There is no such right for a long time

Let’s say right away that since 2013, tax accounting for exchange rate differences under the simplified tax system has become impossible. The corresponding provisions were removed from the Tax Code of the Russian Federation long ago.

REFERENCE

Exchange rate difference is the difference that arises when converting a certain number of units in one currency into another currency using different exchange rates (clause 8 of IFRS 21 “The Impact of Changes in Exchange Rates”, put into effect in the Russian Federation by Order of the Ministry of Finance dated December 28, 2015 No. 217n) .

According to para. 4 clause 3 PBU 3/2006, exchange rate difference is the difference between the ruble valuation of an asset or liability, the value of which is expressed in foreign currency, on the date of fulfillment of payment obligations or the reporting date of a given reporting period, and the ruble valuation of the same asset or liability on the date of its acceptance for accounting in the reporting period or the reporting date of the previous reporting period.

Thus, the exchange rate difference that arises under the simplified tax system “Income” or the exchange rate difference under the simplified tax system “Income minus Expenses” does not in any way affect tax accounting and deductions under this special regime, which the simplifier must make. That is, there is no point in using the simplified tax system to track changes in the official exchange rate of foreign currency to the ruble, established by the Central Bank of Russia.

Positive exchange rate differences and negative exchange rate differences cannot be reflected in the simplified tax system when choosing any object for this special regime.

In fact, exchange rate differences between currencies affect the simplified tax system only once - at the time of receipt of revenue, when it is necessary to evaluate values and/or claims expressed in currency. After all, payers of the simplified tax system use the cash method of accounting for income.

Of course, individual entrepreneurs using the simplified tax system should not consider exchange rate differences as a basis for adjustments in tax accounting.

Let us emphasize once again that income and expenses from currency exchange revaluation do not need to be determined or taken into account. Whether it is an exchange rate difference with a simplified tax system of 6 or 15%. The same approach should be taken if the requirements (obligations) are expressed in foreign currency or monetary units, but the payment is made in rubles.

There is an opinion that an individual entrepreneur using the simplified tax system “Income” has non-operating income from a positive exchange rate difference, which must be taken into account when a payment is received in foreign currency and transferred to his personal bank account as an individual, and then the currency is exchanged for rubles at an inflated rate. The account from which the currency was sold does not matter.

The reason for exchange rate differences

Currency rates can fluctuate in any direction – both increase and decrease. Events may develop unpredictably, so the company may receive less or more income than expected if the price in the contract is not specified in rubles. A change in the official value of the currency will affect the amount of income of the organization.

The growth of the exchange rate increases:

- expenses for the purchase of goods, equipment, materials, payment for services;

- volume of sales revenue.

Conversely, a depreciation of the exchange rate can reduce the cost of paying obligations in foreign currency or income from sales of goods, works, services, the price of which was indicated in the monetary units of another state.

Exchange rate differences can be either positive or negative. If the exchange rate has not changed, there will be no difference.

What is currency revaluation?

Transactions in foreign currency and the subsequent revaluation of foreign currency are relevant today for any enterprise, regardless of its size, form of ownership and focus of production. In an era of crisis, both giants like Gazprom and Lukoil, and medium and small businesses strive to operate in several areas of activity at once in order to stay afloat.

So a construction company can engage in trade, and a law firm can invest part of its assets in investment activities. Very often, enterprises, especially those working in the field of medicine or high technology, have to purchase equipment and consumables from foreign partners. All this requires foreign currency, and transactions in foreign currency, in turn, require special control and accounting.

Return ps3

- The buyer has the right to refuse within seven days from the date of delivery, that is, receipt in hand.

- If information about the procedure and terms of return was not received by the buyer in writing upon delivery of the goods, then it can be refused within three months.

- The product must be in proper appearance. That is, it is clearly not in use (tags, seals and other evidence that you did not use it are preserved)

- Documents confirming the fact of purchase must be available (receipts, invoices, forms)

- Items that are not defective and were made to order cannot be returned.

The return of goods is carried out upon a written application from the buyer, which must contain his passport data and a reasoned reason why he decided to return the purchase.

Is it possible to return a game console to the store within 14 days?

To which the seller said “why are you going to bother here for 1,500 rubles??” I asked to return my money for the console, which was also refused. Although, according to the Law “On Protection of Consumer Rights”, I can return the goods within 14 days from the date of purchase. please tell me how to exchange the console or return the money.

thank you Yulia Viktorovna Svetova Lawyer’s response: Hello, Yulia Viktorovna. Within 14 days, you can EXCHANGE a non-food product of proper quality for a similar product only if the specified product does not fit in shape, dimensions, style, color, size or configuration.

A special procedure for accepting claims applies to them. For such cases, a 15-day period for satisfying the buyer's request is prescribed. Also, if the product cannot be used for its intended purpose for more than thirty days during the warranty period, the seller is obliged to exchange it for a similar one or return the money within no more than twenty days.

Info

If, due to a defect in a purchased technically complex product, the buyer submits it for warranty repair, he also has the right to demand that a similar unit be provided to him for the duration of the repair. A replacement device will be provided by the seller free of charge. All costs for delivery and transportation of the replacement device are borne entirely by the seller.

Is the console working? Have you been playing on it these 6 days? They played, they didn’t play. What a strange way to pose the question. Returnable or non-returnable. vit92861 well, Article 25 says that if you don’t like the product, then I can return it! Read the list of non-refundable items. Consult a lawyer you know. Read the judicial practice, as well as the decision of the Supreme Court in these matters.

Approve the attached list of technically complex goods. Recognize the decree of the Government of the Russian Federation of May 13, 1997 as invalid. Every buyer has encountered a common problem: they purchased a product, but it turned out to be unsuitable or they simply didn’t like it. What to do in this case? Is it possible to return a purchase to the store without explaining the reasons? The content of the article:

- Consumer rights to return purchased items to the store

- Reasons for exchanging or receiving money

- Returning goods of proper quality

- Terms within which you can return

- Purchase by phone or online store

- Protection of buyer rights

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. The law clearly defines the rights of the buyer. They can be divided into two parts:

- The first part of the rights applies to the buyer at the time he makes the purchase. He has the right to receive all information about the product in order to finally determine for himself the need for purchase.

- The second part of the rights applies to those consumers who have already made a purchase, paid and become owners.

The law (Article 4) determines that the seller is obliged to transfer to the buyer goods of appropriate quality, suitable for use and consumption in accordance with the contractual terms. As a rule, a written contract is concluded only in cases of large purchases. Most often there is none. The proof of the transaction will be the cash receipt, and the product itself. The seller is responsible for the quality of the products.

Buying and selling foreign currency: accounting in 2021

Many companies are faced with transactions involving the purchase or sale of foreign currency. There is a lot of controversy regarding these transactions. In the article we will look at the correct accounting of such transactions: how to take into account currency when selling, when buying, how to take into account differences from the official exchange rate.

Examples of entries for accounting for the sale and purchase of currency on account 52 are also given. Accounting is regulated by Order No. 154n dated November 27, 2006.

When interacting with currency, Russian companies are faced with the need to account for the following transactions:

- purchase;

- revaluation;

- conversion operations.

- sale;

For accounting of these transactions, the following accounts are used:

- 57 “Transfers in transit” - transit account, shows the intermediate movement of funds between accounts.

- 52 “Currency accounts” - reflects the current amount of currency in Russian rubles at the exchange rate of the Central Bank of the Russian Federation;

What you need to know when making foreign exchange transactions:

- The purchase and sale of currency can only be made through authorized banks;

- Currency transactions between residents of the Russian Federation are not allowed (exceptions are listed in paragraphs 1-24, clause 1, article 9 of Law 173-FZ;

- To conduct transactions for the purchase and sale of currency, residents must open foreign currency accounts in authorized banks, and for the majority there are no restrictions.

- Residents must submit data on opening, closing, and changing the details of a foreign currency account to the Federal Tax Service within a month.

- Non-residents have the right to open foreign currency accounts in Russian banks also without restrictions;

- The regulatory body for these operations is the Central Bank of the Russian Federation and the Government;

- Currency transactions between persons are carried out without restrictions on the amount;

- Revaluation is carried out on reporting dates, for the preparation of financial statements, on the day of a currency transaction, and also as the exchange rate changes;

- Exchange differences from translation are classified as other income or expenses.

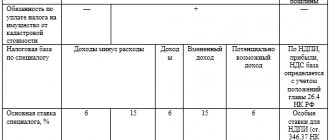

We present an infographic with a brief description of 52 accounting accounts:

- Subaccounts;

- Basic typical wiring.

- Purpose and application;

Foreign currency received from foreign buyers is subject to sale to authorized banks.

How does this happen? Until the moment of sale, foreign currency funds are stored in the debit of account 52. At the time of sale, they are written off from the credit of account 52. Please note: entries in all accounting accounts, including in foreign currency account 52, are made in Russian rubles.

Transfers to rubles are carried out at the time of crediting funds to account 52 at the Central Bank rate. At the moment of receiving payment from a non-resident buyer of the Russian Federation (foreign) in non-cash currency, they are credited to the debit of account 52 in rubles.

The rate is taken by the official Bank of Russia on the day of enrollment. At the time of sale of currency to the bank, the value is recalculated at the current official rate; if it differs from the rate on the day of enrollment, then a difference arises - positive or negative.

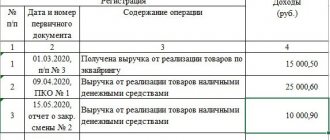

Purchasing foreign currency under the simplified tax system: transactions

In the case when foreign currency is purchased to pay off a loan or compensate for the costs of employees on foreign business trips, the following is recorded in accounting:

| Debit | Credit | A comment |

| 57 | 51 | Transferring money to purchase foreign currency |

| 52 (1, 2, 3) | 57 | Crediting funds to a transit account |

| 91.2 | 51 | Commission paid to the bank |

Non-operating income is obtained when the Central Bank quote is higher than the purchase rate. The wiring looks like this:

DT 57 KT 91.1

The company's income increases.

Example 3 . has a foreign currency loan. To repay it, you need to buy currency for €5,500. At a commercial bank, the exchange rate for € is 73.6987, at the Central Bank – 74.2256 RUB/€.

The Central Bank quote is higher, which means that when purchasing you will get a positive exchange rate difference:

5,500·(74.2256-73.6987) = 2,897.95 rubles.

This amount will be reflected in KUDiR as income.

Currency conversion at exchange rates

For businesses that value exchange rates $ ¥ € Cost reduction Thanks to direct access to the foreign exchange market. Transparency You see offers to buy and sell.

Convenient and fast transactions Conclude transactions through the terminal or voice order. Saving on conversion transactions You buy currency directly on the exchange. Exchange rate Minimum amount $1000 usd eur RUB Commission for a transaction and withdrawal of currency Rate including commission Client Client buys currency from a broker Broker Broker executes the client’s order Exchange Currency conversion at the MICEX rate Broker gives the client currency with a minimum commission Client Client buys currency from a bank Bank Bank buys currency on the exchange Exchange Exchange sells currency to the bank Currency conversion at the bank rate (MICEX rate +%) 3 trillion rubles Trading turnover of BCS broker, according to the Moscow Exchange, more than 3 trillion rubles for dollar-ruble and euro-ruble currency pairs per month* 4000 companies Operates on the stock exchange through BCS Broker 27.8% Share on MICEX-RTS 24 years On the market *Data as of December 2021 Fill out the form and we will call you back as soon as possible I agree to transfer and processing Send BCS broker © 1995–2021.

LLC "Company BKS" The data is exchange information, the owner (owner) of which is PJSC Moscow Exchange.

Distribution, broadcast or other provision of exchange information to third parties is possible only in the manner and under the conditions provided for by the procedure for using exchange information provided by Moscow Exchange OJSC. LLC "Company BKS", license No. 154-04434-100000 dated January 10, 2001 to carry out brokerage activities.

Issued by the Federal Financial Markets Service. No expiration date. The profitability of investment portfolios, “Exchange Guru”, modeled by experts of BKS Company LLC, taking into account commission expenses for a transaction in the amount of 0.03% of the transaction volume according to trading data on the Moscow Exchange OJSC, does not take into account the costs of paying for depository services, submitting orders by telephone and other expenses payable by the client.

The full list of tariffs of BCS Company LLC is given in Appendix No. 11 to the Regulations for the provision of services on the securities market of BCS Company LLC.

Past investment performance does not determine future returns. BKS Company LLC is not responsible for the results of activities based on these recommendations. Stock Guru's trading recommendations are provided for informational purposes only and cannot be construed as, or be used as, an offer or inducement to make an order to buy or sell, or invest in securities or other financial instruments.

BCS Company LLC may not take any steps to convince anyone that the securities referred to in trading recommendations are suitable for a particular investor. 1 LLC "Company BKS" number 1 in the rating of PJSC Moscow Exchange "Leading operators of Stocks and units: main trading mode T+, mode

Summarize

Thus, when dealing with currency and using the simplified tax system, you should remember the following main points:

- Foreign exchange earnings should be recorded in the income and expenses ledger on the day the money was received in the transit foreign exchange account.

- Convert income received in foreign currency into rubles. For conversion, use the one set by the Central Bank of the Russian Federation on the date of receipt of money in the transit currency account.

According to the Ministry of Finance of the Russian Federation, currency is considered a commodity. If you share this point of view, include in income the entire amount received from the bank for the currency sold. If you are willing to argue, reflect only income from the sale of foreign currency at a rate higher than that established by the Central Bank of the Russian Federation.

Amount and exchange rate differences under a simplified taxation system

- Attention

home

- Basic accounting concepts

The legislation of the Russian Federation does not provide for any restrictions or prohibitions for simplifiers regarding transactions with foreign currency. The quotation of the money supply of different countries does not remain unchanged, which leads to the formation of exchange rate differences.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.