on the State Services portal.

The operation is carried out after authorization on the site and going to the menu covering the scope of taxes and financial transactions made in their direction. You can submit an application to provide information about a partner after going to the section intended for submitting requests from a single database. Responsible persons are given 5 days to process the application.

It is worth noting that it is more profitable to resolve the information issue on the tax website. The advantage is that it is resolved quickly and free of charge.

Checking the counterparty on the State Services portal

You can use a conservative method of obtaining information by contacting the inspectorate directly. However, in this situation, documentation for the enterprise that is the subject of the request may be needed. Not all branches of the regulatory authority will provide information about another company, so the easiest way to resolve such information issues is via the Internet.

You can find out about the status of counterparties from their constituent documentation, if it contains correspondence from the tax office, which contains the relevant information. An experienced accountant can determine the applicable tax scheme by studying the reporting provided to him, which the organization submitted at the end of the reporting period. The nature of taxes paid is identified by the type of payments made.